SVB Financial is a regional American bank, established for about 40 years, with headquarters in Silicon Valley, whose core business is to provide financial services to innovative companies (start-ups, tech, medtech, biotech mainly). It could be the second largest American bank failure.

The genesis

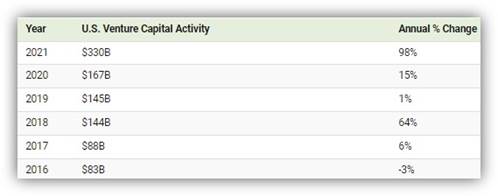

SVB works with 50% of US venture capital funds, financing startups. When interest rates were at their lowest in order to stimulate the economy after the pandemic, US venture capital raised record amounts of money : $330 billion in 2021, i.e. double the amount in 2020. In the midst of the “US Tech bubble”, SVB has logically seen its balance sheet deposits double as well.

With little credit to produce, SVB invested these deposits in interest rate products, thereby taking on a duration or transformation risk between its assets and liabilities. However, interest rate increases in recent months have caused bond prices to fall, resulting in unrealized capital losses for the bank. At the same time, deposits, the main source of funding, have declined rapidly due to client cash burn and lower fundraising. As a result, SVB had no choice but to sell loss-making assets (a $21 billion portfolio with a 3.5-4 year duration sold last week) in order to strengthen its liquidity to meet client withdrawals. In a typical “bank run” pattern, having caught wind of the difficulties, customers began to withdraw their assets en masse, prompting the California regulator and the FDIC to intervene and close the bank in a flash.

FDIC has taken two strong measures to stem the repercussions of Sillicon Valley Bank’s difficulties, notably with deposit protection and the announcement of a Bank Term Funding Program allowing cash advances to banks (against collateral). Signature Bank has also been placed under the control of the regulator.

The US 2-year posted a correction not seen since 2008 in two days

Source : Bloomberg

The Treasury, the Fed and the FDIC intervened quickly and it is likely that the difficulties of the banking system will limit the Fed’s monetary tightening. The Fed’s quick intervention (1 day versus 1 month in the Lehman case), while showing that it is taking the situation seriously, is mainly aimed at reassuring and avoiding contagion (e.g. Signature Bank’s closure) and a generalized flight of deposits. The spectre of Lehman Brothers is obviously on everyone’s mind, even if the situations of SVB and Lehman are not at all comparable in terms of systemic risk. SVB is relatively small in terms of balance sheet and only offers traditional (so-called vanilla) products, whereas Lehman was a major player in structured products and securitization of real estate-based products.

Overall, the deterioration of the banks’ capital position is likely to capture the Fed’s action on short-term rates. The assumption of a 50 bps hike in March is obviously off the table, but we think the Fed could stop tightening in March before resuming in May. We maintain a 25 bps hike in May, June and July for a terminal rate of 5.25/5.5% for now. If the situation worsens, the QT could also be interrupted. In Europe, we maintain our expectation of a 50 bps hike due not only to the delay in normalization but also to the lesser short-term impact on the Eurozone.

FDIC to guarantee all SVB Financial & Signature Bank deposits. The Fed is creating a Bank Term Funding Program (BTFP) that will allow banks to access liquidity via collateral pledges (US treasuries, Agency-debt, Mortgage-Backed Securities). These measures should limit panic movements and allow banks to finance themselves in order to avoid forced sales, even if this will not prevent deposit withdrawals by banks considered at risk.

The movement remains very violent in all asset classes and mainly in Europe.

Other banks

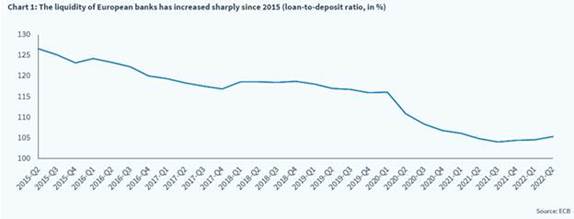

European banks are particularly targeted in the movement.

Source : Bloomberg

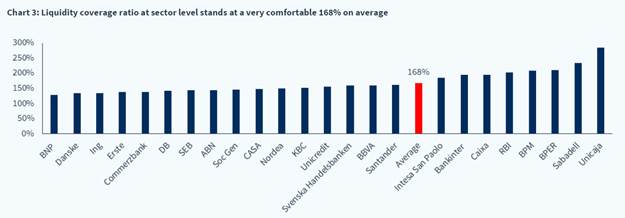

We recall that the average liquity coverage ratio of European banks is 168%, with each of the institutions at over 100%, they cover their deposits!

In other words, even in the theoretical case of a withdrawal of 100% of the deposits, the banks would not have to sell products with a loss of value like SVB. Funding also shows a satisfactory duration. Finally, the capital position of European banks is very robust.

Source : Kepler

The risk of a deposit run thus seems very low for European banks. There could be a run on deposit remuneration, but this was already part of the sector’s roadmap for fiscal 2023.

The case of the “black swan” is still possible, of course, but it does not seem to us to be a working hypothesis for the moment. We will have to keep an eye on the fragile European player, Credit Suisse, whose LCR was 144% versus 192% in Q3 2022 (before its reputation problems were publicized last year). It would take a media storm to make this specific situation worse… Even the most idiosyncratic bank failure can have implications… So there is inevitably something systemic about this kind of situation.

Source : Kepler

The strong liquidity position of European banks and their solidity are not in question, which makes an accident such as the one we experienced in the US unlikely.The rules are different in Europe and in the US… Europe was perceived as over-regulated, but in the end, it is the US regulators who will surely have to tighten the screw !

SVB is very specialized and faces specific problems related to the instability of its deposit base. European banks have a completely different structure, both in terms of funding and assets.

Nor are there any truly “small-cap” or “niche” European listed banks. They all tend to be diversified and have a broad funding base.

Impact on financial assets

Despite the extreme volatility of the market at the moment, we are not worried about an uncontrolled spread thanks to the measures announced by the regulators, even if SVB is forcing a reassessment of the effect of rate hikes on the economy.

The Fed’s rate hikes will slow down significantly (no hike in March against 50 bps expected) which should have an unfavorable impact on the USD.

The situation also reflects the violence of a change in the interest rate regime that affects the entire financial system and this should put pressure on central banks…

Source : Bloomberg

The credit markets, especially the riskiest areas, will see their spreads widen initially, taking into account the specific risks.

Sources : Bloomberg

We remain overweight on the European zone given the sell-off of the last two days.

This liquidity episode is reminiscent of the one in the UK pension funds in early October 2022, before the intervention of the British central bank. We expect the authorities to act as soon as equilibrium is restored. This could be an entry point into the US markets given the central bank’s reaction.

We prefer large caps to potentially capture the rebound.

Impact on illiquid assets

Silicon Valley Bank, the 16th largest bank in the United States, at the heart of the ecosystem of start-ups and private equity funds in the American technology sector, was closed this Friday by the American authorities, creating a wind of panic…. It failed to launch a capital increase to bail out after suffering heavy losses on the sale of part of its bond portfolio ($1.8 billion) to try to free up cash. Several medium-sized and regional banks are at risk. If we add to this the collapse of the Silvergate bank, a bank that became central in the crypto sector for its payment network, avoiding the domino effect in the ecosystem of Californian tech start-ups has become urgent for Treasury Secretary Janet Yellen. It was possible that SVB’s demise would cause problems among venture-backed U.S. companies, among which it had a very large customer base. If this had been true, it could have had a direct impact on the sector’s exposure to US venture capital and, more indirectly, on the broader private asset sector, although this may be a bit of a stretch, given that, for example, buyout and real asset investments are focused on profitable, cash-generating businesses.

After the U.S. regulator’s intervention, this concern seems to have dissipated, although it is still possible that the end of SVB will have lasting effects on the venture capital ecosystem.