- Market volatility should present opportunities.

- We believe geopolitical tensions have peaked.

- We prefer to seek opportunities in more “value” segments in Europe.

- The hesitations of the Bank of Japan encourage us to stay out of this market.

- In the short term, China’s focus on reducing housing inventory could be a catalyst to prolong the recovery.

- If US 10-year rates exceed 5%, the correction would be significant.

- We favor the investment-grade (IG) segment and higher-quality high yield (HY) primarily in Europe.

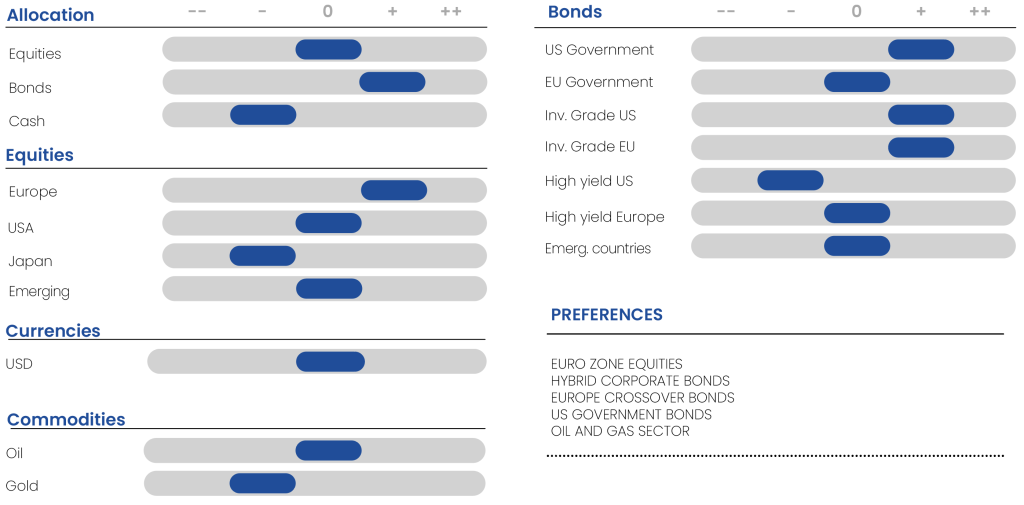

GLOBAL ALLOCATION

The underlying macroeconomic backdrop remains positive as the global economy shows resilience. There is uncertainty regarding the decline in inflation given recent data. During the second week of April, we advised to be slightly more cautious on equity markets without changing our neutral outlook considering earnings releases.

We do not have ambitious targets for indices for the next six months. Doubt about central banks’ attitudes is likely to increase volatility, whether in equities or interest rates. As we approach the end of June, the fateful date for the beginning of rate cuts by the ECB or the Fed, the market is likely to stress over every inflation or price data release. However, we are convinced that as US growth slows, disinflation will materialize.

In the future, we believe geopolitical tensions have peaked, at least in the short term. None of the parties involved (the US, Israel, Iran) have an interest in an escalation that would spike oil prices and could cause a global recession. Even Russia may not be interested in dealing a major blow to the global economy as it is more dependent than ever on oil prices to fund its war economy. We are confident that growth concerns will outweigh inflation worries (which remain cyclical). In this perspective, bonds should be favored given the yields reached at the end of the month. Market volatility should present opportunities to be more flexible.

Global indices in local currencies

Sources : Bloomberg, Richelieu’s Group

EQUITIES

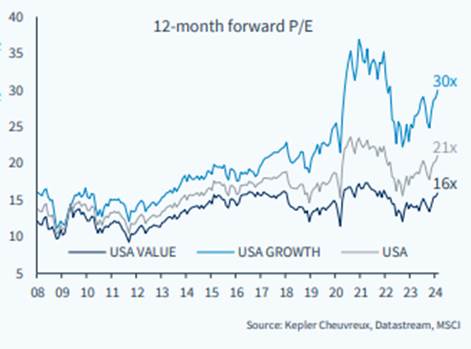

Valuations will come under pressure from the Fed’s commitment to maintaining restrictive policies despite still resilient earnings. The largest weights in US indices are expected to experience profit-taking in favor of other more cyclical sectors. We should see a sectoral rotation that allows indices to stabilize after a period of consolidation. However, if US 10-year rates exceed 5%, the correction would be significant. Some inflation caused by strong demand is actually favorable for corporate earnings growth. Positive figures announced on the US economy and profit forecasts have pushed US equity markets towards valuations that seem stretched to us, less compatible with a less accommodative Fed.

Valuation of the US market

The companies in the S&P 500 are experiencing the lowest average outperformance after positive earnings releases since the fourth quarter of 2020, despite still solid fundamentals. Small-cap US stocks continue to underperform due to their sensitivity to interest rates. Estimates of post-pandemic excess savings by the Federal Reserve suggest that they have now been depleted.

We prefer to seek opportunities in more “value” segments in Europe. Our conviction remains that European indices are best positioned in the current setup. PMI indices show a recovery in the private sector, driven by services benefiting from increased household purchasing power. Disinflation is more pronounced, and the ECB has far fewer questions to answer than the Fed. The ECB can afford to be the most accommodative central bank. Additionally, China’s stated desire to stabilize should favor the region overall, cyclical stocks, and Germany in particular. The UK, Europe’s most diversified index with a clearly defensive characteristic, can also be favored. The hesitations of the Bank of Japan lead us to stay out of this market. Even though the timing is uncertain, the fact that the BOJ has officially announced the end of ETF purchases, combined with our expectation of intervention in the Japanese currency, leads us to stay away.

Regarding emerging markets, currencies are expected to suffer from the strength of the dollar, favoring local currency-denominated equities. In the short term, China’s focus on reducing housing inventory could be a catalyst to prolong confidence and stock markets recovery, at least cyclically until structural weaknesses take over again. We remain positive on the Indian market given the growth dynamics and the lesser sensitivity of the Indian currency to the dollar. The INR is among the most resilient emerging market currencies and least correlated with the dollar.

Major equities markets

Sources : Bloomberg, Richelieu’s Group

SOVEREIGN BONDS

The major government bond markets have moved in concert in recent years, but we expect this to change in the future due to differences in debt fundamentals, monetary policy transmission, and fiscal support. Inflation in the United States remains largely cyclical, and the slowdown in growth towards the end of the year should favor disinflationary outlooks and allow for a decrease across the rate curve. This gives us a preference for US Treasuries over other government bond markets. Real interest rates are expected to remain high as inflation dynamics weaken. Our intervention level was between 4.3% and 4.5% on the US 10-year, and current levels are even more attractive given our growth slowdown scenario. At its latest meeting, the Fed announced that from June 1, it would reduce the cap on Treasury securities allowed to mature and not be replaced to $25 billion, while the current cap is $60 billion per month. This is clear evidence that Jerome Powell does not want much higher levels on government interest rates. Our year-end outlook at 3.8% is raised to 4.1% (the same for the 5-year).

Sovereign 5-year rates

Sources : Bloomberg, Richelieu’s Group

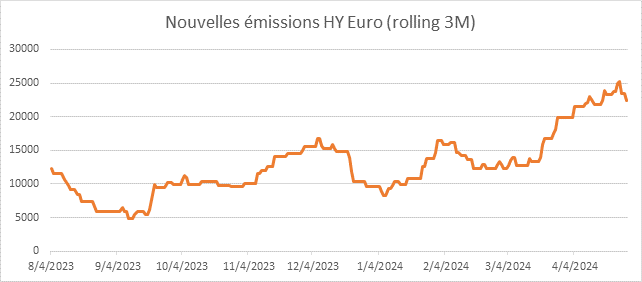

CREDIT

We are constructive on duration, especially in Europe given the recent rise in yields and the accommodative tone of the ECB. For corporate credit, we prefer quality and securities with maturities of 2 to 5 years in Europe and the United States. We are also positive on select emerging markets while remaining cautious of short-term dollar strength, preferring other funding currencies. There is increasing dispersion within the credit asset class itself, notably in high yield (HY) with the recent confirmation of difficulties for some issuers weighing heavily on the market (Altice, Atos, Intrum, Ardagh, or Grifols). Many small-sized and poorly-rated (B-/CCC) issuers are also in distress. The risk for the most indebted issuers is even greater as rates remain high for longer, making refinancing difficult. This situation underscores the importance of being selective and sufficiently compensated, in terms of spreads, to address these challenges. We favor the investment-grade (IG) segment and higher-quality high yield. Unlike distressed issuers, these better-rated issuers have benefited from relatively tight spreads for refinancing since the beginning of the year, evidenced by a record level of issuance in the BB segment. We remain cautious on US high yield. We believe the market has not yet fully priced in the impact of high rates for an extended period. The most vulnerable players will face increasing financial pressures.

Credit spreads

Sources : Bloomberg, Richelieu’s Group

New Euro High Yield Issues (rolling 3M)

Sources : Bloomberg, Richelieu’s Group

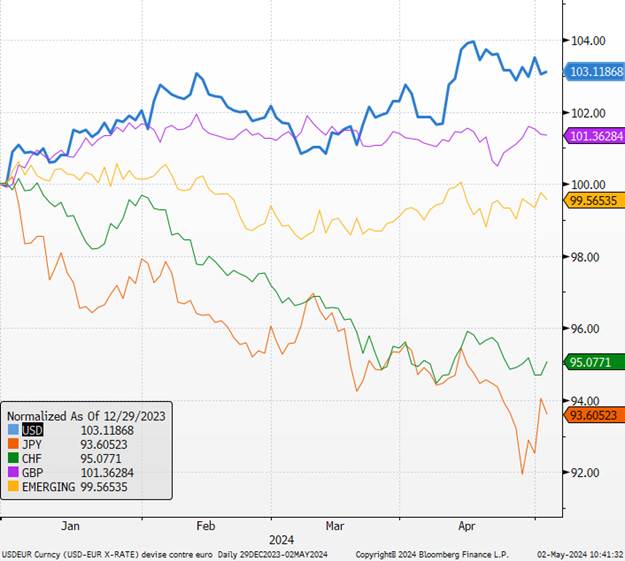

CURRENCIES

The dollar is expected to remain strong in the short term as the prospects for rate cuts in the United States diminish while those for the ECB remain. We anticipated a strengthening of the US currency since February to account for the adjustment of expectations regarding the central bank’s rates. This has been realized. The latest publications show strong resilience in the economy, both in terms of real estate and employment, providing some support until the summer. We anticipate a revaluation of the euro in the second half of the year as the market factors in slower US growth (targeting 1.12 in 12 months).

Currencies against EURO (Base 100 as of 31/12/2023)

Sources : Bloomberg, Richelieu’s Group

Asset Allocation Table