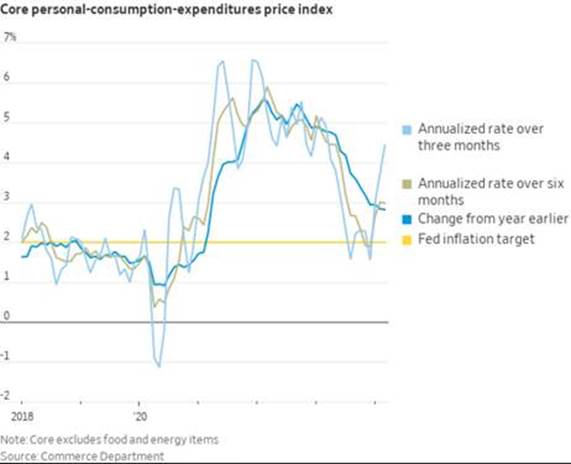

- American disinflation, which has been underway for several months, appears to be slowing down and casting doubt on the Fed’s future actions.

- The economic recovery in Europe is unlikely to deter rate cuts as early as June.

- The Bank of Japan does not foresee any changes in monetary policy.

- Chinese authorities are attempting to reassure regarding their ability to end the real estate crisis and restore some short-term confidence.

- The Indian momentum remains unchallenged.

UNITED STATES

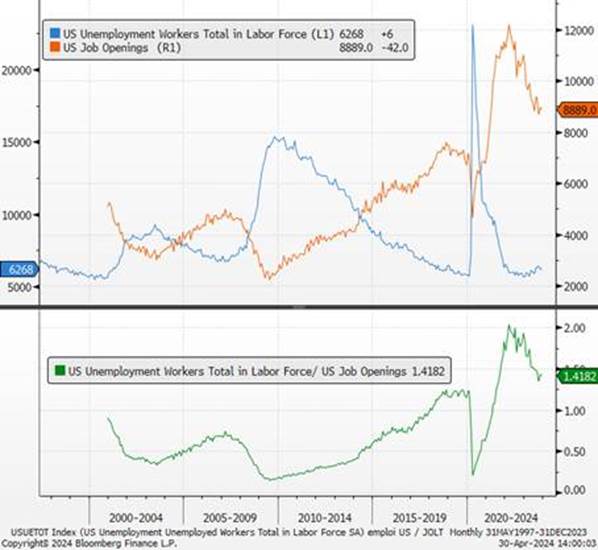

The data released in the United States this month once again sent mixed signals. American growth remained robust. However, the factors that supported consumption and investment are gradually dissipating. American households’ room for maneuver has begun to shrink in the face of several headwinds: rising taxes, still restrictive financial conditions (particularly high credit card and mortgage interest rates), and depletion of savings accumulated during the pandemic. The prospects for a smooth landing of the US economy seem to be materializing. Tension in the job market appears to be gradually easing, with employers “no longer feeling pressured to hire” (according to the Beige Book) and an increase in the number of candidates per job opening.

Job openings and number of unemployed in the United States

Sources : Bloomberg, Richelieu’s Group

We expect a slowdown in demand and thus a relapse in growth and inflation. For business investment, its dynamism is partly explained by the effects of the stimulus and investment plans implemented by Joe Biden in recent years (such as the Reduction Act of 2022 or the Bipartisan Infrastructure Law of 2021). This effect on GDP will diminish without new fiscal stimulus, which is highly unlikely in the coming months as the elections approach. In a context of slowing demand, business investment decisions are likely to be revised downwards, contributing less favorably to growth.

Jerome Powell aimed for greater confidence in inflation figures, but so far, this hasn’t materialized. However, we expect price increases to be more moderate in the second half of the year, allowing the Fed to lower interest rates. With a moderate slowdown on the horizon, the most likely date for the Federal Reserve to cut interest rates is now July or September. We maintain our forecast of two rate cuts (one in December) and a firm Fed commitment to restrain growth by keeping real rates high to avoid any uncontrolled return of inflation.

Core inflation figures over 12, 6, and 3-month periods

EUROPE

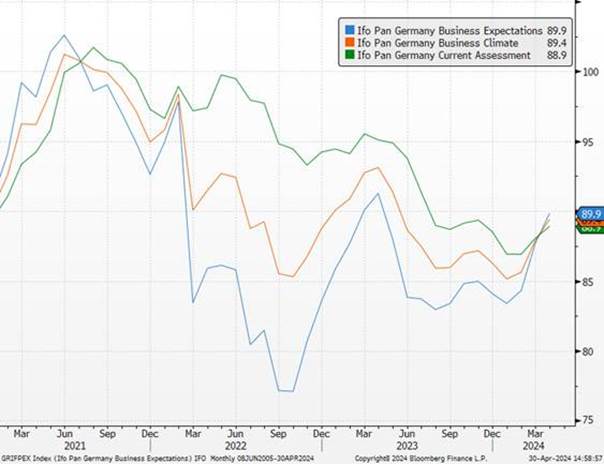

Europe continues its recovery. The release of preliminary PMI indices for April in the eurozone has sent a positive signal regarding the ongoing activity recovery. This momentum is mainly driven by the services sector (52.9 in April), while the manufacturing sector still faces challenging conditions. In the case of Germany, the release of the IFO indices has reassured all sectors of the economy, including manufacturing, which continues to recover. This will reinforce the hypothesis that the trough of activity in the eurozone has been surpassed and that the economic environment is tending towards normalization.

German economic indicators

Sources : Bloomberg, Richelieu’s Group

In this regard, while the improvement in European consumer confidence remains slow, it is expected to strengthen in the coming months alongside the rebound in real wages, which will support household consumption without bringing about inflationary pressure. Underlying inflation should show a slowdown due to a weakening of the wage-price spiral, as well as a lesser ability for businesses to raise prices in an economic environment that remains delicate after several quarters of demand contraction. The door is therefore clearly open to a first interest rate cut in June followed by a path of gradual easing.

Consumer confidence indicators

Sources : Bloomberg, Richelieu’s Group

The debate now shifts to the timing of further interest rate cuts. The ECB will be able to cut them four times this year.

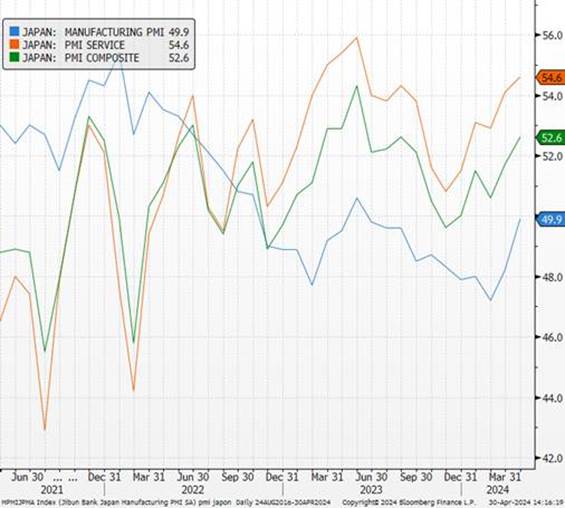

JAPAN

The Bank of Japan keeps its monetary policy unchanged, but maintaining a very dovish tone contrasts with many recent statements. The central bank’s modus operandi is confirmed: new rate hikes will only occur in the event of higher-than-expected inflation. The tourism sector remains very dynamic, with the number of visitors surpassing 3 million for the first time (visitor spending has increased by over 40% since 2019). Supported by the depreciation of the Yen, foreign trade is active, and the trade balance surprises with a positive balance of 366 billion. Exports remain strong, especially driven by semiconductors to China. Japanese business sentiment is strong (Tankan report). It’s worth noting that the central bank officially ended its ETF purchase program in March, while remaining the largest holder of Japanese equities with nearly 7% of the country’s market capitalization.

Economic indicators in Japan

Sources : Bloomberg, Richelieu’s Group

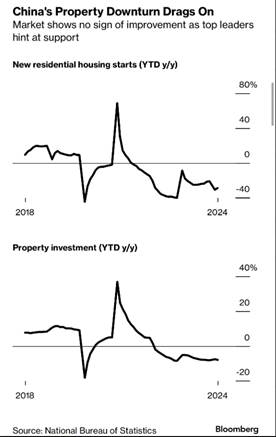

CHINA

Despite strong Chinese data in January and February, the slight downturn in March reinforces the need for fiscal and monetary support. Chinese policymakers are finally focusing on reducing housing inventories. The recent decline in home sales and prices has allowed for further measures to prevent a prolonged slowdown, which would harm household wealth and confidence. Growth has improved, but it is not the time to withdraw support. We should expect a continued recovery in infrastructure investments, but consumer weakness should remind us of the delicate economic situation and a worrying debt trajectory combined with a deflationary environment.

Consumer and producer prices in China

INDIA

Nearly a billion voters are heading to the polls to elect the 543 members of the lower house of the Indian Parliament (Lok Sabha). The third phase of India’s general elections (out of a total of seven) is scheduled for May 7, and the election results will be announced on June 4. The latest economic indicators affirm the country’s robust growth profile. Activity has continued to grow at a very strong pace, still driven by strong domestic and external demand. Over the month, price pressures have eased slightly, and employment in the manufacturing sector is increasing. With new demand engines coming from green energy and India’s manufacturing ambitions, the Capex theme is expected to continue to be the main driver of growth.

Economic indicators in India

Sources : Bloomberg, Richelieu’s Group