The Fed’s Problem, Americans Are Too Rich!

Tweet about X on August 27, 2022

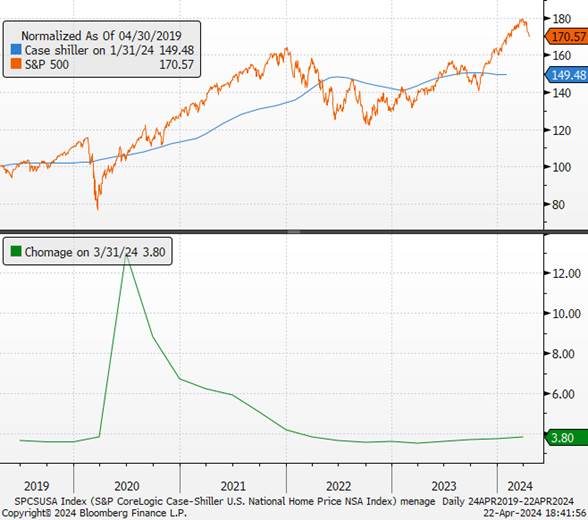

In August 2022, Jerome Powell made it clear: the fight against inflation would “cause pain for households and businesses” in the United States. Nearly two years after the historic interest rate hike, the sources of wealth for American households have never been more flourishing:

- Equities markets: they have reached historic highs,

- Housing prices: they are higher than ever,

- Unemployment rate: it remains extremely low.

Housing prices / S&P 500 / Unemployment rate

Sources : Bloomberg, Richelieu’s Group

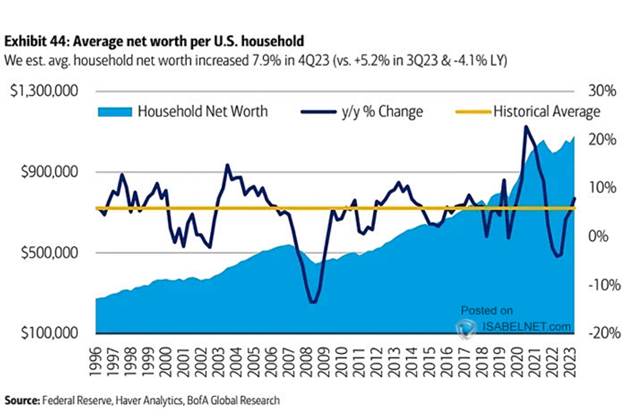

Household wealth in the United States reached a record of approximately $156 trillion by the end of 2023. It increased by about 3.2% from October to December. At the end of 2019, it was $110 trillion, representing a growth of over 40% in 4 years!

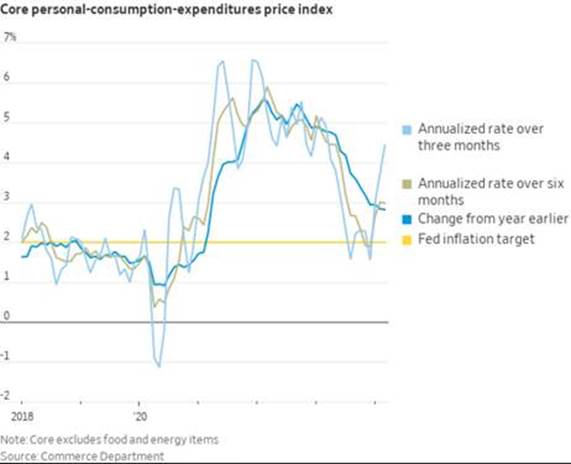

Household deleveraging has partly occurred at the expense of the state, which has become poorer due to Covid. Despite the rate hikes, the Fed still struggles to slow down growth. The temporary effects on inflation are now over, and the last mile to bring it back to the 2% target proves challenging. Lowering rates too aggressively could prove dangerous. By reigniting the credit machine, another wave of inflation could emerge even before the central bank’s target is reached.

The latest IMF report shows that the impact of the rate hike on real estate in the United States has been limited due to the loan structure (fixed rates). Real estate inflation is declining but very modestly and remains high.(https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024)

Households have adapted to higher interest rates offered on savings accounts and certificates of deposit, as well as money market mutual funds. In a way, the increase in interest rates now promotes household wealth growth, as real rates are now largely positive.

Real interest rates in the US at 5 and 10 years

Sources : Bloomberg, Richelieu’s Group

However, excessive tightening or maintaining higher rates for an extended period could pose a more significant risk. Over time, as mortgage rates reset, the transmission of monetary policy could suddenly become more effective and depress consumption at a sustained pace. Households may feel the effects, even where they have been relatively shielded so far.

If we look back simplistically since 2009, the decline in real rates has allowed for asset reflation for nearly 10 years to offset real estate losses on balance sheets. The level of negative real rates has led to increased leverage and thus wealth effects. In 2020, massive state aid in the US (and subsequent stimulus packages) triggered a rapid rise in household savings and led to deleveraging. Full employment following the lockdowns added to the wealth effect. A seemingly perfect sequence for households at first glance?

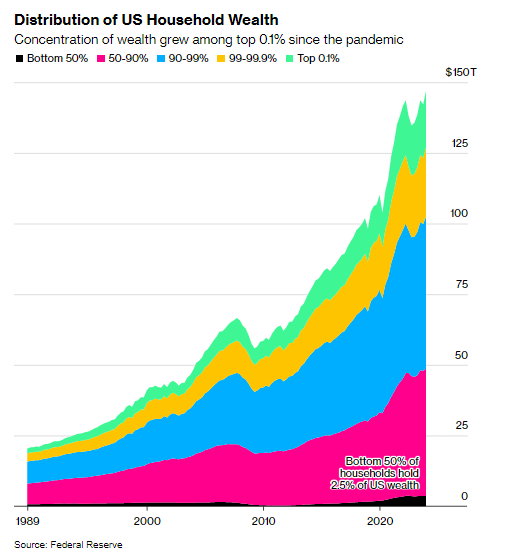

However, the landscape is less idyllic than it seems. Recall that out of the $37 trillion in additional wealth over the past four years, the distribution is concentrated among the top 0.1%. These 133,000 individuals shared about $20 trillion in wealth at the end of 2023, which amounts to roughly $150 million per household, according to Bloomberg.

The increase in rates has exacerbated and continues to exacerbate the imbalance… The higher the rates remain, the more the debt burden will increase, impacting the state’s budget deficit. The higher the rates remain, the more vulnerable economic agents (businesses and consumers) become entrenched. Meanwhile, the state becomes poorer, and systemic risks (commercial real estate, credit card defaults) increase. The US presidential elections in November should be a moment of tension crystallization.

Unlike Europe, American inflation remains linked to a demand shock and a robust economy. Economic slowdown is likely necessary to meet the central bank’s demands. So far, so good, but risks are increasing… just a few months away from the elections…

Raising rates is not a solution, and neither is a sharp decrease. It’s a delicate balancing act for the Fed, which must be patient and credible at the same time.

Perhaps its best interest would be to wait and keep its fingers crossed…

Macro-economic point

· American disinflation, which has been underway for several months, appears to be slowing down and casting doubt on the Fed’s future actions.

· The economic recovery in Europe is unlikely to deter rate cuts as early as June.

· The Bank of Japan does not foresee any changes in monetary policy.

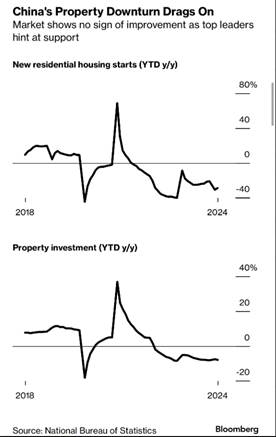

· Chinese authorities are attempting to reassure regarding their ability to end the real estate crisis and restore some short-term confidence.

· The Indian momentum remains unchallenged.

UNITED STATES

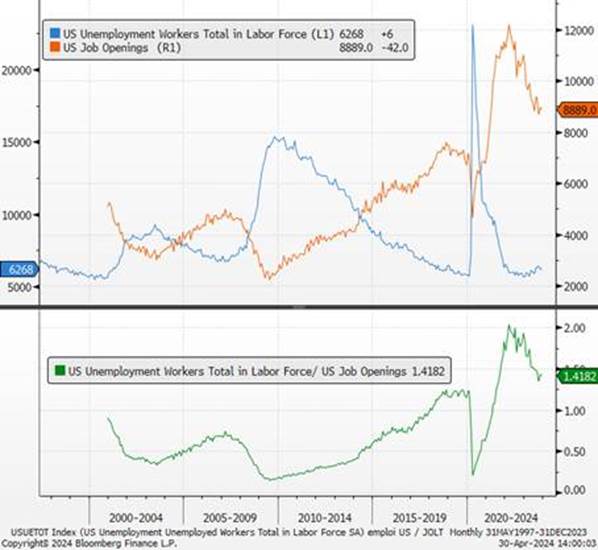

The data released in the United States this month once again sent mixed signals. American growth remained robust. However, the factors that supported consumption and investment are gradually dissipating. American households’ room for maneuver has begun to shrink in the face of several headwinds: rising taxes, still restrictive financial conditions (particularly high credit card and mortgage interest rates), and depletion of savings accumulated during the pandemic. The prospects for a smooth landing of the US economy seem to be materializing. Tension in the job market appears to be gradually easing, with employers “no longer feeling pressured to hire” (according to the Beige Book) and an increase in the number of candidates per job opening.

Job openings and number of unemployed in the United States

Sources : Bloomberg, Richelieu’s Group

We expect a slowdown in demand and thus a relapse in growth and inflation. For business investment, its dynamism is partly explained by the effects of the stimulus and investment plans implemented by Joe Biden in recent years (such as the Reduction Act of 2022 or the Bipartisan Infrastructure Law of 2021). This effect on GDP will diminish without new fiscal stimulus, which is highly unlikely in the coming months as the elections approach. In a context of slowing demand, business investment decisions are likely to be revised downwards, contributing less favorably to growth.

Jerome Powell aimed for greater confidence in inflation figures, but so far, this hasn’t materialized. However, we expect price increases to be more moderate in the second half of the year, allowing the Fed to lower interest rates. With a moderate slowdown on the horizon, the most likely date for the Federal Reserve to cut interest rates is now July or September. We maintain our forecast of two rate cuts (one in December) and a firm Fed commitment to restrain growth by keeping real rates high to avoid any uncontrolled return of inflation.

Core inflation figures over 12, 6, and 3-month periods

EUROPE

Europe continues its recovery. The release of preliminary PMI indices for April in the eurozone has sent a positive signal regarding the ongoing activity recovery. This momentum is mainly driven by the services sector (52.9 in April), while the manufacturing sector still faces challenging conditions. In the case of Germany, the release of the IFO indices has reassured all sectors of the economy, including manufacturing, which continues to recover. This will reinforce the hypothesis that the trough of activity in the eurozone has been surpassed and that the economic environment is tending towards normalization.

German economic indicators

Sources : Bloomberg, Richelieu’s Group

In this regard, while the improvement in European consumer confidence remains slow, it is expected to strengthen in the coming months alongside the rebound in real wages, which will support household consumption without bringing about inflationary pressure. Underlying inflation should show a slowdown due to a weakening of the wage-price spiral, as well as a lesser ability for businesses to raise prices in an economic environment that remains delicate after several quarters of demand contraction. The door is therefore clearly open to a first interest rate cut in June followed by a path of gradual easing.

Consumer confidence indicators

Sources : Bloomberg, Richelieu’s Group

The debate now shifts to the timing of further interest rate cuts. The ECB will be able to cut them four times this year.

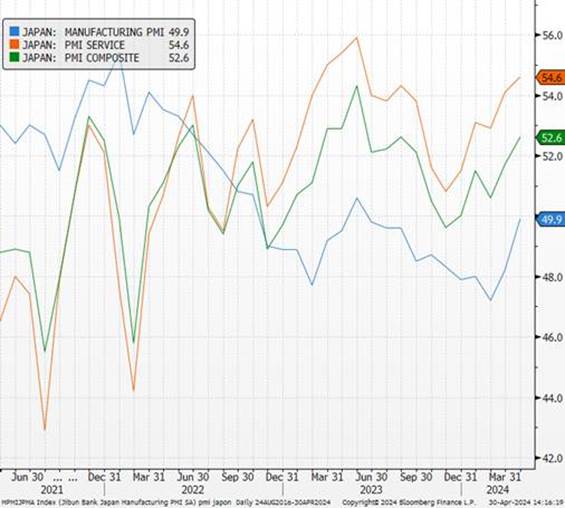

JAPAN

The Bank of Japan keeps its monetary policy unchanged, but maintaining a very dovish tone contrasts with many recent statements. The central bank’s modus operandi is confirmed: new rate hikes will only occur in the event of higher-than-expected inflation. The tourism sector remains very dynamic, with the number of visitors surpassing 3 million for the first time (visitor spending has increased by over 40% since 2019). Supported by the depreciation of the Yen, foreign trade is active, and the trade balance surprises with a positive balance of 366 billion. Exports remain strong, especially driven by semiconductors to China. Japanese business sentiment is strong (Tankan report). It’s worth noting that the central bank officially ended its ETF purchase program in March, while remaining the largest holder of Japanese equities with nearly 7% of the country’s market capitalization.

Economic indicators in Japan

Sources : Bloomberg, Richelieu’s Group

CHINA

Despite strong Chinese data in January and February, the slight downturn in March reinforces the need for fiscal and monetary support. Chinese policymakers are finally focusing on reducing housing inventories. The recent decline in home sales and prices has allowed for further measures to prevent a prolonged slowdown, which would harm household wealth and confidence. Growth has improved, but it is not the time to withdraw support. We should expect a continued recovery in infrastructure investments, but consumer weakness should remind us of the delicate economic situation and a worrying debt trajectory combined with a deflationary environment.

Consumer and producer prices in China

INDIA

Nearly a billion voters are heading to the polls to elect the 543 members of the lower house of the Indian Parliament (Lok Sabha). The third phase of India’s general elections (out of a total of seven) is scheduled for May 7, and the election results will be announced on June 4. The latest economic indicators affirm the country’s robust growth profile. Activity has continued to grow at a very strong pace, still driven by strong domestic and external demand. Over the month, price pressures have eased slightly, and employment in the manufacturing sector is increasing. With new demand engines coming from green energy and India’s manufacturing ambitions, the Capex theme is expected to continue to be the main driver of growth.

Economic indicators in India

Sources : Bloomberg, Richelieu’s Group