The 3 must-know news stories of the week:

- Nvidia impresses again!

- The Eurozone continues its recovery.

- The trade war saga continues.

Nvidia impresses again!

The AI star has released new upward sales forecasts, showing that spending in the AI computing sector remains significant. Revenue and EPS exceeded consensus expectations despite the Osborne effect, a phenomenon where sales of an existing product (Hopper) decrease before those of a new product (Blackwell).

Not only does Nvidia deliver sales growth superior to other megacaps (sales up +262% yoy in Q1), but the company also manages to improve its margins (57% FCF margins). At this rate, Nvidia could generate more than $120 billion in FCF over the next two years and more than $200 billion in the next three years. Additionally, the 40%+ growth in its operating expenses (compared to controlled capex by other chip manufacturers) should help the company maintain its leadership position. According to management, each $1 of capex generates $5 in revenue in 4 years for customers.

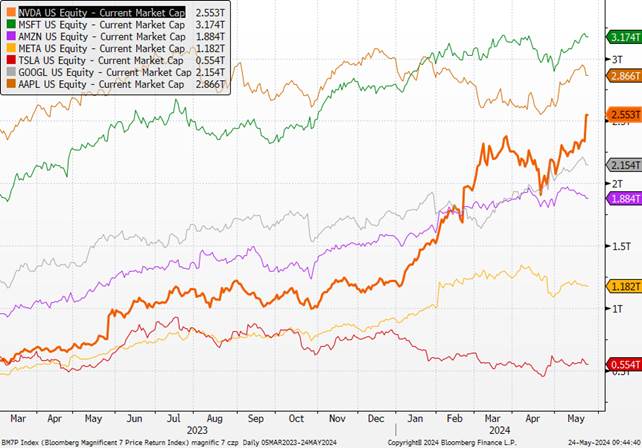

The company also announced a 10-for-1 stock split and increased its quarterly dividend by 150% to 10 cents per share. So far, profits from US tech companies have been among the highest of the first-quarter reporting season, with revisions in the sector surpassing the rest of the market…

Market Capitalization in Trillions of Dollars of the Magnificent 7

Sources : Bloomberg, Groupe Richelieu

The Eurozone continues its recovery.

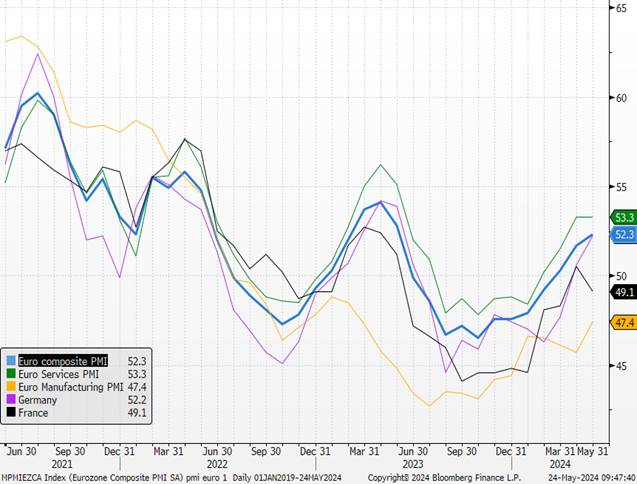

The composite PMI continues its recovery in May at 52.3 after 51.7 in April, slightly better than expected (52.0). The services PMI remains unchanged at 53.3, and the manufacturing PMI continues its recovery, rising from 45.7 to 47.4, the highest in 15 months. Activity is growing in the services sector for the 4th consecutive month, and in the manufacturing sector, the volume of activity is only slightly declining. New business and employment are up in services and only marginally declining in the industrial sector. Price inflation and billed price inflation have slowed compared to April. However, notable disparities exist between France (where activity contracted in services contrary to expectations) and Germany (where PMIs significantly exceeded expectations in both services and manufacturing). The German composite PMI (52.2) is up and signals growth for the second consecutive month. Conversely, the French composite PMI falls (49.1) due to a deterioration in the services PMI (49.4).

Simultaneously, the pace of negotiated wage growth, a statistic closely watched by the ECB and thus also scrutinized this morning, shows an unexpected reacceleration in Q1-2024 (up 4.7% yoy, +20 bp vs Q4-2023). This movement, partly linked to the dynamics of wage increases in Germany, is likely to fuel the ECB’s caution in the coming weeks, echoing recent statements from various members, such as J. Nagel (Bundesbank) in recent days. However, smoothing out the bonus-related part, wage growth remains stable.

PMI Indicators in the Eurozone

Sources : Bloomberg, Groupe Richelieu

The trade war saga continues.

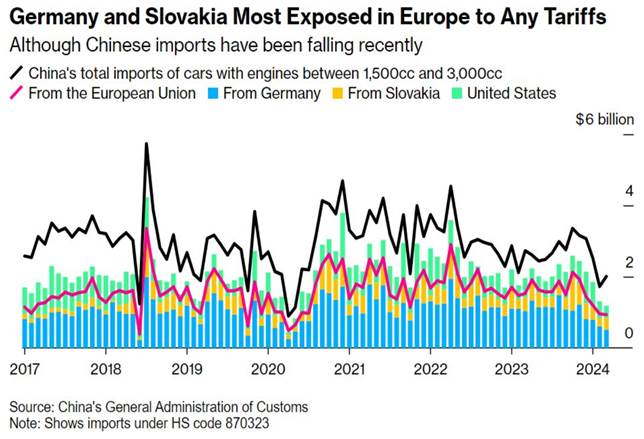

Trade tensions between China and other major world powers continue to gradually escalate: following Washington’s significant tariff hike announcements last week, Beijing announced on Sunday the launch of an “anti-dumping” investigation into certain plastics imported from Europe, the United States, Taiwan, and Japan. The investigation should be completed within a year but could be extended by six months according to Chinese authorities. While these announcements add to the risk of additional trade tensions, they confirm for now that China’s response remains measured to avoid provoking too drastic an escalation, especially since the European Commission has also launched similar investigations into subsidies for electric vehicle imports from China. In this context, the impact on the global economy and inflation will remain limited, but the scenario of a large-scale trade war cannot be ruled out, especially in the event of Donald Trump’s victory in the upcoming US elections in the fall.

In recent days, American, Chinese, and European statements have continued to fuel fears of increased protectionism. This time, cars are in the spotlight with the possibility of new Chinese tariffs of around 25% on high-powered cars (with engine displacement over 2.5 liters), a measure that would mainly target the EU and the US (which announced 100% tariffs on Chinese electric cars last week), and possibly Japan. Although this position has not been officially confirmed by the government, the risk of such a decision is increasing. The EU absorbs 40% of China’s electric vehicle exports.

Additionally, the publication of this press information comes at a strategic time for China as the European Commission has until June 5 to decide whether to impose new taxes on Chinese products, especially electric vehicles, which pose an increasing competition problem for European manufacturers. Ahead of the major European election on June 9, such a scenario cannot be entirely ruled out as the issues related to Chinese electric vehicle imports are twofold: industrial and cyber-security. Once again, the information indicates a growing geopolitical and protectionist risk that would hamper growth and global trade if the escalation continues…

Source : X

Chart of the Week

Kodak, IBM, and GE were also in the top 10 companies of the S&P 500.

Source : X