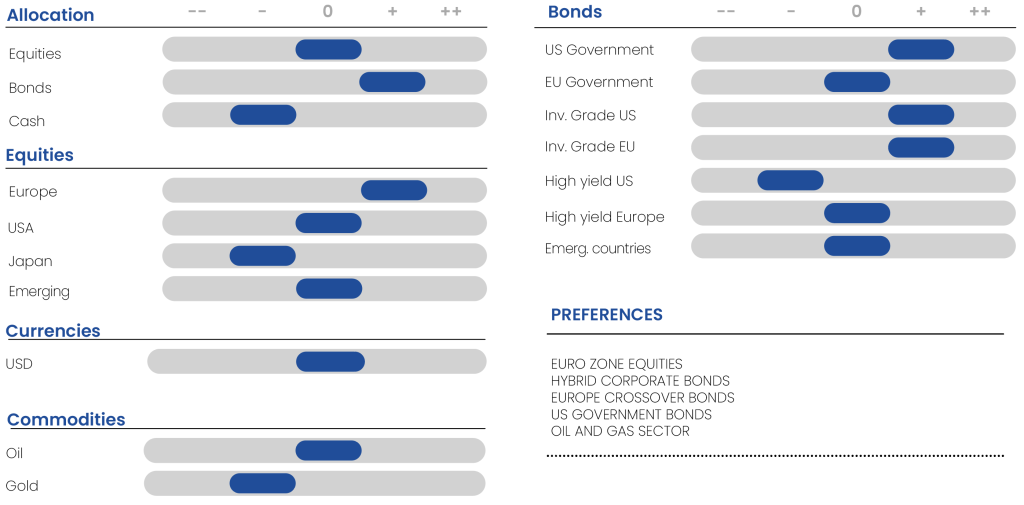

Asset Allocation: Growth Dynamics Limit Appreciation Potential

We continue along the same lines as the previous month. We believe that the disinflation process will resume in the second half of the year, thanks to a slowdown in the growth dynamics of the American economy. There is no certainty about the decrease in inflation given the recent data. In this context, bonds should be favored. Market volatility should provide opportunities to be more flexible.

Equities

Equity Indices in Euros over 3 Months

Sources : Bloomberg, Richelieu Group

The rapid growth in results within the artificial intelligence segment remains a key catalyst for U.S. equity indices, prompting us to raise the 6- and 12-month target levels for the S&P 500 to 5200 and 5300, respectively. With optimistic assumptions (additional upward revisions of EPS in the AI segment, strong resilience of U.S. growth without compromising the disinflationary trajectory allowing for two Fed rate cuts in the second half), the additional upside potential for the S&P 500 by year-end seems relatively limited.

We remain positive on European equities. The combination of rate cuts and growth acceleration is indeed the best cocktail for European stocks, especially since the ECB is expected to cut rates before the Fed. Small caps represent one of the best investment opportunities to play the cyclical strategy and rate cuts. Over the past few weeks, flows have been improving towards Europe, and this trend should continue. Our targets remain 5200 and 5300 for the next 6 and 12 months, respectively.

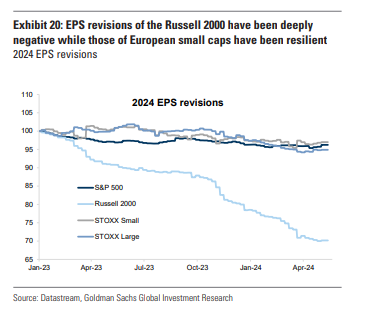

While growth, momentum, and large caps were particularly sought after in the first leg of the rally at the beginning of the year, we have seen a notable comeback of value stocks since early March (banks/commodities) and the end of the underperformance of defensive stocks and small caps. Macroeconomic data is improving: PMIs are well-oriented, GDP growth is at +0.3% in Q1 after 5 quarters of stagnation, and the first ECB rate cut is still expected in June. Therefore, we believe that all the stars are aligned for a return to small caps, especially if the resurgence of M&A activity is confirmed. Unlike the U.S. small-cap market, the results of European small caps demonstrate strong resilience in 2024.

Earnings Revisions for 2024

Sources : GS, X

Emerging Equity Markets Remain Significantly Undervalued Compared to Developed Markets. The reevaluation of their attractiveness factors should lead to a revaluation of these markets. China’s focus on reducing housing stock has been a catalyst for extending the recovery of its stock markets, but this trend is beginning to falter. In the medium term, growth is expected to slow to 3.3% due to an aging population and a slowdown in productivity gains. As long as there is no effective rate cut by the Fed, Chinese authorities are constrained by the weakness of their currency. Many emerging countries benefit from China’s efforts to counter the protectionist tendencies of Western countries. We remain positive on the Indian market given its growth dynamics and the lower sensitivity of the Indian rupee to the dollar. Our overall market outlook remains based on continuity of power after the general elections.

Indices of Major Emerging Markets Over 1 Year

Sources : Bloomberg, Richelieu Group

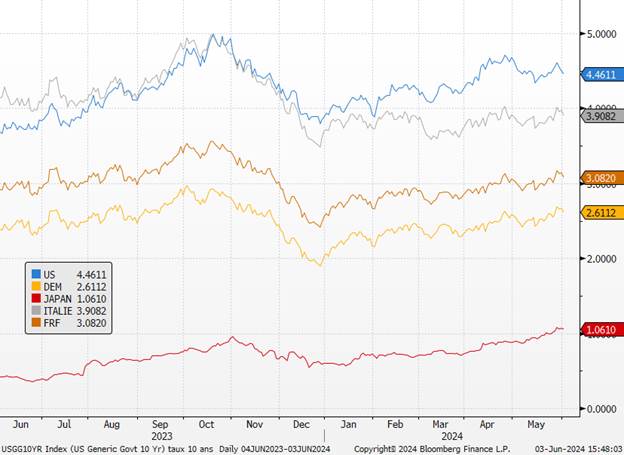

Sovereign rates

The confirmation of various growth and inflation statistics will allow investors to reintegrate a horizon of gradual easing of U.S. key interest rates over the coming quarters, which will amplify the decline in U.S. sovereign rates in the second half of the year. This gives us a preference for U.S. Treasuries over other government bond markets. Real rates should remain high as inflation dynamics weaken. A balance between the interest burden paid by states and the budget deficit leads us to believe that rates should not rise excessively. Our year-end outlook for the 5- and 10-year U.S. Treasuries is 4.1% (same for the 5-year). For the first time since the early 2000s, the Treasury Department will launch a series of buybacks targeting older, harder-to-trade debts. The goal is to enhance trading ease, as older securities are generally less liquid. The Federal Reserve will begin slowing the pace of its balance sheet reduction in June. The slowdown in the Fed’s quantitative tightening will be useful as it is a prudent risk management approach that should dispel concerns about a repeat of the overnight funding market crisis. Eurozone sovereign rates should also benefit from the ECB’s rate cut sequence, although the European elections could bring some post-election tensions.

10-year yields

Sources : Bloomberg, Richelieu Group

Credit

The relative improvement in the economic situation in Europe, despite the prospect of persistent inflation in services, as well as generally positive corporate results in the first quarter, lead us to be positive on credit. Especially as interest rates remain at satisfactory levels. However, technical factors seem to have the most influence on the asset class, with investor demand remaining strong. Investment-grade credit funds have just experienced 7 months of positive net inflows globally (which hasn’t happened since 2019). The significant influx of issuances is easily absorbed. Despite these tight spreads, the only thing preventing credit from rebounding strongly is the high level of new issuances in recent weeks. We anticipate that issuance volumes of Investment Grade bonds will slow down. June is expected to be the lowest month in terms of issuances for 2024, below $105 billion. We no longer expect spread tightening as credit spreads are at their tightest levels of the year, or nearly so, and are below the long-term average. Financial bonds, especially subordinated ones, remain our preferred securities as they offer a premium compared to corporate and senior debt, with strong fundamentals. Low dispersion in high yield, with insufficient spread between BB and B-rated papers, and the narrow gap with the BBB segment, leads us to favor the highest-rated issuers. We remain cautious on US high yield. We believe the market is starting to factor in the impact of high rates for an extended period. The most fragile players will face increasing financial pressures.

High Yield credit spreads

Sources : Bloomberg, Richelieu Group

Oil

The end-of-month cartel meeting concluded with a seemingly durable extension of production cuts (until the end of 2025 for the main quotas, and until the end of September 2024 for voluntary additional cuts, mainly affecting Saudi Arabia and Russia), but with an explicit intention to gradually reduce them starting from the fourth quarter. While the unity displayed by OPEC+ is positive for prices, as well as the postponement of debates on production capacities for over a year, the indication of a gradual increase in production in the coming quarters, coupled with an exception already granted to the United Arab Emirates, who can gradually increase their production from next January, currently limits the positive impact on crude prices. For our part, we maintain our target between 80 and 85 per barrel, anticipating a global demand for crude oil that will also increase in the coming months, with an adjustment in OPEC+ production that will only come with a delay. Note that the next OPEC+ meeting is scheduled for December 1, 2024.

Oil production of the 3 main producers

Sources : Bloomberg, Richelieu Group

Change

At the end of May, the US dollar weakened against all G10 currencies. Slightly weaker US economic data, albeit from very high levels, reassured markets that the economy is not accelerating and that a soft landing remains the base scenario. Speeches by Federal Reserve officials, pushing back expectations of a rate hike and emphasizing that the next move will be a cut, albeit later than expected, also helped. Better economic data from the rest of the world, notably Europe and China, although from low levels, were another factor. Solid US economic data led to a massive reassessment of the Fed, shifting from expectations of seven cuts earlier in the year to less than two. Most other central banks, including the ECB and the BoE, have also been reassessed but are still expected to begin cutting rates before the Fed. The main driver of the currency market for us remains the Fed’s ability to cut rates by the end of the year or not.

The expected delay in the Fed’s rate cut is currently being offset by weakness in the US consumer. At this point, we maintain a neutral view on the currency in the short term. Our year-end forecast remains at 1.11, compared to a consensus of 1.08, but relies heavily on the assumption of a Fed cut in December. However, if the Fed finds itself stuck with high rates for longer, which may also depend on US policies after the elections, renewed strength in the USD remains a risk. We believe the euro should strengthen by the end of the year as weakness in the US economy begins to materialize.

Major currencies against Euro

Sources : Bloomberg, Richelieu Group

Asset allocation table

Source : Richelieu Group