- United States: avoiding another wave of inflation

- Europe: sustaining growth momentum

- Japan: yen’s impact on inflation may push BoJ to accelerate

- China: two-speed economy

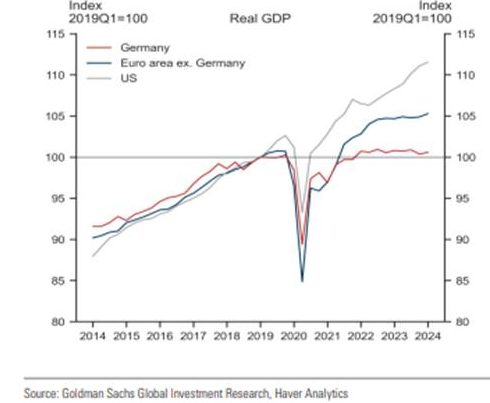

The question of the specificity of the United States so far obviously arises. Indeed, we regularly hear that both the ECB and the BOE could cut their rates in June, but the risk is that the first rate cut by the Fed may be much later, or even non-existent. After several quarters of very clear outperformance, US growth should now be closer to that of G10 countries, or even slow down, while that of G10 countries should progress.

US / Europe growth differential

Sources : GS, X

United States: avoiding another wave of inflation

The inflation data at the beginning of the year are less favorable and have slightly reduced members’ confidence in the disinflationary trend. This leads them to anticipate a more prolonged and elevated maintenance of key interest rates at their current level. Inflation certainly accelerated in the first quarter in the United States, but we believe this trend should reverse, given the expected slowdown in growth. The US labor market is rapidly normalizing to return to pre-pandemic levels, and the observed tightness is ultimately quite similar to that of G10 countries. Monetary policy is starting to have an increasingly significant impact on real estate and employment, two sources of fundamental inflation. We believe that the gradual easing of US growth will also gradually limit the strength of inflation. We expect 2 rate cuts this year.

Unemployment and labor force participation rate in the US

Sources : Bloomberg, Richelieu Group

Europe: sustaining growth momentum

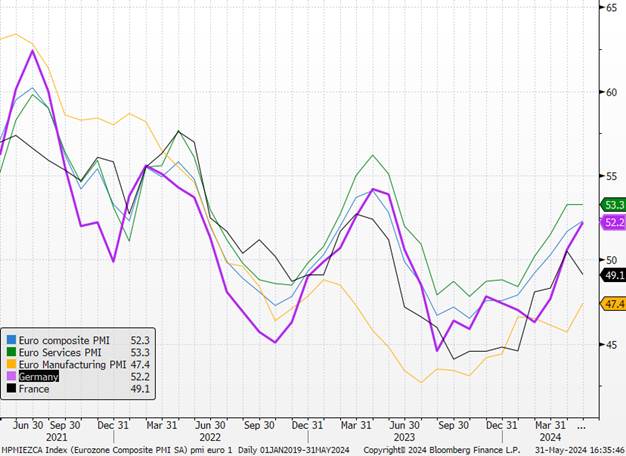

Published European statistics have sent a favorable signal regarding economic prospects. PMI indices have continued to rebound across the eurozone, particularly due to the lesser deterioration of activity in the manufacturing sector and the stabilization of the services activity index. Activity is growing in the services sector for the 4th consecutive month, and in the manufacturing sector, volume is now only slightly decreasing. Inflation of both input and output prices has slowed compared to April. It is worth noting that this positive momentum has also been observed in Germany. Overall, the first-quarter growth rebound appears to be continuing thanks to the strength of domestic demand. Household consumption remains supported by wages, as highlighted by the publication of negotiated wages earlier in the year. Contrary to expectations, these have slightly rebounded to +4.7%, but this dynamic is largely driven by developments in Germany and an anti-inflation bonus paid to German civil servants. Excluding the “bonus” component, wage growth remains stable. This does not challenge the monetary policy of the eurozone, although it will need to maintain a degree of caution in the pace of monetary easing. Following the SNB and the Swedish Riksbank, we continue to anticipate further monetary easing with the BOE and the ECB in June.

PMI Eurozone

Sources : Bloomberg, Richelieu Group

Japan: yen’s impact on inflation may push BoJ to accelerate

As expected, Japanese inflation has slowed overall. While it remains above the Bank of Japan’s inflation target of 2%, its inflation measures, which exclude the most volatile elements, are now moving below the BoJ’s forecasts. However, these data are not expected to deter the Bank of Japan from its intention to raise key interest rates. The BoJ governor reiterated, on the sidelines of the G7, that the weakness in activity in the first quarter (contracting sequentially) is not sufficient to question the continuation of monetary tightening, as a growth rebound is expected. PMI indices support this hypothesis by remaining positive in May. The manufacturing PMI returns to expansion territory. Machinery orders rebound, and business sentiment remains positive, but export dynamics remain sluggish.

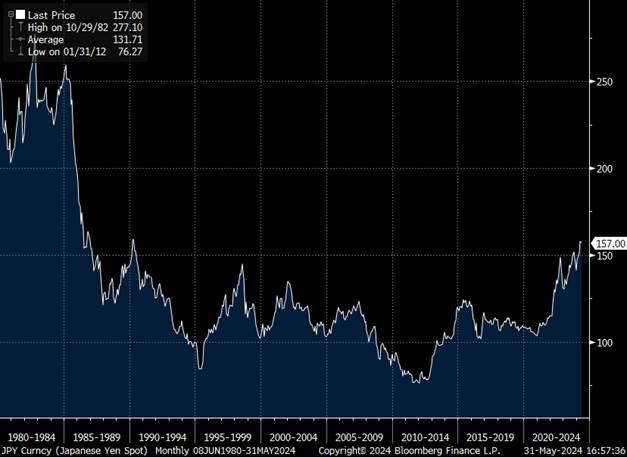

It is also worth mentioning that the weakness of the yen against the dollar, which led to two likely interventions by the Ministry of Finance in the foreign exchange market in April, is an inflationary factor through import costs. The weakness of the currency is also evident in Japanese consumer sentiment, which has significantly declined in May. We believe that the BoJ will need to raise its key interest rates again in the third quarter to contain these inflationary pressures, which will support the appreciation of the yen.

Dollar versus Yen

Sources : Bloomberg, Richelieu Group

China: two-speed economy

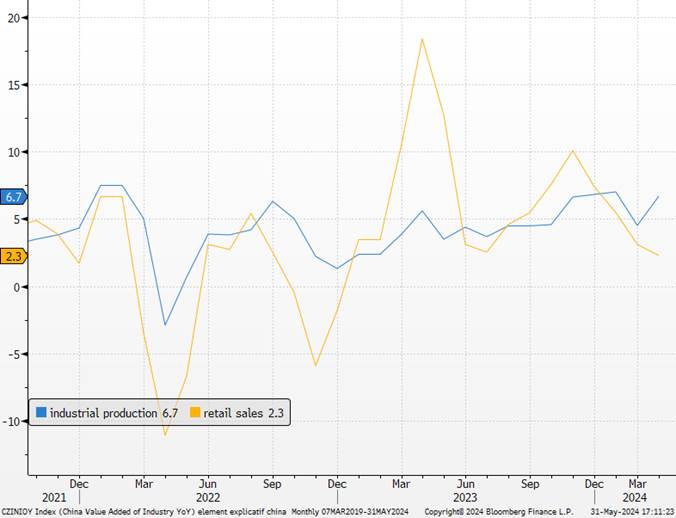

The saga of the trade war continues. Price developments struggle to reassure about the state of the Chinese economy. Indeed, despite a third consecutive month of prices moving into positive territory, this slight improvement in the inflation profile is mainly due to the end of the negative contribution from energy. However, the landscape is not favorable on the domestic demand side. Inflation in real estate remains particularly low compared to its contribution before the real estate crisis in the summer of 2021. In the services sector, improvement is very slow, which is an additional sign of an economy still showing moderate dynamics. Therefore, underlying inflation remains below 1%, which continues to indicate the risks of deflation and a “liquidity trap,” as monetary stimulus in recent quarters has yet to stimulate credit, as evidenced by the publication of financing statistics for the economy.

The release of official PMI indices for May served as a reminder of the challenges that Chinese growth still faces. Despite government support to limit the negative impact of the real estate sector, domestic demand continues to be affected by the caution of Chinese households, thereby limiting the expansion of services. But it is mainly in the industry where PMI indices disappointed. This is due in part to much less favorable new orders, including for exports, in a context where many countries are trying to limit China’s access to their domestic market. While this is bad news for Chinese growth, which we believe will remain modest in the coming quarters, it could help alleviate tensions in maritime freight and be good news for Western central banks. This reinforces a cautious scenario regarding growth prospects, with the bulk of the economic rebound now behind us.

Industrial production and retail sales in China

Sources : Bloomberg, Richelieu Group