What strategy to adopt following the announcement of the dissolution of the Assembly in France?

Often less closely watched than other elections, rarely has a European election had such a significant impact in France.

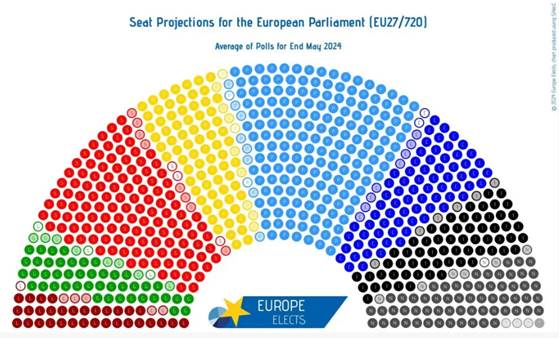

Although at the European level, the shift to the right of the Parliament is confirmed, there is political stability that should not affect financial markets.

Source : Europe Elects

The main event remains the calling of early legislative elections in France. Indeed, the President of the French Republic, Emmanuel Macron, decided on Sunday evening to dissolve the National Assembly and call early legislative elections for June 30 and July 7. The presidential majority list (Renaissance) came significantly behind the National Rally list.

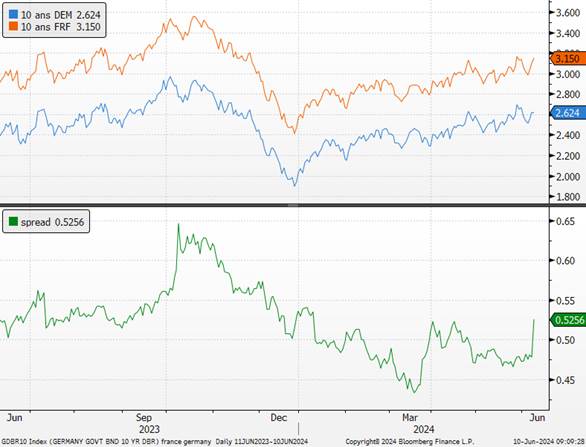

The calling of early legislative elections in France increases political risk in Europe and opens a period of uncertainty until the evening of the second round on July 7. In the short term, European stocks, primarily French ones, will suffer. We recommend reducing positions. We are neutral on the area until the election results. The OAT-Bund spread will also widen. We are negative on Eurozone sovereigns despite less restrictive monetary policy.

10-year German and French rates

Sources : Bloomberg, Richelieu Group

There is now great uncertainty about the future composition of the National Assembly and the government that may result from it. Indeed, unlike yesterday’s election, the two-round nature of the legislative elections emphasizes the importance of pre-election negotiations to form alliances between political forces to maximize chances of winning in 577 different constituencies.

The sectors most at risk are those with a high beta related to political risk, high exposure to France and the EU, and high debt. The main sector expected to suffer from this political uncertainty remains the financial sector. We downgrade our short-term outlook to neutral. By nature sensitive to political risk, more than 50% of their revenues are generated in the Eurozone. Their long-term beta (20 years) is also one of the highest at 1.34x. Real estate should also suffer from the increase in risk premiums.

The automotive sector, the quintessential cyclical sector with a high beta (1.26 on average over 2 years and over 20 years), would suffer from uncertainty over the European trajectory on thermal engine regulations.

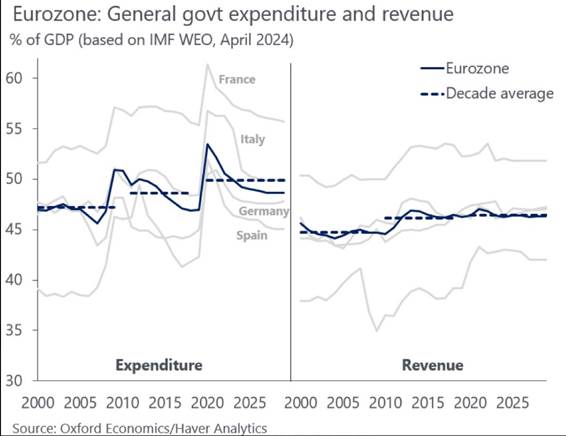

The coming weeks will therefore be crucial but in any case, the future parliament and government will face a major challenge: to restore the balance of public finances, which have deteriorated after efforts made during Covid and to fight inflation post-war in Ukraine. This will be the main issue for financial investors as the French deficit exceeded 5% of GDP in 2023 (and France’s sovereign rating was recently downgraded by the rating agency S&P).

Comparison of expenditures and revenues of the main Eurozone countries

Source : X