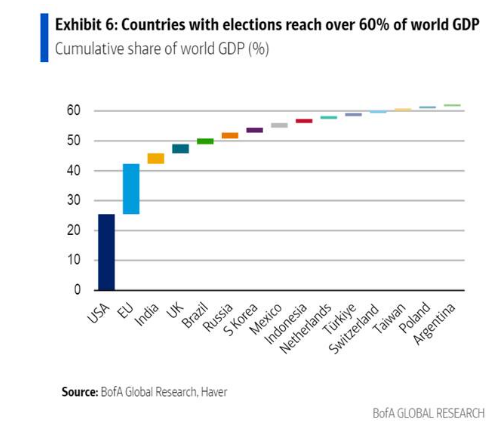

With elections impacting 76 countries and 4.2 billion people, more than 60% of the global GDP, the stakes have never been higher.

When we highlighted political risk in our 2024 outlook, we did not imagine that two other surprise elections would take place (UK general elections, French legislative elections).

With the rise of populism and polarization, we had anticipated volatility linked to the political cycle. We are witnessing major changes in the political landscape.

The various elections this year have been a significant source of short-term volatility.

Taiwan

The 2024 presidential election in Taiwan, won by Lai Ching-te, had several notable impacts on financial markets. First, political uncertainty and geopolitical tensions between Taiwan and China led to increased volatility. Stocks of companies related to semiconductors, a key sector of Taiwan’s economy, were particularly affected due to concerns about regional stability and potential disruptions to supply chains.

Source: X

Inde

The results of the Indian elections unfolded somewhat differently than expected. Indian President Narendra Modi and his allies did indeed win, granting Modi his third term. However, his party, the Bharatiya Janata Party (BJP), although remaining the largest party in terms of seats in the Indian Parliament, no longer holds an absolute majority. The markets reacted with surprise to these results: on Tuesday, June 4th alone, the Nifty50 index lost 5.93% of its value, and the BSE Sensex index dropped by 5.74%. While overall stability will not be compromised, it is likely that the Indian government will face difficulties in implementing its future economic policies.

NIFTY 50 (Indian Market) Over 6 Months

Source: Bloomberg

The elections in South Africa saw a historic setback for the ANC, which lost its absolute majority in the National Assembly.

The 2024 presidential election in Mexico, won by Claudia Sheinbaum, led to a significant devaluation of the Mexican peso.

Dollar vs. Mexican Peso

Source: Bloomberg

European countries appeared relatively immune in 2024, with a European election that would not bring about any drastic changes. The shift to the right in the Parliament is confirmed, and there is political stability that should not impact financial markets.

United Kingdom

After several defeats in local elections, Prime Minister Rishi Sunak announced on May 22 that he had requested the king to convene general elections for July 4, 2024. In December 2019, they resulted in a landslide victory for the Conservative Party. The situation has reversed. The British Conservatives are reportedly on the brink of total eradication in the upcoming general elections, according to the latest polls. Three “megapolls” predict an unprecedented collapse of the Conservative Party on July 4. The Tories face a long period in the wilderness. A survey of a sample of 17,000 people ahead of the next elections, as reported by the Telegraph (https://www.telegraph.co.uk/politics/2024/06/19/kemi-badenoch-future-of-tory-party-general-election-2024/), “is terrifying for the Conservative Party,” exclaims the newspaper close to the ruling majority. According to Savanta’s modeling, Labour could win up to 516 of the 650 seats in the House of Commons. The Tories? Only 53. This unprecedented decline is accompanied by an unprecedented blow: outgoing Prime Minister Rishi Sunak would lose his seat, along with several prominent figures such as Home Secretary James Cleverly, and former Prime Minister, Liz Truss.

Source: x

France

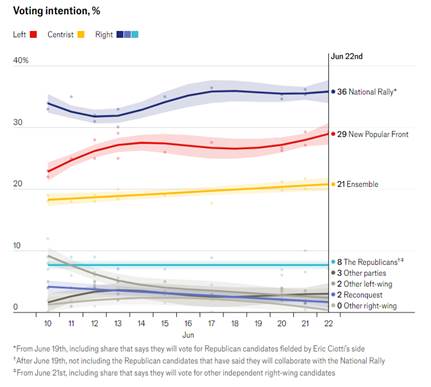

The situation is comparable for the ruling party. According to polls, the Rassemblement National (National Rally) continues to lead by a wide margin in voting intentions with a score between 35% and 36%, followed by the Nouveau Front Populaire (New Popular Front) with 27% to 29.5%. Ensemble (party of the President of the Republic) remains third with 19.5% to 20% of the votes. Given the expected high turnout, there are likely to be numerous three-way contests with potential withdrawals and uncertainties regarding the transfer of votes between different parties. It remains probable that the election outcome will be a relative majority, necessitating agreements to form a coalition.

Both leading parties face two challenges: the potential inflationary effect and the risk of public finance slippage if expected growth does not materialize. These factors could further deteriorate France’s state financing conditions, while the spread with Germany continues to fluctuate around 80 basis points. No scenario can be ruled out regarding market reactions.

It’s worth remembering the short-lived Truss government in Great Britain, which lasted only two months from early September to late October 2022. The announcement of an unfunded budget without consultation with financial institutions triggered an unprecedented crisis in the British debt market, prompting the central bank to intervene and leading to the Prime Minister’s resignation less than two months after taking office. Conversely, despite predictions of a financial market tsunami, Donald Trump’s first election resulted in a strong bull market.

Poll for the Legislative Elections in France

Source: The Economist

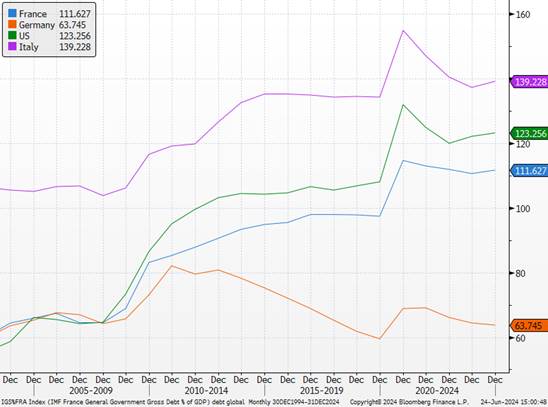

The coming weeks will be crucial. Regardless of the election outcomes, future parliaments and governments will face a significant challenge: restoring the balance of public finances, which have deteriorated due to efforts during the Covid pandemic and in response to post-war inflation in Ukraine. This will be the primary concern for financial investors, especially as France’s deficit exceeded 5% of GDP in 2023 and its sovereign credit rating was recently downgraded by S&P.

Beyond the July deadlines, there will be a lull until November 5th with the U.S. presidential, senatorial, and House of Representatives elections.

A victory for Donald Trump could have significant implications for the U.S. economy, particularly concerning inflation.

During his first term, Trump implemented economic policies that impacted inflation, separate from Covid consequences. Firstly, tax cuts, mainly benefiting businesses, spurred economic growth by increasing corporate investments and consumer spending. Secondly, the trade war with China and tariffs on various goods raised import costs, contributing to inflationary pressures. His second term could mirror the first, despite changes in economic and geopolitical contexts.

The Covid pandemic not only transformed societies but also clearly weakened state balance sheets, even those seemingly immune, in terms of both debt and budget deficits. The electorate’s preferences in elections could conflict with market realities and creditors’ expectations…

Debt-to-GDP ratio

Sources: Bloomberg, Richelieu Group

It is premature to assess the heightened reactions before and during, human capacity to adapt to everything, media biases, high-frequency polling, and the uncertainty of such elections. However, the main risk at this stage, in our view, would be a “Liz Truss moment” for France – that is, an uncontrollable situation arising not from within but from outside, plunging the country (and likely the region) into a debt crisis.