We base our analysis on two convictions:

- The disinflation process will resume in the second half of the year, driven by a slowdown in U.S. growth momentum

- The U.S. elections will also impact asset behavior, but the uncertainty regarding the outcome, especially for Congress, is too high for it to influence asset allocation at this stage. We remain vigilant for a market reversal given the upcoming Q2 corporate earnings results in the coming weeks. In the current environment, selecting high-quality, low-risk stocks is preferred.

The events that could lead us to change our viewpoint in the coming months are:

- Higher-than-expected inflation, implying that central banks cannot start normalizing their rate policies.

- The results of the U.S. elections compromising inflation moderation or global geopolitics.

In short, the trajectory of financial markets is unlikely to be as linear as it has been over the past six months.

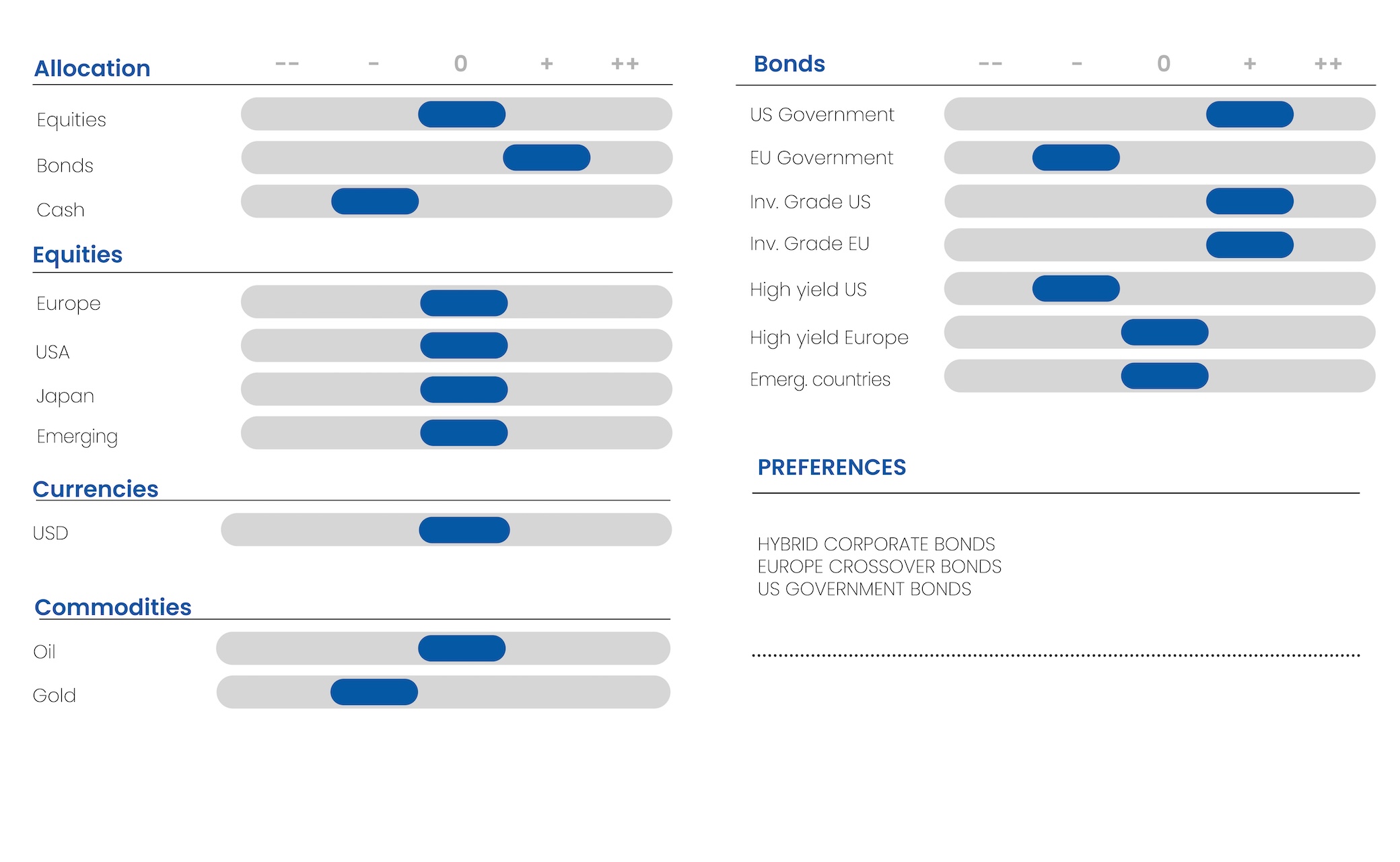

Equities

The U.S. market remains resilient this month. A deceleration in the U.S. economy could challenge this trend, although this factor should favor fixed income over equities, given their relative valuations.

We anticipate that earnings will reach new highs in the second half of 2024, but will largely moderate. A slight downside risk is likely in the third quarter due to volatility related to the election period starting in September. The outperformance of mega-cap stocks relative to the average S&P 500 stocks is now at a critical stage. We remain vigilant but could take advantage of market corrections. Corporate results related to AI will continue to be encouraging, but some investors’ high expectations might be disappointed.

In a context of moderated growth (without recession), dividend stocks should outperform. We also see opportunities outside of technology in the industrial sector, which could help indices avoid excessive declines as central bankers’ rhetoric becomes more dovish.

S&P 500, S&P ex Magnificent Seven, S&P Equal-Weight

Sources : Bloomberg, Richelieu Group

Investors are wondering if a turnaround is finally underway for U.S. small-cap stocks, which have had their worst start to the year compared to their large-cap counterparts. The Russell 2000 index has trailed the S&P 500 by nearly 15 percentage points so far in 2024. Small-cap companies have struggled to raise capital due to rising interest rates, while many of them are not generating strong profit growth.

As long as there is no significant rate cut from the U.S. central bank, we do not anticipate a trend reversal in our current scenario.

Russel 2000 versus S&P 500

Sources : Bloomberg, Richelieu Group

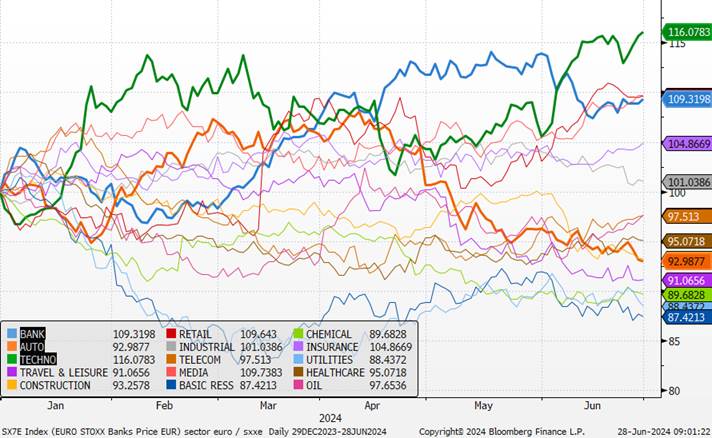

On the European market, the calling of early legislative elections in France increases political risk in Europe and opens a period of uncertainty until the evening of the second round on July 7th.

In the short term, French stocks will suffer. Following the European elections, we downgraded our view on European stocks to neutral (from positive) while holding a negative opinion on French stocks. There is now significant uncertainty surrounding the future composition of the National Assembly and the potential government that may result. Unlike the European elections, the two-round nature of legislative elections emphasizes the importance of pre-election negotiations to form alliances among political forces in 577 different constituencies to maximize their chances of winning.

The sectors most at risk are those with high political risk beta, significant exposure to France and the EU, and high debt levels. The financial sector, inherently sensitive to political risk with over 50% of revenues generated in the eurozone, is expected to suffer the most from this political uncertainty. Real estate is also likely to suffer from rising risk premiums. The automotive sector, a quintessential cyclical sector with a high beta (1.26 on average over 2 years and 20 years), would be impacted by uncertainty over the European regulatory path for thermal engines.

For European equities, growth dynamics are expected to continue and disinflation to accelerate. The consumer, with strengthened purchasing power, is expected to provide necessary support. France and Germany overshadow the good performance of other economies. This is one reason why we do not have a negative view on the year despite political turbulence. We favor defensive sectors in the short term. Small caps (excluding France) remain a conviction for the year and a good diversification against Europe’s magnificent seven (Novo Nordisk, ASML, LVMH, SAP, Schneider, Siemens, Hermès). Unlike U.S. small-cap segments, European stocks have much better balance sheet quality.

Relative performances of Eurostoxx sectors since the beginning of the year

Sources : Bloomberg, Richelieu Group

We believe that emerging markets can be a good asset diversification given their undervaluation and the limited impact of US and European policies on their own markets. They continue to be supported by strong corporate fundamentals and an expanding investment universe. India and Asia (excluding China) remain our preferred geographical areas.

Index of major emerging markets over 1 year

Sources : Bloomberg, Richelieu Group

Regarding Japanese stocks, even though authorities are expected to take actions against the yen’s decline, the weakness of the currency and the anticipated rise in interest rates should favor shifts towards equity assets. We are neutral on the region. Markets continue to benefit from profit growth and a significant corporate governance reform.

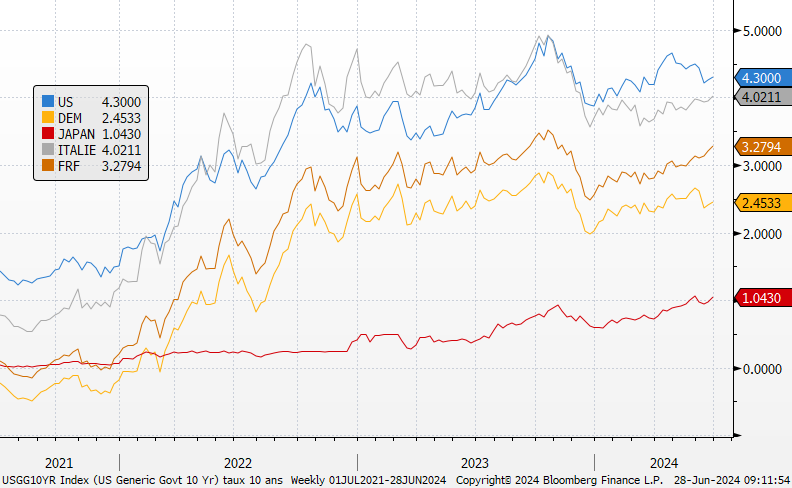

Sovereign bonds yields

As the normalization of fiscal policies implemented in response to the pandemic continues, budget deficits and the supply of public debt are expected to remain high in major developed countries. Generally, bond market volatility is likely to be higher this time around, as deficits are unlikely to be reduced regardless of election outcomes (France, UK, US).

Many Japanese institutional investors continue to sell their international sovereign bonds. Norinchukin announced the sale of a portfolio of foreign bonds worth 10 trillion yen, equivalent to nearly 60 billion euros. Additionally, the BOJ may officially further reduce its monthly purchases of Japanese debt. Monthly bond purchases have already significantly slowed from a peak of 23.7 trillion yen reached in January 2023. This is expected to add additional pressure in terms of flows on sovereign assets overall, even as the amount of net issuance is projected to decrease in 2024 (mainly in Spain and Germany).

10-year yields

Sources : Bloomberg, Richelieu Group

Confirmation of various growth and inflation statistics will allow investors to anticipate a gradual easing of US interest rates in the coming quarters, which will further drive down US sovereign bond yields in the second half of the year. We maintain a structurally positive view on US sovereign debt due to its defensive characteristics and yield levels. Our year-end outlook for the US 5-year and 10-year yields at 4.1% (same for the 5-year) remains unchanged.

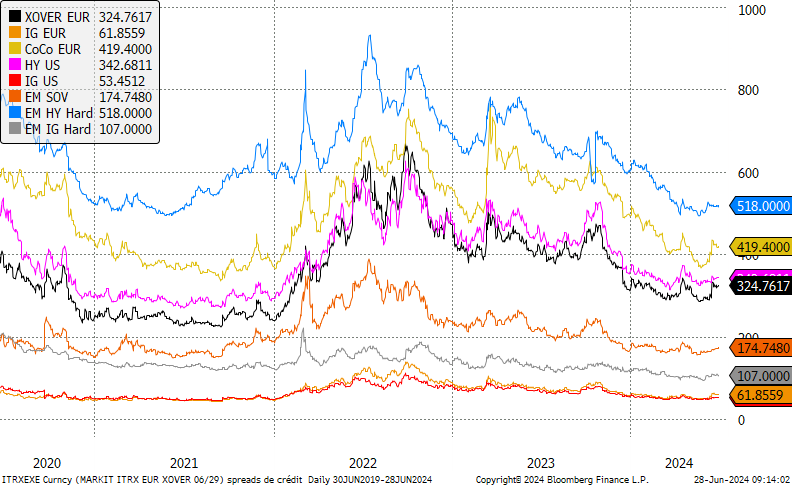

Credit rates

We believe there are potential risks for lower-quality and less liquid market segments, which could be more vulnerable in scenarios characterized by reduced liquidity, economic slowdown, or unexpected shocks. The longer rates remain high, the more likely these risks will materialize, particularly in the United States. Bankruptcies are increasing. In the US, 275 large companies declared bankruptcy in May of this year, the second-highest number since 2010. We remain cautious on US high yield (HY).

Credit spread

Sources : Bloomberg, Richelieu Group

Paradoxically, we remain more comfortable in the eurozone where we are starting to see an improvement in credit distribution combined with a more accommodative ECB. With an outlook for more significant ECB rate cuts in 2025, we are increasing our duration. The low dispersion in high yield, with insufficient spread between BB and B rated papers, and the narrow gap with the BBB segment, encourages us to favor higher-rated issuers.

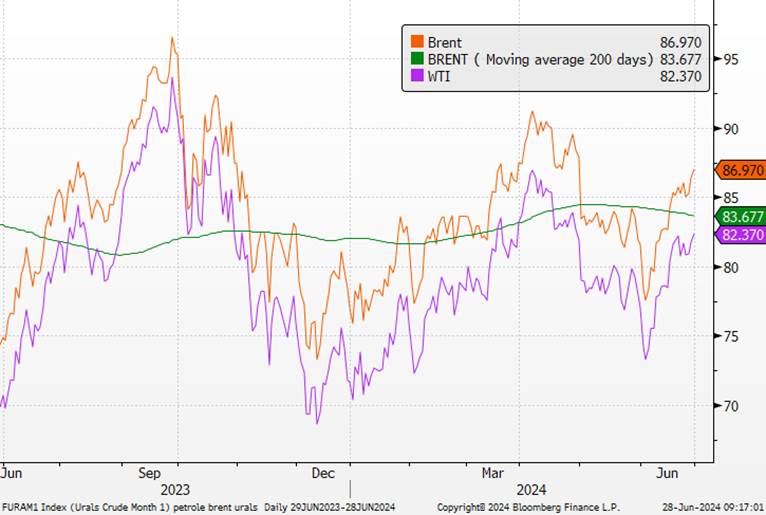

Oil

The OPEC+ ministers have dismissed the initial downward reaction in oil prices earlier this month following their decision to gradually increase crude production starting in October. We believe that the $80 level remains a floor for the organization, which will resist any significant decline.

“The alliance remains committed to oil market stability and can react swiftly to any changes,” said ministers from the largest producers of the group at the St. Petersburg International Economic Forum. Saudi Energy Minister Abdulaziz bin Salman reiterated that the production increase agreement, like many other OPEC+ agreements, retains the option to suspend or cancel production changes if necessary. We maintain our price range of $80 to $85 for WTI. We continue to favor oil stocks, which should benefit from this stability.

Oil price

Sources : Bloomberg, Richelieu Group

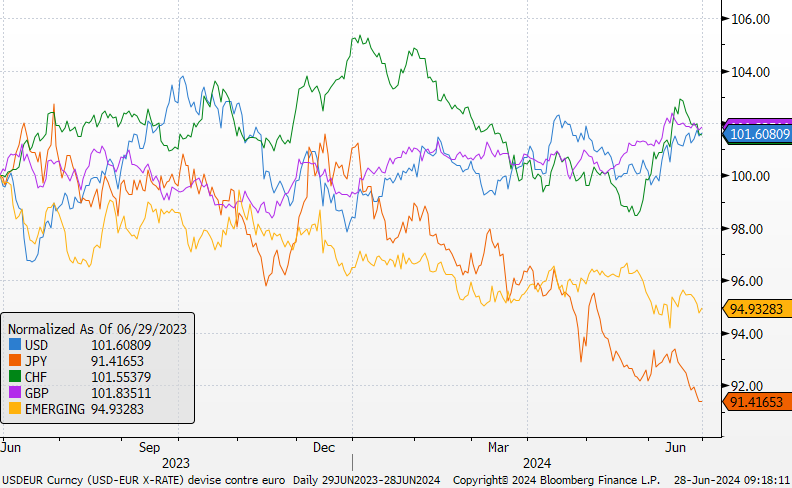

Currencies

Amidst the political events in France, the dollar reached the lower end of our range (1.07). Uncertainty is high and weighs on the currency in the short term. The dollar continues to benefit from higher interest rates. A divided parliament or an absolute majority for the Rassemblement National could impact the European currency. In the short term, we are less optimistic on the euro-dollar, but we do not foresee a massive downturn. US macroeconomic data is expected to weaken in the coming months.

Meanwhile, the spread between Japanese and US sovereign rates continues to support a yen appreciation, especially as we remain convinced that the Bank of Japan will continue to adjust its monetary policy in a less accommodative direction in the coming months.

Currencies against the Euro over 1 year

Sources : Bloomberg, Richelieu Group