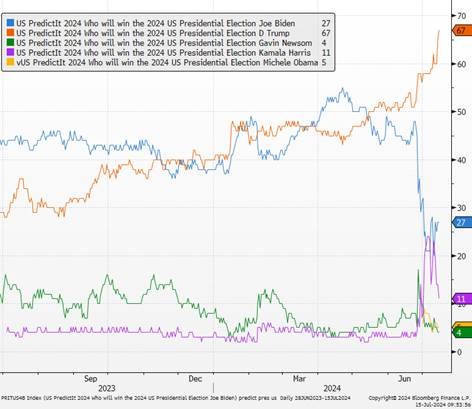

With the increasing probability of a second term for Donald Trump, prediction markets are already anticipating the potential repercussions for the Eurozone economy. A return of Trump to the White House could lead to a new “trade war,” increased pressures in security and defense, as well as spillovers from US domestic policies on Europe.

Prediction of Victory in the US Presidential Elections

Sources : Bloomberg, PredicIt, Richelieu Group

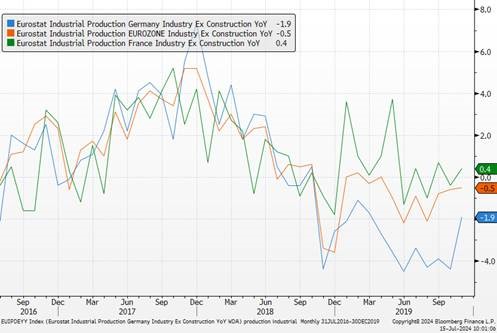

Trump has promised to impose a 10% tariff on all US imports, including those from Europe. This measure could cause a significant increase in trade policy uncertainty, similar to what was observed in 2018-2019.

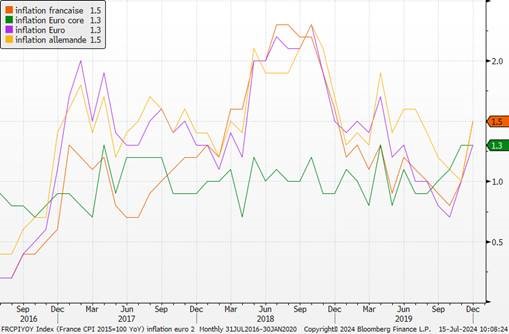

Increased trade policy uncertainty tends to have significant and persistent negative effects on Eurozone activity, while actual tariff increases are more difficult to pinpoint. Generally, trade uncertainty reduces inflation, but higher tariffs could have a slight inflationary effect..

Inflation in EURO Zone

Sources : Bloomberg, Richelieu Group

In 2018-2019, trade uncertainty reduced Eurozone industrial production by about 2%. The repercussions were particularly significant in Germany, due to its greater reliance on industry.

Industrial Production in the Eurozone

Sources : Bloomberg, Richelieu Group

Core inflation on a three-month annualized basis fell to 2.1% in June, the lowest figure since the pandemic. At the same time, overall inflation decreased in June and inflation over the past 12 months was just below 3%, the same level as in June 2023.

A second Trump term would also increase defense pressures for Europe. The US president expects European countries to increase their defense spending to at least 2% of GDP, in line with NATO requirements. Currently, EU members spend about 1.75% of GDP on defense, which would require an additional increase of 0.25% of GDP. Moreover, the potential halt of US military aid to Ukraine would force European countries to step up their contributions, representing an additional cost of 0.25% of the EU’s GDP.

Example of Military Spending in Germany

Source : X

Trump’s defense policies could also affect economic confidence in Europe, especially if they call into question the US commitment to NATO. Increased geopolitical risk could lead to a decline in investment and confidence, negatively impacting economic prospects.

Additionally, the new tax cuts and deregulation envisaged by Trump could have spillover effects on Europe through stronger US demand and changes in financial conditions. We estimate that a tax relief under a Republican administration could increase Eurozone activity.

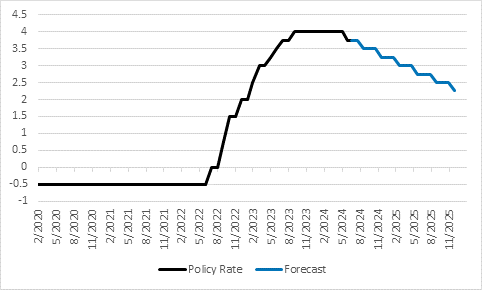

The re-election of Trump could pose a significant risk to Eurozone growth. The negative effects on economic activity would be more pronounced than the inflationary pressures, justifying further cuts in ECB interest rates in 2025.

ECB Deposit Rate and Groupe Richelieu Forecast

Sources : Bloomberg, Richelieu Group