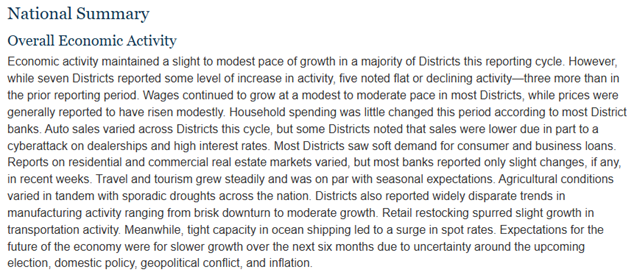

The American economic activity continues to slow down. The Fed’s Beige Book, which presents the economic evolution in the 12 districts of the regional Feds, indicated that activity had stagnated or even declined in 5 districts (3 more than in the last publication).

The phrase from the Beige Book “Expectations for the future of the economy are for slower growth over the next six months due to uncertainty related to upcoming elections, domestic policy, geopolitical conflicts, and inflation” summarizes the current situation and the Fed’s mindset.

Comments from the Beige Book

Source : FOMC

Prices and wages continue to evolve modestly, as does employment, with some districts indicating a slight improvement in labor supply conditions. Labor turnover has decreased, according to the report, which has reduced the demand to find new workers. Companies anticipate the continuation of their activity slowdown over the next 6months.

C. Waller, a member of the monetary policy committee, acknowledged that recent economic statistics favor a soft landing for the economy, bringing the Fed closer to a rate cut.

Sources : X, Bloomberg (cliquez here)

J. Williams (New York Fed) stated that the Fed will have more data by its September 18 meeting to ensure inflation returns to the 2% target.

T. Barkin (Richmond Fed), a voting member of the FOMC this year, indicated that the Fed is closely monitoring the evolution of the unemployment rate. For now, companies are hesitant to lay off staff, and some sectors still lack workforce while testing their pricing power. He indicates that this is not a permanent situation and that “we are clearly at the end of the inflation period.”

Sources : X, forexlive (cliquez here)

In general, Fed members reiterate the need to wait longer to see the favorable evolution of statistics before proceeding with a rate cut. We do not expect the Fed to lower interest rates at its next meeting at the end of July. The most important question for this meeting is to what extent officials are preparing the ground for a cut in September.

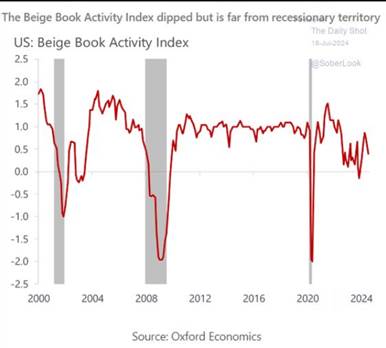

This observation confirms the latest figures on American inflation. Prices largely decreased in the second quarter and were below economists’ expectations, unlike the first three months of the year, when inflation was surprisingly strong. We believe this represents a confidence factor for the Fed. The report leaves the door wide open for an interest rate cut in September. This observation, in our view, supports the hypothesis of a 25 bp rate cut by the Fed in September, an eventuality to which Fed members seem increasingly favorable. We believe this represents a confidence factor for the Fed. The report leaves the door wide open for an interest rate cut in September. Jerome Powell has prepared the ground for a cut by suggesting that the labor market is slowing down in a way that has reduced a major source of inflation and undesirable additional weakness risks.

Housing inflation, which reflects rental costs and represents about one-third of the CPI, has kept overall prices high. We anticipate this inflation would decrease because rents for new housing units have decreased for 1.5 years. But the figure often reflects market conditions with several months of lag. The latest report seems to provide a welcome confirmation that official inflation indicators are capturing this decline.

US Inflation over 3 Month

Source : WSJ

L’eThe example of PepsiCo is notable. PepsiCo executives, who also announced their quarterly results, indicated that consumers tired of inflation are reducing their spending. Over the past few years, even as prices soared, many consumers continued to buy affordable treats like Doritos and Lay’s instead of splurging on more expensive things like restaurants, concerts, or travel. But now, they are limiting their spending in all areas.

PepsiCo Brands

Source : X

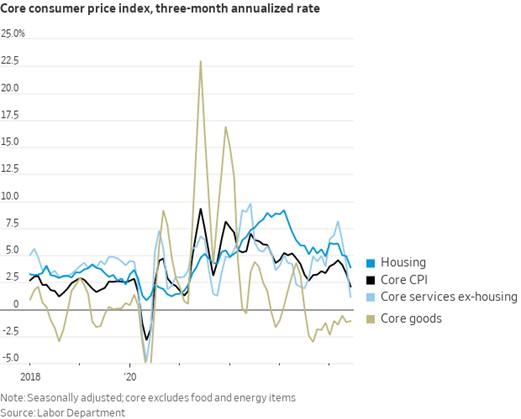

There were signs that the economy had slowed, not enough to provoke fears of recession, but enough to prompt a change in tone from the Fed. Officials are trying to balance the risk of reducing rates too early and allowing inflation to persist with the risk of waiting too long and causing unnecessary damage to the labor market.

Unemployment Rate and Participation Rate

Sources : Bloomberg, Groupe Richelieu

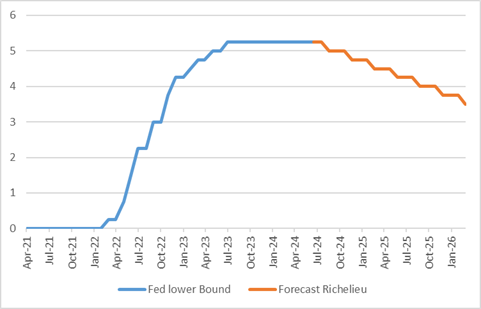

The American consumer has been a growth driver for years. With small cracks in the American labor market data now (for example, the US unemployment rate rising to 4.1% in June), it makes sense that the spending trajectory has somewhat slowed. But as long as the small cracks in the labor market do not become large cracks, there remains fundamental support for spending. For now, this is not a concern, but we remain attentive to ensure there is no acceleration in deterioration. We reiterate our view that the demand slowdown will not lead to a marked recession in the United States, allowing the Fed to lower its key rates gradually, by 25 bp per quarter, from September until mid-2026.

This trajectory will support the decline in sovereign rates (4% at 10 years at the end of the year).

US Central Bank Rates and Forecasts

Sources : Bloomberg, Richelieu Group