The sharp depreciation of the Yen in recent months, significant wage increases in small businesses, and the persistence of underlying inflation suggest that there are strong reasons to raise rates at the end-of-July meeting of the Bank. According to sources close to the institution, this decision has not yet been made by the members and the issue remains open. Another key point of the meeting will be the extent of the reduction in the bank’s monthly bond purchases as it takes a first step towards quantitative tightening after maintaining a massive monetary easing program for more than a decade.

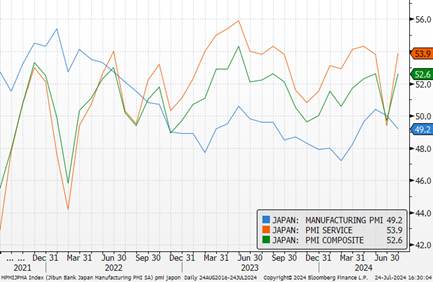

Japanese inflation

Sources : Bloomberg, Richelieu Group

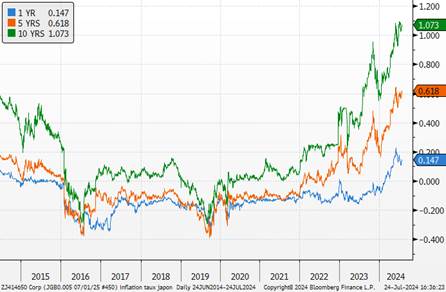

Since the previous monetary policy meeting on June 14, Japanese economic data has been mixed. Inflation expectations have remained high while consumer spending has shown no signs of robust recovery. The Yen reached a new low this month, unseen for 38 years. The government appears to have conducted a second currency intervention this year to reverse the trend.

USD-JPY over a long period

Sources : Bloomberg, Richelieu Group

The Bank of Japan stated in June that it might announce a detailed plan to reduce long-term government bond purchases as early as its July 31 meeting. This meeting is crucial to discern the BoJ’s future stance. It is about whether the BoJ will continue normalization based on its outlook or wait for data to confirm whether the strong spring wage discussions definitively translate into real incomes and consumer spending. During the update of its forecasts at this meeting, the BoJ is expected to revise down its economic growth outlook for the archipelago but maintain its inflation forecasts.

Economic growth indicator

Sources : Bloomberg, Richelieu Group

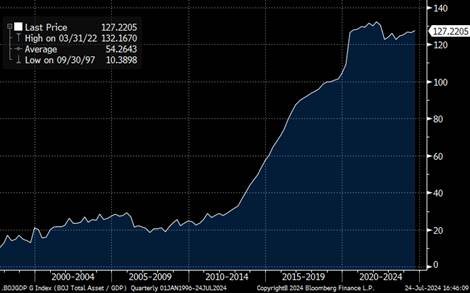

Bank of Japan officials need to examine whether quantitative tightening could push long-term interest rates above a theoretical level based on the past effect of quantitative easing, fearing that the impact could increase as the Bank of Japan reduces its portfolio. Recall that the Bank held about 53.25%, or JPY 586 trillion, of the JGBs in circulation at the end of March, with the portfolio stock effect estimated to have lowered the 10-year interest rate by 100 basis points from the 2013 level before quantitative and qualitative monetary easing. (source: Bloomberg)

Japanese Central Bank balance sheet relative to GDP

Sources : Bloomberg, Richelieu Group

Although the stock effect does not disappear immediately, if the Bank of Japan engages in quantitative tightening due to the sheer size of the portfolio, bank officials worry that tightening could put upward pressure on long-term interest rates, with some theorizing that a 10% reduction could increase them by 10 basis points. The impact could also grow as the Bank of Japan’s bond holding ratio declines compared to foreign central banks. Rates are expected to be under tension.

Japanese rates

Sources : Bloomberg, Richelieu Group

The prospect of additional policy tightening should contribute to the appreciation of the Yen. We estimate that the weakness of the Yen, which has led to currency market interventions by authorities two weeks ago, has complicated the BoJ’s task by reinforcing imported inflation, household inflation expectations (which are reaching historic highs), and further weighing on their purchasing power.

Therefore, in addition to favorable wage and inflation developments (particularly in services), the exchange rate issue could weigh on central bankers’ decision to raise key rates next week (by 15 bp to 0.25%). This should contribute to the additional appreciation of the Yen (target 147 USD/JPY by year-end).

USD-JPY

Sources : Bloomberg, Richelieu Group