- Biden withdraws from the 2024 presidential race to “save democracy”

- The Chinese central bank lowered its key interest rates this morning for the first time since February

- Doubt grows even more in the German economic fabric

- Chart of the week: US GDP

Biden withdraws from the 2024 presidential race to “save democracy”

American President Joe Biden announced his decision not to run in 2024, stating his intention to “pass the torch to a new generation” to save American democracy. In his Wednesday night speech, he promised to dedicate his remaining six months in office to pursuing his political agenda and calling for significant reforms to the U.S. Supreme Court.

“I have a deep respect for this office, but I love my country more,” Biden said. “Nothing should stand in the way of safeguarding our democracy, including personal ambition.”

With just over 100 days until the November presidential election, Biden confirmed his decision to support Vice President Kamala Harris as the Democratic candidate. His decision follows weeks of tension within the party regarding his ability to serve another term at 81 years old.

“There is a time and place for new voices, younger voices. That time and place is now,” he stated.

Biden praised Harris as an “experienced, tough, and capable” leader and reminded that the choice now rests with the American people. This announcement means Harris will face Donald Trump in November, with polls indicating a tight race.

Biden, recently recovered from Covid-19, also announced his intention to propose major Supreme Court reforms, although he did not detail his plans.

In conclusion, he emphasized that the coming months would be dedicated to ensuring the strength and security of the United States. Biden also planned an important meeting with Israeli Prime Minister Benjamin Netanyahu to negotiate a ceasefire in Gaza.

“Serving this nation for over 50 years has been the privilege of my life,” Biden said. “Nowhere else could a kid from Scranton, Pennsylvania, and Claymont, Delaware, one day sit behind the Oval Office desk.”

Sources : Bloomberg, Richelieu Group

The Chinese central bank lowered its key interest rates this morning for the first time since February

The Chinese central bank lowered its key interest rates this morning for the first time since February, reducing them by 10 basis points (particularly the 7-day reverse repo rate to 1.7%) to stimulate credit and thus activity. This additional support comes as the disappointing publication of second-quarter growth statistics highlighted economic weaknesses in China (weak domestic demand, real estate crisis, high debt) and the government’s support remains poorly targeted at consumption. Furthermore, following the third plenum of the Chinese Communist Party, a political meeting held every five years, the Chinese government formulated a somewhat more precise economic strategy, though it did not seem to sufficiently meet the expectations of financial investors. These measures, the details and implementation of which remain to be defined, should, among other things, attempt to

- Improve the functioning of the real estate market;

- Strengthen market mechanisms;

- Flexibly delay the retirement age;

- Aim for better wealth distribution;

- Promote the private sector.

Additionally, Beijing intends to rebalance local government debt by transferring more resources to them. For now, due to the lack of significant support for household consumption combined with the authorities’ budgetary and monetary constraints, China’s growth dynamics will remain more limited than in the past, preventing, in our view, the Chinese economy from reaching the 5% growth target in 2024.

Chinese rates

Sources : Bloomberg, Richelieu Group

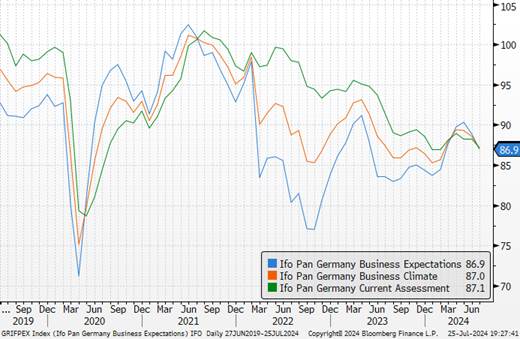

Doubt grows even more in the German economic fabric

The latest business climate survey from the Ifo Institute for July shows only declining trends. The aggregate figure, which measures the morale of business leaders across various sectors, fell by 1.6 points to 87 points, contrary to economists’ expectations for an increase.

The decline is fueled by a more negative perception of medium-term economic prospects and the valuation of the current situation. The first indicator dropped from 88.8 points to 86.9 points in one month, and the second from 88.3 points to 87.1 points. “Businesses were less satisfied with the current business situation. Skepticism about the coming months has increased significantly. The German economy is in crisis,” commented Clemens Fuest, president of the Ifo Institute.

The gloom is particularly notable in the manufacturing sector, where the business climate dropped from -9.3 points to -14.1 points. The current situation is particularly bad, with a production capacity utilization rate down 6 points to 77%. As a result, the short-term business sentiment indicator fell by 7.9 points to -13.9 points.

In the rest of the German economy, the business climate is deteriorating very slowly among real estate developers, to -26 points (-0.8 points), while the retail sector leaders’ climate fell from -19.5 points to -25.4 points. The current situation of the latter is particularly affected, with an indicator at -16.2 points, compared to -7.1 points in June. This corroborates the sentiment of German consumers in July from the Centre for European Economic Research (ZEW), which came in at 41.8 points this month, down from 47.5 points in June. This seems to mark the end of a “Euro 2024” effect, which took place in Germany.

German economic indicators

Sources : Bloomberg, Richelieu Group

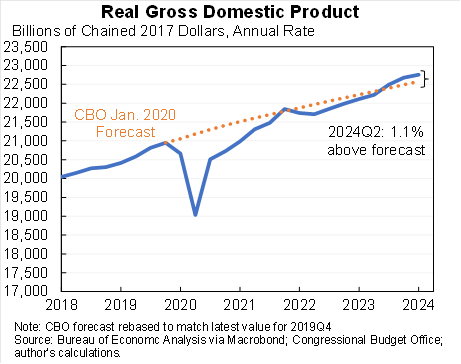

Chart of the week

The American economy grew more strongly than expected in the second quarter, according to the first estimate of data published by the Commerce Department on Thursday.

Source: X