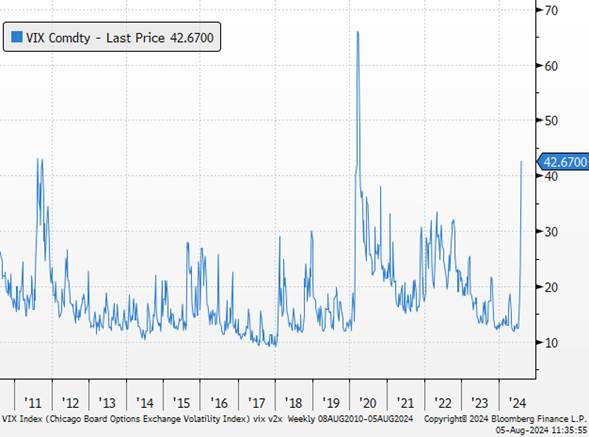

With the drop in stocks and bond yields, fears of a recession have resurfaced. Investors are worried and anxious, wondering if the U.S. economy is headed for a recession, causing an increase in the market’s implied volatility, as measured by the VIX (Volatility Index).

VIX

Sources : Bloomberg, Richelieu Group

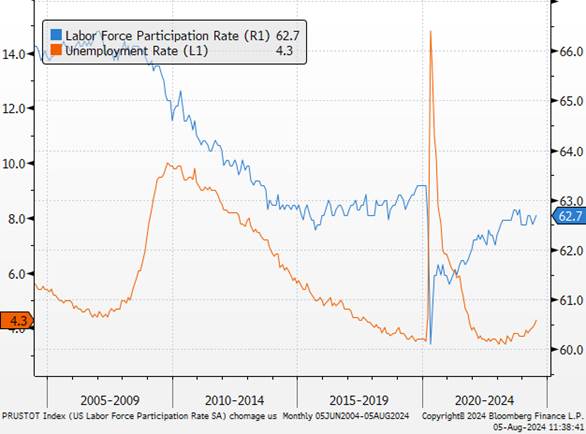

On Friday afternoon, disappointing employment figures were released, leading to a substantial drop in U.S. sovereign rates amidst fears of a sharp slowdown in activity or even a recession. In addition to the weakness in job creation in July (114k compared to 175k expected and 176k in June, revised downward) and the slowdown in wages (+3.6% year-on-year versus +3.7% expected and +3.8% in June, revised downward), the significant rise in the unemployment rate by 20 basis points (to 4.3% versus the expected stable rate of 4.1%) particularly worried investors, triggering the “Sahm rule,” which historically signifies that an increase in the unemployment rate as rapid as we have seen in 2024 has been consistent with 100% of recessions over the past 50 years.

US Unemployment

Sources : Bloomberg, Richelieu Group

This rapid rise in the unemployment rate is seen by many as a leading indicator of a recession in the United States. We believe that the current econometric models have not been predictive since 2022. The cycle we have experienced has broken all types of traditional economic rules regarding recessions, but what is clear is that any risk of a wage-price spiral is likely behind us, and a Fed pivot from focusing on inflation to the labor market as the main concern is likely in its early stages.

10 years rate

Sources : Bloomberg, Richelieu Group

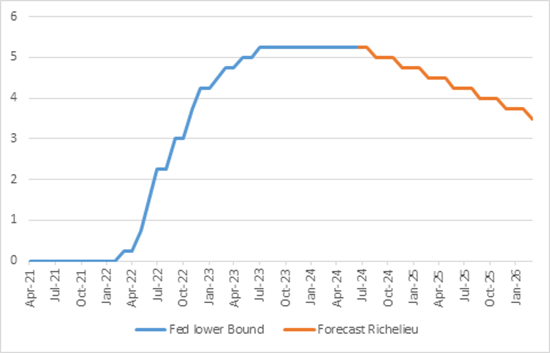

As we wrote some time ago, the Fed’s monetary policy is not too restrictive for this given level of the economy. Expectations for rate cuts have changed significantly (nearly 125 basis points of rate cuts are now expected by December, equating to 5 cuts). We consider these expectations excessive. We still anticipate 2 (or 3) rate cuts, or 50 to 75 basis points by the end of the year. We were anticipating 4 or even 5 cuts in 2025 under the weight of a sluggish U.S. economy.

Fed rate

Sources : Bloomberg, Richelieu Group

Wage growth and the ability of households to consume remain quite resilient in a context where disinflation continues. The market downturn is good news for the Fed because it moderates the wealth effect of economic agents over the past four years and promotes disinflation.

All we can say at present, in light of the latest published economic figures, is that the fight against inflation finally seems to be won.

The slowdown in U.S. data combined with a rise in rates in Japan has been an explosive cocktail for risk assets worldwide. The economic data from August, following the rate collapse, will be very important:

- August 5: ISM Services

- August 15: Retail sales and industrial production for July

- August 29: Second estimate of Q2 GDP

- August 30: July PCE price and consumption data

- September 3 and 5: Next ISM indicators for August

- September 6: August employment figures

Meanwhile, Fed Chairman Jerome Powell will have the opportunity to speak at the Fed Symposium in Jackson Hole from August 22 to 24.

We, therefore, maintain our scenario of more moderate growth in the United States, compatible with a gradual easing of monetary policy over the year, but without a recession in our central scenario.

As this scenario becomes credible again in the eyes of the majority of investors, U.S. sovereign rates should, in our opinion, appreciate (towards our targets of 3.90% to 4.00% at 10 years), even if U.S. sovereign rates remain the primary asset against a systemic crisis.

The essential question for us at the moment is that the economy has not been very sensitive to rising rates… it will need to be sensitive to falling rates.

At present, we cannot confirm that the lows have been reached. We still recommend a moderately cautious position on equities (at the lower end of the neutral range). The strong increase in volatility could provide the appropriate conditions to gradually reposition.

For us, paradoxically, the significant movement comes from the “yen carry trade.” A carry trade operation involves borrowing in a low-yield currency (yen) to lend in another higher-yielding currency. For this strategy to be profitable, one must accept a certain exchange rate risk. The movement we have experienced in the Japanese currency is causing massive sales in the market. The unwinding of positions causes significant movements over time, but it also helps to cleanse the market of excessive speculation, which could have eventually led to a systemic risk.

Dollar versus Yen

Sources : Bloomberg, Richelieu Group