In the context of asset allocation, we base our analysis on three convictions for the second half of the year:

· The disinflation process is expected to resume in the second half of the year, thanks to a slowdown in U.S. economic growth.

· Later in the year, the U.S. elections will also impact asset behavior, but in our view, the uncertainty regarding the outcome, particularly for Congress, is too high to influence asset allocation at this stage. In the current environment, a selection of high-quality, low-risk stocks is preferred.

Two main changes in recent weeks:

1/ Market attention has shifted away from inflation to focus on the labor market,

2/ The U.S. labor market is steering the economy.

Events that could lead us to revise our perspective in the coming months are:

· Higher-than-expected inflation, implying that central banks may not be able to continue normalizing their interest rate policies.

· Potential outcomes of the U.S. elections that could jeopardize inflation moderation or global geopolitics.

· A significantly higher unemployment rate or other recessionary data?

IN SHORT

EQUITIES: sector rotation is taking place

SOVEREIGN RATES: Excessive anticipation of rate cuts

CREDIT: Quality still prevails

DOLLAR: Strengthening as expectations of U.S. rate cuts decrease

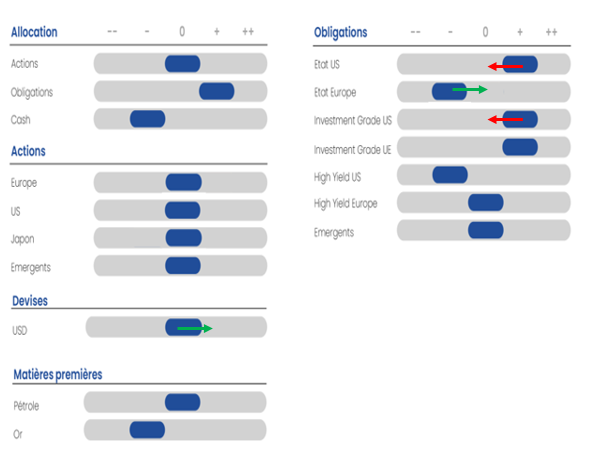

ASSET ALLOCATION TABLE

EQUITIES

The global equity sell-off observed in early August has been completely reversed, as recent macro data did not confirm investors’ concerns about a hard landing. Paradoxically, the significant movement at the beginning of the month is more related to the “yen carry trade.” The movement we have seen in the Japanese currency is causing massive sales in the market. The unwinding of positions results in substantial movements over time, but it also helps to “cleanse” the market of excessive speculation that could have eventually led to systemic risk.

Equity Indices

During the decline in the first week of August, we advised to gradually reposition in equities. As long as the technology sector is not severely affected, we maintain the scenario of rotation occurring in the market. Large-cap tech stocks are heavily weighted in the indices, and their significant decline will lead to a drop in the market. However, as long as there is no “sell-off,” sector rotations should allow the indices to advance, albeit to a lesser extent.

While the bar was set quite high for Q2 earnings reports, U.S. companies once again demonstrated their resilience. 56% of S&P companies exceeded expectations by more than one standard deviation (compared to a historical average of 46%). S&P EPS showed 11% year-over-year growth in Q2 versus the expected +9%.

The Fed is expected to begin lowering its key interest rates in September, methodically and without haste, which should provide reassurance. The question is whether it will ease its policy by choice or out of necessity (i.e., due to falling inflation or weakness in the labor market). If the Fed lowers rates by choice because inflation is normalizing, then the reduction in discount rates would provide a boost to equity markets. Conversely, if it does so out of necessity because the macroeconomic situation is deteriorating rapidly, it would be accompanied by an increase in risk premiums, which would be detrimental to the markets. We advocate for a middle ground. The ISM indicator and August employment figures, to be released on September 3 and 6 respectively, will provide more concrete guidance.

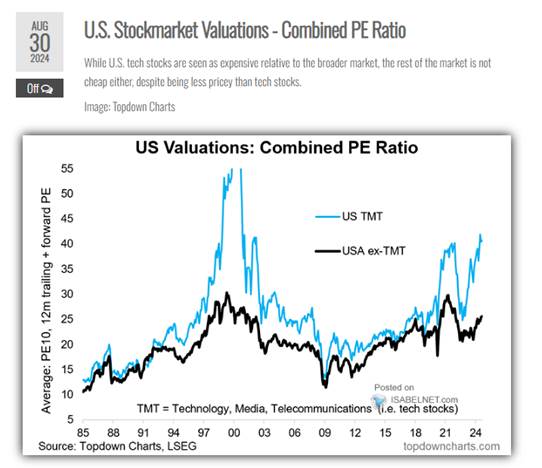

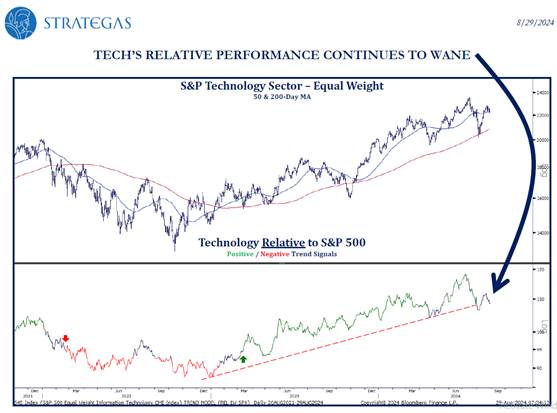

The dominance of tech leadership has weakened since the yen carry trade disruption, but it remains a strategic sector in portfolios. The equal-weighted S&P index is at a new high, while giants like MSFT, GOOGL, and AMZN are not. At a minimum, this indicates a shift in trend from the strong influence that the largest stocks have had on the market throughout the year.

The relative performance trend of small-cap technology stocks has even turned negative in recent days, and European technology (with ASML having a significant weight) is not far behind. While the technology leadership profile may weaken, the rest of the market remains relatively strong.

The reduction in risk costs due to accommodative monetary policy and a steepening of the yield curve should be favorable for U.S. banks. We favor more defensive sectors that are likely to catch up. Consumer staples and healthcare are particularly attractive. The decline in rates should benefit a rebound in mid-cap U.S. stocks. As for small-cap stocks, we are expecting delayed earnings momentum.

Japanese stocks have returned to levels comparable to those seen before the summer. The BoJ appears to have taken market reactions to its recent measures into account and is signaling a more cautious approach. With the currency rebound, we should expect lower volatility.

Emerging markets can provide good asset diversification given their undervaluation and the low impact of U.S. and European policies on their own markets. They remain supported by solid business fundamentals and a growing investment universe. The decline in U.S. rates should be beneficial for them. India and Asia (excluding China) continue to be our preferred geographic regions.

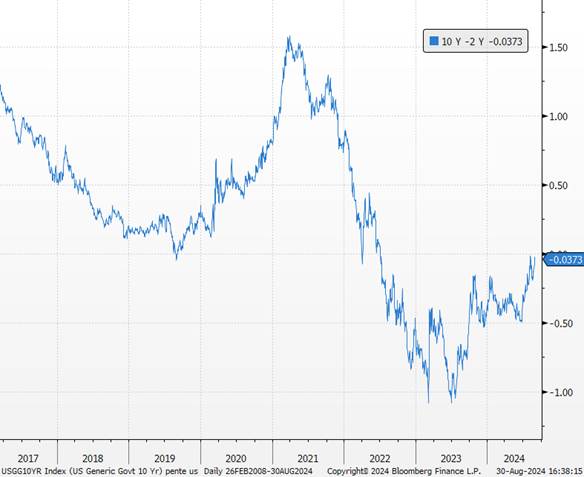

SOVEREIGN RATES

While equity markets have almost returned to their early August levels, a clear trend has emerged in sovereign rates. The arrival of the Fed’s pivot point and recession fears have allowed sovereign rates to revisit the lows seen at the beginning of the year, when investors were anticipating six rate cuts throughout 2024.

10-year rates

We believe that short-term expectations for rate cuts by the Fed are excessively high. Over the next 16 months, the market currently anticipates 225 basis points of rate cuts and earnings growth of 10% for 2024 and 15% for 2025. It is extremely rare to see more than 100 basis points of cuts alongside double-digit earnings growth. This has only occurred once, in 1984, a period often overlooked today but with many similarities to the current economic environment and occurring in the midst of a bull market.

We are betting on two rate cuts this year (see this month’s editorial) and four cuts next year. The yield curve should steepen due to a stabilization of inflation and growth expectations. Therefore, we maintain our scenario of more moderate growth in the U.S., compatible with a gradual easing of monetary policy throughout the year, but without a recession in our central scenario, at least until the end of the first half of the year.

US 2-10 Year Yield Curve Spread

As this scenario becomes credible to the majority of investors again, we believe U.S. sovereign rates should appreciate (toward our target of 4.00% for 10-year yields), even though they remain the primary asset against systemic crises. Therefore, it is advisable to reduce duration and take advantage of overly generous expectations regarding central banks. Any rise in long-term rates will present an opportunity to reposition.

The decline in rates will be more pronounced in the Eurozone, and we are more comfortable with bonds there. However, we remain cautious about French debt, which could be tested by the market with the announcement of a new government.

CREDIT RATES

We maintain the same carry strategy on corporate bonds. We believe there are potential risks for lower-quality and less liquid market segments, which could be more vulnerable in scenarios marked by reduced liquidity, economic slowdown, or unexpected shocks.

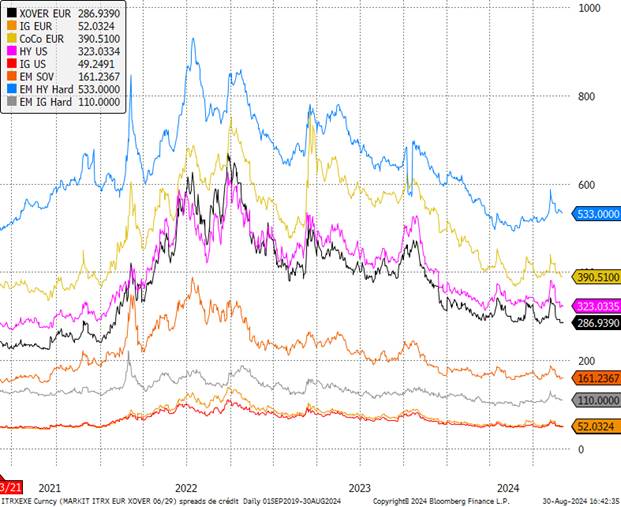

Credit Spreads

With a view toward a more significant rate cut by the ECB in 2025, we are extending our duration in the Eurozone. We maintain our positive outlook on credit, with performance expected to materialize through carry. The strengthening economic rebound in Europe and continued monetary easing by the ECB should keep spreads relatively stable, including in the High Yield segment. Within Investment Grade, non-financial hybrids still appear attractive compared to non-financial senior debt (spread differential for equivalent issuer credit risk). Senior financial spreads are also attractive compared to non-financial seniors, with a composite rating of indices significantly higher. However, we remain cautious about the lowest credit ratings.

DOLLAR

Economic data from recent months have clearly indicated a weakening of the U.S. economy, both in terms of growth and inflation. In the foreign exchange market, this has led to a decline in the U.S. dollar from its high levels reached at the end of June, as the start of the Fed’s rate-cutting cycle now appears much closer (September in our baseline scenario for several months). Recent inflation reports have shifted the market narrative. Previously, the focus was on persistent inflation observed in the first quarter and early second quarter.

Euro-dollar

In the labor market, conditions continue to return to equilibrium, as evidenced by the rise in the unemployment rate and jobless claims, as well as the moderation in job openings. Powell has communicated a shift in assessment regarding inflation and employment risks, moving away from the previous focus on rising inflation risks.

As a result, markets now anticipate at least four rate cuts by the end of the year. We forecast two (possibly three) rate cuts this year. While we have been confident for several months that rate cuts in September would signify success in the fight against inflation, we now believe that market expectations are overly ambitious. J. Powell cannot risk a resurgence of price increases in 2025.

Our year-end forecast for the euro was relatively optimistic, considering the resumption of the disinflation process in the second half of the year and a more pronounced-than-expected weakness in the U.S. economy towards the end of the year. This has proven to be accurate. Only a severe deterioration in the U.S. economy could lead to a higher level for the euro.

Our expectations for the dollar remain unchanged. Since the beginning of the year, we have highlighted a range between 1.07 and 1.12. In the short term, the dollar could strengthen as expectations for rate cuts temper.