FED: Hope it’s not too late!

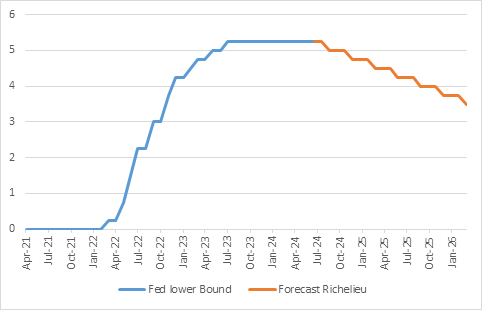

It’s official: the Fed’s first rate cut will take place on September 18th. It’s fair to say that Powell left no room for suspense. Taking advantage of his speech at Jackson Hole, he clearly paved the way for a rate cut as early as the September meeting. We’ve been waiting a long time for this much-anticipated monetary pivot…

Highlighting the deterioration of the labor market, he indicated that the Fed does not want this situation to worsen. He thus reiterated the dual mandate of the U.S. central bank and the need to ease monetary policy to fulfill it.

« The time has come » – J. Powell’s speech at Jackson Hole

For this fall, we have decided to answer a few questions our clients asked us over the summer about U.S. monetary policy.

It seems as though the fight against inflation is coming to an end, and we can now enter a new era of easing. However, the key question is whether Jerome Powell is starting to lower interest rates because he is concerned or because he is increasingly convinced that inflation is now under control.

Why would Jerome Powell be concerned?

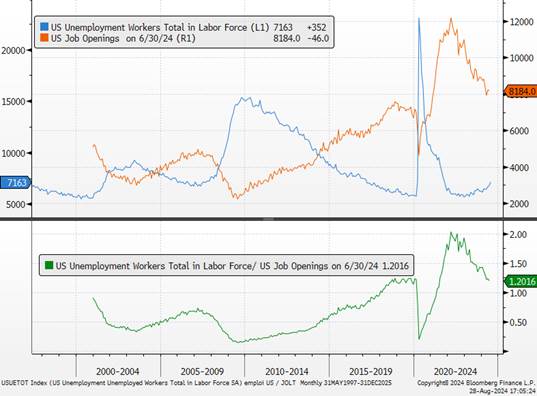

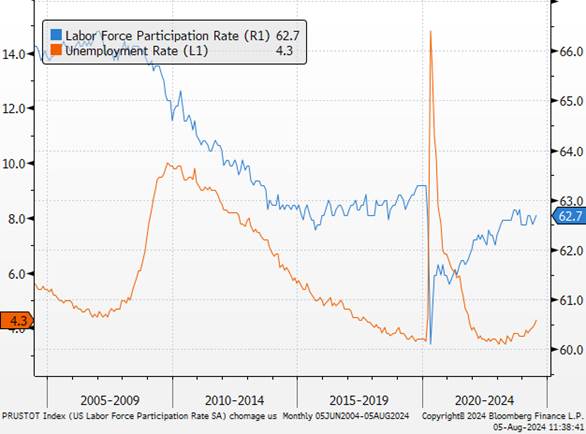

The August employment figures came in below expectations, fueling concerns that the Fed may be late in easing monetary policy and that maintaining a significantly restrictive stance could contribute to a sharp economic slowdown, or even a recession. We believe that, for now, the deterioration in the labor market is part of a normalization process intended by the Fed’s chairman. It does not yet signal a recession but no longer reflects the high tension seen in March 2022, at the beginning of the Fed’s rate hike cycle. Part of the increase in the unemployment rate stems from the growth in labor supply due to higher participation rates and migratory flows. Although it has declined, labor demand from businesses is far from collapsing, and layoffs remain at low levels.

The ratio of job openings to job seekers illustrates this normalization.

Given that U.S. inflation was partly cyclical, the cooling of the labor market remains a positive development, as it was intended by the U.S. central bank officials. It has taken longer than expected, but its realization should reassure about the impact of monetary policy. The unemployment rate is likely to peak below 5%, close to its natural rate of around 4.5%, which should result in slower wage growth.

Why might the market be concerned?

Many economists had criticized the Federal Reserve for not raising its rates quickly enough before March 2022. A number of analysts have again criticized the central bank for delaying rate cuts this time. The substantial increase in the unemployment rate by 20 basis points (to 4.3% compared to the expected steady 4.1%) particularly alarmed investors, triggering the “Sahm Rule,” which historically indicates that a rapid increase in the unemployment rate, as seen in 2024, has been consistent with 100% of recessions over the past 50 years.

This rapid rise in the unemployment rate is considered a leading indicator of a recession in the U.S. We believe that current econometric models have not been reliable since 2022. The cycle we have experienced has broken all traditional economic rules regarding recessions. What is clear is that the risk of a wage-price spiral is likely behind us, with the Fed now focusing primarily on the labor market.

U.S. Unemployment

On the contrary, it is crucial that the Fed (unlike the market) does not overreact to a single data point after the unemployment rate unexpectedly rose to 4.3% in July. An overly restrictive policy for too long could unduly weaken economic activity and employment, increasing the risk of compromising a period of economic growth.

The third quarter is expected to be disappointing in terms of growth (mainly due to a lack of restocking ahead of the presidential elections), but the reduction in interest rates (and inflation) should lead to increased consumer confidence and a recovery in certain sectors.

Recent economic indicators from businesses (such as the service PMI) remain positive, and consumer confidence is improving.

MARKET US PMI

For example, banks have already reported an increase in mortgage applications, and developers are ready to launch projects as soon as rates decrease. As we begin to normalize interest rates, we will see the issue of inflation in the housing sector (a major contributor to rising prices) resolve over time as supply capacities align with demand. The reduction in interest rates will help alleviate the structural housing shortage in the country. As of now, there are no concerns.

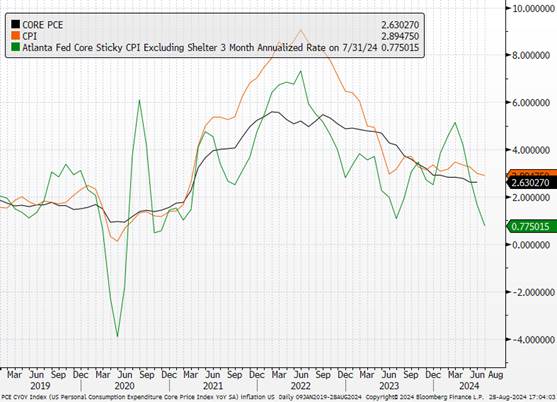

Could inflation make a comeback?

Current economic dynamics might lead us to a situation where we remain significantly above 2%. Wage and housing dynamics provide good visibility for short-term disinflation. The impact of a rate change typically takes 12 to 18 months to materialize. The risk of inflation could reemerge in 2025 due to monetary and/or fiscal policies, which could put Jerome Powell in an uncomfortable position. This risk might establish a floor for long-term rates and lead to a steepening of the yield curve as short-term rates decrease.

US Inflations

What actions should the Fed take?

The vulnerabilities in the job market argue for monetary easing, specifically a 25 basis point rate cut in September and another in December. The November meeting, because it takes place literally the day after the elections, is unlikely to be a part of this. Patrick Harker, President of the Philadelphia Fed, noted at Jackson Hole: “Inflation – we know where it’s headed, barring unforeseen changes. If the labor market unexpectedly turns negative, then I think we’ll need to accelerate the process. At this stage, it’s not in our forecasts.”

A 50 basis point cut in September would be seen by many as a sign that the Fed is extremely, extremely nervous, and markets would react sharply.

Fed Rate Forecasts

The key to maintaining business confidence right now is a well-orchestrated series of rate cuts by the Fed to bring rates back to a neutral level, which we estimate to be around 3%. After faltering in 2022, the Fed has regained all its credibility. It must not miss its pivot point by remaining methodical and pragmatic.