· USA: No Recession in Sight

· Eurozone: More Accommodative Monetary Policy Deemed Necessary

· China : improvement…

· Japan: Tightening Monetary Policy

Highlight

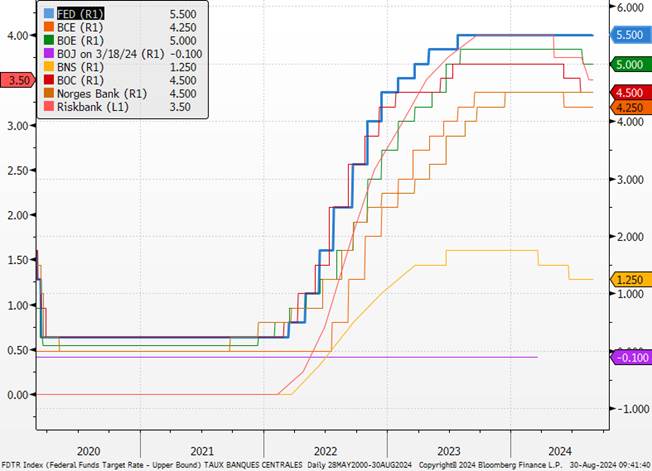

The Fed’s next rate cut will be a relief for everyone. Indeed, the U.S. economy remained robust compared to its neighbors in less favorable situations. A deliberately restrictive monetary policy had prevented any effective action from other central banks.

Key Central Bank Rates

United States: For Now, No Recession in Sight

Concerns about a potential recession are resurfacing, fueled by a monetary policy considered too restrictive. However, economic growth continues to show resilience. Although household consumption appears set to slow down, real wage growth remains positive. Additionally, an imminent easing of U.S. monetary policy could stimulate investment.

US Unemployment Rate and Wage Growth

The ISM Services Index, which briefly dipped into contraction territory in June, has been supported by an increase in new orders. The “employment” component of this index has also returned to expansion territory, suggesting an improvement in economic activity in the services sector.

While some data indicates an economic slowdown, the growth dynamics in the U.S. remain broadly positive. Retail sales showed a significant increase in July, reinforcing the notion of a gradual slowdown, far from the feared recession.

Recent employment statistics, although slightly below expectations, are not sufficient to justify a recession scenario. The expected economic slowdown in the U.S. is likely to result in a reduction in demand for new hires rather than massive layoffs. The Federal Reserve (Fed) is prepared to adjust its monetary policy in the coming months to avoid a deterioration in the labor market.

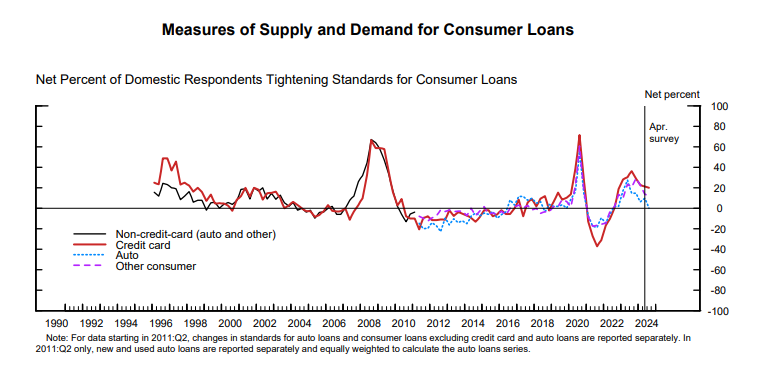

Moreover, a relaxation of financial conditions is anticipated, which could lead to a better alignment of credit supply and demand. According to the Fed’s Senior Loan Officer Opinion Survey (SLOOS), fewer banks are tightening their lending conditions for businesses.

SLOOS Survey for Consumer Loans

Regarding inflation, the services sector, which has been the last stronghold of excessive inflation, also seems to be normalizing. Businesses are facing smaller cost increases, partly due to a slowdown in wage hikes, and are struggling to pass these increases on to prices due to weakened demand.

Results from the NFIB survey show a continued decline in the proportion of businesses planning to increase wages or prices, reinforcing the idea of a gradual normalization of inflation. In this context, the Fed might begin to reduce its key interest rates as early as September, adopting a methodical and cautious approach with a moderate pace of 25 basis points per quarter, which would amount to two cuts planned for this year.

Surveys on Small Businesses

Eurozone: More Accommodative Monetary Policy Deemed Necessary

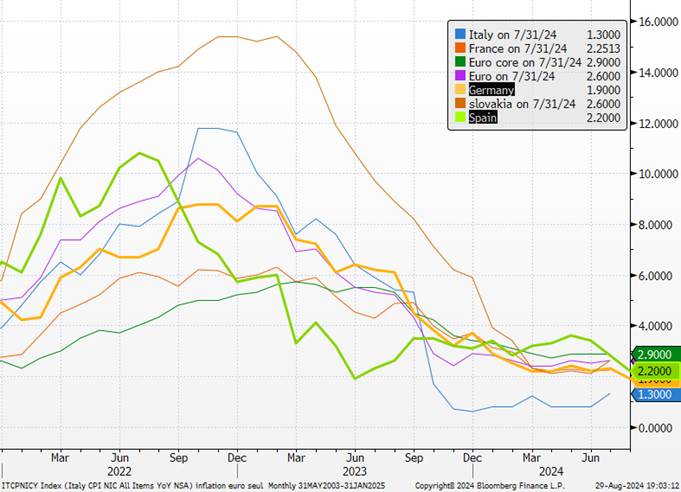

In response to weaker-than-expected economic indicators and a slowdown in wages and prices, the European Central Bank (ECB) appears to be moving towards a more accommodative monetary policy. A rate cut could be decided in September, also influenced by the prospect of monetary easing in the United States. Recent inflation figures in Spain and Germany reinforce this expectation. In August, inflation in Spain and Germany fell to 2.2% and 1.9% year-over-year, respectively, primarily due to the decline in fuel and food prices.

Inflation in the Eurozone

The ECB has repeatedly criticized the non-targeted support measures taken by governments in 2022 and 2023, which, by supporting consumption, exacerbated inflationary pressures by allowing businesses to more easily pass cost increases on to consumers. Today, with public deficits reducing, the impact of these fiscal policies on growth and inflation is turning negative, thereby tightening the overall economic policy stance in Europe.

To counterbalance this effect and avoid excessive deterioration of economic activity, the ECB will find it necessary to ease its monetary policy. This need for adjustment comes on top of an inflation situation that shows signs of improvement across all countries. However, the ECB will remain measured in its statements and will highlight new economic data before firmly committing to this path. Credibility is essential!

In the Eurozone, although the growth of loans to the private sector is improving very slowly, consumer and mortgage loans are showing signs of recovery. The annual growth rate of the M3 money supply, at 2.3% in July 2024, remains low. A reduction in interest rates could further support this trend, encouraging a rebound in household and business investments, which have been significantly down in recent quarters.

This easing is expected to gradually stimulate still-fragile growth by boosting purchasing power and invigorating domestic demand. However, disparities remain within Eurozone economies. In Germany, consumer confidence fell in August, according to the GfK index, with deteriorating income expectations and a declining propensity to spend.

“German consumer enthusiasm sparked by the European Football Championship was only a brief flare-up and faded after the end of the tournament. Negative news regarding job security is making consumers more pessimistic, and a rapid recovery in consumer sentiment seems unlikely. The rise in unemployment, increasing business bankruptcies, and planned staff reductions in various German companies worry employees about their jobs. Hopes for a stable and sustainable economic recovery must therefore be pushed further back,” according to GfK.

In France, business bankruptcies continued to rise in June, reaching their highest level since 2015, particularly in the construction sector and real estate-related services.

Details of GfK Surveys on German Consumers

These factors do not prevent the ECB from continuing to lower interest rates in a sustained and regular manner, with the possibility of three additional cuts by the end of the year, aiming for a terminal rate of 2.25% by the end of 2025, without necessarily rekindling inflationary dynamics at least in the coming months.

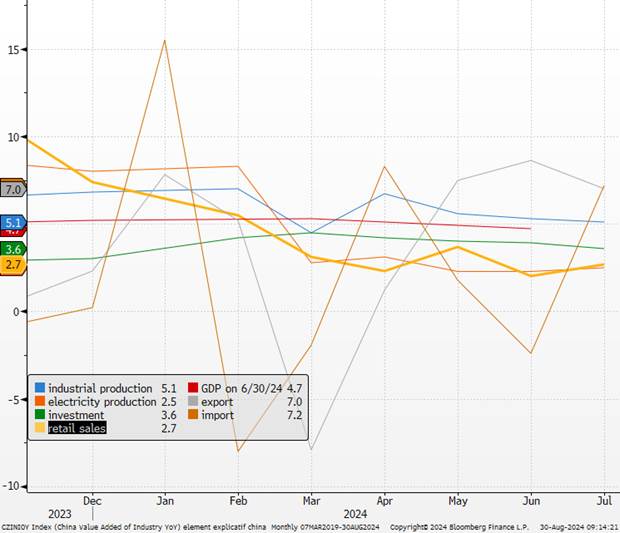

China: Some Improvement…

Economic growth continues to disappoint. Recent statistics show mixed activity, characterized by uneven economic performance. Although retail sales have slightly rebounded, the overall trend since the beginning of the year remains downward, reflecting ongoing fragility in Chinese consumer confidence.

Explanatory Elements of Chinese Growth

Economic indicators are hardly encouraging, as reflected by the slowdown in industrial production, which is affected by weak external demand. Recent data on the trade balance indicate a drop in exports, a situation that could worsen due to numerous trade restrictions imposed by the United States and the European Union amid increasingly protectionist policies.

Without targeted stimulus measures for households, a return to more dynamic growth seems limited, although this situation paradoxically might help contain global inflation. In July, credit production in China fell to its lowest level in 15 years, signaling a worrying slowdown.

Investment, particularly in the real estate sector, remains in crisis. It has dropped by 10.2% year-on-year since the beginning of the year, and housing prices continue to decline, suggesting that the sector has not yet reached its lowest point. Furthermore, the rise in inflation is largely due to a rebound in food prices, which have reversed several months of decline.

However, the Caixin indicator, which mainly covers small and medium-sized private enterprises, shows slightly more positive signs. Domestic conditions argue for increased monetary easing, but the People’s Bank of China (PBoC) remains constrained in its actions due to the weakness of the yuan and the deteriorating financial situation of Chinese banks. The recent rate cut by the U.S. Federal Reserve (FED) could provide new leeway for the PBoC.

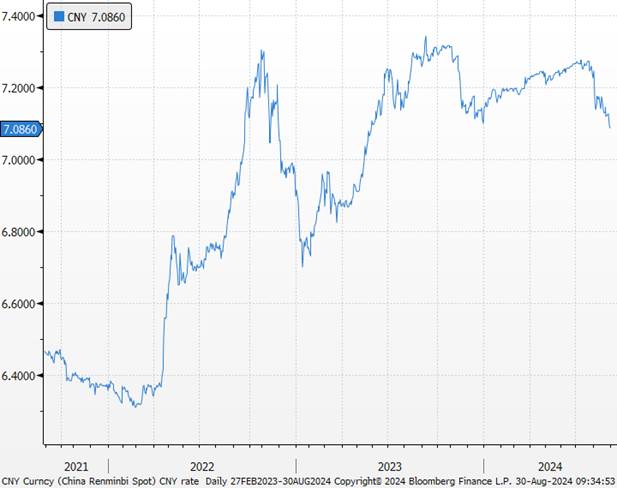

PBoC Governor Pan Gongsheng has stated that the central bank will continue to adopt a supportive monetary policy to encourage reasonable credit growth and support the world’s second-largest economy. A possible sign that the low point has been reached is the appreciation of the renminbi in August, after six months of decline.

USD-CNY

Japan: Toward a Tightening of Monetary Policy

Economic activity shows signs of progress, although the manufacturing sector remains in contraction, affected by persistent margin pressures and employment issues. Meanwhile, the services index remains high, reaching 54, supported by robust domestic and international demand. This confidence in growth dynamics and inflation expectations, aligned with forecasts, allows the Bank of Japan (BoJ) to consider further interest rate hikes.

Pressures on the yen have decreased following the appreciation of the currency in August, which should boost domestic demand. However, the increasingly “complex and volatile” business environment could limit corporate profit growth.

USD-YEN

The second-quarter GDP figures show a marked acceleration in growth, with a 0.8% increase quarter-on-quarter, compared to a 0.6% decline in the first quarter of 2024. The government is raising its economic forecasts for the first time since May 2023. This recovery, supported by the positive impact of wage increases on household demand and economic activity, justifies the Bank of Japan’s tightening monetary policy. The central bank plans to raise its key interest rates again early next year, bringing them to 0.50%.