THE FED’S GAMBLE

The Federal Reserve made up for lost time by cutting rates for the first time by 50 basis points, justifying this move by the continuing slowdown in inflation and, above all, the deterioration in the job market. Many, including us, thought that such a significant reduction might herald serious concern about an imminent recession. However, this is not the case.

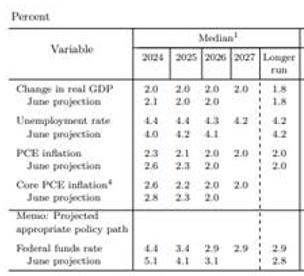

Fed economic forecast

In his press conference, Jerome Powell described the rate cut as a “recalibration” rather than a “response” to any concerns about the state of the labor market. We noted several evolutions in the FOMC’s speech, notably on job growth, which is now described as “slowing” rather than “moderating”. The tone regarding falling inflation is more confident.

So it seems that the Fed is claiming victory in its fight against inflation. ” The Committee is convinced that inflation is moving sustainably toward 2% ,” reads the official statement.

The decision was clearly facilitated by the sharp slowdown in inflation, enabling the central bank to approach the return of prices to the 2% target with greater serenity, and to focus more on its second mandate: full employment.

In the short term, we expect labor market data to influence the pace and extent of future rate cuts.

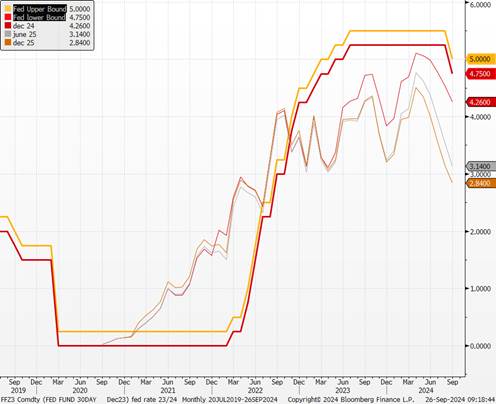

Fed rates and futures market expectations

The Fed’s decision to cut its key rates by 50 basis points was not motivated solely by increased confidence in the trajectory of inflation. There are other factors behind this abrupt move:

– A late start

Unlike other central banks, which had already begun their downward cycle in July, the Fed chose to maintain its policy. This delay proved costly when the sudden deterioration in the job market took the institution by surprise, making its monetary policy too restrictive for current economic conditions.

– A political decision

With two months to go before the US elections, it’s fair to ask whether this decision is not also a political one. When Jerome Powell’s term was extended to 2021, the White House praised his “steadfast leadership in the face of unprecedented challenges”, including the greatest recession in modern history. Nevertheless, Donald Trump, who appointed him, has not hesitated to regularly criticize Powell. Indeed, revelations in April indicated that Trump’s campaign team had considered restricting the Fed’s independence.

Fox New broadcast

The economic programs of both presidential candidates, especially Trump, are perceived as inflationary. The question is whether rate cuts will continue to be justifiable after the election. We’re not sure about either candidate.

– The question of credibility

The Fed has a dual mandate (triple with financial stability): price stability and full employment. It failed on the former by arguing for too long that inflation was only temporary. Imagine if it made the same mistake on employment! Can she really maintain that the cooling in employment (which has yet to be proven, by the way) is merely a normalization, and this time wait for it to deteriorate irrepressibly? Would she risk failing in her second term?

– Forward-looking action

Although the Fed’s decision may seem “dovish”, the overall tone of the FOMC is more “hawkish” than expected, with relatively optimistic economic forecasts. Actions and speeches therefore appear to be in balance. Jerome Powell’s key phrase in his speech remains: ” There is no indication that the Committee is in a hurry “, which reassures us of the Fed’s ability to anticipate, rather than react defensively to, the economy.

– Fear of a hard landing in 2025

With the envisaged rate cut, the macroeconomic scenario forecasts growth dynamics similar to those previously anticipated until 2025, with a moderate slowdown to 2% for 2024 and 2025. However, this scenario incorporates a lower inflation rate (total PCE at +2.3% in 2024 versus +2.6% previously and +2.1% in 2025 versus +2.3%) and a higher unemployment rate. Presidential candidate Donald Trump closely follows the Fed’s decisions and was quick to react to the rate cut. ” It shows the economy is doing very badly… unless they’re just playing the political card,” he said, an opinion shared by some but not all Republican lawmakers.

Why is it risky to lower rates so quickly?

The Fed’s gamble is clear: keep US growth above potential, with a labor market that is slowly deteriorating, thus limiting pressure on wages, and inflation that is gradually moderating. However, this gamble carries risks. Although the economy still looks solid, the Fed is keen to avoid finding itself “behind the curve” in its monetary response.

The main risk will be to push down real estate rates too quickly through the distribution of credit. Another inflationary wave would then be inevitable. We have written extensively on this subject. The challenge would be a strong recovery in supply to counterbalance this effect.

Freddie Mac 30-year rate (real estate)

The aim is to ensure a “soft landing” in the coming quarters, by cutting rates quickly, before the economy slows too sharply. If the central bank waited too long to act, it could be forced to cut rates even more drastically, thereby entering accommodative territory to revive a sharply slowing economy. This scenario would run the risk of rekindling inflationary pressures, calling into question the gains made in the fight against rising prices.

So, although the current approach seems balanced, the risk of a “hard landing” in 2025 has not been totally ruled out if the economy were to deteriorate faster than expected.

The risk of a resurgence in inflation has not been ruled out either. The rise in long rates since the announcement by the President of the US central bank certainly reflects this realization.

Short-term under control, but longer-term uncertainties

In the very short term, visibility on disinflation remains rather good, with a marked fall in commodity prices and a clear deterioration in the job market. These factors support the current disinflationary trend. However, inflationary forces may re-emerge, notably in the housing market, which remains a key component of overall inflation. The maintenance of growth expectations at 2% reflects the Fed’s confidence in its ability to influence the economy directly by cutting rates. But what happens if inflation stabilizes above target?

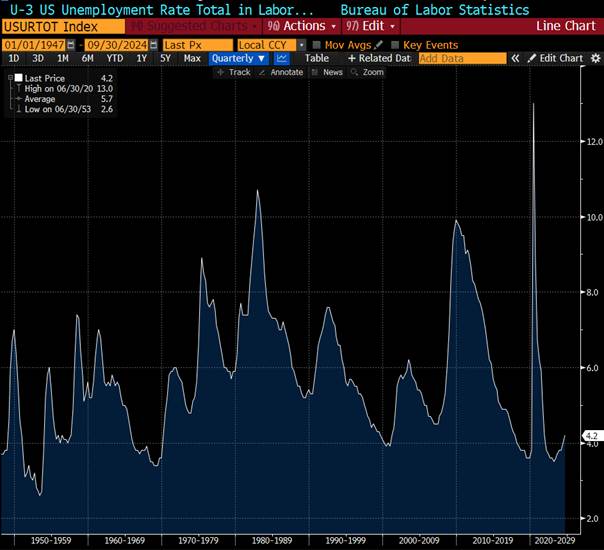

The unemployment rate rose back above 4% in June, marking a slight deterioration, although it remains historically low. Furthermore, the latest macroeconomic data continue to show the strength of US growth. Interestingly, in 2017, the fall in unemployment had been influenced by Donald Trump’s strict immigration policy. Today, the uncertainty surrounding the US presidential election seems to have cooled companies’ investment and hiring, as shown by the job vacancy statistics. However, a rebound could take place after November 5, once the election results are known.

Long-term unemployment rate

Can we trust the Fed (the system)?

The economic scenario assumes similar growth dynamics until 2025, with lower inflation (total PCE at +2.3% in 2024 vs. +2.6% previously, and +2.1% in 2025 vs. +2.3%) and higher unemployment. However, the Fed has changed its tune significantly in just three months. Although inflation forecasts have been revised downwards and unemployment forecasts upwards, the overall economic situation has not changed radically from previous forecasts.

Financial markets are beginning to doubt the Fed’s ability to accurately predict future interest rates. The “dot plot”, which presents Fed officials’ expectations of future rate movements, has often proved inaccurate. This raises the question of whether this mechanism could be abandoned, especially if investors no longer trust it.

Currently, markets are forecasting that the Fed’s terminal rate will reach 2.9% in September 2025, well ahead of Fed officials’ forecasts. In concrete terms, markets are anticipating around eight rate cuts over the next 12 months, while the Fed is currently only planning six. This discrepancy reflects investors’ mistrust of the central bank’s projections.

Powell has insisted that the Bank has not yet claimed victory on inflation. If the risks reappear, we think he won’t hesitate to reverse the process.

Powell has a strong track record of resisting political pressure on rate movements. While his 2019 feud with Trump is the most memorable, some Democrats have also tried, unsuccessfully, to influence Fed rate decisions.

A real source of concern if Trump wins in November.

Read more : Macro-Economic Point October 2024