1. In the Eurozone, voices in favor of a rate cut in October are multiplying.

2. US Presidential Elections: Final debate.

3. Iranian strikes on Israel: Oil prices soar, fears of escalation grow.

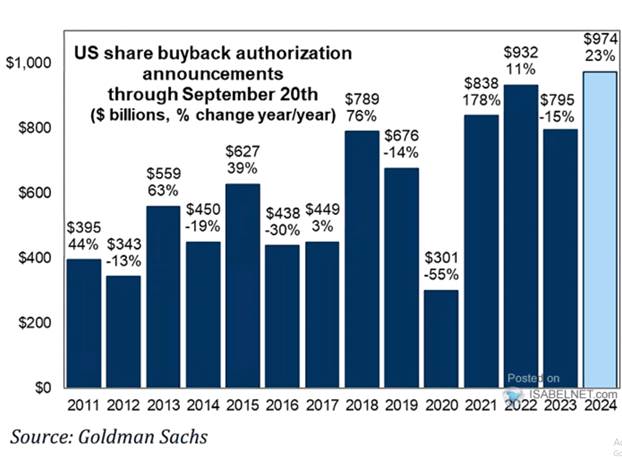

4. Chart of the week: Stock buybacks in the United States.

In the Eurozone, voices in favor of a rate cut in October are multiplying..

Recent days have seen a series of statements, with a growing number of central bankers now more openly discussing the possibility of the ECB lowering its key interest rates this month (monetary policy meeting on October 17). After Christine Lagarde and Olli Rehn earlier in the week, Isabel Schnabel, a traditionally hawkish member (i.e., supportive of a more restrictive monetary policy) of the Governing Council, has expressed support for a less restrictive monetary policy in Europe, highlighting the current challenges facing European growth.

According to her, the ECB can no longer ignore the obstacles to economic recovery in light of early signs of slowing labor demand, while recent progress on the inflation front supports a return to target. However, I. Schnabel acknowledged that wage growth remains strong and continues to contribute to persistently high services inflation. Her remarks underscore the central bank’s growing concern over struggling growth and inflation falling faster than they had anticipated in September. The more moderate oil prices are accelerating the inflation slowdown and, combined with rising risks to European activity, are increasing the ECB’s room for maneuver to ease its monetary policy..

Our opinion: As we anticipated, this context supports a new rate cut by the ECB this month, followed by another in December. We expect monetary policy easing to begin in 2025, aiming for a terminal rate of around 1.75% by 2025.

US Presidential Elections: Final Debate

The televised meeting between the running mates of Trump and Kamala Harris was significantly more moderate and policy-focused compared to last month’s heated clash between the two presidential candidates. The debate, which took place as the race for the White House enters its final stretch, was presented as an opportunity for Americans to learn more about the vice-presidential candidates, two men chosen for their supposed popularity among working-class communities in key Midwestern swing states.Walz’s standout moment, and one of the debate’s most memorable exchanges, came when he asked Vance if he could finally admit that Trump had lost the 2020 election. The Ohio senator responded by saying he was “looking toward the future” and tried to pivot to talking about the “censorship” of the left during the Covid-19 pandemic.

The Minnesota governor, however, stumbled several times, notably when he admitted earlier in the evening that he had “misspoken” by claiming to have been in China in 1989 during the Tiananmen Square protests, when in fact he had not arrived in the country until several months later.Foreign policy was the focus of Tuesday’s debate, which took place just hours after Israeli Prime Minister Benjamin Netanyahu vowed to retaliate against Iran following a barrage of ballistic missiles fired at Israel by the Islamic Republic. Walz echoed Harris’s condemnation of the Iranian attack and her promise to “always ensure that Israel can defend itself.” However, he also accused Trump of being an “unstable” leader who had abandoned multilateral coalitions, particularly by withdrawing from the Iran nuclear deal.

Vance has taken a particularly hard stance on immigration since becoming Trump’s running mate, sometimes courting controversy by amplifying unfounded claims that Haitian migrants in Springfield, Ohio, were stealing pets to eat. He stated that the U.S. was facing a “historic immigration crisis” because Harris and President Joe Biden had rolled back Trump’s border policies.The debate was relatively civil compared to last month’s hostile clash between Harris and Trump. However, the two vice-presidential candidates became heated when discussing abortion policy. Reproductive rights have become a mobilizing issue for Democrats since the Supreme Court overturned the national right to abortion in 2022, and Republican-led legislatures across the country have imposed increasingly strict bans on the procedure.

Vance, who has taken a strong anti-abortion stance and declared that he would support a “national standard” to restrict access to the procedure, tried to soften his message. Tuesday’s debate, hosted by CBS News, is likely to be the final televised debate of the 2024 presidential election cycle. Although Harris accepted an invitation from CNN for another presidential debate at the end of October, Trump has said he has no intention of returning to the stage.The economy proved to be a weak point for Harris, with voters blaming the Biden administration for the high cost of living. Vance dismissed economists’ concerns on Tuesday, offering a vigorous defense of tariffs, which he claimed were beneficial for creating higher-paying jobs for American workers.

Voting Intent Gap in Swing States.

Sources : Bloomberg, Groupe Richelieu

Our Opinion: Poll tracking shows that the two candidates remain neck and neck in the seven key states that will determine the outcome of the presidential election. The economic programs of both presidential candidates, particularly Trump’s, are viewed as inflationary. The question, therefore, is whether rate cuts will continue to be justifiable after the elections. Given the stark differences between the programs, an increase in volatility is expected as the election approaches.

Iranian Strikes on Israel: Oil Prices Soar, Fears of Escalation Grow

The launch of nearly 200 missiles by Iran on Israel has triggered an immediate rise in oil prices, although the spike remains somewhat contained for now. In response to these geopolitical tensions, Brent crude prices surged by 7% within a few hours, reaching over $75 on Wednesday morning, compared to less than $70 the previous day. This sudden price increase followed the Iranian attacks on October 1, just before the anniversary of the October 7, 2023, attacks. Iran targeted Israel in retaliation for the Israeli military’s operations against Hezbollah in Lebanon. Although the strikes did not cause significant damage, they raise fears of escalating tensions in a region critical to the global oil supply.

The prospect of open conflict between Iran and Israel is unsettling markets, particularly due to the risk of a blockade in the Strait of Hormuz, through which a large portion of the world’s oil passes. A war could also lead to Iranian strikes on Saudi Arabia’s oil infrastructure, the region’s main crude producer. Such a scenario could push oil prices beyond $80 per barrel.

Despite recurrent tensions in the Middle East in recent months, there has been no major disruption to oil production. According to several media outlets, Iran reportedly warned the U.S. before launching its missiles, suggesting that the country seeks to assert its strategic position rather than ignite a full-scale conflict with Israel and its Western allies.

However, some analysts believe the risk of escalation is real. There are signs that the risks are higher this time. The attack involved twice as many ballistic missiles as the strikes last April, making it uncertain whether this is an isolated operation by Iran. Israel has already warned that Tehran will pay the price for this attack, while the U.S. has reiterated its support for the Jewish state. An Israeli retaliation could include targeted strikes on Iranian oil facilities. Iran, which produces around 4% of the world’s oil, would see its production capacities impacted, potentially driving Brent prices significantly higher. Nonetheless, OPEC’s response, particularly from Saudi Arabia, to compensate for any potential supply reduction will be crucial.

Our opinion: If tensions ease, oil prices could stabilize. If OPEC+ gradually reverses some of its production cuts, market rebalancing could occur.

WTI prices

Sources : Bloomberg, Groupe Richelieu

Chart of the Week

The strength of stock buyback authorizations in the United States reflects not only positive business outlooks but also serves as a strategy to optimize capital structure and reward investors.

Sources : Goldman Sachs, X