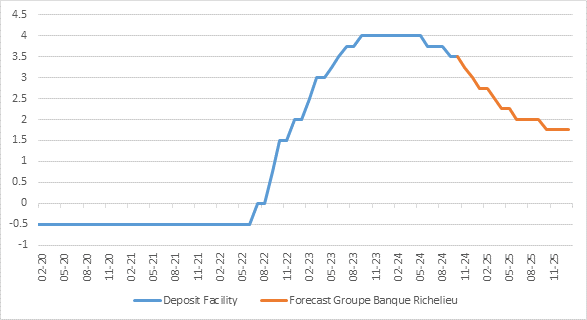

This afternoon, the European Central Bank (ECB) is expected to lower its three key interest rates by 25 basis points, reducing the deposit facility rate from 3.50% to 3.25%. A decision that, although consistent with our scenario (we had anticipated three more cuts by the end of the year back in August), still seemed unlikely to the markets following the meeting on September 12.

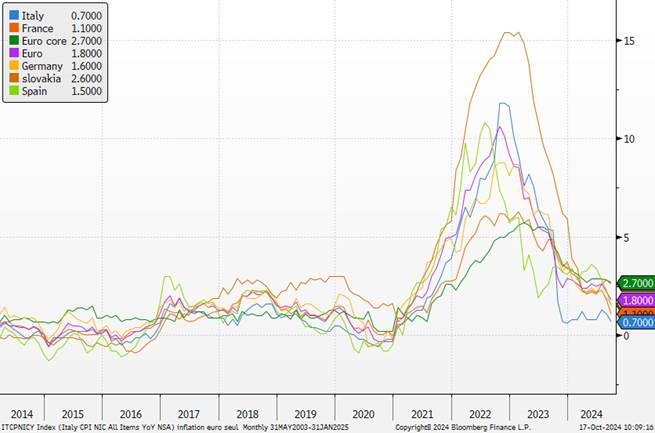

Eurozone Inflation

Sources : Bloomberg, Groupe Banque Richelieu

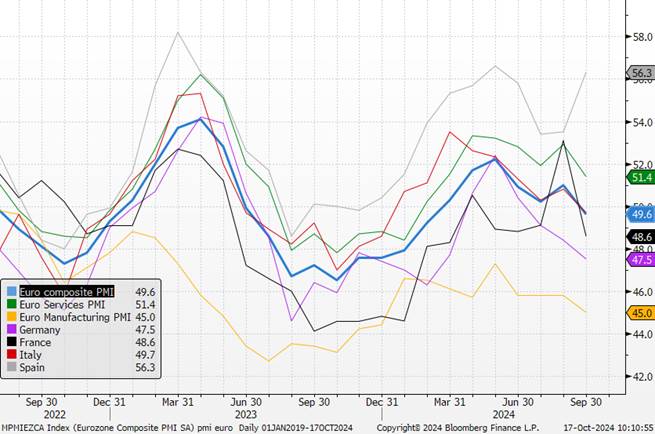

Since then, the economic context has rapidly evolved. Inflation, which had long defied projections, fell below the 2% threshold in September, reaching +1.8% year-on-year. This decline, more pronounced than expected, confirms an economic slowdown. At the same time, the latest PMI indicators in the Eurozone also reflect this cooling of activity.

PMI in the Eurozone

Sources : Bloomberg, Groupe Banque Richelieu

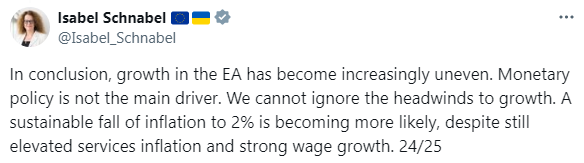

Notably, several ECB members, including advocates of a stricter monetary policy, have recently argued for further easing as early as October. This change in tone reflects the new dynamics at play.

The latest statements from OPEC and the drop in oil prices give the ECB more confidence regarding imported inflation.

Sources : X

However, market attention will focus primarily on Christine Lagarde’s communication during the press conference following the meeting. The key issue of this meeting will lie in the ECB president’s communication during her press conference. The market could be disappointed. Certainly, the ECB might express concerns about witnessing an excessive slowdown in activity and inflation (below the 2% target), which would justify another cut in key interest rates before the end of the year. However, we anticipate that the ECB staff will wait until the December meeting to lower their growth and inflation forecasts.

Our scenario predicts a deterioration in recent activity indicators, easing wage pressures, and the continued decline of inflation. Consequently, the scenario of successive 25 basis point adjustments at each meeting starting in December will gain strength, with a terminal rate expected at 1.75% by the end of the year (and a 2% rate by June 2025).

ECB Deposit Facility Rate and Expectations

Sources : Bloomberg, Groupe Banque Richelieu