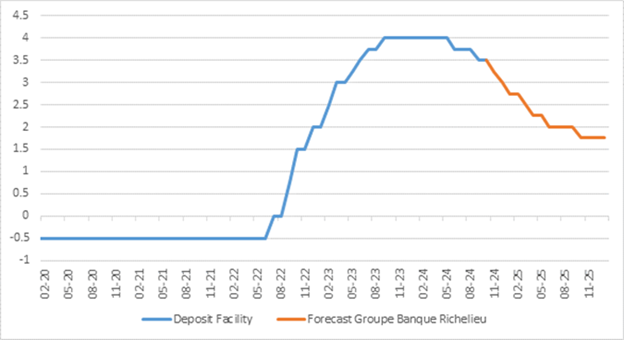

1. ECB: A Cut That Suggests More to Come

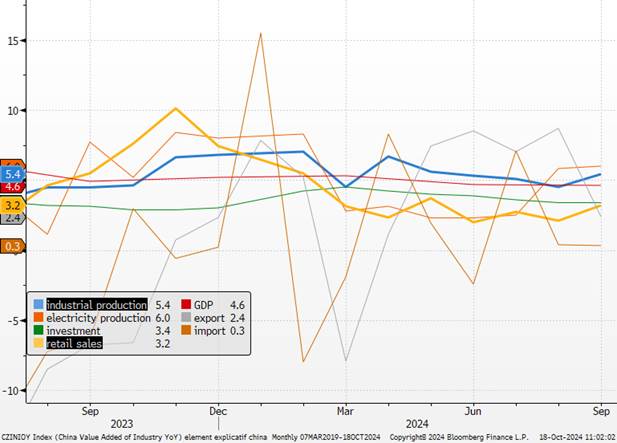

2. China: Early Signs of Economic Improvement Despite Still Weak Growth

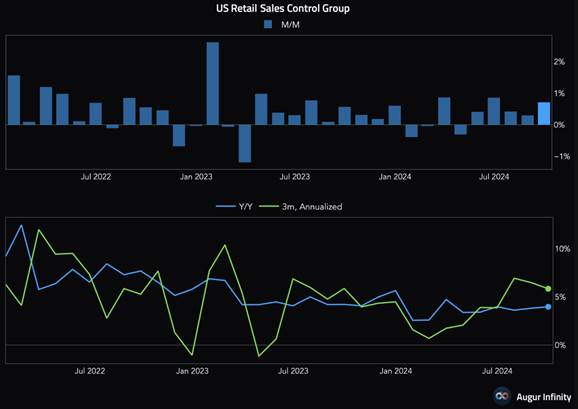

3. The US Consumer Holds Steady

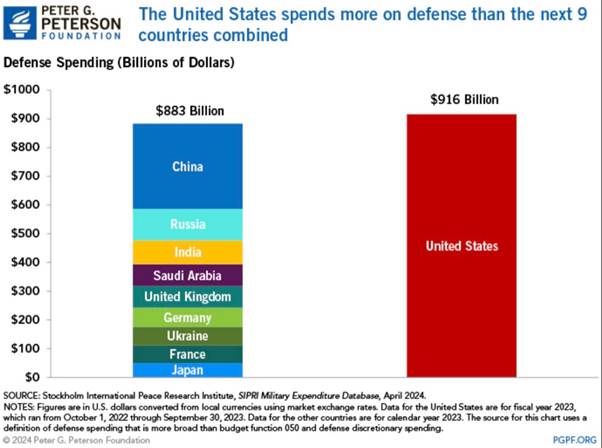

4. Chart of the Week: Military Spending / The US and the Rest

ECB: A Cut That Suggests More to Come

The European Central Bank lowered its interest rates by 25 basis points for the second consecutive meeting on Thursday, stating that the disinflation process was “well underway” and that it would continue with a meeting-by-meeting approach. Recent data shows that the decline in inflation is progressing as the ECB had hoped.

“We will continue to do exactly the same,” ECB President Christine Lagarde said at a press conference, adding that the decision to cut rates was unanimous due to lower-than-expected inflation data and a weaker economy. “I’m not sure we had anticipated this 1.7%, but no one else had either,” she said, referring to the downward-revised inflation figures for September, adding that the eurozone was on track to sustainably reach its 2% inflation target by 2025. There is still a balance of risks of either falling short of or exceeding this target, but there are “probably more downside risks,” she added.

“Have we broken the neck of inflation? Not yet. Are we in the process of doing so? Yes,” she stated.

The risks to economic growth are tilted to the downside, Lagarde said, adding: “We are concerned about growth insofar as it impacts inflation.” There are also risks in both directions for inflation, with higher-than-expected wages playing a role, and geopolitical tensions in the Middle East potentially influencing prices either upward or downward. The growth of unit labor costs is expected to decrease significantly. The rise in unit labor costs has already slowed from its historic highs in 2023 to an estimated 4.7% in the second quarter of 2024. It is expected to fall further, and sharply, to reach 2.1% by 2026. This reflects anticipated productivity gains along with a slowdown in wage growth.

“I haven’t opened anything at all. We will review the data at each meeting,” Lagarde said, emphasizing that the October rate cut decision was a “perfect example of data dependency.” Recall that at the last September meeting, a rate cut in October had been nearly ruled out.

The ECB is not currently forecasting a recession in the eurozone, though it remains concerned about growth. The economy is not rebounding as strongly as the ECB had expected, but it does not foresee a recession and still considers a soft landing as the most likely scenario. The ECB believes financial conditions remain restrictive (and will stay that way as long as necessary), even though there has recently been a slight rebound in credit demand in the eurozone.

ECB Deposit Facility Rate and Forecasts

Our View: Our scenario predicts a deterioration in recent activity indicators, a loosening of wage pressures, and a continued decline in inflation. Therefore, the scenario of successive 25 basis point adjustments at each meeting from December onwards will gain strength, with a terminal rate expected at 1.75% by the end of the year (and a 2% rate by June 2025).

China: Early Signs of Economic Improvement Despite Still Weak Growth

The release of the latest economic statistics in China this Friday confirms the ongoing weakness of the economy, while also providing encouraging signs for the future. Indeed, government measures appear to be starting to bear fruit. While economic growth remains less dynamic than before, signs of improvement were noted at the end of the quarter. GDP slowed in the third quarter, with a year-on-year increase of 4.6%, slightly above expectations (+4.5%) but below the previous quarter’s growth (+4.7%). However, on a sequential basis, the economy accelerated with a 0.9% rise compared to the previous quarter (+0.7% in Q2), though this figure still fell short of forecasts (+1.1%).

The September data, meanwhile, turned out to be generally better than expected, largely thanks to a recovery in household consumption. Retail sales grew by 3.2% year-on-year, exceeding expectations (+2.5%) and showing a clear improvement over August (+2.1%). This rebound was mainly driven by increased purchases of household appliances, supported by state subsidies that have been in place for several months. The unemployment rate also declined, standing at 5.1% compared to 5.3% the previous month. At the same time, industrial production saw a notable increase of 5.4%, again exceeding forecasts (+4.6%) and outperforming August’s result (+4.5%).

However, China remains heavily burdened by its struggling real estate sector, with both property prices and real estate investments continuing to decline. Overall investment remains relatively stable, without significant momentum.

While these end-of-quarter statistics offer a more optimistic outlook for China’s economy, they also highlight that the goal of achieving 5% growth by 2025 will depend on a more pronounced rebound in the fourth quarter. To support the economy, Beijing recently announced several monetary and fiscal support measures aimed at boosting household consumption and confidence. However, the details of these measures remain vague, while the real estate crisis continues to weigh on consumer confidence.

Elements of Chinese Growth

Our View: The Chinese political calendar hints at significant measures, particularly from the Politburo and the Central Economic Work Conference at the end of the year. However, these initiatives will take time to materialize, and investors will remain cautious, awaiting guarantees before fully believing in a sustainable economic recovery. Nonetheless, these signals are encouraging and reflect a clear intent from Beijing to revive its struggling economy.

The US Consumer Holds Steady

Strong discretionary spending boosted U.S. retail sales in September. Retail sales in the U.S. increased in September, likely driven by lower gasoline prices, which allowed consumers to spend more at restaurants and bars, supporting the notion that the economy maintained a solid growth pace in the third quarter. The slightly stronger-than-expected increase in sales also reflected sharp gains in clothing store revenues as well as diverse retailers. Consumers increased their online purchases and spent more at health and personal care stores.

Spending and the broader economy are being supported by solid income growth and strong household balance sheets. Although the labor market’s momentum has slowed, layoffs remain historically low, thus supporting wage increases. The signs of economic resilience are unlikely to discourage the Federal Reserve from cutting interest rates again, but they will reinforce expectations of a more modest 25 basis point reduction in borrowing costs. The Atlanta Fed raised its estimate for third-quarter GDP growth to an annualized rate of 3.4%, up from 3.2% previously. The economy grew at a 3.0% pace in the second quarter. Strong consumer spending in September suggests that economic growth in the previous quarter was well above trend. Economists view dining out as a key indicator of household finances.

Retail sales rose 0.4% last month following an unrevised 0.1% increase in August, according to the Census Bureau of the Commerce Department. Gasoline prices dropped by about 12 cents per gallon between August and September, according to data from the U.S. Energy Information Administration. The strength in sales contrasts with consumers’ rather gloomy sentiment, as well as comments from several companies indicating that households are showing some hesitation to spend ahead of the U.S. presidential election on November 5.

Nestlé’s CFO said Thursday that the slowdown in U.S. sales of the packaged food producer was partly due to “election-related concerns.” However, the American consumer still has spending power, which they continue to use somewhat more selectively.

Unemployment claims have also decreased, supporting this situation. A separate report from the Labor Department showed that initial state unemployment claims dropped by 19,000 to a seasonally adjusted 241,000 last week (hurricanes and a month-long strike at Boeing make it harder to assess the labor market).

Our View: Given the recent statements from central bankers, we now anticipate a total rate cut of 50 basis points by the end of the year, with two 25 basis point reductions at the November and December meetings. Our previous forecast had only expected one cut in December. Following this, a series of additional 25 basis point cuts could bring the Fed’s benchmark rate down to 3% by 2025. However, it is important to note that there is no clear consensus among monetary policymakers on the next steps. Powell has been adamant that the Fed has not yet declared victory over inflation. If risks resurface, we believe he will not hesitate to reverse the course of rate cuts. Powell has a strong track record of resisting political pressure on rate movements. While his 2019 clash with Trump is the most notable, some Democrats have also unsuccessfully attempted to influence the Fed’s rate decisions. This becomes a real concern if Trump wins in November.

Chart of the week: military spending