- The Bank of Canada accelerates its rate cuts.

- The yen falls and Japanese authorities respond.

- Investors increasingly play the Trump card next month.

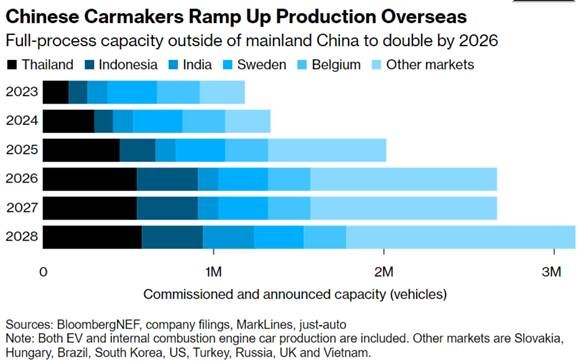

- Chart of the week: Chinese automakers redouble their efforts to open factories abroad.

The Bank of Canada accelerates its rate cuts.

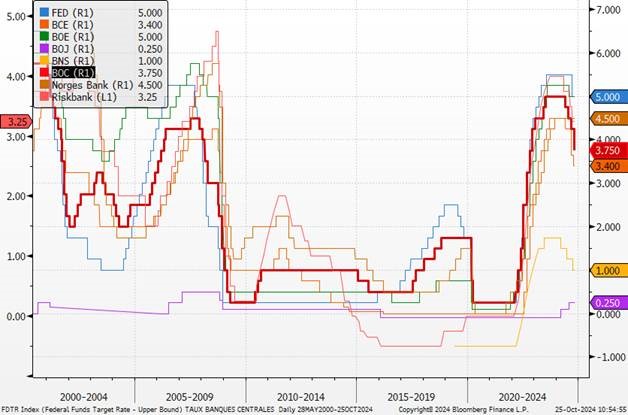

The Bank of Canada (BoC) once again surprised markets by announcing a 50 basis point (bp) cut to its key interest rate, compared to the expected 25 bp. This decision, driven by growing concerns over the labor market, marks the fourth consecutive cut, bringing the rate down from 4.25% to 3.75%. Since June, the BoC has made three 25 bp cuts, but this latest move is more aggressive. While markets anticipated this change, economists were more divided, particularly due to slowing inflation. In September, inflation fell to 1.6%.

Governor Tiff Macklem called the decision “justified,” signaling that further rate cuts could follow if economic data continues to evolve as expected. Although the pace of future cuts remains uncertain, markets anticipate another 40 bp reduction by December, contrasting with expectations for Fed funds rates, further increasing downward pressure on the Canadian dollar.

Economically, consumption continues to grow in Canada, though at a slower per capita rate. Exports, bolstered by the opening of the Trans Mountain Expansion pipeline, have also stimulated activity, despite a weakening labor market. According to the BoC, the economy is showing signs of excess supply, justifying these rate cuts. The IMF, in its outlook published Tuesday, estimates that Canada could record 2.4% growth in 2025, the best performance among G7 countries, ahead of the United States. However, the BoC cannot ignore the rising unemployment, partly linked to the increased labor force due to immigration. Finally, inflation remains heavily influenced by housing costs. Excluding these, inflation would fall below 1%. As for employment, it exceeds pre-pandemic levels by one million workers, mainly due to immigration, a factor that should moderate wage and inflationary pressures in the medium term. Since the first rate hike in March 2022, the Canadian economy has faced several challenges, notably due to household debt. Unlike the U.S., where fixed-rate mortgages are the norm, Canadians are more exposed to fluctuations in variable rates, which has weighed on their finances, with debt rising from 140% to 175% of disposable income.

Comparison of rates from different central banks.

Our opinion: We believe that the Bank of England’s (BoE) stance is indicative of that of other central banks, particularly the ECB, in their fear of being “behind the curve.” The Canadian dollar, like the euro, could come under pressure against a U.S. dollar supported by a more reluctant Fed to make significant rate cuts.

The yen falls and Japanese authorities respond.

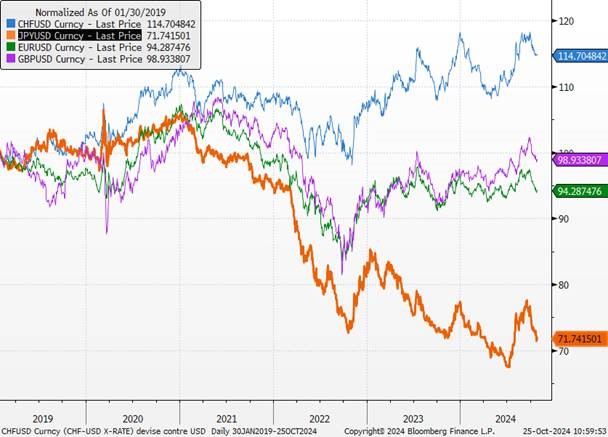

Since the beginning of October, the USD/JPY has risen significantly due to, on one hand, the dollar’s appreciation driven by expectations of a more resilient U.S. economy and the prospect of a Trump victory, and on the other hand, the yen’s depreciation following comments made earlier in the month by Prime Minister S. Ishiba. The yen’s decline, which is exacerbating imported inflation and reducing real wages, forced Japan’s Finance Minister K. Kato to warn investors against speculation yesterday. Meanwhile, K. Ueda, the Governor of the Bank of Japan, attempted to temper currency movements by highlighting the counterproductive nature of an overly cautious stance by the BoJ, which could encourage speculation and increase volatility risks. In response, the yen has appreciated slightly against the dollar this morning (USD/JPY down 0.4%). However, for now, the likelihood of intervention by Japanese authorities to support the yen in the foreign exchange market remains low, given the proximity of the general elections to be held on Sunday.

The BoJ may be able to raise its key rates by 25 bp (to 0.5%) early next year, which should further strengthen the yen against the dollar (toward 138 USD/JPY by June 2025), especially since the Japanese currency could simultaneously benefit from a smaller monetary policy gap with the Fed.

Currencies against USD

Notre avis : La BoJ a pris en compte les réactions du marché à ses récentes mesures (sell-off du mois d’août) et signale une approche prudente. Cependant, la nomination du prochain Premier ministre pourrait faire craindre une pression vers une politique monétaire plus restrictive et des actions surprises pour soutenir la devise. Nous restons à l’écart de la zone.

Investors increasingly play the Trump card next month

The prospect of a victory by the Republican candidate, Donald Trump, in the presidential election, and a Republican sweep in Congress next month, seems to be partly driving the rise in sovereign rates and the dollar. The 2024 U.S. presidential race is tightening between Donald Trump and Kamala Harris, creating significant uncertainty, particularly in key swing states where every vote counts. Harris appears to have a slight edge in states like Michigan, Pennsylvania, and Wisconsin, while Trump leads in Arizona, North Carolina, and Georgia. The margins are sometimes razor-thin, especially in Pennsylvania and Michigan, where polls show a difference of less than 0.2 points, making the outcome highly uncertain.

The polling uncertainty is already affecting financial markets. Investors are adjusting their bets based on Trump’s chances of re-election, which could lead to major economic changes. Trump has expressed his desire to weaken the dollar and lower interest rates, but investors expect his policies to have the opposite effect, especially if Republicans achieve a “red wave” by controlling the White House and both houses of Congress.

The recent strength of the dollar is partly due to the resurgence of “American exceptionalism” and solid economic data. However, the rise of the “Trump trade,” where his protectionist policies are perceived as inflationary, is causing concern among investors. If Trump wins the election, his program could include tariff increases, immigration restrictions, and tax cuts, which are expected to raise interest rates and inflation.

Coupled with significant fiscal stimulus, his “America First” agenda has several anticipatory effects. On one hand, it should keep the U.S. economy (very) strong, and consequently, lead to a less aggressive monetary easing cycle by the Fed in the coming years. Betting markets and polls in key states show momentum in favor of the former president, prompting investors to factor in the potential economic impacts of a Republican victory. As a result, the prospect of a “Republican sweep” is already contributing to the rise in sovereign rates, as markets anticipate a less accommodative monetary policy from the Fed if Trump is elected.

10-year U.S. Treasury yields versus the probability of a Republican Sweep

Our opinion: U.S. political risks are intensifying just weeks before the election and are likely to continue impacting asset volatility. A Trump victory would raise serious doubts about the Fed’s ability to lower interest rates.

Chart of the Week

Chinese automakers are redoubling their efforts to open factories abroad as they seek to bypass tariffs by producing outside of China. This trend highlights the rise of neutral economies positioning themselves as hubs between China and Western countries.