Key Messages

Rare and critical metals are the raw materials necessary for the development of digital technologies and the energy transition. These resources, such as rare earths, copper, and lithium, are essential to strategic sectors like aerospace, defence, renewable energy, and new technologies. Unlike fossil resources, their management is dominated by China, which controls a significant portion of global refining, creating a critical dependency for Western countries like Europe and the United States.

This dependency is exacerbated by the fluctuations in the rare metals market. Market volatility remains a major concern, especially since investments in mining are hampered by low prices and high interest rates, making development of new supply sources a challenge.

Therefore, Europe and the United States are implementing strategies to reduce their dependency, such as developing partnerships with other countries and establishing regulations to promote local extraction and the recycling of critical metals. However, these efforts face environmental and ethical challenges related to mining and refining, as well as geopolitical uncertainties that continue to weigh on the stability of global supply chains.

Investment involvement

The most exposed sectors to price volatility in rare metals are those heavily dependent on these raw materials, such as information technology, automotive, renewable energy, and aerospace. Companies in these industries are vulnerable to supply chain disruptions and rising costs, which could affect their profitability and lead to stock declines.

On the other hand, companies investing in rare metal recycling technologies or innovating to reduce their dependency on these resources could benefit from greater resilience. Companies that diversify their supply sources, by signing agreements with governments or developing their local refining and extraction capacities, are better positioned to face fluctuations in the critical metals market.

On the bond side, a rare metals crisis could impact the credit market, increasing credit risk for companies exposed to these raw materials. Volatility could also contribute to inflation, leading central banks to raise interest rates, which would reduce the value of existing bonds.

Introduction

Are we at a Turning Point of the Fourth Industrial Revolution? After the coal revolution at the end of the 18th century, followed by the oil and gas revolution in the late 19th century, electricity began its rise in the 1970s, with the emergence of computer science. At the dawn of the 21st century, the fourth industrial revolution, that we are currently experiencing, continues the previous one, marked by the management of digital data (artificial intelligence) and the energy transition.

The essential resources for this new revolution are critical metals. Raw materials essential to industrial value chains. Many strategic sectors depend on them, such as aerospace, defense, clean technologies, and for the entire digital needs.

Unlike coal, oil, and gas, the management of rare metals is now dominated by China, which holds a hegemonic position over these resources. This situation creates a critical dependency for the rest of the world. Europe and the United States are now seeking to catch up in this crucial area.

Rare Metals, Rare Earths, or Critical Metals?

A variety of terms are often used to refer to these raw materials, which can be confusing. We will focus here on three of them: rare metals, rare earths, and critical metals.

Rare metals are elements with low average abundance and/or availability in the Earth’s crust. Among them, rare earths form a group of seventeen chemical elements (scandium, yttrium, and the fifteen lanthanides) that are part of rare metals. Contrary to what their name suggests, rare earths are not truly rare in terms of concentration in the Earth’s crust. However, they are distinguished by the rarity of their deposits, meaning the low presence of natural concentrations large enough to be economically exploitable. Their exceptional properties (lightness, strength, energy storage capacity, heat resistance, magnetic properties, etc.) make them essential in many technologies, such as permanent magnets, batteries, and catalytic systems.

Metals are considered critical when a supply difficulty could lead to major industrial or economic consequences. This definition of criticality is not universal; it varies from country to country and evolves over time. The European Union currently lists 34 critical raw materials, 17 of which are considered strategic[1]. A large portion of this list is made up of rare metals.

[1] Consilium Europa : critical-raw-materials

Extraction and Refining: A Chinese Monopoly?

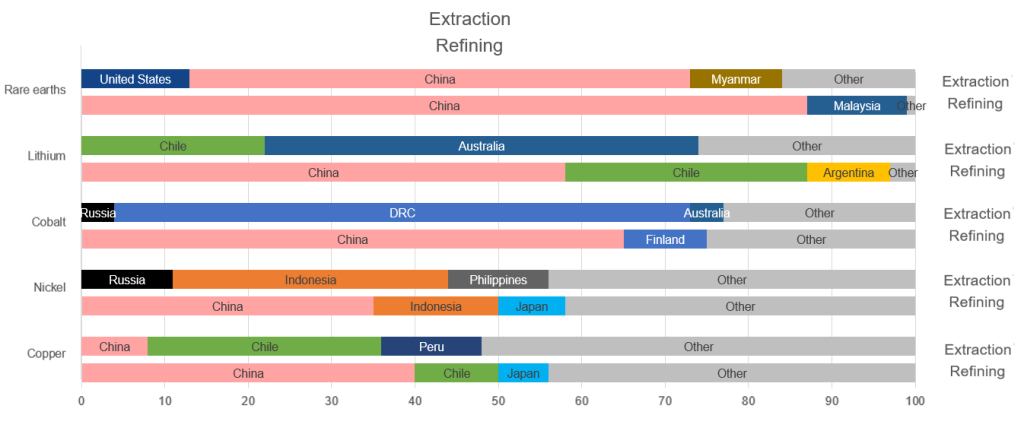

Extraction and refining of metals are two distinct steps in the production of metals from ores. Extraction involves retrieving metals from natural ores or deposits, while refining follows to purify the extracted metals. This refining process aims to remove impurities, unwanted elements, and residual contaminants to obtain high-quality metals.

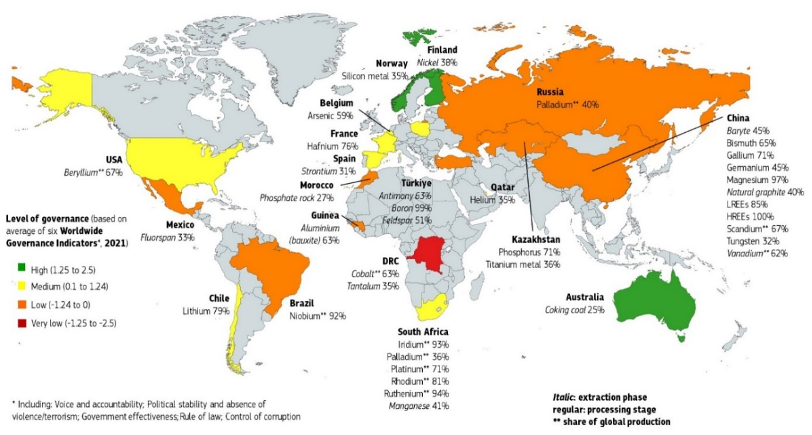

The European Union, conducting very little extraction and refining on its own territory, relies heavily on a diverse range of international suppliers for these crucial steps.

EU : critical materials providers 2023

Although the value chain (extraction, refining, and then transformation) involves several countries, thus increasing risks and supply tensions, China maintains a monopoly on refining. This contrasts with the distribution seen in the fossil fuel sector.

A striking example is lithium, with over 75% of the world’s extraction taking place in Chile and Australia. However, China handles around 60%[1] of the world’s refining demand. For cobalt, the Democratic Republic of Congo (DRC) is responsible for 75% of global extraction, but 8 of the 14 largest mining companies operating in DRC are owned by China[2].

Europe’s dependency on raw materials is a major strategic issue. Currently, European Union member states depend on more than 95% of production and processing conducted outside the EU. Moreover, only six countries currently have strategic reserves of rare metals: The United States (for military needs), China, Russia, Japan, South Korea, and Switzerland. Some nations are also establishing lists of critical minerals, while others impose import restrictions.

Is the Metal Market Volatile?

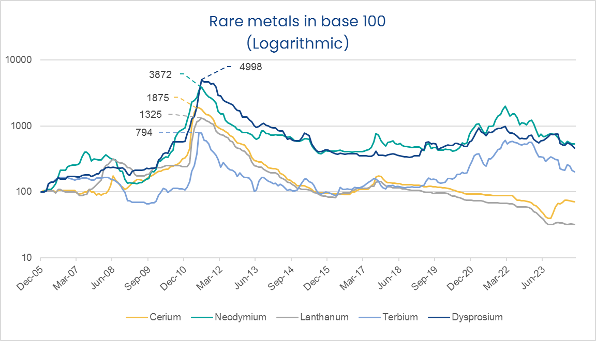

Risk of supply shortages, due to China’s monopoly, was materialized during the rare metals crisis from 2009 to 2011. The introduction of export quotas by Beijing, following a diplomatic crisis with Japan, led to a surge in rare earth prices starting in 2010. For instance, the price of terbium increased nine fold in just a few months. However, 2012 saw a dramatic reversal, with dysprosium prices dropping by 64.7%. This steep decline led to the bankruptcy of the small British fund Rare Earths Metal Exchange, while the global leader, Baotou Steel Rare Earths, had to extend the closure of its main mine in Mongolia[1].

A significant market reversal was triggered by efforts from industries using rare earths, which mobilized their research centers to limit the use of these materials. The market remains unstable, with a sharp drop in some prices in 2023 (including a 75% decrease in lithium), following two years of steep increases (tripling of prices between January 2020 and 2022), before nearly returning to its original level at the end of 2023[1].

Fears of renewed tensions reappeared in July 2023, when China announced restrictions on the export of gallium and germanium, whose prices rose in 2024[2]. In October, these restrictions extended to graphite. More importantly, as of December 21 2023, China is banning the export of “rare earth extraction, processing, and smelting technologies”[3] in the context of growing rivalry with the United States.

Currently, rare metal prices remain relatively low, and interest rates are high. This situation hinders the development of new mining projects, as the lower the prices of rare metals, the less profitable their extraction becomes. Although a short-term price increase is expected due to rising demand, investments in new mines require loans, and high interest rates present an additional obstacle to these developments. All these factors suggest increased volatility in the rare metals market in the near future.

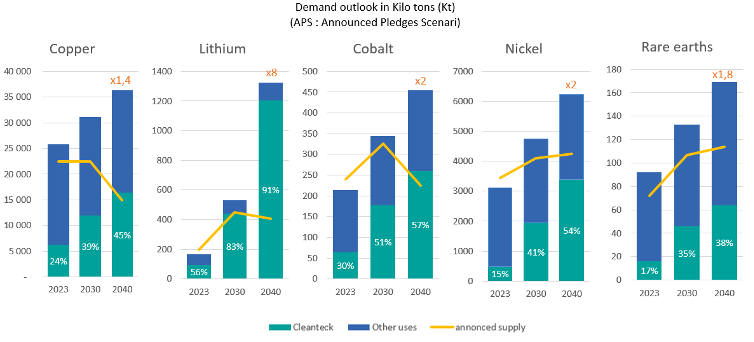

In the face of the emerging energy economies and the constant need for technological evolution, the demand for critical metals will multiply.

Interestingly, rare earths, contrary to popular belief, are not only used for renewable energy, but also for the growth of new technologies.

Just like oil, the concept of peak metals reserves is often discussed. However, global reserves remain poorly understood. New deposits continue to be discovered. The latest example is from Rare Earths Norway[1], which in June 2024 announced that it had identified a rare earth deposit estimated at nearly 10 million tons in south-eastern part of Norway. This is a significant reserve for Europe. Metals could begin to be exploited starting in 2030.

[1] Courrier International

Are We Moving Towards More Sustainability?

European companies must comply with strict environmental and ethical regulations, which sometimes complicates their metal supply chains. This is due to the environmental impact of the whole extraction process. Numerous studies and articles offer contrasting perspectives on the sustainability of these practices, particularly compared to fossil fuels.

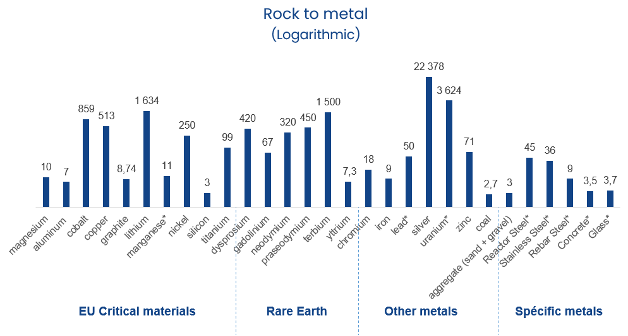

The International Energy Agency (IEA) noted in 2021 that “renewable energies generally require more minerals for their construction than their fossil fuel equivalents.” This difference is explained by the “rock to metal” ratio, which measures how many kilograms of rock are needed to obtain one kilogram of metal.

Unlike coal-fired power plants, which require continuous fuel extraction, renewable energy technologies are constantly improving their efficiency while reducing their reliance on rare metals. A recent study by the Breakthrough Institute, published in April 2024, examined the amount of metals needed to produce a gigawatt-hour (GWh) of electricity. The institute estimates that the mining intensity of coal power plants is 20 times higher than that of onshore wind turbines, while the intensity of gas power plants is about twice as high.

The refining process also raises many environmental and social questions. In his book “The Rare Metals War”, Guillaume Pitron details the challenges associated with the extraction of these metals, including the use of chemical solvents to separate them from rock, which are often released into the environment, affecting local populations. There are also social controversies surrounding cobalt mining in the Democratic Republic of Congo (DRC). In response to these issues, Europe is implementing stricter standards to avoid repeating these ecological and social disasters.

One of the biggest challenges remains the development of rare metal recycling, as none of these metals are currently recyclable in an economically viable way. This makes it difficult to definitively confirm or deny the increased sustainability of the raw materials used for the energy transition and digital technologies compared to fossil-based technologies.

Regarding sustainability, it is crucial not to overlook the impact of climate change. Moody’s rating agency estimates that between 20% and 25% of mining companies are exposed to critical flood risks, while nearly 15% face physical risks from hurricanes or typhoons.

Even minerals that are not classified as critical can have a major impact on the supply chain. For example, following the damage caused by Hurricane Helene, the mines in North Carolina, USA, were shut down for more than two weeks. These sites represent 80% of the world’s production of high-purity quartz, which is essential for the semiconductor and solar panel industries.

What are the European and American Response?

The strategic importance of rare metals is pushing governments to implement regulations and negotiate agreements to ensure supply in order to meet their goals. In March 2024, the European Council adopted a regulation on critical raw materials. The goal is that by 2030, at least 10% of the European Union’s annual consumption will come from locally extracted minerals, 40% from elements processed within the Union, and 25% from recycled elements. Furthermore, no third country will be allowed to supply more than 65% of Europe’s annual consumption for any key material.

To achieve these objectives, the European Union is establishing strategic partnerships. In May 2024, it signed an agreement on a critical and strategic minerals supply with Australia. On the Canadian side, although the CETA[1] agreement is still under negotiation, more than 90% of the provisions under this agreement have been in force since 2017, allowing for a significant increase in imports of rare minerals and metals from Canada.

In the United States, the Inflation Reduction Act (IRA) encourages companies to use metals sourced from the north American territory or from countries with a free trade agreement on critical minerals. The United States has taken steps to secure its supply of rare metals, including investing in refining infrastructure on its own soil. Additionally, the Pentagon is actively supporting initiatives aimed at reducing the country’s reliance on imports, by funding refining and extraction projects.

Despite these efforts, the United States and Europe remain dependent on China for much of their rare metal supply.

[1] Le Figaro

And in terms of stock market investments, who is most at risk?

The companies most exposed to fluctuations in rare metal prices are, of course, those that rely on these materials for their products or processes. A rise in production costs and supply chain disruptions could lead to a drop in their stock prices. This decline could be exacerbated by investor sentiment in tense geopolitical contexts. On the other hand, the least volatile companies would be those that manage to find alternatives to rare metals or innovate to reduce their reliance on these materials. Four sectors stand out in particular for their exposure to risks associated with fluctuations in rare metal prices.

The information technology sector depends heavily on rare metals for manufacturing smartphones, computers, and other electronic devices. For instance, Apple uses lithium, cobalt, and tantalum in its iPhones, iPads, and MacBooks. To meet these needs while reducing its environmental impact, the Californian company is investing in developing recycling technologies for these metals. Apple is committed to using 100% recycled cobalt for its batteries by 2025, as well as 100% recycled rare earth elements for the magnets in its batteries. Semiconductor companies like Nvidia and STMicroelectronics are also affected by this reliance on rare metals, as they need gallium, germanium, tantalum, and cobalt for manufacturing their components.

The automotive sector, particularly for electric and hybrid vehicles, heavily relies on rare and strategic metals for battery and motor production. To secure their supply, car manufacturers such as Volkswagen AG and Mercedes-Benz AG have signed agreements with governments, like Canada’s, to ensure access to the rare metals needed for their battery production.

In the renewable energy sector, companies involved in the energy transition, such as wind turbine manufacturers (Vestas, Siemens Gamesa) and solar panel makers (First Solar), use rare metals to optimize the efficiency of their technologies. The offshore wind industry in Europe particularly suffered in 2023 due to supply issues and rising prices of critical metals.

The aerospace and defence sector, with players like Airbus and Thales, also uses critical metals to manufacture essential components for aircraft and defence systems. Russia, which accounts for 40% of the world’s titanium production, remains a key supplier for European companies such as Airbus. As a result, some metal exports, including titanium, have not been affected by sanctions imposed on Russia following the conflict with Ukraine.

On the bond market, there could be several consequences from restrictions on rare and critical metals. Firstly, the increased credit risk could affect the perception of bonds exposed to these raw materials. A rare metal crisis could contribute to inflation, prompting central banks to raise interest rates, reducing the value of existing bonds. In times of uncertainty, investors may turn to safer government bonds, increasing their demand and potentially their prices.

In conclusion

The Fourth Industrial Revolution, driven by digital data management and the energy transition, heavily relies on critical metals access, which have become essential strategic resources. China’s dominance in refining these metals, coupled with global dependence, particularly from Europe and the United States, poses significant economic, geopolitical, and environmental challenges.

In response, efforts to diversify supply sources, promote recycling, and encourage sustainable practices are increasing. As Einstein once said, “We cannot solve our problems with the same thinking we used when we created them.” However, market fluctuations, price volatility, and uncertainties related to geopolitical tensions, suggest an increase of complexity in managing these essential resources for the future of global technology and energy.