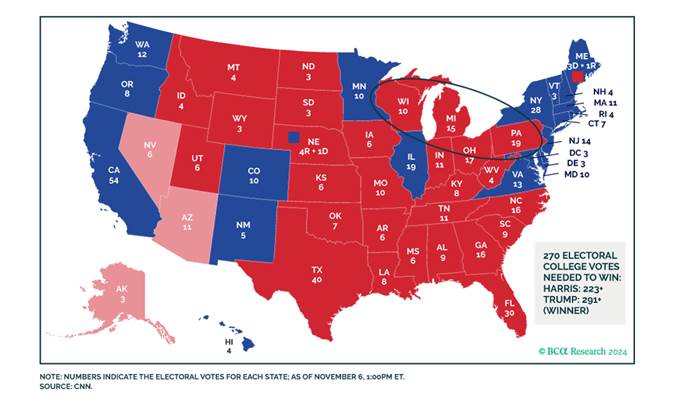

Donald Trump won the White House with 51% of the popular vote, marking a major achievement for a party that often struggles to secure an absolute majority and for a candidate making his third bid, whose highest share until now was 46.9%. Trump secured 292 electoral votes, becoming the first and only president since Democrat Grover Cleveland in 1892 to win a non-consecutive second term.

Trump not only won the “Sunny States” but also swept through the “Blue Wall” or the “Rust Belt” states of Pennsylvania, Michigan, and Wisconsin, echoing his 2016 victory and validating his electoral strategy of economic nationalism by appealing to the working class and calling for the revival of America’s industrial base.

The Republicans won the Senate with at least 52 seats, potentially reaching 54 or 55. GOP Senate candidates pulled off surprising victories in Pennsylvania and Nevada. While national economic growth held steady, these states lagged behind the national average and suffered from the global manufacturing recession, a situation reminiscent of Trump’s 2016 victory. These states saw their growth dip as the election approached, with Michigan’s economic activity already beginning to contract.

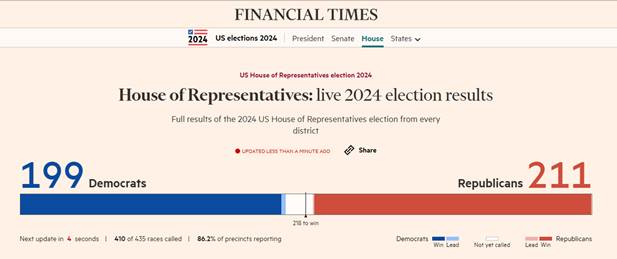

Votes for the House of Representatives are still being counted, but Republicans have gained five seats, while Democrats have gained only two. Republicans are expected to achieve a narrow majority, in line with the red wave that swept across the country. Control of the House is extremely important for political prospects in 2025-26..

More than unemployment, it was inflation that drove the vote against the party in power – the most significant factor in the Republicans’ resounding victory. The cumulative increase in the general price level since 2021 stands at 20.5%, resulting in negative real wages, especially in the states Joe Biden won in 2020.

Impact on Markets

Financial markets broadly welcomed the Republicans’ victory in the U.S., with strong gains in stock indices, sovereign rates, and the dollar, exceeding our expectations given the recent pre-election anticipation. This movement is underpinned by the expectation that the GOP will hold a sufficient majority in both the Senate and the House of Representatives to implement the core elements of its economic program.

Bond Market: Inflationary Risk…

The rise in tariffs, expulsion of migrants, border closures, and support for domestic demand through tax cuts for households—all with only a limited intent to lower gasoline prices by supporting oil production—are likely to delay the slowdown of inflation toward the 2% target. As a result, the Fed may not be able to reduce its policy rates as much as initially anticipated.

These factors are likely to lead to a less favorable balance for U.S. government bonds (with the 10-year rate expected to remain above 4% for the foreseeable future), though the likelihood of it exceeding 5% remains low. Implementing the entire economic program with massive fiscal support may be hindered by Republican lawmakers themselves, who oppose such an increase in debt, risking a sharp reaction in financial markets, as seen in the U.K. under Liz Truss. The absolute level now appears interesting, even if risks persist. We will gradually increase the duration on U.S. debt.

As previously mentioned, the new president’s program will have a significant impact on European growth, which the ECB will need to consider in its upcoming meetings. Rate cuts are likely to be more pronounced in the Eurozone, and we are more comfortable with European bonds.

Overall, bond market volatility is expected to be higher this time, as deficit reduction seems unlikely. We are not changing our view on corporate bonds, which will remain correlated with government rates.

10-Year Rate

The Euro and the ECB Under Pressure

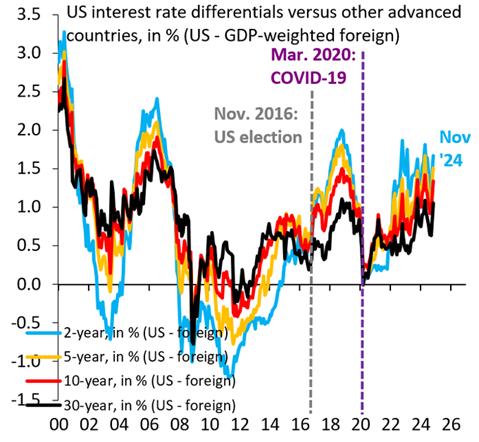

In the foreign exchange market, the dollar has significantly benefited from the surge in U.S. interest rates. This factor is expected to persist, and the narrowing of the rate differential can no longer contribute to strengthening the euro against the dollar, as the trend shifts in favor of the U.S. currency. We remain favorable to the U.S. dollar and adjust our range to 1.05-1.1 (from 1.07-1.12).

Euro vs USD

Interest rate differentials shifted massively in favor of the dollar during the two years following Trump’s 2016 electoral victory. Rate differentials immediately bounced in November 2016, but a much more significant increase followed over the next two years.

Oil: A Crucial Turning Point for U.S. Energy Policy.

As anticipated in our last update, Donald Trump’s victory marks a crucial turning point for U.S. energy policy.

In 2024, the United States remains one of the world’s leading producers of oil and natural gas, thanks to advances in hydraulic fracturing (fracking). However, the global energy transition and climate commitments made at international summits, such as COP26, have put the current administration under pressure to reduce fossil fuel dependency and promote renewable energy. President Joe Biden had undertaken broad reforms to green the American economy, notably through the Inflation Reduction Act (IRA), adopted in 2022, which supports wind and solar energy as well as electric vehicles.

Donald Trump, however, may again prioritize shale oil and gas extraction, backing a major oil sector that was crucial to his campaign. Republicans generally favor deregulation and the revitalization of the oil and gas industry, posing a potential threat to the renewable energy sector.

Saudi Arabia’s desire to increase its market share, particularly in the United States, could be intensified if the U.S. supports a production boost. For now, our targets remain at $65-75 USD, with additional downside risk if U.S. crude production increases further or if there is a potential easing of sanctions on Russian oil, which would undermine OPEC.

Oil Production

Equity Markets

Equity index performance in local currencies since the beginning of the year.

The “presidential” risk is now behind us, but as Trump’s announcements unfold and Congress reacts, volatility will be heightened in the coming months. We anticipate a more “pro-business” economic policy and a more expansionary fiscal policy (including corporate tax relief) in our outlook on U.S. markets, and we upgrade our view to “neutral.” The president has mentioned reducing the corporate tax rate from 21% to 15% for certain companies producing in the U.S. Companies listed in the U.S. with strong exposure to the American economy remain well-positioned, as does the banking sector, which is expected to be a structural beneficiary. Extending the economic expansion, coupled with a likely improvement in CEO confidence, suggests that M&A activity will increase next year.

However, the key challenge will be to avoid an overly inflationary scenario, which could prompt a Fed response in 2025.

European equity indices will face new obstacles, leading to downward earnings per share (EPS) revisions, which we believe are still incomplete (-5% since the beginning of summer). The automotive sector will likely remain under pressure, and the renewable energy sector is entering a period of uncertainty. We maintain a “neutral” stance while awaiting the ECB’s reaction, which may provide some support. We continue to favor less cyclical stocks that are sensitive to rate declines. Falling energy prices should benefit household consumption.

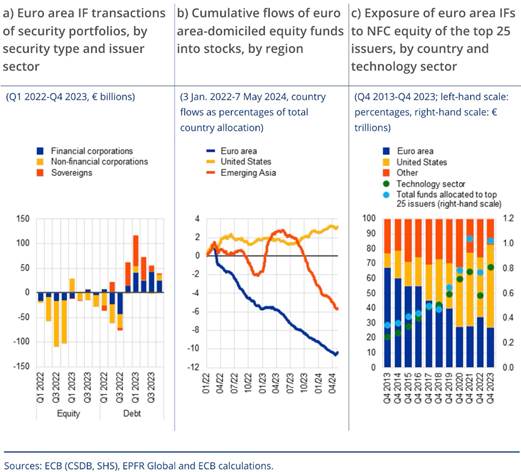

Eurozone investment funds have already significantly reduced their exposure to Eurozone equities, increasing their portfolio concentration in U.S. and tech sectors. Cumulative fund flows from equity funds domiciled in the Eurozone toward Eurozone equities have been negative for two years, while flows toward U.S. equities have been rising steadily, reflecting diverging growth expectations.

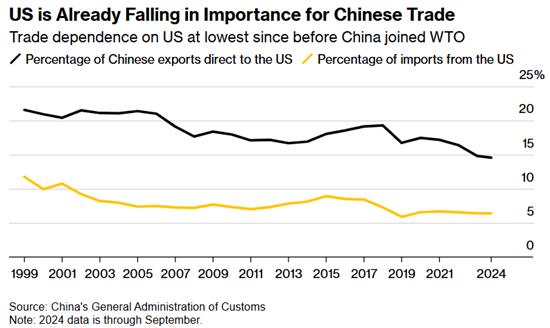

Emerging equity markets, particularly in China, appear weakened, which could accelerate reform and stimulus plans. China has announced a fiscal plan of 10 trillion RMB ($1.4 trillion) to support its economy in response to trade tensions with the United States. Beijing has authorized heavily indebted local governments to issue 6 billion RMB in new bonds and reallocate 4 trillion RMB to restructure their finances. The 60% tariffs imposed by Trump on Chinese goods are expected to impact $500 billion in exports to the United States, equivalent to 15% of China’s total export value. China may respond by introducing export controls on essential raw materials and establishing a list of entities to target key American companies.