Financial markets have widely welcomed the Republican victory in the United States, with a strong increase in stock indices, sovereign yields, and the dollar, surpassing our expectations given the anticipation in the final days before the election. Behind this movement, there is the hypothesis that the Grand Old Party will have a sufficient majority in the Senate and House of Representatives to implement the core of its economic program.

The establishment of the Trump government in the coming weeks will be crucial for international markets. Beyond any prospective effect on price dynamics in the United States, we are convinced that economic statistics will remain the primary factor in the Fed’s decision-making, and in no case will a potential inflationary wave created by the new president’s program take precedence.

The economic decoupling between the United States and the rest of the world is exacerbated.

Between today and the inauguration, the U.S. major partners (Europe, China, Mexico) will have to endure and wait for the new team’s policies or threats. Markets will primarily be dependent on statements from Donald Trump. Beyond the United States, political risk in Europe predominates (coalition in Germany, disagreement over attitude toward the US, budget vote in France) and adds a significant risk premium to the Zone.

SUMMARY

- Rates: the perception of inflationary risk predominates in the short term

- Credit: performance allows you to be patient

- US stocks: resilience and growth have a price

- Europe stocks: between hammer and anvil

- Emerging Actions: a reaction should take place

INTEREST RATE MARKET: INFLATION RISK…

The increase in tariffs, the expulsion of migrants, the closure of borders, and domestic demand support through tax cuts for households—except for a desire to lower gasoline prices by supporting oil production—are factors likely to delay the slowdown of inflation toward the 2% target. Therefore, the Fed will not be able to lower its key rates as much as originally expected.

These elements will lead to a more unfavorable equilibrium for U.S. government bonds (the 10-year rate is expected to remain sustainably above 4%), although the probability of a rate exceeding 5% remains low in our opinion. The implementation of its entire program with massive budget support should be slowed down by the Republican elected officials themselves, who refuse such a debt dynamic, risking provoking a brutal reaction in the financial markets, as it took place in the United Kingdom with Liz Truss. The absolute level now seems interesting to us even if the risks persist. We will gradually increase the duration on American debt.

As mentioned earlier, the impact of the new president’s program on European growth will not be negligible and the ECB will have to take this into account in its next meetings. The fall in rates will be more marked in the euro zone, and we are more comfortable on European bonds. It is necessary to be selective about countries. We favor countries like Spain, Portugal or Italy where political risk seems to be under control.In general, bond market volatility is expected to be higher this time, as it is unlikely that deficits will be reduced. We do not change our view on corporate bonds, which will be correlated with government rates.

10-Year Rates

CREDIT: YIELD ALLOWS FOR PATIENCE

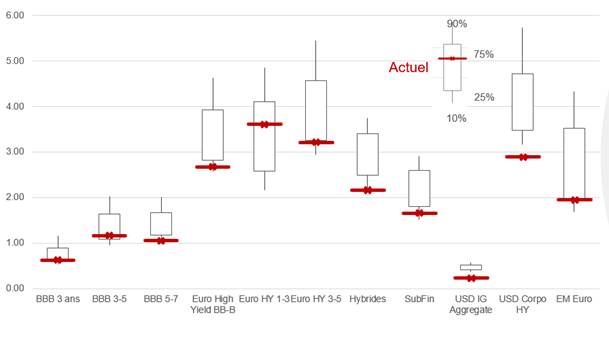

Credit spreads are currently slightly below their 10-year average, reflecting a resilient economic fabric despite repeated crises (Covid, inflation, Ukraine, etc.). The quality of issuers has continuously improved over the past decade. As a result, the share of BB-rated companies within high yield has increased, improving the average credit rating. Donald Trump’s election should not lead to a deterioration in corporate fundamentals. His economic policy will support growth. However, its impact will vary significantly by sector. In the automotive sector, the presence of suppliers in the United States, positioned close to automakers’ factories, should limit the risk related to tariffs. We favor BBB and BB-rated bonds for their risk-adjusted yield profile. As shown in the chart below, the HY 1-3 segment appears particularly attractive. We prefer short durations in the current context of interest rate uncertainty.

Absolute valuations vs the last ten years

EXCHANGE: THE EURO AND THE ECB UNDER PRESSURE

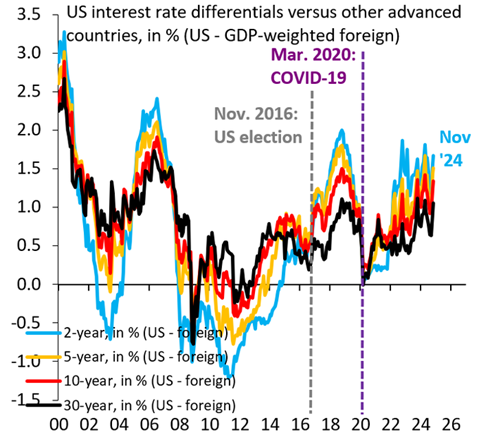

In the foreign exchange market, the dollar has significantly benefited from the surge in US interest rates. This factor is expected to persist, and the reduction in the interest rate differential can no longer contribute to strengthening the euro against the dollar, with the trend reversing in favor of the US currency. We remain positive on the US dollar and adjust our range to 1.05-1.10 (from 1.07-1.12). Parity is conceivable in the context of an increased trade war scenario.

Euro versus USD

Interest rate differentials have shifted significantly in favor of the dollar in the two years following Trump’s electoral victory in 2016. The rate differentials immediately rebounded in November 2016, but a much larger increase followed over the next two years.

OIL: A CRUCIAL TURNING SHOT FOR U.S. ENERGY POLICY.

As anticipated in our previous statement, Donald Trump’s victory marks a crucial turning point for U.S. energy policy. In 2024, the United States remains one of the world’s leading producers of oil and natural gas, thanks to advancements in hydraulic fracturing (fracking). However, the global energy transition and the climate commitments made at international summits, such as COP26, have put the current administration under pressure to reduce dependence on fossil fuels and promote renewable energy sources. President Joe Biden had initiated extensive reforms to green the U.S. economy, notably through the Inflation Reduction Act (IRA) adopted in 2022, which supports wind and solar energy, as well as electric vehicles.

Donald Trump could, however, once again prioritize the extraction of shale gas and oil, supporting a major sector of his campaign. Republicans generally adopt a stance focused on deregulation and the revitalization of the oil and gas industry, thus threatening the renewable energy sector.

We believe that Trump sees a reduction in energy prices both as a way to counter the inflationary effects of his agenda and to satisfy American consumers (the election results were partly determined by this issue). On the other hand, he may view it as a means to pressure Russia into engaging in a conflict resolution process.

Furthermore, Saudi Arabia’s desire to gain market share, particularly in the U.S., could be exacerbated if the U.S. supports an increase in production. Our price targets remain between $65-75, with an additional downside risk if U.S. crude production increases further and if sanctions on Russian oil are eased, which would weaken OPEC.

Oil production

EQUITY MARKETS

Local currency stock index since the beginning of the year.

The “presidential risk” is now behind us, but as Trump’s announcements continue and the reactions from Congress unfold, volatility is expected to intensify in the coming months. We anticipate a more “pro-business” economic policy and a more expansive fiscal policy (including corporate tax cuts) in our outlook on U.S. markets, and we are moderately optimistic about the asset class. We believe it is important to remain selective and to reinvest gradually, taking advantage of the volatility. The small and mid-cap segment should benefit from the new president’s “reshoring” efforts and tax cuts. In our latest Market Flash, we discussed a rise in U.S. equity indices following Trump’s victory. The president has proposed reducing the corporate tax rate from 21% to 15% for certain companies producing in the U.S. U.S.-listed companies, heavily exposed to the domestic economy, remain well-positioned, as does the banking sector, which should be a structural beneficiary. The continued economic expansion, coupled with a probable improvement in CEO confidence, suggests that M&A activity will rise next year.

Russel 2000 (small businesses) vs S&P 500

However, the key challenge will be to avoid an excessively inflationary scenario (which still needs to be confirmed), as it could provoke a response from the Fed in 2025.

European equity indices will face new challenges, leading to downward revisions in BPA forecasts, which we believe are still incomplete (down 5% since the start of the summer). The automotive sector will likely remain under pressure, and the renewable energy sector is entering a period of uncertainty. We will have to wait for the ECB’s reaction, which could offer support, but only at its next meeting in December. We continue to favor less cyclical stocks that are sensitive to interest rate cuts. A decline in energy prices should be supportive for household consumption.

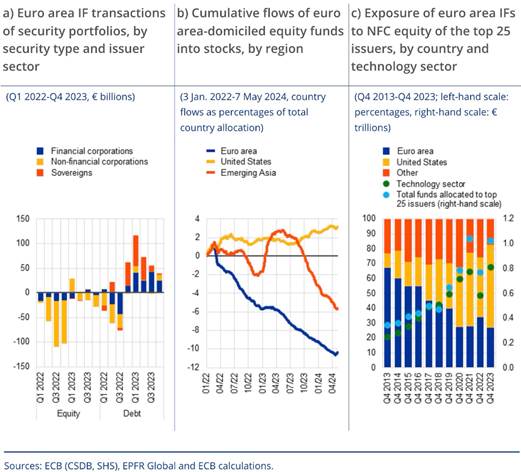

Investment funds in the euro area have already significantly reduced their exposure to eurozone equities and increased the concentration of their portfolios towards U.S. and tech sectors. Cumulative flows from eurozone equity funds to eurozone stocks have been negative for the past two years, while flows into U.S. equities have been steadily increasing, reflecting divergent growth expectations.

The political setbacks of the two European “leaders” (France and Germany) have undoubtedly led to a lack of confidence and a failure to react with unity in the face of the American project. The next ECB meeting is not until late December. Until then, it is difficult to expect a catalyst. We are adjusting our position to underweight during this period.

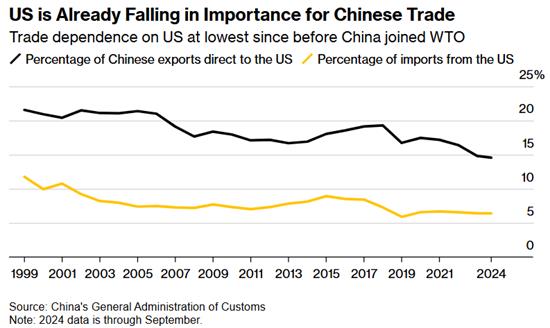

Emerging equity markets, particularly in China, appear weakened, which could accelerate reforms and stimulus plans. China has announced a fiscal plan of 10 trillion RMB (1.4 trillion USD) to support its economy amid trade tensions with the U.S. Beijing has allowed heavily indebted local governments to issue 6 billion RMB in new bonds and reallocate 4 trillion RMB to restructure their finances. The 60% tariffs imposed by Trump on Chinese goods could impact 500 billion USD worth of exports to the U.S., representing 15% of the total value of Chinese exports. China could respond by imposing export controls on key raw materials and establishing a list of entities that could target key American companies.

Although it is still far too early to say for certain, Elon Musk, the new power player in the Trump administration, could have a stabilizing effect on the protectionist tendencies of other members towards China due to his industrial interests (particularly Tesla) and his historical ties with Xi Jinping.

Over the past month, we have moderated our strong conviction from the beginning of the year regarding India. We are further reducing our outlook on the country. Inflation above 6% (the upper tolerance limit of 6.0% set by the RBI) has far exceeded expectations. We now believe there is no probability of an interest rate cut by the Reserve Bank of India (RBI), which had previously been our baseline scenario.

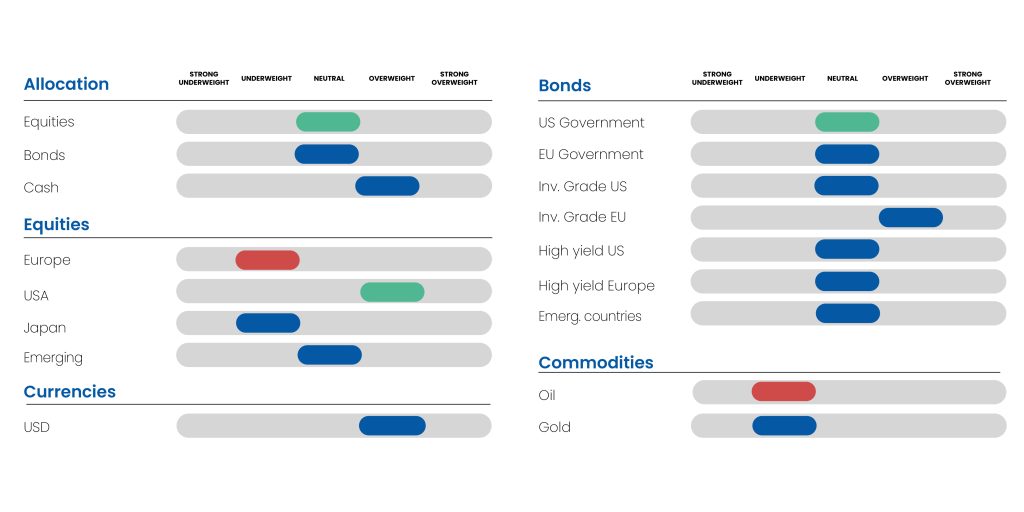

Allocation table