1. U.S. Inflation Accelerates, Driven by Housing and Service Prices

2. The Next German Coalition in Support of Growth

3. In Japan, Inflationary Pressures Intensify.

4. Chart of the Week: The U.S. Becomes a Nation of Renters

U.S. Inflation Accelerates, Driven by Housing and Service Prices

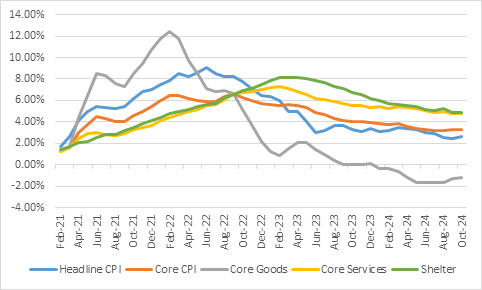

In October, inflation in the United States slightly accelerated, aligning with economists’ forecasts. The Consumer Price Index reached 2.6% year-on-year, up from 2.4% in September. This figure largely reflects the contribution of housing and service prices to the overall rise.

Core inflation (excluding food and energy) remained steady at 3.3% year-on-year in October, maintaining the same level as in September. Core inflation also rose by 0.3% for the third consecutive month. This stability has helped extend the downward trend, with a six-month annualized rate of 2.6%, a figure recently referenced by Federal Reserve Chairman Jerome Powell.

While these results do not lead to major revisions for the Fed, the deceleration of “supercore” inflation offers some relief to the institution, which could consider a further rate cut at the December 18 meeting.

With the exception of a few goods, such as audio-visual equipment (+1.4% monthly) and newspapers (+9% monthly), most other categories saw their prices stabilize or decline in October. Clothing fell by 1.5% after rising in September, while technology products decreased by 1.2%, medications by 0.2%, and recreational goods remained stable.

Housing and services, however, remain the main drivers of inflation. Services, although still elevated, show signs of slowing down, with a 0.3% rise in October compared to 0.4% in September, bringing their annual increase to 4.8%. Housing, which accounts for 36.5% of the CPI, saw annual stagnation at 4.9%, although the monthly increase slightly accelerated from 0.2% to 0.4%. The housing sector remains the primary variable of uncertainty for short-term inflation. Rising mortgage rates are dampening demand but also limiting new construction, thereby maintaining an imbalance between supply and demand that is expected to persist beyond 2025..

Breakdown of U.S. Inflation

Our Opinion: While inflation has currently taken a back seat to labor market data, economic policies under the Trump administration, particularly tariffs, are likely to exert inflationary pressure. However, the impact may be more moderate than expected, due to a redirection of spending toward domestic production and other import suppliers, as well as retailers absorbing part of the increased supply chain costs. The appreciation of the dollar and the economic slowdown could also help to moderate this inflationary surge.

The Next German Coalition in Support of Growth

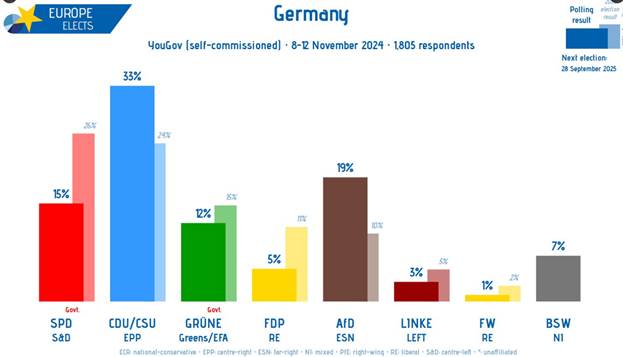

Preliminary official estimates of the economic impact of Donald Trump’s upcoming term are beginning to emerge. The proposed tariff hikes promised during his campaign (ranging from 10% to 20% on all imports to the United States) could cost Germany 1% of its GDP, according to Bundesbank President Joachim Nagel. Germany’s export-driven industrial sector, already reeling from the energy crisis (with energy costs higher than in other parts of the world) and a drop in global demand, especially from China, faces a potential further blow from decreased U.S. demand. This could push the German economy into another recession year in 2025, following two years of negative growth in 2023 and 2024 (-0.1% in 2024). More favorable prospects for consumer spending and interest rates could help cushion growth.

In this context, pressure is mounting on the next coalition to address the economic downturn. Early parliamentary elections could take place on February 23, 2025 (following a confidence vote on December 16), and CDU party leader Friedrich Merz has launched his candidacy, emerging as the frontrunner for the chancellorship (with his CDU/CSU coalition polling at 33% of the vote). Based on current polls, Merz will also need coalition partners to form a government; he has expressed openness to working with Olaf Scholz’s SPD, while ruling out cooperation with the far-right AfD (currently at 18% in the polls). A positive sign for economic activity is Merz’s recent expression of willingness to reform the debt brake rule that limits structural public deficit to 0.35% of GDP if it would allow for increased investment (particularly in transportation and digital infrastructure).

To achieve this, he would need a two-thirds majority in both chambers of Parliament (as only suspension of the rule is allowed in specific circumstances with a simple majority). However, other issues could provoke new tensions, as Merz aims to revise climate and migration policies. An increase in German sovereign debt issuance to support investments would benefit the entire eurozone by boosting growth, raising sovereign rates, and strengthening the euro to offset the negative impact of Trump’s victory..

Polls in Germany

Our Opinion: The political troubles facing the two European “leaders” (France and Germany) are undeniably creating a lack of confidence and a void in unified responses to the U.S. agenda. The next ECB meeting isn’t scheduled until late December, making it difficult to find a short-term catalyst. However, this crisis could accelerate the implementation of the Draghi plan sooner than anticipated.

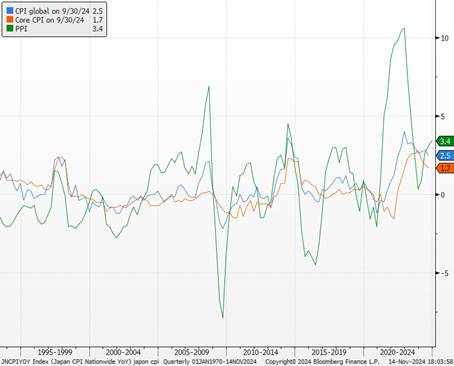

In Japan, Inflationary Pressures Intensify.

Japan’s October wholesale prices, released this morning, have accelerated more than expected, rising by 3.4% year-on-year (vs. the 2.9% expected and 3.1% in September), confirming an amplification of inflationary factors. This increase is due to the rising costs of raw materials (such as oil) and food items (like rice), as well as the depreciation of the yen. Consequently, the Bank of Japan (BoJ) may once again tighten its monetary policy by raising interest rates, even as the Fed and ECB have entered a rate-cutting cycle.

Opinions from central bank members, published on Monday, indicated that a continuation of the current inflationary trend would be compatible with another interest rate hike. This message was echoed by BoJ Governor K. Ueda, who emphasized that the central bank would be willing to raise rates again, but only if inflation was increasingly driven by strong domestic demand and higher wages, rather than by the rising cost of raw materials. The Bank of Japan will thus wait for wage growth to continue and for its impact on prices to strengthen, likely postponing the next rate hike until 2025. Additionally, it must navigate Japanese political uncertainty, as S. Ishiba’s ruling coalition lost its absolute majority in the early legislative elections held in October.

CPI and PPI in japan

Our Opinion: Although the Prime Minister retained his position at the head of a minority government following a relative majority vote in the lower house, he will need to work with other parties that are more favorable to an accommodative monetary policy. The BoJ is expected to raise its key interest rates in the first quarter of 2025, which will support the yen and sovereign rates.

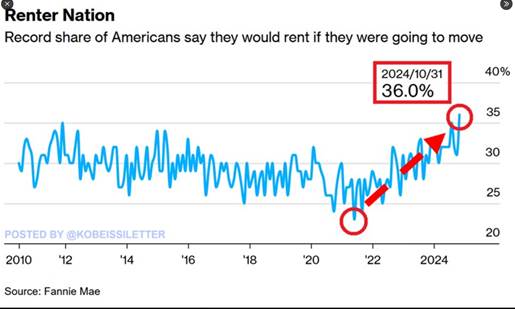

Chart of the Week: The U.S. Becomes a Nation of Renters

In October, 36% of Americans stated that they would rent a home if they had to move, marking the highest percentage ever recorded by Fannie Mae. This share has risen by 13 percentage points over the past three years, as housing has become historically unaffordable for buyers. At the same time, only 20% of Americans feel it’s a good time to buy a home, down from 60% four years ago, though above the record low of 15% reached in October 2023. Meanwhile, the average interest rate on a 30-year mortgage has climbed to 6.9%, the highest level since July. Renting has become the only option for a significant portion of Americans.