Small caps have never been so disliked! Small-cap stocks now account for less than 4% of the entire U.S. stock market, representing the same market share they held in 1930, before the Great Depression. Despite the buzz around AI and spreads, small-cap stocks have significantly underperformed compared to large-cap stocks. Currently, over a third of the Russell 2000 index reports negative earnings (compared to around 45% in 2020)

Small caps recorded their best weekly performance in over four years, reaching new all-time highs (finally breaking out of a 3- to 4-year sideways stagnation). Relative strength trends still need to gain momentum to bolster confidence, and relative earnings trends continue to decline (which has been a hurdle). However, the market often anticipates fundamentals, and there are reasons to remain optimistic.

S&P 600

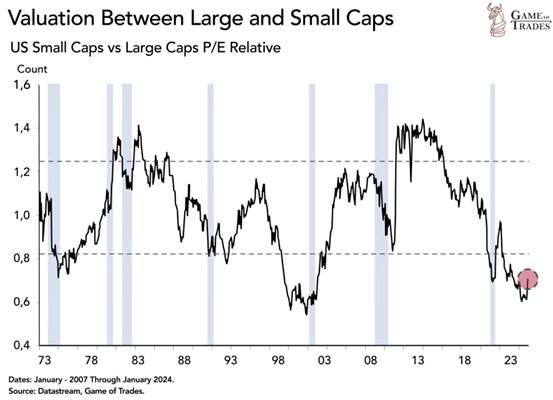

In addition to this technical breakout, the valuation gap between small caps and large caps remains very significant.

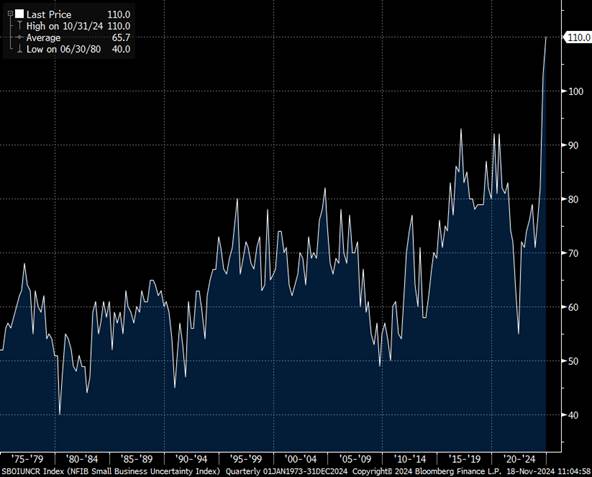

Moreover, uncertainty among small businesses has reached record levels. Following the election results, this uncertainty is expected to decline (as is typically the case after a presidential election). There is a positive correlation between the NFIB Small Business Optimism Index and the relative performance of small caps, both of which have been weak in recent years.

NFIB Small Business Uncertainty Index

NFIB Small Business Optimism Index versus performance relative des small versus large

As discussions increasingly focus on pro-growth policies (such as tax cuts, deregulation, increased public spending, and an “America First” mindset), small business optimism could begin to rise, which would bode well for the performance of small caps.