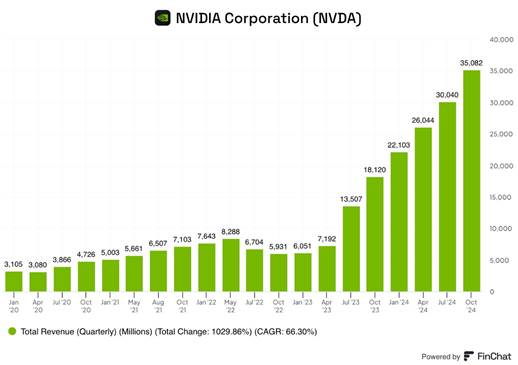

1. Nvidia announced on Wednesday the weakest revenue growth in seven quarters, yet it still exceeded analysts’ expectations.

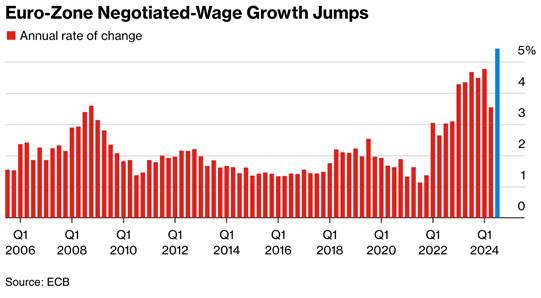

2. Wages in the Eurozone accelerated significantly in the third quarter.

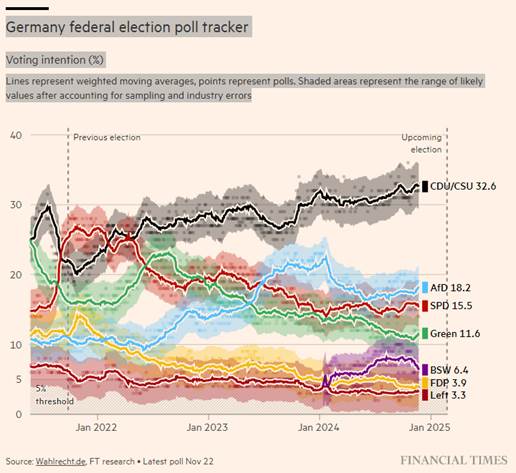

3. The “debt brake” divides opinions as elections approach.

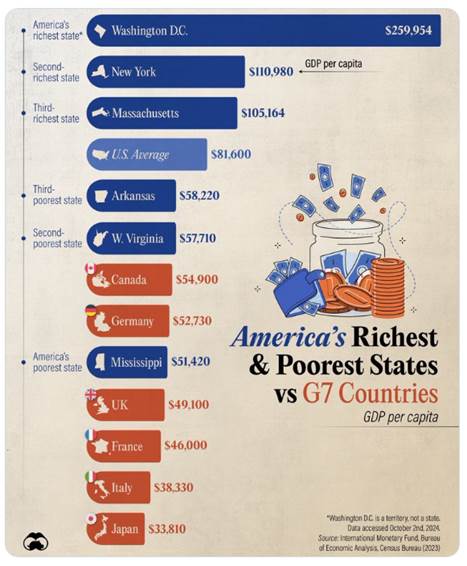

4. Chart of the week: The poorest state in the United States, Mississippi, has a GDP higher than France or Italy, and the second poorest state exceeds Canada or Germany.

Nvidia announced on Wednesday the weakest revenue growth in seven quarters, yet it still exceeded analysts’ expectations.

Expectations were high ahead of the results, as Nvidia’s stock had risen by more than 20% over the past two months, even hitting a record intraday high on Monday. The stock has nearly quadrupled since the beginning of the year and has increased more than ninefold over the past two years, giving the company a market capitalization of $3.6 trillion. Nvidia is currently rolling out its powerful Blackwell family of AI chips, which will initially weigh on the company’s gross margins but are expected to improve over time. The new processor line has been adopted by Nvidia’s customers, and the company will exceed its initial projections by several billion dollars in processor sales during the fourth quarter, Chief Financial Officer Colette Kress told analysts during a conference call.

When asked about media reports claiming that a flagship liquid-cooled server containing 72 of the new chips had overheating issues during initial tests, CEO Jensen Huang stated there were no problems and that clients like Microsoft, Oracle, and CoreWeave are implementing the systems. Initially, the gross margins for the Blackwell chip family will be around 70%, but they are expected to rise to approximately 75% as production scales up.

The company forecasted revenue of $37.5 billion, plus or minus 2%, for the fourth quarter. At the lower end, this target would fall short of analysts’ expectations of $37.09 billion in sales for the period, according to data compiled by LSEG. Sales in the data center segment, which account for the majority of Nvidia’s revenue, rose 112% to $30.77 billion in the quarter. This segment had reported 154% growth in the previous quarter. Additionally, the company reported that the adjusted gross margin contracted to 75%.

The U.S. firm, a leader in advanced chip production and a major player in the AI segment, published its Q3-2024 results, confirming that demand for AI-related chips continues to grow at a high level.

How Nvidia’s revenue has skyrocketed in recent years

Our View: These elements reinforce our short-term tactical preference for U.S. equity indices over those from the rest of the world, including Europe. European indices face continued downward revisions to EPS over the coming months and the ongoing integration of U.S. political risks, particularly protectionism.

Wages in the Eurozone Accelerated Significantly in the Third Quarter

Negotiated wages in the Eurozone accelerated significantly in the third quarter, rising by 5.4% year-over-year compared to 3.5% in Q2-2024, reaching their highest level since the early 1990s.

This rebound is largely linked to wage increases in Germany, driven by the payment of exceptional bonuses, as seen earlier this year. These figures highlight that wage normalization in the Eurozone will take time, as reiterated by several ECB members, including its Chief Economist, Philip Lane. The level of tension in the European labor market remains high, exceeding pre-COVID levels (especially in the services sector). This continues to delay a slowdown in wages, thereby maintaining upward risks for service inflation, the only component still far from the 2% target.

However, the central bank expects a more pronounced slowdown in wages next year, as employees’ bargaining power is expected to diminish in a context of low economic activity and inflation. For instance, the agreement reached last week between the German IG Metall union and employer organizations resulted in more modest wage increases for the coming years (+2% by April 2025 and +3.1% the following year). The Governor of the Bank of France, François Villeroy de Galhau, noted that the sharp rise in negotiated wages in the Eurozone in the third quarter (+5.4%) was “mainly attributable to the delayed effects of past negotiations in Germany” and had already been factored into the ECB’s September projections.

Thus, “we must continue to reduce the restrictiveness of our monetary policy,” with further rate cuts, but at a pace determined by “agile pragmatism: we maintain full optionality for our upcoming meetings,” he assured. Citing economist Frank Knight’s distinction between “risks, which are measurable and can be hedged, and uncertainty, with unknown probabilities and outcomes,” François Villeroy de Galhau emphasized that “uncertainty currently negatively affects investment decisions and household consumption.”

Our View: The baseline scenario is that inflation is now declining faster than the ECB anticipated in its September forecasts. It appears likely that we will achieve the 2% target sustainably by the first or second quarter of 2025, rather than in the last quarter as indicated in the ECB minutes. The ECB will have no choice but to adopt a more accommodative stance in light of the Eurozone’s cyclical challenges, which will help normalize cyclical inflation. In the foreign exchange market, the U.S. dollar has largely benefited from soaring American interest rates. This factor is expected to persist, and the narrowing of the interest rate differential will no longer support the euro against the dollar, as the trend now favors the U.S. currency. We remain favorable to the U.S. dollar.

The “Debt Brake” Divides as Elections Approach

The upcoming German elections, scheduled for February 23, spotlight a critical debate on the future of the “debt brake.” Introduced by Angela Merkel in 2009, this constitutional measure limits the structural budget deficit to 0.35% of GDP. A symbol of fiscal discipline, it faces criticism today amid multiple crises and growing public investment needs. The coalition led by Olaf Scholz, comprising the SPD, Greens, and FDP, collapsed in early November. Finance Minister Christian Lindner, leader of the FDP and a staunch defender of the debt brake, refused to back budget proposals aimed at relaxing the rule to address current economic challenges. His refusal led to the FDP’s exit from the government, making early elections inevitable.

The tensions surrounding the debt brake highlight a deep divide between political parties. While the Greens and SPD advocate for loosening the rule to finance the energy transition and economic modernization, Lindner remains committed to strict fiscal discipline, upholding his party’s conservative legacy. The need for reform of the budgetary rule is acknowledged by several stakeholders. Even the Bundesbank, a bastion of fiscal orthodoxy, has supported a moderately higher borrowing allowance. Similarly, the government’s Council of Economic Experts has proposed adjustments to enable greater investment.

The debt brake also faces international criticism. Figures such as Yannis Stournaras, former Greek Finance Minister, argue that the rule is outdated, especially given new European budgetary norms. However, reforming the debt brake remains a challenge. Any modification requires a two-thirds majority in both parliamentary chambers. With the Alternative for Germany (AfD) and FDP firmly opposed to change, negotiations are expected to be complex. The CDU, the main opposition party, could leverage this debate to strengthen its position ahead of the elections. Polls suggest that the far-right AfD and the radical left Sahra Wagenknecht Alliance may gain enough seats to block reforms in Parliament. This prospect has led some leaders, particularly within the Greens, to call for an agreement before the elections.

Friedrich Merz, leader of the CDU and the frontrunner to become the next chancellor, could play a pivotal role in this debate. A long-time supporter of the debt brake, he has recently shown openness to reform, but under certain conditions. During his campaign, he suggested that additional borrowing could be considered for investments, while ruling out increased spending on consumption or social protection. Merz’s position reflects a cautious strategy: reassuring conservatives while signaling a willingness to adapt to economic needs. His potential government would need to balance economic modernization with fiscal discipline, a delicate task for Europe’s largest economy.

Our View: The outcome of this fiscal debate will not only shape Germany’s economic future but also influence the broader European political dynamics. Germany faces significant challenges: an industrial sector in crisis, the energy transition, unfavorable demographics, and international pressures, including technological and trade competition. Loosening the debt brake could accelerate the public investments needed to address these issues, fostering a more optimistic outlook on European assets.

Chart of the Week

The poorest state in the United States, Mississippi, has a GDP higher than France or Italy, and the second poorest state has a GDP exceeding that of Canada or Germany.