Is TRUMP really so inflationary for Americans ?

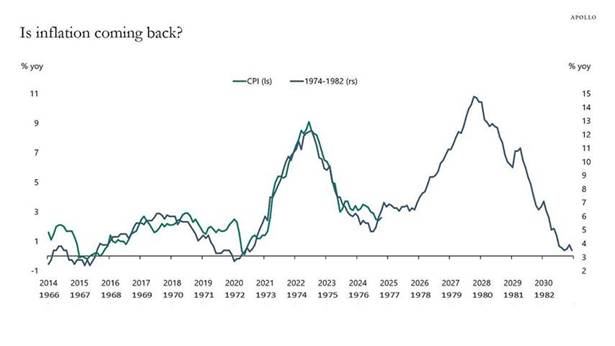

One of the most striking economic aspects of Trump’s reelection remains his potential impact on inflation. The fear of a third wave of inflation, similar to what we experienced in the 1970s, is a major concern for many of our clients.

Comparison of inflation with the 1970s

In the markets, this is known as the “Trump trade”, a bet that Donald Trump’s return to the White House would herald more inflation and higher interest rates. Many of the key policies of the next president point in this direction: tariffs would increase import costs, immigrant expulsions could drive up wages, and deficit-financed tax cuts would stimulate the economy. Faced with rising inflation, the Federal Reserve would have little choice but to raise rates. We believe this risk is very real but largely overstated for the time being.

It is worth noting that despite strong growth (the U.S. economy is thriving compared to the rest of the world, and employment remains solid), inflation weighed heavily on the outcome of the U.S. presidential election, beyond other societal debates. At a time when inflation appears to be partially under control thanks to the actions of the Federal Reserve, it is hard to imagine Donald Trump accepting becoming unpopular with American households. Beyond the initial simplistic comments on the Republican agenda and fears of another wave of inflation, it is unlikely the new president would pursue policies that caused Democrats to fall out of favor with public opinion. He has several levers that should mitigate this risk: deregulation, energy, real estate, administrative reforms, geopolitics, and a strong dollar.

The deregulation proposed by Donald Trump could also help reduce inflation in several ways, impacting a wide range of sectors. In the field of transportation and logistics, deregulation of the aviation, rail, or road sectors could improve efficiency and lower costs. Similarly, deregulation in the financial sector would stimulate consumer and business lending, thereby encouraging consumption and investment. However, this could have inflationary effects in the long term if the policy is not carefully managed. Donald Trump’s plan to reduce healthcare costs is based on market liberalization, tax incentives, and reduced regulations, aiming to increase competition and make healthcare more affordable for Americans.

Energy is, of course, a sensitive issue for Americans, accounting for about 7% of the Consumer Price Index. This is especially true for gasoline prices, which make up roughly half of household energy expenses. Lowering oil and gas prices is a priority for public opinion. Donald Trump has promised to “drill, baby, drill” to cut energy costs in half.

The choice of Chris Wright, CEO of a hydraulic fracturing company, as Secretary of Energy likely reflects the general direction: liberalize and produce more. The Inflation Reduction Act of 2022 had imposed significant constraints on the U.S. oil industry, notably introducing a methane tax set at $900 per ton in 2024, increasing to $1,500 per ton by 2026. This announced liberalization is likely to lower the average breakeven price for a barrel of oil, estimated at $60.

Production and Oil Prices

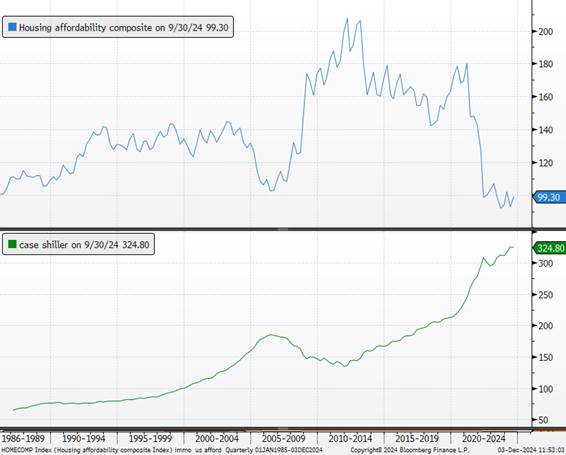

The second issue affecting the population remains real estate. Housing inflation accounts for one-third of core inflation. Despite increases in mortgage rates over the past three years, home prices and rents remain high, making housing accessibility historically low. Regulations, including zoning laws and environmental standards, have a significant impact on rising real estate prices in the United States. Trump plans to simplify these regulations and streamline permitting processes for housing construction. In his campaign speeches, he stated that the government would open vast tracts of federal land for real estate development. The goal is to encourage private investment and increase housing supply, which could help stabilize or lower real estate prices.

U.S. Home Prices (Case-Shiller) vs. Household Affordability

Elon Musk’s appointment to a key position in the Trump administration marks a turning point in U.S. government management. Known for his disruptive approach and obsession with efficiency, Musk brings with him a radical vision for administrative reform. This nomination aligns with Donald Trump’s intent to modernize and streamline the functioning of the state, drawing inspiration from private-sector models. Elon Musk, appointed as a special advisor to Donald Trump, detailed his “radical” federal reform plan for the first time on Wednesday in the Wall Street Journal.

This project includes massive layoffs of federal employees, the elimination of subsidies, and significant deregulation. The stated goal is to drastically reduce the role of the federal government. Musk also announced large-scale workforce reductions, which could directly impact the budget deficit. This would partially offset the inflationary effects on the labor market and wages, as confirmed by the statement from the new Treasury Secretary.

Another weapon: geopolitics. Donald Trump’s desire to end major international conflicts could have a disinflationary effect under certain conditions. Reducing geopolitical tensions and military spending could stabilize trade flows disrupted by conflicts and limit price increases linked to supply chain issues. A de-escalation policy could thus mitigate some inflationary effects.

The economic growth and monetary policy divergence we anticipate between the United States and the rest of the world is expected to strengthen the dollar. This strengthening could largely offset the effects of higher tariffs imposed on the rest of the world, limiting their impact on imported prices.

Between inflation and transition, the new president has clearly made his choice. Beyond the economic implications for other countries and societal issues within the United States, inflation remains a priority for the new administration, as it is critical to leaders’ popularity with voters. Trump’s immigration program is arguably the most questionable aspect from an economic perspective. During his previous term, reduced migration flows already triggered an initial wave of inflation by driving up wages.

Experience has shown that if inflation were to resurge, it would be even more challenging to control. A similar misstep this time could have severe economic and financial consequences, reviving the greatest fears of the 1970s.