If the wars have continued and intensified in Ukraine and the Middle East, Donald Trump’s victory in the U.S. presidential election has resolved a major uncertainty for the global economy. Trump may show more flexibility on certain issues based on political priorities, though he is unlikely to change his stance on tariffs, immigration, and alliances. Everything he does must satisfy the American consumer, as Trump aims to maintain his popularity and be recognized as someone who delivers solutions.

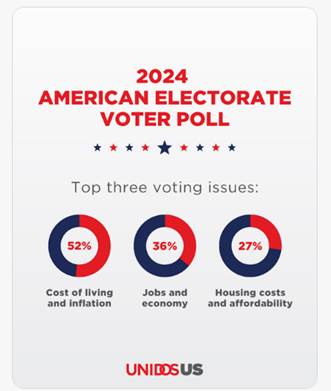

For U.S. consumers, inflation and China emerge as the main sources of concern in various polls. On the first issue, the new president is unlikely to risk a new wave of price increases. Lower energy prices and a stronger dollar may help dilute the inflationary impact of his agenda. On the second issue, relations with China are likely to involve a forced rebalancing, with a focus on selling more American goods to China to address the trade imbalance.

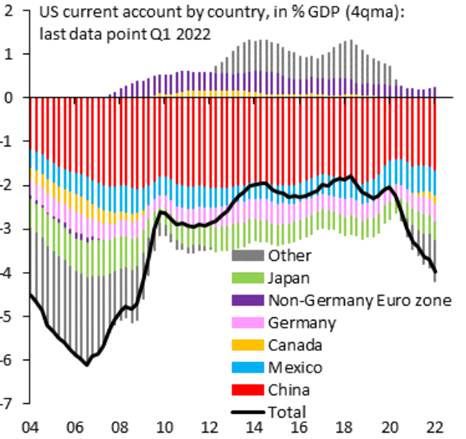

The current major loser could be Europe, which has fewer arguments: its current account balance is largely favorable, and it has benefited from U.S. growth. The U.S. can exert additional geopolitical pressure at a lower cost due to the conflict in Ukraine. The political instability of Europe’s two leading countries further exacerbates this overall fragility. So far, the European Union’s only response has come from Ursula von der Leyen, who proposed to Donald Trump replacing Russian gas with American gas.

The recalibration of monetary policies, disparities in economic performance, and the resurgence of protectionism on the international stage are bringing exchange rate balances back into focus.

US : no landing

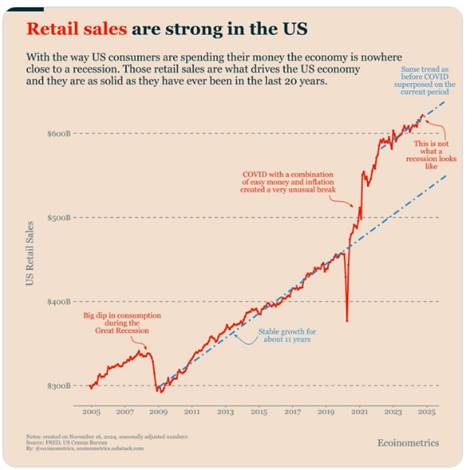

The U.S. economy continues to show resilience, allowing the Federal Reserve to bide its time through 2025. Once again, U.S. statistics highlight the economy’s strength, particularly due to robust household consumption. Trump’s campaign promises are designed to further improve their net financial Position.

Indeed, tax cuts would allow the continued recovery of purchasing power (Trump intends to make permanent the income tax cuts introduced by the Tax Cuts and Jobs Act, which came into effect in 2018 and are set to expire in 2025. He also plans to exempt tipped wages, overtime, and Social Security payments from taxes).

Trump’s “drill at all costs” oil policy is expected to put downward pressure on oil prices and help lower gas prices, further reinforcing the ongoing disinflation, all else being equal. The labor market slowdown continues, while various survey data (notably the Federal Reserve’s Senior Loan Officer Opinion Survey – SLOOS – for Q3 2024) indicate that financial conditions remain restrictive, dampening demand.

Americans are still spending their income surpluses (positive real wages, low savings rates), which will support growth in the coming months and offset a less favorable situation in the industrial sector. This sector remains affected by weak global demand and high financing costs. However, two indicators already point to a “Trump effect” in the industry. The Philadelphia Fed’s manufacturing survey returned to contraction in November, but the “expectations” component surged to its highest level since June 2021, reflecting increased post-election optimism among business leaders. Similarly, the Kansas City Fed’s manufacturing survey showed a slight decline in November due to decreased activity and new orders. However, activity expectations are up, and employment remains solid.

The three main pillars of Donald Trump’s program—relentless crackdowns on illegal immigration, massive tariff hikes, and challenges to the Federal Reserve’s independence—would, if implemented, represent a new inflationary shock for the U.S., particularly as economic growth continues to exceed its potential.

Despite the initial simplistic commentary on Trump’s policies and fears of another wave of inflation, it seems unlikely that the new president would repeat the missteps that led to the Democrats’ decline in public opinion.

While strong growth persists, inflation and the unequal distribution of income weighed heavily on the outcome of the U.S. presidential election. Tariff hikes and tax cuts will undoubtedly contribute to this trend. However, falling energy costs, a strong dollar, deregulation, stabilized real estate markets, and administrative reform led by a “determined” Elon Musk could act as a firewall to stabilize inflation, enabling the Federal Reserve to maintain a more accommodative policy overall.

The recent rise in long-term rates was driven primarily by real interest rates and, to a lesser extent, by inflation expectations, underscoring the focus on growth.

As for the potential inflationary effects of implementing the new administration’s economic policies, J. Powell noted in his post-FOMC speech on November 7 that these remain largely speculative at this stage.

Donald Trump’s election to the White House serves as a catalyst for U.S. economic growth in the coming months.

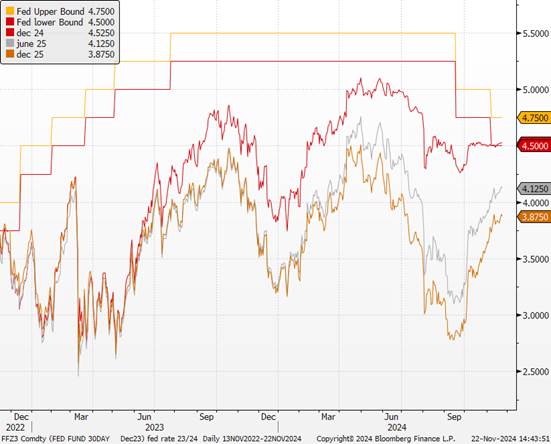

The U.S. economy is expected to maintain its momentum, allowing the Federal Reserve to exercise greater caution in easing its monetary policy without disrupting the overall trajectory. Inflation continues to decelerate, and the effects of Republican policies are unlikely to materialize before the next budget vote, enabling the Fed to gradually lower rates.The institution is not expected to reconsider the 25 basis point rate cut projected for December, as the already evident decline in inflation has made the current federal funds rate excessively restrictive. We anticipate a 25 bp cut in December, followed by three to four additional cuts in 2025. The Fed is likely to pause thereafter to assess the impact of Donald Trump’s economic policies on inflation and the labor market. We believe that J. Powell must avoid pursuing a policy that directly opposes President Trump’s measures, as doing so could risk a politically motivated replacement in 2026, potentially leading to a Fed that is excessively subservient to the administration.The equilibrium rate is expected to stabilize at 3.75%-4% by Q2 2025, aligning with our initial scenario.

Fed Rates and Futures Rate Expectations

EUROPE: Risks Tilt More Toward Growth Than Inflation

In today’s Europe and the broader global landscape, non-monetary action is both more necessary and more challenging than ever due to the weakened state of many governments. The balance of risks for growth and inflation is shifting downward, and potential U.S. tariffs are unlikely to significantly alter inflation prospects in Europe. According to J. Nagel, President of the Bundesbank, these tariffs could cost Germany 1% of its GDP.

During the ECB’s most recent meeting, central bank members expressed greater concern over the disappointing economic activity dynamics relative to September’s expectations than over inflation trends. For central bankers, downside risks to growth have intensified, particularly for consumption, as the savings rate remained very high in Q2. Geopolitical risks to global trade, escalating trade tensions affecting exports, and the potentially stronger-than-expected impact of monetary tightening are likely to prompt the ECB to respond.

Regarding inflation, ECB members are increasingly confident, which supports our scenario. L. de Guindos (ECB Vice President) and J. Nagel (Germany) in particular emphasized the impact of new trade restrictions on eurozone production. According to Y. Stournaras (Greece), the increase in U.S. tariffs could even lead to a recession and a period of deflation in the medium term..

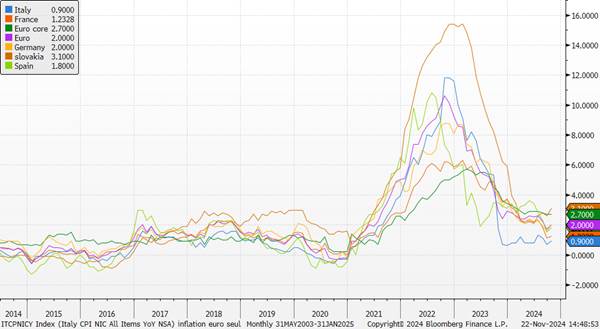

Inflation in the euro zone

The favorable slowdown in price increases can partly be attributed to the decline in energy prices, while the progress in core inflation and the services component remains significantly less encouraging.

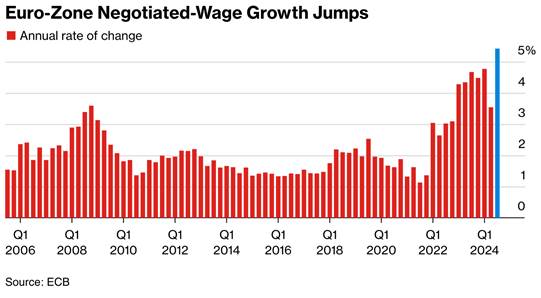

Negotiated wages accelerated sharply in Q3 (+5.4% year-over-year vs. +3.5% in Q2 2024), reaching a high not seen since the early 1990s. However, this rebound is largely tied to wage increases in Germany driven by exceptional bonuses, similar to those at the start of the year. While these figures highlight that wage normalization in the eurozone will take time, we anticipate a more pronounced slowdown in wage growth next year. Employee bargaining power is expected to diminish in the context of low economic activity and subdued inflation.

Evidence of this trend includes last week’s agreement between the IG Metall union and German employer organizations, which resulted in more modest wage increases for the coming years. Even the most hawkish ECB members appear to align with the broader consensus, acknowledging that the risk of lowering rates too early is now smaller than the risk of doing so too late..

The decline of the euro, once a significant concern for the ECB due to its focus on imported inflation, is no longer expected to hinder more decisive action. This movement is likely to be offset by falling energy prices on one hand and by mitigating the effects of anticipated U.S. tariffs on the other.

We believe that the deteriorating growth outlook in the eurozone, which could worsen due to the confidence impacts of Donald Trump’s upcoming trade policies, will prompt the ECB to continue lowering policy rates in December and throughout 2025, adopting a more accommodative monetary policy approach in 2025.

We expect the terminal rate to be reached by the end of the year at 2%, slightly below the equilibrium rate we estimate at 2.25%. PMI indicators reflect this deterioration. The renewed decline in economic activity in November has been accompanied by weakening confidence in future prospects. The eurozone’s manufacturing sector is sinking further into recession, and now the services sector is beginning to falter after two months of marginal growth..

Euro Zone PMI Indicators

This is hardly surprising given the political turmoil in the major eurozone economies. The election of Donald Trump as President of the United States has only added fuel to the fire. The Old Continent must unite more than ever to face these economic and geopolitical challenges.

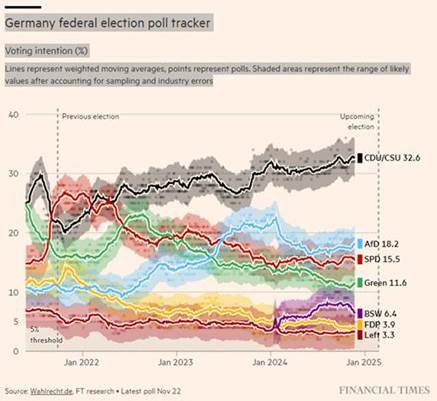

France’s political context has effectively nullified its historic leadership role. A potential bright spot could come from the German elections in February (still a long way off), which might see a relaxation of the debt brake. However, with the Alternative for Germany (AfD) and the Free Democratic Party (FDP) firmly opposed to any changes, the negotiations are set to be complex

One of the few positive developments this month is that the various parties in the European Parliament have finally agreed on the composition of the new European Commission team after difficult negotiations. Italian R. Fitto, a member of the far-right Fratelli d’Italia party led by G. Meloni, will serve as a Vice President of the Commission alongside U. von der Leyen. This is evidence, if any were needed, that unity is difficult but necessary and that Europe perhaps only progresses through crises.

CHINA: No Other Choice

In global trade, the effects of explicit reshoring strategies are likely to disproportionately impact emerging markets. The implications of the radical shift in the U.S. context include deteriorating growth prospects, reduced portfolio flows, and less accommodative monetary policies. The new U.S. government will specifically target countries with significant current account surpluses, such as Mexico and China.

Current Account Balances with the U.S.

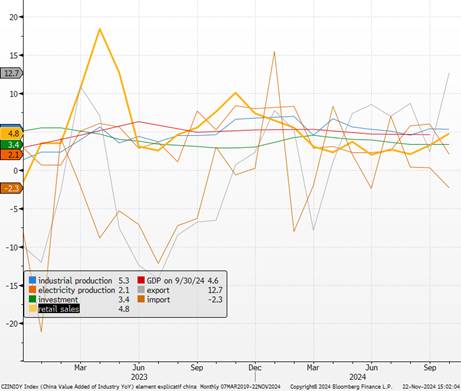

October brought encouraging signs for the Chinese economy, particularly in domestic consumption. While industrial production remains hampered by weak global demand, domestic demand is showing signs of recovery. Retail sales saw a significant acceleration, growing by +4.8% year-over-year (compared to +3.2% in September). This improvement reflects the initial effects of consumption-support measures announced in July, such as subsidies for replacing durable goods.

Key Drivers of Chinese Growth

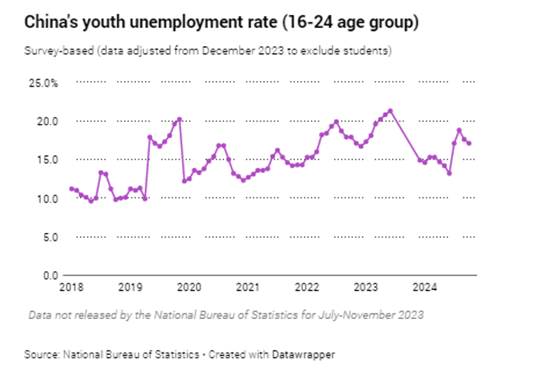

In the labor market, the unemployment rate for young people aged 16 to 24 continues to decline, reaching 17.1% in October after peaking at 18.8% in August. However, this rate remains high, as does the unemployment rate for those aged 25 to 29, which saw a slight increase to 6.8% (up from 6.7% the previous month).

Economic stimulus measures are beginning to show their effects, potentially accelerated by the international context marked by Donald Trump’s election. The first phase of this plan aims to address the local debt crisis, with the goal of improving the fiscal health of local governments. Real estate and bank capital are likely to be the next focal points to watch. Beijing appears determined to maintain an ambitious growth target of 5% for 2025, although this goal will not be officially announced until March during the annual session of the Chinese Parliament. However, to reach this level as early as next year, Beijing will likely need to implement a significant stimulus plan focused on household consumption and increased support for investment.

Such a program seems even more essential given the likelihood of escalating trade tensions between China and the United States under the Trump administration. Proposed protectionist measures, including a substantial increase in tariffs on Chinese imports, could heavily impact the country’s foreign trade.

Faced with these challenges, China can no longer afford to hesitate. Without large-scale stimulus measures, the structural weaknesses of its economy will continue to constrain its growth momentum. Beijing must therefore intensify efforts to support domestic demand or risk seeing its growth ambitions compromised in an increasingly hostile global economic environment.