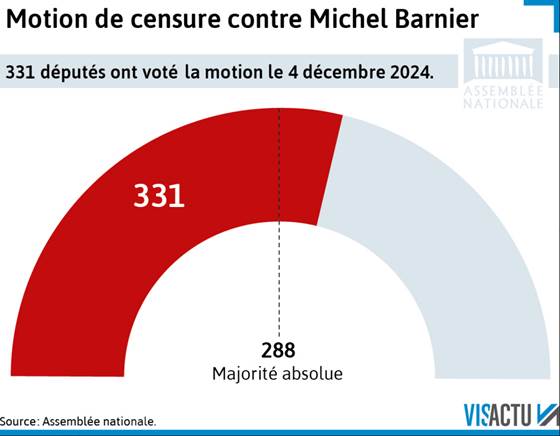

Only one precedent: October 5, 1962, to bring down the Pompidou government. In 1962, as in 2024, the censure was foreseen. The markets have partly already adapted..

The political right and left in France have united to oust Prime Minister Michel Barnier. However, the fall of his minority government and the rejection of his ambitious austerity budget do not necessarily signal an immediate and major financial crisis. For now, President Emmanuel Macron, whose term ends in mid-2027, has no reason to resign, as he can appoint a new Prime Minister, although the latter will face a still fragmented Parliament.The fact that the right and left joined forces to oust Barnier highlights the risk that they could jointly overturn certain reforms, beyond the partial rollback of corporate tax cuts. Coupled with heightened political uncertainty and elevated risk premiums, this outlook will likely weigh on corporate investment.

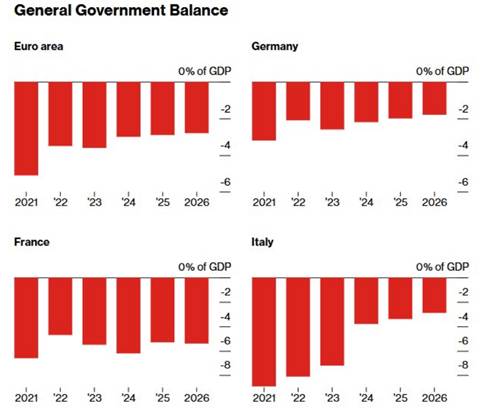

The reluctance to return to a sustainable fiscal policy means that the correction will have to be even harsher in the future, even if the EU temporarily accepts further budgetary slippage from France, which seems likely. Instead of outperforming the eurozone average, as France did in 2023 and 2024, we anticipate that France will fall well below this average over the next two years. We are lowering our forecast for French real GDP growth to 0.5% for 2025. The adverse effects on business confidence will add to those stemming from the economic slowdown, weak demand in the industrial sector, and the looming trade war with China..

We do not expect the French turmoil to trigger a crisis of confidence in the euro similar to that of 2010-2012. France matters, and Europe has learned lessons from Brexit. Even Le Pen no longer wants to leave the euro. If necessary, the ECB could intervene to prevent any risk of contagion to other countries. However, the situation would need to be extreme, which is not the case. It would likely act through simple statements rather than bond purchases! In any event, this reinforces our scenario of a more pronounced rate cut by the ECB. Christine Lagarde has also mentioned the risks weighing on the eurozone’s growth outlook before the European Parliament.

While awaiting the adoption of a suitable budget for 2025, the extension of the previous budget through the passage of a special budgetary law—submitted before December 19 and enacted before January 1—is expected to result in a deficit of between 5.5% and 5.8% of GDP for 2025 (excluding the impact of a sharp decline in growth). This deficit will be lower than under an unchanged fiscal policy, notably because some expenditures and revenues will remain at their 2024 levels and will therefore not account for GDP growth and inflation.

The motion of no confidence “exacerbates the country’s political stalemate,” Moody’s has already noted. “This event is credit negative,” referring to the country’s rating, the global agency stated in a press release issued overnight, just hours after the deputies voted to censure the government. France has the highest tax burden in Europe, and political paralysis will prevent structural reforms, particularly concerning its pension system. The high percentage of French debt held by foreign investors adds urgency to the situation.

Until potential new elections, persistent political uncertainty is likely to keep the risk premium on French assets elevated. Foreign portfolio investments in French equities amounted to €1,140 billion at the end of Q2 2024, representing 38% of the market capitalization of the CAC All-Tradable index. Sectors directly tied to public spending and sovereign risks are the most vulnerable.

The France-Germany spread is stabilizing this morning, indicating that, for now, investors are not alarmed. However, the French risk premium is expected to remain durably higher and could gradually approach that of Italy if fiscal slippage becomes evident. We continue to favor assets from other eurozone countries whose fiscal discipline and political stability will keep attracting investors.

French 10-Year Yield vs. German 10-Year Yield