1. The Fed does not need to rush, according to J. Powell

2. Chinese support measures continue to bear fruit

3. France: The motion of censure is adopted

4. Chart of the week: The record growth of the American economy relies on faster productivity growth, a more sustainable driver of economic performance.

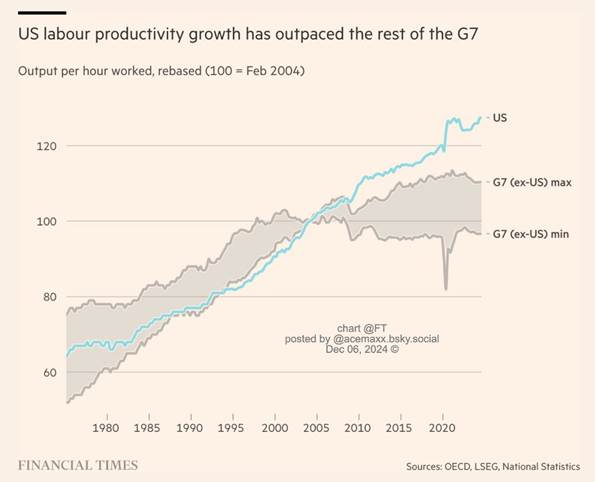

The Fed does not need to rush, according to J. Powell

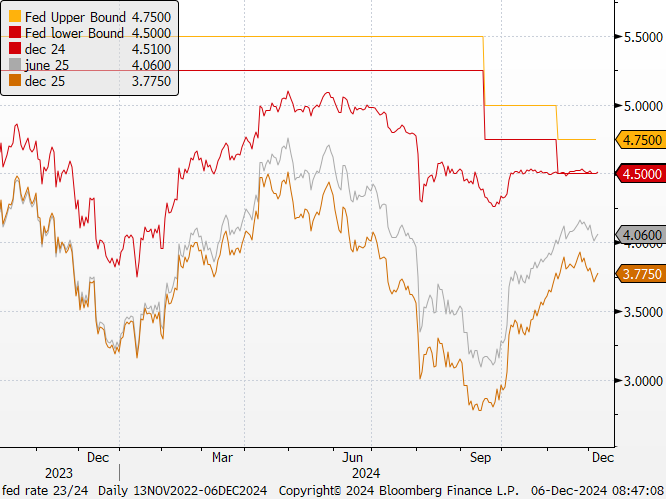

Two weeks ahead of the Fed meeting (December 18), questions are mounting about the need to ease monetary policy in response to the resilience of the economy. While some, such as A. Musalem (a voting member of the FOMC next year), suggest the possibility of a pause as early as this month, Fed Chair Jerome Powell believes that the Fed can continue lowering its key interest rates but that the solid performance of the economy will allow the central bank to take its time. Growth is significantly stronger than anticipated and is expected to maintain this momentum, according to the Fed Chair.

While recent weeks have focused more on D. Trump’s return to power and its implications for the global economy, the U.S. economy continues, for now, to show signs of resilience. In this regard, early employment statistics for the week highlighted a still-robust labor market in the United States: job openings increased significantly in October, according to the JOLT survey. This has kept the ratio of job openings to unemployed persons at 1.1 for the fourth consecutive month, a more normative level for the U.S. economy.

As the normalization of the U.S. labor market progresses gradually, D. Trump’s proposed immigration policy for his second term could create a new labor shortage in the United States, contributing to a resurgence of wage tensions and, consequently, inflationary pressures. For the Fed, this will be a key factor to consider in managing its monetary policy starting next year, especially since economic activity, particularly in services, remains dynamic and supported by household consumption. However, the Beige Book released this week paints a slightly less favorable picture of the U.S. economy.

Activity across the 12 districts has not seen significant changes since October and remains generally modest, with consumer spending stable and hiring less dynamic. However, U.S. businesses are expressing greater optimism regarding demand and activity prospects in the coming months, even as they report increasing difficulty in passing rising costs on to final prices. These elements reflect a still-gradual normalization of the U.S. economy, as seen in the ISM Services Index published yesterday, which fell short of expectations due to a slowdown in new orders and employment..

Fed Rates and Futures Market Expectations

Our View: Inflation continues to decelerate, and the effects of Republican policies will not be felt until the next budget vote, allowing the Fed to gradually proceed with rate cuts. The institution is unlikely to challenge the anticipated 25 bp cut in December, as the current level of interest rates has become overly restrictive given the ongoing decline in inflation. We expect a 25 bp cut in December, followed by 3 or even 4 cuts in 2025.

The Fed should then pause to assess the effects of Donald Trump’s economic policies on inflation and the labor market. We believe J. Powell should avoid pursuing a policy entirely at odds with President Trump’s measures, as this could lead to a replacement in 2026 that would be excessively aligned with Trump. The equilibrium rate is expected to be 3.75%-4% by Q2 2025, aligning with our initial scenario.

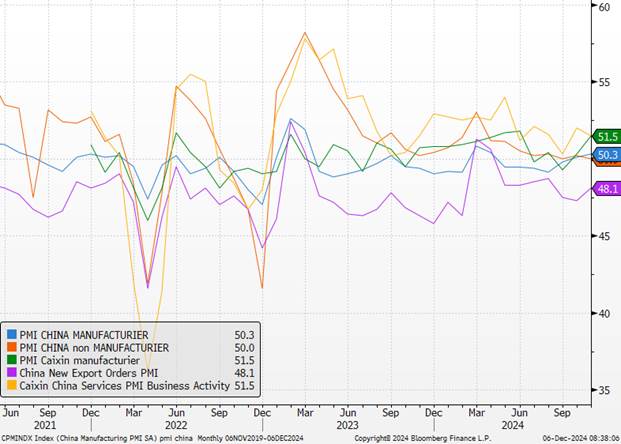

Chinese Support Measures Continue to Bear Fruit

November’s manufacturing PMI indices delivered positive signals regarding the strength of the industry. The Caixin Manufacturing PMI rebounded to its highest level since June, firmly settling in expansion territory at 51.5, driven by growth in new orders, including exports. However, this export resurgence may also stem from foreign demand anticipating the potential tariff increases promised by D. Trump.

According to Caixin, pressures on corporate margins eased slightly during the month—a trend likely tied to lower costs, even as the price war continues. A positive note: expectations have reached their highest level in seven months. Official PMI indices, which focus less on SMEs and the export sector, paint a more mixed picture. The manufacturing index shows little improvement, and the services sector remains stagnant.

China’s economy is gradually benefiting from government-announced measures, but for a clearer and more sustainable recovery, authorities will need to address the structural challenges facing the country (weakened household confidence, real estate crisis, high private and public debt). This will require targeted stimulus measures aimed at domestic demand and households. Without such actions, China’s growth potential will continue to decline (we forecast +4.6% growth in 2024 and +4.2% in 2025).

Chinese PMI Indicators

Our View: October brought encouraging signs for the Chinese economy, particularly in domestic consumption. While industrial production remains constrained by weak global demand, domestic demand is showing signs of recovery. Retail sales recorded a sharp acceleration, rising by +4.8% year-on-year (compared to +3.2% in September). This improvement reflects the initial impact of consumer support measures announced in July, such as subsidies for replacing durable goods.

Economic stimulus measures are beginning to take effect, potentially accelerated by the international context, notably marked by Donald Trump’s election. The first phase of this plan aims to address the local debt crisis, with the goal of improving the fiscal health of local governments. Real estate and bank capital are likely the next areas to watch.

Beijing appears determined to maintain an ambitious growth target of 5% for 2025, although this will only be officially announced in March at the annual session of the Chinese Parliament. However, to achieve this level as early as next year, Beijing will likely need to roll out a significant stimulus plan focused on household consumption and increased support for investment.

France: The Motion of Censure is Adopted

There is only one precedent: October 5, 1962, when the Pompidou government was toppled. In both 1962 and 2024, the outcome of the censure was predictable, and markets have partially adapted to the event.

The political right and left in France joined forces to oust Prime Minister Michel Barnier. However, the fall of his minority government and the rejection of his ambitious austerity budget do not necessarily signal an immediate or major financial crisis. For now, President Emmanuel Macron, whose term ends in mid-2027, has little reason to resign. He can appoint a new Prime Minister, though this appointee will still face a fragmented Parliament.

The collaboration between the right and left to remove Barnier underscores the risk that they could jointly roll back certain reforms, including partial reversals of corporate tax cuts. Combined with increased political uncertainty and higher risk premiums, this scenario will likely weigh on business investment.

The reluctance to return to sustainable fiscal policy means that future corrections will need to be even harsher, even if the EU temporarily allows additional fiscal slippage by France, which appears likely. Instead of outperforming the eurozone average, as France did in 2023 and 2024, we now expect the country to fall significantly below this average over the next two years. We have lowered our forecast for French real GDP growth to 0.5% in 2025.

Adverse effects on business confidence will compound those stemming from the economic slowdown, weak industrial demand, and a looming trade war with China. Until a suitable 2025 budget is approved, the provisional extension of the previous budget, via a special fiscal law to be tabled before December 19 and enacted by January 1, is expected to result in a deficit between 5.5% and 5.8% of GDP in 2025 (excluding the impact of a sharp growth decline). This figure will be lower than it would under an unchanged fiscal policy, as some spending and revenue levels will remain fixed at their 2024 values, excluding GDP and inflation growth adjustments.Moody’s has already noted that the censure “worsens the country’s political deadlock.” The global agency described the event as “credit negative” for France’s sovereign rating in a statement released overnight, just hours after the censure vote.

France’s high tax burden—the highest in Europe—and its political paralysis will hinder structural reforms, particularly regarding its pension system. The high percentage of French debt held by foreign investors adds urgency to the situation.

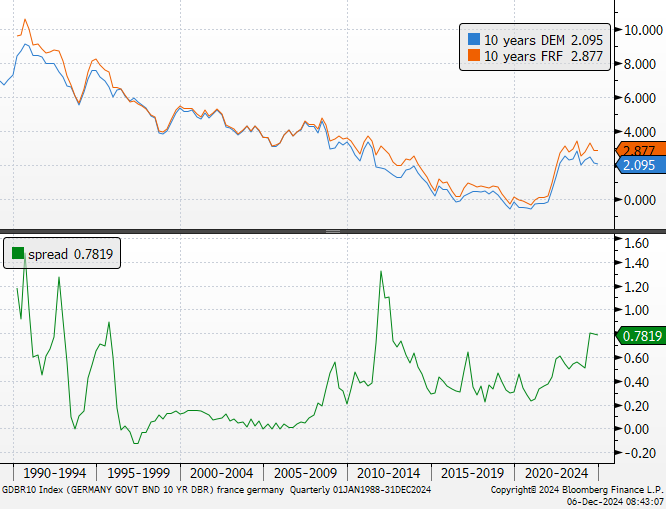

France-Germany Spreads Over the Long Term

Our View: We do not anticipate that the turmoil in France will trigger a confidence crisis in the euro akin to 2010-2012. France remains pivotal, and Europe has learned lessons from Brexit. Even Marine Le Pen no longer advocates leaving the euro. If necessary, the ECB could step in to prevent any contagion risks to other countries. However, such intervention would only occur under extreme circumstances, which is not currently the case. Likely, the ECB would rely on simple statements rather than outright bond purchases.This scenario further supports our outlook for more pronounced rate cuts by the ECB. Christine Lagarde, in her address to the European Parliament, highlighted the risks weighing on the eurozone’s growth prospects.

Until possible new elections, persistent political uncertainty is expected to keep the risk premium on French assets elevated. Foreign portfolio investments in French equities totaled €1,140 billion at the end of Q2 2024, representing 38% of the market capitalization of the CAC All-Tradable index. Sectors directly tied to public spending and sovereign risks are the most vulnerable.Even if the France-Germany spread stabilizes—indicating that investors are not yet alarmed—the French risk premium will remain sustainably higher. It could gradually approach Italy’s premium if fiscal slippage materializes. We continue to favor assets from other eurozone countries whose fiscal discipline and political stability will remain attractive to investors.

Chart of the Week

The record growth of the U.S. economy relies on faster productivity growth, a more sustainable driver of economic performance.