The Spanish economy has outperformed most others since 2022 in terms of real economic output. Spain’s short-term growth prospects are relatively favorable. The Bank of Spain forecasts a slowdown in economic activity from 1.9% in 2024 and 2025 to 1.7% in 2026, which is significantly higher than the projections for the rest of Europe.

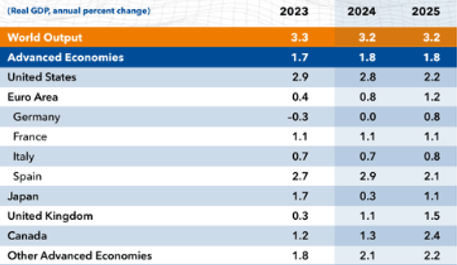

IMF Forecasts

There are numerous reasons for this resilience. Services play a much larger role than industry in the Spanish economy, significantly more than in countries like France, Germany, or Italy. With the pandemic behind us, Spain has benefited from the faster growth of services compared to industry, boosted by tourism (foreign tourist arrivals exceeded pre-pandemic levels, reaching a record high of over 85 million) and greater resilience to the energy crisis, which affected gas-dependent industrial sectors. Spain was less exposed to the risk of Russian energy export disruptions thanks to diversified supply sources. Energy prices decreased rapidly, dropping by 24% from their peak by December 2022, compared to a 9% drop in the eurozone.

Spain even capitalized on the crisis by becoming the EU’s main gas hub. The country has six operational LNG terminals—the highest number in Europe—allowing it to receive gas shipments from various global suppliers, including the United States, Qatar, and Algeria. The EU initiative to strengthen energy interconnections between countries has driven improvements in links between Spain and France, particularly the BarMar project (a submarine pipeline between Barcelona and Marseille). The BarMar link between Barcelona and Marseille is a key component of the H2Med project, a vast hydrogen transport corridor capable of carrying 10% of the 20 million tons of hydrogen outlined in Europe’s RePowerEU targets by 2030.

BarMar-H2Med: The First Major Green Hydrogen Corridor in Europe

Moreover, Spain is less dependent on China than many of its European neighbors. In 2022, China accounted for 1.96% of Spanish exports, compared to 6.7% for Germany and 4% for France. On the contrary, Beijing has intensified its investments in the Southern European country in recent years.

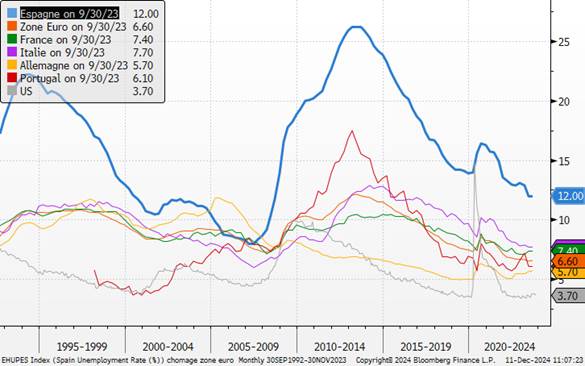

On the labor market front, employment has reached a record high, and the unemployment rate is at its lowest level in 16 years, although it remains structurally higher than in other Eurozone countries. The labor market reform of December 2021 increased permanent contracts by limiting the use of temporary contracts. Spanish households have steadily reduced their debt..

Unemployment Rate

Their debt amounts to 46% of GDP, nearly half its level during the global financial crisis. Additionally, a higher proportion of fixed-rate mortgages has reduced their exposure to rising interest rates. Positive real wage growth has further amplified the favorable conditions for domestic demand. The rapid deceleration of inflation, combined with strong wage growth, has firmly pushed real wage growth into positive territory, ahead of any other European economy. Furthermore, the significant increase in the minimum wage—up by more than 50% since 2018 and outpacing overall wage growth—has further strengthened real wage growth..

Inflation in the Eurozone

The inflows from the Next Generation EU funds have significantly supported Spanish growth. To date, Spain has received approximately 40% of the €163 billion allocated to it, with 60% still to be disbursed.

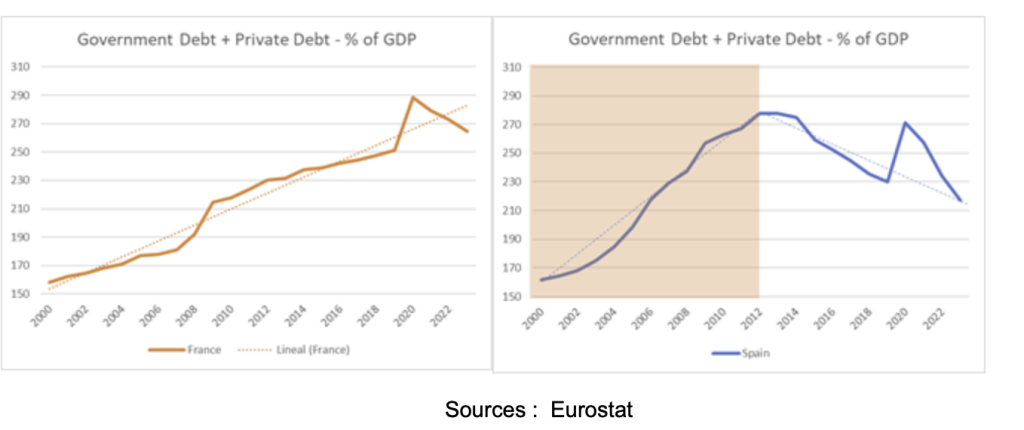

Spanish sovereign bonds have outperformed due to an improved fiscal trajectory. The public debt-to-GDP ratio decreased from 143% in 2021 to 105% in 2024. This downward trend in yields remains intact, justifying an overweight position in Spanish bonds compared to other European bonds.

The country’s public debt-to-GDP ratio fell from its peak of 143% in 2021 to 105%, below pre-pandemic levels (Graph 13, top panel). Spain also recorded one of the largest increases in general government revenue as a share of GDP among Eurozone countries, which helped curb the rise in public debt and reduce the public deficit. This improvement, combined with an extension of the average maturity of public debt from 6.6 years in 2010 to nearly 8 years, has mitigated the impact of higher interest rates.

Comparison of Private and Public Debt Between France and Spain

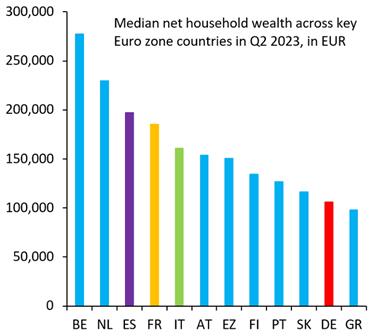

It is worth noting that the median net wealth of Spanish households (ES) is twice as high as that of German households (DE).

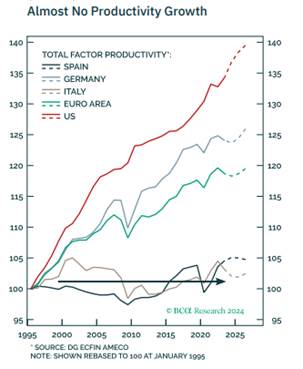

The country’s fragility lies in its ability to address slow productivity growth and an aging population. Micro-enterprises—with fewer than 10 employees—make up the majority of the entrepreneurial landscape in Spain. These micro-enterprises exhibit low productivity growth due to their inability to achieve economies of scale or access financing sources. Consequently, these businesses underinvest..

Productivity Factor

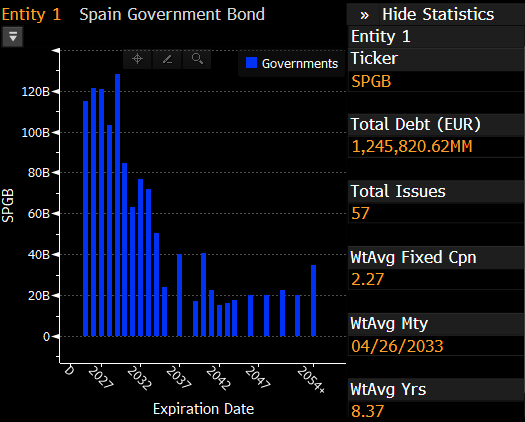

The proportion of debt maturing in the short term remains a risk. Approximately €180 billion and €125 billion of public debt will mature in 2025 and 2026, representing 13% and 9% of the total outstanding debt, respectively. Given our forecast that the ECB deposit rate will stabilize between 1.5% and 1.75% by 2026, the cost of new issuances will be higher. Note that the share of short-term maturing debt is similar in France and Italy.

Breakdown of Spanish Debt

The downward trajectory of Spanish bond yields remains intact. In a portfolio of European bonds, it is recommended to overweight Spanish debt compared to the sovereign bonds of core Eurozone countries. Consistent with our positive outlook on Germany’s economic prospects, we further recommend that investors take long positions on Spanish 10-year bonds relative to German and French bonds.

10-Year Comparison: France vs. Spain