The year 2024 was marked by exacerbated political instability. Most elections (whether planned or not) led to changes in majorities (USA, France, UK, Mexico) or weakened the powers that be (India, Japan). Next year should offer greater visibility in this respect, except for the two major European powers (France, Germany). As for the arrival of Donald Trump, the repercussions, both domestically and internationally, will take some time to materialize, as some of the candidate’s campaign promises are particularly polarizing. We remain convinced that tangible economic statistics will remain the Fed’s main decision-making factor and that, under no circumstances, will a potential inflationary wave created by the new president’s program directly influence its policy. On the macroeconomic front, inflation should continue to decline at a gradual pace over the first few months of the year. Bond assets will continue to provide effective diversification for portfolios. As far as equity markets are concerned, the consensus seems to be strongly in favour of US assets, which raises the question of possible reversal catalysts. For the time being, economic decoupling between the US and the rest of the world seems to have been established.

Synthesis

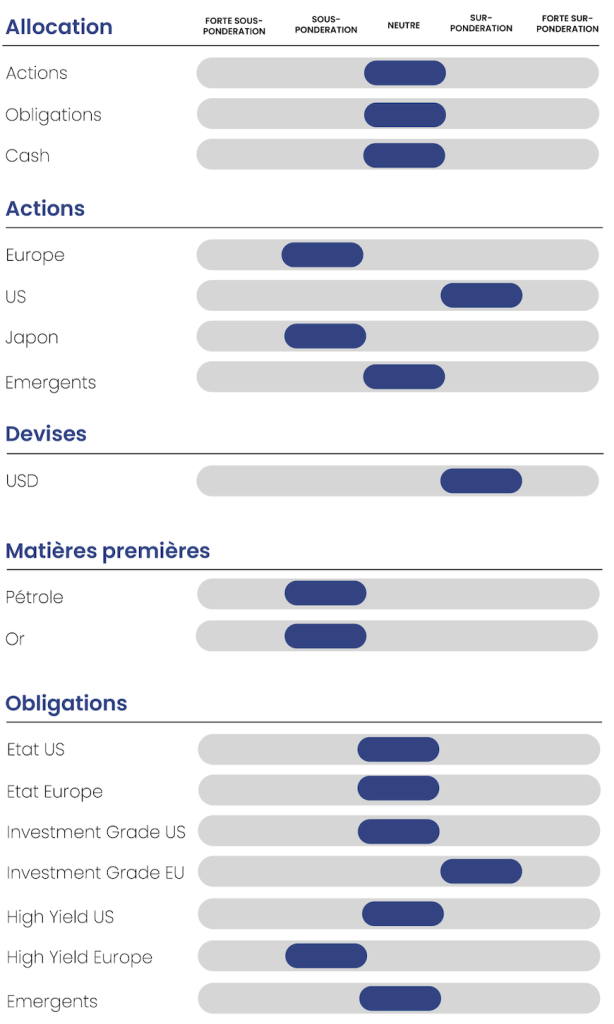

- Adjustment of our view on cash from overweight to neutral in view of the general downward trend in key interest rates in developed economies excluding Japan.

- Repentification of sovereign yield curves is underway, with short rates falling (due to lower central bank key interest rates) and long rates rising (due to repricing following the change of US administration, which is partly affecting European rates). Short- and medium-term maturities (1.5 to 5 years) are to be favored over cash (<1 year) and long maturities (>5 years).

- Repentification of sovereign yield curves is underway, with short rates falling (due to lower central bank key interest rates) and long rates rising (due to repricing following the change of US administration, which is partly affecting European rates). Short- and medium-term maturities (1.5 to 5 years) are to be favored over cash (<1 year) and long maturities (>5 years).

- Degradation of our vision of High Yield bonds in Europe from neutral to underweight given the deterioration of the European economy and the risk of spreads rising for issuers with poorer credit quality

Bonds: Effective diversification for portfolios

A new U.S. administration seems to favor growth and stability at the expense of fiscal discipline, adopting higher deficits to achieve its objectives. In Europe, Germany is trying to revitalize its struggling economy. The next coalition, resulting from the February elections, should make it possible to amend the constitution in order to increase debt capacity. France, for its part, is facing increased pressure on its budgetary discipline while seeking to finance its ambitious projects. These challenges unite these nations around a common challenge: convincing prudent investors to support bond markets in an era marked by growing debt.

Sovereign Obligations:

United States: doubts about inflation will create volatility

In 2025, the U.S. bond market will evolve under the influence of contradictory forces: a more accommodative monetary policy of the Fed, growing budget deficits and increased volatility in financial markets. Investors will have to adapt to a moderately inclined yield curve and recurring inflationary pressures and to control. The Fed is engaged in a policy rate cut cycle, with a goal for Fed Funds to 3.50% by the end of 2025. This movement aims to support moderate economic growth while maintaining inflation expectations around 2.2%. A slightly steeper slope in the yield curve is expected, although uncertainties surrounding the monetary relaxation cycle could limit this increase. Despite the Treasury Secretary’s criticism of the recent dependence on short-term bonds, no major changes are planned in the bond issuance strategy to extend the maturity of the debt.

Long-term bond yields are expected to range between 4.25% and 4.75%, fluctuating according to uncertainties related to Fed policy and published inflation data. The Fed plans to end its balance sheet reduction program by the third quarter of 2025. This decision could reduce tensions in the bond markets by reducing the supply of Treasury bills.

US rate

Eurozone: peripheral bonds remain attractive

The continued deceleration in inflation and the lack of growth engines in the euro area will allow the ECB to continue to reduce its policy rates by the end of 2024 and 2025. In 2025, European bonds will evolve in a context marked by increased political uncertainty, divergent fiscal trajectories and an accommodative monetary policy of the European Central Bank. The ECB is engaged in a cycle of gradual decline in its policy rates, with an expected terminal rate of 1.75% (or 2%) by the end of 2025. This policy aims to support a European economy weakened by moderate growth prospects and external uncertainties. Yields on euro area sovereign bonds, including 10-year German Bunds, are expected to range between 2.00% and 2.50%. This range reflects an asymmetry typical of monetary relaxation cycles, where risks are more oriented towards lower yields during peaks in bond issues. The slope of European curves is expected to increase in 2025. This dynamic will be fueled by the persistence of ECB rate cuts, uncertainties related to fiscal policies in Germany (including a potential debt brake reform) and pressures on French public finances in an unstable political context. Spanish and Italian sovereign bonds are expected to outperform their German and French counterparts thanks to relatively strong macroeconomic fundamentals and proactive management of fiscal policies. In 2025, net issues of sovereign bonds in the euro area are expected to reach about €770 billion, a level higher than in 2024. France will be the main issuer, thus increasing supply on the secondary market. We maintain a negative outlook on French assets.

Spread 10 years France – Spain

Credit

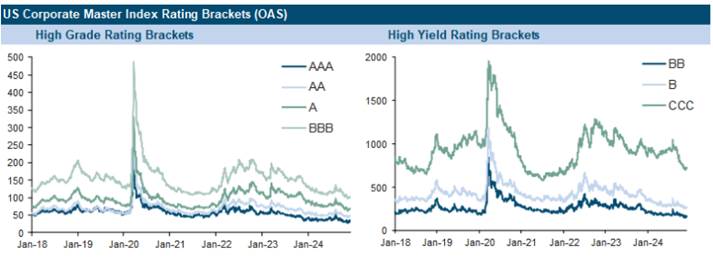

Credit investors should start the year 2025 with a valuation that has rarely been so tense for several decades. However, to see a real gap in spreads, a combination of two factors would be needed: a deterioration in fundamentals and unfavourable technical elements. We do not predict either and estimate that credit spreads should remain relatively tight this year. Credit will continue to be an attractive alternative in an environment of declining global bond yields.

We also observe that the beta of credit in relation to shares is increasingly weak, which reinforces its role of diversification.

United States: growth supports spreads

The dynamics of global credit markets remain strong, supported by business-friendly global growth. The U.S. economy continues to outperform with growth in 2024 exceeding its trend, a key element in assessing global risks. We do not anticipate significant change in this environment for the coming quarters. The rate reduction cycle of central banks on a global scale also favors credit spreads, creating a favorable environment for investors to return to this asset class. This dynamic, which has supported the balance between supply and demand over the past eighteen months, is expected to continue in 2025. Investment grade (GI) bonds are expected to continue to attract investors looking for stability and moderate returns. This segment benefits from solid fundamentals, with generally well-capitalized company balance sheets and prudent debt management. Companies with high international exposure could take advantage of a strong dollar and abundant liquidity in USD, thus strengthening their attractiveness. IG bonds with intermediate maturities (5-7 years) offer an attractive balance between yield and sensitivity to rate movements. High yield bonds offer moderate risk premiums, sometimes poorly reflecting degraded sector prospects and an increased likelihood of defaults related to still demanding financing conditions. Low-rating companies, especially in the energy and durable goods sectors, could be vulnerable to a slowdown in economic growth. However, the new administration should take a proactive approach to support growth, which would limit an excessive increase in credit spreads. Short-term high yield bonds offer an attractive compromise between return and risk in an uncertain environment.

Eurozone: economic risks weigh on the most vulnerable

In the euro area, the growth momentum is threatened, and we believe that the credit spreads of the lowest ratings could suffer. Since the cyclical peak of risk premiums in October 2022, the margin of tightening spreads has decreased, especially for issuers rated BB and B. The bulk of the decline in rates of return is expected to come from the reduction in risk-free rates, driven by the action of the central bank. Although we are not expecting a recession, we identify a risk of a deterioration in growth, due to potential political changes in France and Germany, as well as a renewed trade barriers. After an exceptionally strong performance of corporate credit in 2024, supported by strong technical fundamentals, resilient bases and a macroeconomic context largely unchanged thanks to the outlook for rate cuts, the foundations of tight spreads and compressed volatility are beginning to change, and the signals of turbulence are intensifying as 2025 approaches. The new emissions for the European GI in 2025 would amount to 575 billion euros, a moderation compared to the record pace of 2024. In terms of net issues, we expect a material decrease in volumes in 2025, with most of the issues being used to repay about €350 billion in debt coming to maturity next year. For HY, the new European HY emissions in 2025 would be 110 billion euros, marking a slight increase compared to 2024. This dynamic is driven by increased needs for fixed-rate refinancing. Given the compression of valuations between ratings, we recommend increasing quality within the sectors and favoring selective exposure to credit rather than significant risks that are not sufficiently remunerated. We prefer short-term high yield bonds because of their relatively attractive portage.

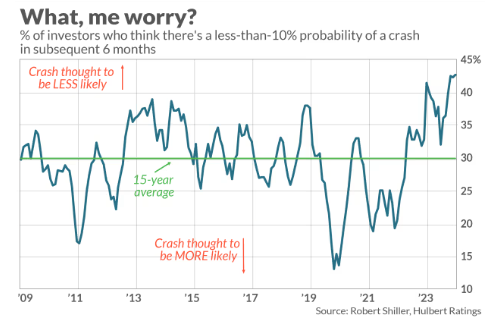

Actions: companies have been able to adapt

A record percentage of 56% of U.S. consumers expect share prices to rise over the next 12 months. At the same time, the cycle-adjusted price/earnings ratio of the S&P 500 index has reached its highest level since the Internet bubble. This situation is unprecedented. In addition, 43% of investors, an unprecedented figure, believe that there is less than 10% chance that a stock market crash will occur in the next six months.

United States: Valoration is not the main driver

The “nominations” do not seem to have amplified the impact of Donald Trump’s initial program. For example, negative trends in the health sector or positive trends in the oil and financial sectors were already in place since Donald Trump’s comeback in the polls and have simply continued. For investors, the key will now be the nature of the decisions actually taken, and the extent to which they will be watered down in relation to electoral promises. For American companies, the Trump administration’s pro-business policy should promote an improvement in operating margins, thanks to two combined effects: an increase in turnover (stimulus by the good performance of domestic demand) and a reduction in costs related to deregulation. The currently most “expensive” sectors continue to be the most sought after, including information technology and, more broadly, sectors related to the revolution of generative artificial intelligence. Conversely, sectors considered “cheaper”, such as utilities (heavyly indebted in a context of high rates), are abandoned.

Performance of the S&P 500 Sectors since the beginning of the year.

However, there are some investment opportunities. For example, the relatively cheaper financial sector could fully benefit from a deregulation dynamic, in particular with a questioning of the implementation of the Basel III agreements, despite their promotion since the mini-crisis of American regional banks in the spring of 2023. The real estate sector, for its part, could benefit from a continued relaxation of monetary conditions. While the “MAG 7” carried the indices this year and accounted for almost half of the gains, the question of the risk of concentration of the US market arises. The 10 largest capitalizations now represent 36% of the S&P 500, compared to 20% on average in recent decades. Beyond this concentration, there is also the question of the valuation of these companies and their ability to maintain the frantic pace of growth shown in recent years. For the time being, the model is not being questioned, and we remain positive about these values, even if we believe that their dominance could gradually fade.

Recall that the earnings per share growth gap (BPA) between these values and the rest of the S&P 493 reached 30% in 2024 and 40% in 2023. We believe that the small and mid caps segment should be privileged in this context. If a scenario similar to that of 2016 (Trump’s first election) is repeated, the confidence of small and medium-sized enterprise leaders (SMBs) is expected to increase rapidly.

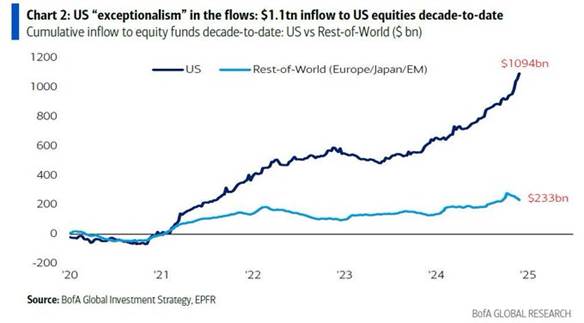

U.S. stocks recorded an inflow of $141 billion last month, the largest monthly inflow in history.

Streams to U.S. stocks versus the rest of the world

Europe: an attractive valuation but justified for the moment

European markets are significantly undervalued, largely due to the multiple uncertainties that weigh on France and Germany politically, as well as on the entire region geopolitically. The war in Ukraine and trade tensions with the United States and China have particularly affected the valuations of the companies concerned.

Although many risk factors are already integrated into the prices, a sustainable appreciation potential can only be released with a substantial pullback from these uncertainties. Some support exists on a global scale, but until the ECB adopts a more assertive position to stimulate growth, investment flows will remain limited. A possible ceasefire in Ukraine, negotiated by Donald Trump, could be a significant catalyst.

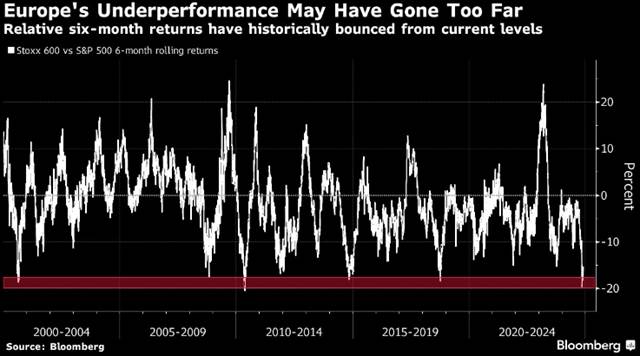

The central question remains to what extent a potential trade war is already integrated into European stock prices. Currently, Europe is trading with a 40% discount compared to the United States and this year recorded the strongest underperformance ever observed in terms of dollars.

6-month relative performance of European stocks versus S&P500

For the moment, some industrial flagships of the “old Europe” remain at the heart of the uncertainties. In the industrial sector, the loss of competitiveness is particularly marked for energy-intensive segments, such as chemicals. This situation results in particular from the war in Ukraine and the loss of low-cost Russian gas supply by pipeline. The entire European automotive industry (manufacturers and equipment manufacturers), facing a faster and more intense technological transition in the euro zone than in the rest of the world due to the implementation of the Green Deal and the objectives of electrification of the car fleet, is particularly vulnerable to low-cost Chinese competition. Given the dynamism of the American economy, contrasting with the gloom of European domestic demand, the companies in the Old Continent most exposed to the American domestic market enjoy a significant competitive advantage over their counterparts more oriented towards the European market. By 2025, the implementation, or at least the realization of the vision of the Draghi report, could be well perceived by the markets. Unlike the United States, the ecological transition in Europe could be seen as an opportunity for economic growth.

In the short term, we remain moderately pessimistic and wait for the next meeting of the ECB to assess its consideration of new risks. Overall, we remain cautious about the euro zone compared to the United States.

3 investment themes emerge on the stock markets:

- The American economic outperformance compared to the rest of the world

- Trade wars (attention to the sectors in the crosshairs of Trump’s latest statements – automotive, non-ferrous metals, textiles, computer equipment, office automation and telecommunications)

- Geopolitics (rearmament supports the defense sector, a possible armistice in Ukraine to be monitored because it would benefit the construction and infrastructure sector)

In terms of sectors:

- In the United States:

- No area of special attention but opportunities within each of these sectors

- + Finance (repentification, deregulation), + oil services (Trump’s drilling policy at all costs), + defense (rearmament), + residential real estate (rate lower, deregulation)

- In the Euro Zone:

- Deterioration of the economy: attention to discretionary consumption, commercial real estate, distribution

- Intensifying the trade war: watch out for cars, food and drinks

- Difficulties in China: beware of luxury

- + Defense, + actors exposed in the USA

- Switchover in the event of an armistice in Ukraine (to construction, infrastructure)

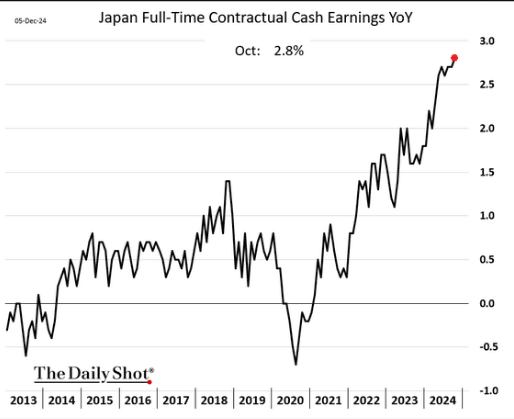

Japan: a monetary clarification is necessary

We maintain an underweight of Japanese stocks in the short term, although the year 2025 may hold good economic surprises. Japan has recently gone through a period of political instability marked by significant changes within its government. We await a clarification of the monetary policy of the Bank of Japan (BoJ). Currently, the President of the BoJ, Mr. Nakamura, expresses reservations about wage increases and advocates caution regarding raising interest rates. This position could further weaken the currency and lead to abrupt interventions to support it. We prefer to wait for a more opportune time to strengthen our position.

Annual salary growth in Japan

Emerging: Customs turbulence is no longer a surprise

China: the politburo will put pressure

China’s main leaders plan to relax monetary policy and expand tax spending next year, as Beijing prepares for a second trade war with Donald Trump, who will take office next month. The Politburo adopts a “moderately accommodating” monetary position for 2025. This is a change in their position on monetary policy for the first time in 14 years. This strategy reflects the urgency of accelerating the easing policy already adopted by the People’s Bank of China, after the expected post-pandemic economic rebound did not materialize. China must “vigorously” stimulate consumption and increase domestic demand “in all directions,” according to the official news agency of the People’s Republic of China, citing the Politburo. This priority answers a crucial question on which investors are focusing to improve the country’s growth prospects.

China is going through a massive transformation: the engine of its growth is moving from real estate to the cutting-edge industry, household savings are reaching unprecedented levels, and the energy transition is underway. On November 25, Donald Trump announced on his social network Truth that he would impose an additional 10% tariff duties on imports from China, as well as 25% duties on those from Mexico and Canada, unless these countries control the flow of fentanyl and illegal migrants to the United States. These additional tariffs on Chinese products are aligned with our scenario for 2025. Chinese actions are facing contradictory forces: a more favorable domestic policy and a new series of tariffs imposed by the United States. Regarding the latter, the timing, magnitude and response of China remain uncertain. Beyond tariffs, other restrictive measures, such as portfolio flows or export restrictions, could also have a negative influence on stock prices. At the same time, these tariffs could trigger additional budget support. The meeting of the National People’s Assembly (NPA) in March will be a key event to watch. The last season of results confirmed a gradual stabilization of profits, while valuations remain generally reasonable despite the market rebound, and investor positions are limited. We remain constructive on this area.

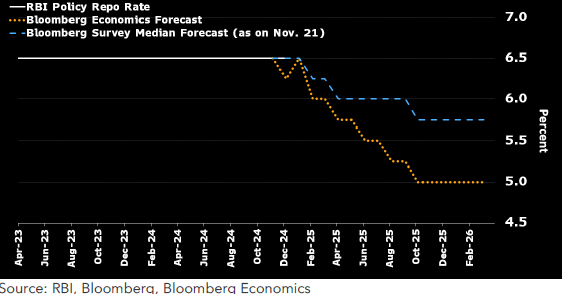

India: disinflation should materialize in 2025

As for India, we had moderated our perception compared to our strongest conviction at the beginning of the year. In October, inflation, at more than 6% (upper tolerance limit set by the RBI), had far exceeded all expectations. The Indian central bank has maintained its repo rate at 6.5% for the eleventh consecutive time, in line with our forecasts. This decision was guided by exceeding the upper limit of its inflation tolerance range (2% to 6%) in October and by a rebound in activity after the low observed between July and September. We expect a downgrade cycle of 150 basis points starting in February, reducing the terminal policy rate to 5% by the fourth quarter of 2025 to drive growth. This would imply a transition to an accommodative position during the second half of 2025. The Minister of Commerce and the Minister of Finance have expressed the need to reduce rates. In addition, the planned change of the head of monetary policy research in January could increase the pressure for a rate cut. At this stage, monetary policy remains excessively restrictive. We anticipate a limited recovery in the coming months. We now remain more optimistic about the coming disinflation. Food inflation began to decline in November, which should allow a reduction in risk premiums in the area.

RBI Rate Reduction Forecast

Currenties: the hegemony of the US Dollar

Dollar: a buying pressure justified by fundamentals

The movement from 1.08 to 1.05 correctly reflects Donald Trump’s victory and the perception of the application of his potential program. Several announced measures are aimed at strengthening the competitiveness of the U.S. economy and limiting the decline in inflation. At this point, a large part of these elements already seems to be integrated into the prices. However, a potentially higher interest rate differential in favour of the dollar zone is not yet fully valued. The European Central Bank should accompany the slowdown in the euro zone with a larger rate cut than what the market currently anticipates. For its part, the Fed could observe the effects of Trump’s new policy and be forced to slow down its monetary easing. This gap between the monetary policies of the two zones could increase the pressure on the euro and bring the euro-dollar rate back to parity by the end of 2025.

Economic surprises between the US and the Eurozone

Yen: pressure on the Central Bank

The yen, like the euro, could remain under pressure due to higher US rates. Investors will continue to take advantage of a very favourable rate differential between the dollar zone and Japan. The “carry trade” positions put in place for several quarters should remain attractive.

Unless the Bank of Japan (BoJ) makes a real increase in its rates while the Fed does the opposite, the pressure on the Japanese currency will remain strong. Another limitation to this dynamic would be a more frequent intervention by the BoJ on the foreign exchange market to support its currency. Although she has already experienced this approach on several occasions, the results turned out to be mixed, also creating extreme volatility.

USD–JPY

Oil: the need for low oil

We do not change our negative view of oil in 2025. Donald Trump’s victory marks a crucial turning point for U.S. energy policy. In 2024, the United States remains one of the world’s leading producers of oil and natural gas thanks to progress in fracking mining. Energy is obviously a sensitive issue for Americans, accounting for about 7% of the consumer price index. This is particularly the case for gasoline prices, which account for about half of household energy bills. The fall in the price of oil and gas is an imperative for public opinion. Donald Trump promised to “drill, baby, drill” to halve energy costs. The choice of Chris Wright, CEO of a hydraulic fracture company, as Secretary of Energy probably reflects the general direction: to liberalize and produce more. The Inflation Reduction Act of 2022 imposed significant constraints on the U.S. oil industry, including the introduction of a methane tax, set at $900 per ton in 2024, then increased to $1,500 per ton in 2026. This announced liberalization is likely to lower the average break-even threshold for a barrel of oil, estimated at $60. We believe that Donald Trump sees in the decline in energy on the one hand a way to counter the inflationary effects of his program and satisfy the consumer and on the other hand as a pressure on Russia and Iran. Attention remains focused on economic data from China, the world’s leading importer of black gold, whose success or failure of the economic recovery could greatly change oil prices in the coming months and undermin the deinflationary scenario for 2025. OPEC+ is currently constrained between the need to maintain market share and preventing prices from falling above the USD 60 per barrel threshold. The organization postponed on 5/12 the increase in its production quotas to the end of March 2025

Statement by the Secretary General of OPEC