1. ECB: Further Rate Cuts Well Underway

2. SNB: Approaching Zero Rates

3. China: Awaiting Commitment to Greater Support

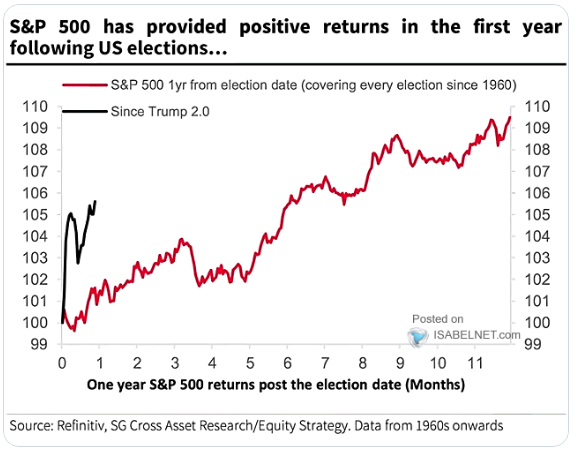

4. Chart of the Week: Since 1960, the S&P 500 has shown a tendency for positive performance post-election.

ECB: Further Rate Cuts Well Underway

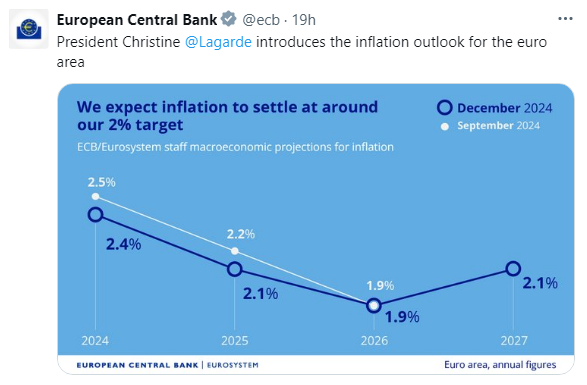

During its final monetary policy meeting of the year, the ECB cut its key interest rates by 25 basis points (to 3% for the deposit rate) for the fourth time in 2024 and the third consecutive time. While the commitment to maintain restrictive rates for as long as necessary to curb inflation was removed from the statement, Christine LAGARDE justified this shift by explaining only that inflation risks are now more balanced.

The ECB removed from the statement the commitment to “keep key rates at a sufficiently restrictive level for as long as necessary to achieve this objective.” It remains, of course, “data-dependent” and will make its decisions on a meeting-by-meeting basis.

ECB Inflation Forecasts

The ECB President, on the contrary, tempered the expectations of financial investors betting on rapid cuts in key interest rates, which contributed to the rise in European sovereign yields. She acknowledged that growth prospects had worsened and that a 50-basis-point cut in key rates had been discussed by ECB members during the meeting (5 of them reportedly favored it, according to press reports), but she subsequently emphasized caution regarding domestic inflation, which remains high.

Financing conditions are easing for businesses and households due to rate cuts, but “they remain tight, as monetary policy is still restrictive, while the transmission of past rate hikes to outstanding credit continues.”

Our View: According to the usual post-meeting press reports citing sources close to the ECB, members of the institution are reportedly preparing to cut key rates by 25 basis points at the next two central bank meetings, in January and March. This would represent an acceleration in the pace of monetary policy easing, and such a commitment could constitute a compromise with members who advocated for more significant rate cuts. In our view, the ECB is likely to be forced to accelerate rate cuts to bring monetary policy into slightly accommodative territory more quickly. It is worth noting that the ECB will no longer be able to rely on its balance sheet with the conclusion of the emergency purchase program. This quantitative tightening will place additional pressure on the issuance programs of eurozone member states, and the central bank might decide to increase the rate cut increment from 25 to 50 basis points if economic prospects deteriorate further. This would confirm our scenario of five rate cuts in 2025.

SNB: Near zero rates.

The SNB cut its key interest rate by 50 basis points to 0.5%, with the rate on excess sight deposits reduced to 0%, the Council announced this week, adding that it remains ready to intervene in the foreign exchange market if necessary. President Martin Schlegel noted that markets anticipate a terminal rate of 0% by 2025 but avoided commenting on the SNB’s rate trajectory or the likelihood of another rate cut.

Monetary conditions were “appropriate,” he stated during his first press conference as President of the Bank, adding that there is room for further policy maneuvers, without directly addressing the possibility of a return to negative interest rates in the future. At the September meeting, when rates were cut for the third consecutive time by 25 basis points to 1.0%, headline inflation stood at 1.1% year-on-year and fell to 0.7% in November. Since then, President Schlegel has noted that “downside risks to Swiss inflation are greater than upside risks.” Policymakers aim to maintain an appropriate stance without lagging behind developments. “We want to act early enough to avoid having to overreact later,” he stated.

The rate cut came as inflation decreased in the last quarter, with an annual rate below the September projection. Without Thursday’s decision, the projection would have been “even lower,” the statement indicated. However, Martin Schlegel affirmed that the SNB does not expect inflation to turn negative on a quarterly basis, although it has lowered its 2025 forecast to just 0.3%. While it is possible that monthly inflation measures could enter negative territory, the Council would look beyond “temporary deviations” from target levels

Without committing to a future path of rate cuts, the SNB stated that it is ready to act if necessary to keep inflation aligned with price stability. “The SNB will continue to monitor the situation closely and adjust its monetary policy as needed to ensure that inflation remains within the range compatible with medium-term price stability,” the statement said. Even with the current low key rate, there appears to be significant room for further cuts, as Schlegel noted that negative rates remain an available tool.

In September, the Council indicated that no changes were planned to the SNB’s foreign exchange intervention policy, particularly due to the “strong influence of foreign developments on Swiss inflation,” reiterating its commitment to containing the franc’s appreciation.

Our View: We anticipate further deflationary elements next year, such as easing energy prices or a reduction in the benchmark mortgage rate, which should feed through to rental levels. Martin Schlegel delivers a clear signal of a determination to combat insufficient inflation on par with that of his predecessor. This is, in fact, the first monetary policy announcement of the SNB under Schlegel’s leadership, who has served as Chairman of the Bank’s Governing Board since October 1. It also underscores that the SNB views the trend of Swiss franc appreciation and its consequences as highly risky. Although the ECB is unlikely to reach Swiss levels of interest rates, it will also need to implement regular rate cuts. Inflationary pressure is likely to continue weakening gradually. Meanwhile, moderate economic growth should persist, prompting the European Central Bank to maintain its easing efforts. The Swiss franc’s status as a safe-haven currency remains unchallenged and is expected to stay strong against the euro. We project an EUR/CHF range of 0.90–0.95 for the next six months, with a target level of 0.94 at the six-month mark.

China: Awaiting a Commitment to Further Support

Announcements of support in China remain moderate. Financial investors had high expectations for new fiscal support in China, but these were once again disappointed following this week’s Central Economic Work Conference. This conference, closely watched by financial markets for a more substantial stimulus plan, failed to deliver convincing new measures. The lack of detailed announcements temporarily dampened market hopes, even though Beijing reiterated its intention to deploy new economic support measures aimed at stimulating household spending.

Chinese authorities reportedly intend to increase the budget deficit, continue easing monetary policy, and may raise debt levels as early as 2025 to bolster domestic demand and counteract the negative effects of trade tensions with the United States. The government has also pledged to strengthen the social protection system, particularly in healthcare and pensions. Chinese consumption remains constrained by weak domestic demand, tied to persistently low household confidence, while external momentum has so far offset the slowdown in Chinese economic activity.

The conference also serves as an opportunity for Beijing to set the official growth target for the coming year, which will only be unveiled in March during the annual legislative sessions. On this front, we anticipate that the rebound in Chinese growth will remain limited by structural vulnerabilities, including degraded household confidence, the real estate crisis, high private and public debt levels, and deflationary pressures.

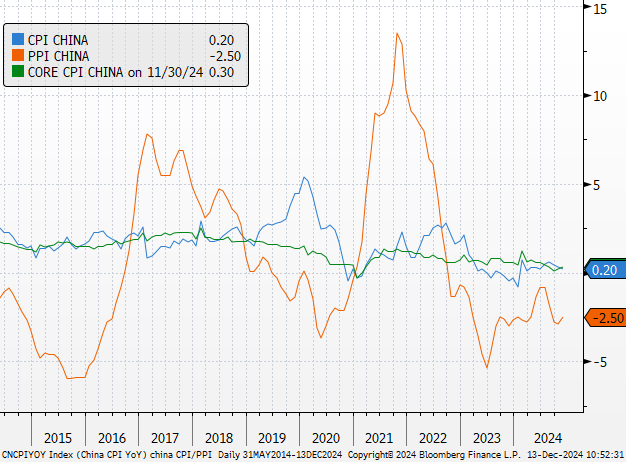

For now, deflationary pressures persist. November’s CPI inflation fell below expectations, marking its lowest point in five months and reflecting persistently weak domestic demand despite the central bank’s monetary easing measures. The weakness of the Producer Price Index (PPI), combined with lower-than-expected CPI inflation, underscores the limited impact of Beijing’s efforts so far, despite gradual improvements seen in last week’s Caixin PMI indices, particularly in the manufacturing sector.

China CPI

Our View: China is undergoing a massive transformation: its growth engine is shifting from real estate to high-tech industries, household savings have reached unprecedented levels, and the energy transition is underway. Chinese equities face conflicting forces: a more favorable domestic policy environment and a new round of tariffs imposed by the United States. Regarding these tariffs, the timing, scale, and China’s response remain uncertain. Beyond tariffs, other restrictive measures—such as portfolio flow controls or export restrictions—could also negatively impact equity prices.

At the same time, these tariffs could prompt additional fiscal support. The National People’s Congress meeting in March will be a key event to watch. The most recent earnings season confirmed a gradual stabilization of profits, while valuations remain broadly reasonable despite the market rebound, and investor positions are limited. Although volatility is likely to remain high, driven by announcements and potential disappointments, we remain constructive on this region.

Chart of the Week

Since 1960, the S&P 500 has exhibited a tendency for positive performance in the year following U.S. elections.