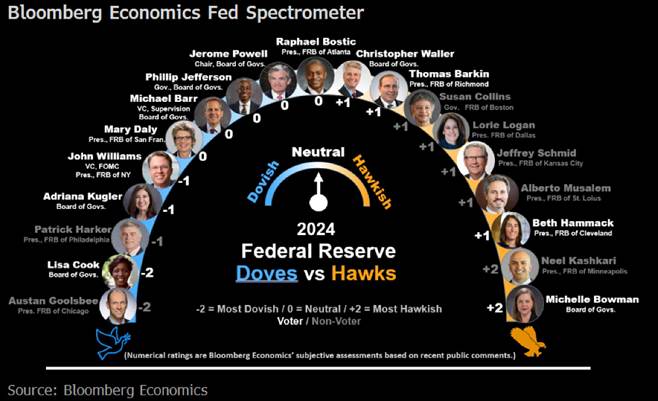

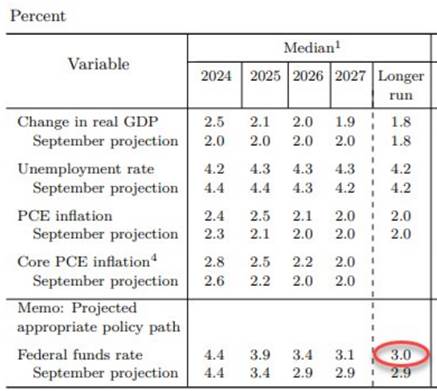

The Federal Reserve lowered interest rates by 0.25 percentage points but signaled a slowdown in the pace of easing next year to bring the benchmark rate to a range of 4.25% to 4.5%, marking a third consecutive cut. Cleveland Fed President Beth Hammack expressed dissent, preferring to keep rates unchanged. Officials’ projections for 2025 indicate fewer cuts than previously expected, reflecting their concerns about persistent inflation.

Fed Members’ spectrometer

In response to these concerns, Fed policymakers also raised their inflation forecasts for next year, sending a clearly “restrictive” message from the central bank. Following the decision announced on Wednesday, Fed Chair Jerome Powell stated that monetary policy settings were “significantly less restrictive” and that they could be “more cautious” before considering further easing.

He also noted that the December decision was “more difficult” to make than previous meetings. According to him, inflation is moving “sideways,” while risks to the labor market have “diminished.”

The Fed’s goal remains to maintain enough pressure on consumer demand and business activity to bring inflation back to the 2% target, while preserving the stability of the labor market and the overall economy.

US Inflation

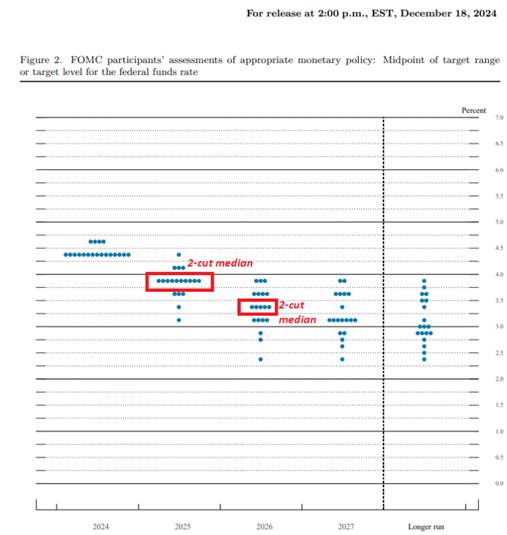

Concerns about inflation stagnating above 2% have led Fed officials to project limited rate cuts in 2025, with a total reduction of 0.5% that would bring the benchmark rate to between “3.75% and 4%.” Powell also noted that policymakers have begun incorporating assumptions regarding Trump’s proposed policies into their projections.

Four members foresee either a limited 0.25% reduction or no cuts at all for next year. By comparison, the previous projections, published in September in the “dot plot,” anticipated a total reduction of 1%.

The updated forecasts released on Wednesday show that the majority of Fed officials expect the benchmark rate to be between “3.25% and 3.5%” by the end of 2026, a level higher than previously anticipated.

Fed’s “Dot Plots”

We consider that fears regarding the labor market have eased since the 0.5% rate cut, and economic prospects have improved.

The central bank described the recent rate cuts as a “recalibration” of monetary policy, reflecting its success in bringing inflation down.

Economic Projections of Federal Reserve Members

On Wednesday, Powell stated that the Fed is entering a “new phase of the process” as borrowing costs approach the neutral rate. Fed officials have once again raised their estimate of the neutral rate, with the majority now placing it at 3%, up from 2.5% a year ago.

By indicating that the period of rapid rate cuts appears to be over and that a more gradual approach based on data will now be required, the Fed has clearly tied further reductions to more favorable inflation indicators.

Our view: In our latest market flash, we anticipated that the Fed would put pressure on the bond market during its meeting. The recalibration of expectations now allows the central bank to finalize its work in preparation for 2025. For the time being, the absence of a true reversal in monetary policy is itself relatively positive news. Inflation expectations are not rising again thanks to Powell’s rhetoric, which is a positive outcome in itself: the Fed remains credible..

5-Year Forward Inflation Expectations

Even if projections are expected to show stronger growth for 2024 than announced in September and weaker disinflation this year, this will not challenge the downward trend in rates. Jerome Powell is likely to adopt a more hawkish tone to demonstrate to the market that he remains the guarantor of price dynamics. Maintaining long-term real rates above 1.75% is his lifeline to prevent any overheating

US Real Rates

Regarding interest rates, our range for long-term bond yields (between 4.25% and 4.75%) remains unchanged for the coming months. However, if rates exceed 5%, risk assets could experience a renewed negative dynamic, leading to significant consequences for financial conditions. In such a scenario, rates would likely trend downward again.

We maintain a neutral stance on U.S. rates. The rise in sovereign yields continues to weigh on total return performance while pushing corporate bond yields higher. Nevertheless, we remain optimistic about Investment Grade and short-duration High Yield bonds, favoring carry strategies, supported by a robust U.S. economy and inflation gradually converging toward 2%.

US Rates

Finally, our opinion on the USD remains unchanged. We maintain a positive outlook on the U.S. dollar. We believe that a potentially higher interest rate differential in favor of the dollar zone is not yet fully priced in. The European Central Bank is likely to respond to the eurozone slowdown with greater rate cuts than currently anticipated by the market. Meanwhile, the Fed could assess the effects of Trump’s new policies and be forced to slow its monetary easing during the year. This divergence in monetary policies between the two regions could increase pressure on the euro and bring the euro-dollar exchange rate to parity by the end of 2025.

As for equities, our outlook remains moderately optimistic as long as there is no reversal in monetary policy. Volatility is expected to rise in 2025, primarily due to Donald Trump’s rhetoric and the risk of escalation in the trade war, along with concerns over a resurgence of inflation throughout the year. While this is not currently our base case, another inflationary wave, akin to the late 1970s, would be very challenging to contain and extremely damaging to the markets.