1. The Bank of Japan Awaits Trump.

2. Trump & Europe: Tariffs or Gas Purchases… No Choice.

3. The Fed Anticipates Trump.

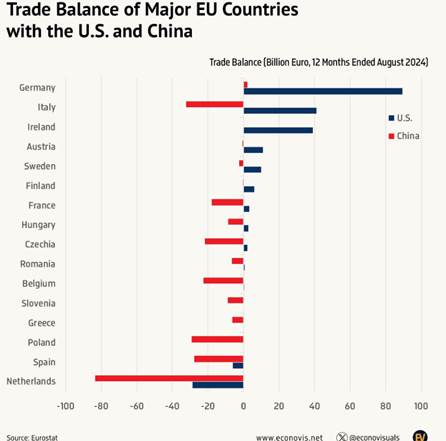

Chart of the Week: Can Italy and Germany Afford to Pay U.S. Tariffs?

The Bank of Japan Awaits Trump

The Bank of Japan (BoJ) has decided to maintain its key interest rate at 0.25% during its final monetary policy meeting of the year. While some observers anticipate a rate hike as early as January, the institution has opted for caution, citing several factors to justify this wait-and-see approach.

During the meeting, the BoJ reaffirmed that the Japanese economy continues to recover, despite local vulnerabilities, and that inflation expectations have moderately increased. However, it emphasized the need for more data, particularly on upcoming wage increases, as well as an assessment of Donald Trump’s initial economic policies before deciding on a potential rate hike.

These factors suggest that a decision could come as late as March. Preliminary results from the “Shunto” spring wage negotiations will be available by mid-March, just ahead of the second monetary policy meeting of 2025. It is widely expected that Japanese workers’ wages will continue to see substantial increases. Furthermore, with the first meeting of January scheduled just four days after Donald Trump’s inauguration, it is likely that the BoJ will wait until spring to take action.

“Uncertainty will never disappear. But over time, we will have more information that we can incorporate into our forecasts. There is a risk of falling behind if we wait too long,” stated Kazuo Ueda, BoJ governor, during a press conference.

Nevertheless, there is no guarantee that uncertainties surrounding U.S. economic policy will be resolved by the next meeting or even later…

USD-YEN

Our View: We maintain an underweight position in Japanese equities in the short term, although 2025 could bring positive economic surprises. Japan has recently experienced a period of political instability marked by significant changes within its government. We are awaiting clarification of the Bank of Japan’s monetary policy. Currently, BoJ President Mr. Nakamura has expressed reservations about wage increases and advocates caution regarding interest rate hikes. This stance could further weaken the currency and lead to abrupt interventions to support it. We prefer to wait for a more favorable moment to strengthen our position.

Trump & Europe: Tariffs or Gas Purchases… No Choice

U.S. President-elect Donald Trump has warned the European Union that it must commit to purchasing “large-scale” quantities of American oil and gas or face tariffs.“I told the European Union it needs to offset its massive trade deficit with the United States by buying our oil and gas in large quantities. Otherwise, it’s TARIFFS everywhere!!!” Trump wrote on his Truth Social platform on Friday.

Trump’s threat follows proposals already made by Brussels to purchase more American liquefied natural gas (LNG). This had been a lifeline for Europe after Russia curtailed its fossil fuel deliveries in the wake of its large-scale invasion of Ukraine. European Commission President Ursula von der Leyen stated in November that the EU would consider buying more gas from the United States. “We are still receiving a lot of LNG from Russia, so why not replace it with U.S. LNG, which is cheaper for us and lowers our energy prices,” she told reporters.

Trump has threatened a sweeping tariff of up to 20% on all U.S. imports from non-Chinese countries. Last month, European Central Bank President Christine Lagarde urged European political leaders to cooperate with Trump on tariffs and to purchase more U.S.-made products. During Trump’s first presidency, then-European Commission President Jean-Claude Juncker had proposed increasing purchases of American gas to avoid the threat of a trade war…

Post de D Trump sur son réseau social

Our View: The central question remains to what extent a potential trade war is already priced into European equities. Currently, Europe is trading at a 40% discount compared to the United States and has recorded this year its worst underperformance ever in dollar terms. For now, key industrial players from “Old Europe” remain at the heart of uncertainties. In the industrial sector, the loss of competitiveness is particularly pronounced in energy-intensive segments like chemicals. This situation is largely due to the war in Ukraine and the loss of low-cost Russian gas supplies via pipelines. The entire European automotive industry (manufacturers and suppliers), facing a faster and more intense technological transition within the eurozone compared to the rest of the world due to the implementation of the Green Deal and the electrification targets for vehicle fleets, is particularly vulnerable to competition from low-cost Chinese producers. Given the dynamism of the U.S. economy, in contrast to the sluggish domestic demand in Europe, companies from the Old Continent that are most exposed to the U.S. domestic market enjoy a significant competitive advantage compared to those more focused on the European market. We believe that the deterioration of growth prospects in the eurozone, which could worsen due to the confidence impacts of Donald Trump’s upcoming trade policies, will lead the ECB to continue cutting key interest rates in December and throughout 2025, adopting a more accommodative monetary policy in 2025.

The Fed Anticipates Trump

The Federal Reserve has lowered interest rates by 0.25 percentage points but signaled a slowdown in the pace of easing next year, reducing the benchmark rate to a range of 4.25% to 4.5%. This marks the third consecutive cut. Cleveland Fed President Beth Hammack dissented, preferring to keep rates unchanged. Officials’ projections for 2025 now anticipate fewer cuts than previously expected, reflecting concerns about persistent inflation. In response, the Fed policymakers also raised their inflation forecasts for next year, delivering a clearly “restrictive” message. Following the decision announced on Wednesday, Fed Chair Jerome Powell stated that monetary policy parameters are “significantly less restrictive” and that policymakers could adopt a “more cautious” approach before considering further easing. He also noted that the December decision was “more challenging” than previous meetings. According to Powell, inflation is moving “sideways,” while labor market risks have “diminished.”

The Fed’s objective remains to maintain sufficient pressure on consumer demand and business activity to bring inflation back to the 2% target, while preserving labor market and overall economic stability. Concerns over inflation stagnating above 2% have led Fed officials to forecast limited rate cuts in 2025, with a total reduction of 0.5%, bringing the benchmark rate to between 3.75% and 4%. Powell also mentioned that policymakers had begun incorporating assumptions about Trump’s proposed policies into their projections. Four members are considering either a limited 0.25% cut or no reduction at all next year. By comparison, previous projections from September’s “dot plot” had anticipated a total cut of 1%.

Updated forecasts released on Wednesday indicate that most Fed officials expect the benchmark rate to settle between 3.25% and 3.5% by the end of 2026, a level higher than previously anticipated. The central bank described recent rate cuts as a “recalibration” of monetary policy, reflecting its success in bringing down inflation. Powell stated on Wednesday that the Fed is entering a “new phase of the process” as borrowing costs approach the neutral rate. Fed officials have again raised their estimate of the neutral rate, with the majority now placing it at 3%, compared to 2.5% a year ago. By indicating that the phase of rapid rate declines is likely over, Powell emphasized that future reductions would require more favorable data on the inflation front, signaling a more gradual, data-driven approach going forward.

Fed Rates and Futures Markets

Notre avis : We believe that concerns about the labor market have eased since the 0.5% rate cut, and the economic outlook has improved. In our latest market flash, we anticipated that the Fed would exert pressure on the bond market during its meeting. The recalibration of expectations now allows the central bank to finalize its preparations for 2025. For the moment, the absence of a real monetary policy reversal is itself relatively positive news. Inflation expectations are not rising again, thanks to Powell’s rhetoric, which is a good sign: the Fed remains credible. Even though projections are likely to reflect stronger growth for 2024 than was forecast in September and weaker disinflation this year, this will not undermine the overall downward trend in rates. Jerome Powell is expected to adopt a more hawkish tone to signal to the market that he remains the guarantor of price dynamics. Maintaining long-term real rates above 1.75% is his safeguard against overheating.

Regarding interest rates, our range for long-term bond yields (4.25% to 4.75%) remains unchanged for the coming months. However, if rates exceed 5%, risky assets could return to a negative trajectory, with significant consequences for financial conditions. In such a scenario, rates would likely start declining again.We maintain a neutral stance on U.S. rates. The rise in sovereign yields continues to weigh on total return performance while driving corporate bond yields higher. Nonetheless, we remain optimistic about short-duration investment-grade and high-yield bonds, favoring carry strategies supported by a robust U.S. economy and inflation gradually converging toward 2%.

Our view on the USD remains unchanged. We maintain a positive outlook on the U.S. dollar. We believe that a potentially higher interest rate differential in favor of the dollar zone is not yet fully priced in. The European Central Bank is expected to accompany the eurozone’s slowdown with rate cuts more significant than currently anticipated by the market. Meanwhile, the Fed might observe the effects of Trump’s new policies and be compelled to slow its monetary easing during the year. This divergence in monetary policies between the two zones could heighten pressure on the euro, potentially bringing the EUR/USD exchange rate to parity by the end of 2025. Our equity outlook remains moderately optimistic as long as there is no monetary policy reversal. Volatility is likely to increase in 2025, primarily due to Donald Trump’s rhetoric and the risk of escalation in trade wars, as well as concerns about a resurgence of inflation throughout the year. While this is not our base-case scenario, another inflationary wave akin to the late 1970s would be very challenging to contain and could severely harm markets.

Chart of the Week

Can Italy and Germany Afford to Pay U.S. Tariffs?