- House of Representatives: Another Victory for Trump

- The British Pound Under Pressure Amid Doubts About UK Fiscal Policy

- Resilience of the US Economy

- Chart of the Week: Donald Trump’s Clear Vision on Tariff Barriers!

House of Representatives: Another Victory for Trump

Mike Johnson is re-elected Speaker thanks to Trump despite Republican divisions. In a fractured House of Representatives (219 Republicans against 215 Democrats), Mike Johnson secured his re-election as Speaker on Friday, January 3, following an initial vote marked by internal dissensions. The decisive support of Donald Trump and firm budget commitments allowed the Louisiana representative to overcome resistance within his own party. This election, traditionally a formality, reflected tensions within the Republican Party. During the first round of voting, three Republican members voted for another candidate. Two of them eventually rallied behind Mike Johnson, prompted by former President Trump. “Mike will be a great Speaker, and our country will benefit. Americans have waited four years for common sense, strength, and leadership,” Donald Trump said on his Truth Social platform.

To secure this crucial support, Mike Johnson had to reassure the radical wing of his party, which accused him of being too conciliatory with Democrats and bearing some responsibility for the deterioration of public finances. From the floor, he promised “drastic cuts” to the federal budget. “We will reduce the size and scope of government to return power to the people,” he stated, making deficit control a Republican priority. These negotiations highlight a political agenda focused on reducing public spending, which could weigh on growth and sovereign interest rates. However, they may partially counterbalance measures proposed by Donald Trump, who has asked his party to swiftly draft legislation combining tax cuts, stricter border controls, and increased energy production.

To finance this ambitious program, the re-elected president mentioned an increase in tariffs. While these measures could stimulate short-term growth, they risk sustaining high inflation, forcing the Federal Reserve to extend its restrictive monetary policy. This election also served as a barometer of Donald Trump’s influence in Congress. Ahead of the vote, the former president had unreservedly endorsed Mike Johnson, calling the representative “very capable, with support close to 100%.” Even Elon Musk, who has become an influential figure in Washington following his alignment with Trump, voiced his support for the outgoing Speaker. “You have my full support,” he wrote on X in response to a message from Mike Johnson acknowledging Trump’s backing.

This re-election comes amid unprecedented turmoil in Congress. A year ago, Kevin McCarthy, the previous Speaker, was ousted by the hard right, which had already accused him of yielding too much to Democrats and worsening the deficit. His removal plunged the House into a 22-day deadlock, exposing the deep fractures within the Republican camp. For Mike Johnson, this new term as Speaker will be a trial by fire. Between pressures to cut spending, voter expectations, and Donald Trump’s ambitions, the challenge promises to be immense. But as the former president asserted, “A victory for Mike is a victory for the Republican Party.”

Our Opinion: As his inauguration on January 20 approaches, Donald Trump is demonstrating that he will have the means to carry out his policies. The president-elect has been making increasingly bold statements, as was the case again yesterday regarding foreign policy issues (Greenland, Canada, NATO military spending, renaming the Gulf of Mexico). In recent weeks, these developments have led to the reassessment of the possibility of a “hard” term under Donald Trump, resulting in a higher term premium for U.S. sovereign bonds and driving up sovereign yields. Our intervention range for long-term rates has been adjusted upwards for 2025, now between 4.5% and 5%.

The British Pound Under Pressure Amid Doubts About UK Fiscal Policy

The British pound fell by nearly 2% against the dollar this week, trading at $1.23, marking an 8% decline since last September. This depreciation comes against a backdrop of tensions over UK sovereign rates and growing investor skepticism toward the fiscal policies of Labour government leader Keir Starmer. Since the autumn 2024 budget presentation by Finance Minister Rachel Reeves, Gilt yields have surged, reflecting concerns about increased debt issuance and economic assumptions considered overly optimistic. In 2025, the UK plans to issue £300 billion in debt, including an additional £20 billion in the first quarter alone, to finance an increase in public investments. However, the fiscal room to meet the target of a balanced budget by 2030 is slim—just £10 billion, according to the Office for Budget Responsibility (OBR). The British economy is showing signs of strain: slowing activity, persistent inflation fueled by rising wages, and a Bank of England forced to keep its policy rates unchanged in December. Yesterday, the 10-year sovereign yield peaked at 4.90% before stabilizing at 4.82%, while the 30-year yield held steady around 5.45%.

Investors now doubt the feasibility of the government’s fiscal goals, which may necessitate spending cuts or further tax increases—measures likely to hinder growth. Deputy Finance Minister David Jones sought to reassure Parliament, stating, “Demand for UK debt remains strong, and the bond market is functioning in an orderly manner.” However, he confirmed that the goal of achieving a balanced budget by 2030 is “non-negotiable,” implying that budgetary adjustments may be required.While the current volatility is reminiscent of the autumn 2022 debacle, several factors mitigate the risks of a similar shock. UK pension funds and insurers are better capitalized and benefit from specific financing facilities, such as the CNRF facility established by the Bank of England to stabilize the Gilt market during periods of stress. However, the low liquidity of the UK bond market, combined with a significant increase in issuance at the start of the year, is exacerbating price movements. This week, the Treasury issued two bonds with 5- and 30-year maturities, the latter receiving the weakest demand since late 2023.

The UK faces a dual challenge: a budget deficit and a structural current account deficit, both exacerbated by the pound’s depreciation. Although a weaker currency is expected to help reduce the external deficit, it raises concerns about capital flight. Some observers fear a crisis scenario reminiscent of the 1970s, when the UK had to seek assistance from the International Monetary Fund (IMF).

UK Rates

Our Opinion: We remain cautious about UK assets. However, Gilts have followed the general decline in global interest rates. This is not September 2022, when the sudden and sharp rise in rates caused losses for certain investors managing their balance sheets through asset-liability strategies, such as pension funds. Back then, long-term rates jumped by 120 basis points in just five days, triggering margin calls and forced Gilt sales that worsened the situation. Although the trajectory of UK debt remains challenging, the correction is not linked to concerns about the UK’s solvency but rather to a broader movement of rising global rates. The OBR will update its forecasts on March 26, providing insights into the viability of the government’s fiscal plans. In the meantime, the public spending audit scheduled for June will be crucial in reassuring increasingly skeptical investors about the UK’s economic outlook.

Resilience of US Economic Growth

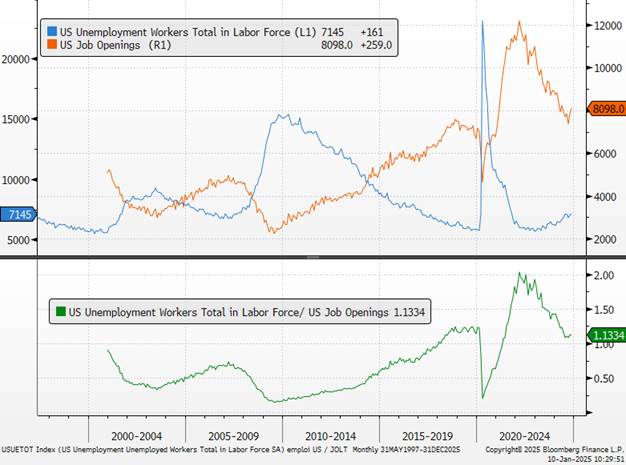

The US economy continues to surprise with its resilience, as confirmed by the December ISM Services Index (54.1 vs. 53.5 expected and 52.1 in November) and the November JOLTS report released yesterday (an increase in job openings to 8.1 million in November compared to 7.84 million in October, which was revised upward). Concerns about protectionist measures remain prominent in the minds of business leaders, as explicitly noted in the December ISM Services survey, which highlighted fears of tariff increases. This anticipation likely contributed to the sharp acceleration in the prices paid component, which rose to 64.4 (vs. 58.2 in November), particularly for electrical components and computers, where shortages persist. Nonetheless, activity remains supported by strong new orders, indicating that domestic demand still has room to grow. This positive momentum can be attributed to a still-robust labor market, as shown by the November JOLTS report. The number of job openings remains high, keeping the ratio of open positions to unemployed individuals stable at 1.1—a level just compatible with an inflation rate between 2% and 2.5%, according to Fed analyses.

These data support the more cautious tone from Fed members advocating for a slower pace of monetary easing this year (two key rate cuts). While they reiterated that further rate cuts remain on the table, several Fed members have expressed doubts about the timeline for monetary easing and emphasized the need for a pause to await further progress in the disinflation process. For now, statements from S. Collins (Boston Fed), J. Schmid (Kansas City Fed), P. Harker (Philadelphia Fed), and M. Bowman (Governor) encourage patience and maintaining current policy rates at the next Fed meeting on January 28–29. In our view, the trajectory of rate cuts will need to remain gradual and will ultimately depend on upcoming economic data. We believe the Fed will likely cut rates by 25 basis points in May. The resumption of normalization in the US labor market—after several reports distorted by temporary factors such as strikes and weather events—remains a key condition for continued monetary easing by the Fed, which has tied its next two rate cuts to a return of inflation toward its 2% target. Furthermore, this is necessary for a decline in US sovereign yields.

The potential for further Fed rate cuts will, however, be constrained by Donald Trump’s economic policies, which are expected to be more inflationary. The first measures adopted by his administration in its early days in the White House will be closely scrutinized, particularly given the heightened concerns of recent days. If these measures turn out to be less radical than the future president has indicated, especially in terms of trade, immigration, or fiscal policy, it would be favorable for a decline in sovereign yields. Strong economic data and the Fed’s cautious stance have led financial investors to believe that the US central bank may not have room to lower rates further, especially in a context where trade conflicts could reignite inflationary pressures, keeping sovereign yields at very high levels. To reverse this trend, beyond the prospect of a softer policy than Trump’s recent statements suggest, clear signs of continued normalization in the labor market will be essential.

US Job Openings

Our Opinion: Beyond tariffs, it is Donald Trump’s immigration policy that raises questions for the Fed. Trump’s restrictive immigration policy risks causing labor shortages, which would accelerate wage growth, making the new administration’s policies inflationary—even before accounting for tariffs. In terms of monetary policy, the greater risk lies in a halt or pause in the monetary easing initiated by the Fed. The more inflationary environment will likely force the Fed to adopt a slightly more restrictive policy than currently anticipated. For now, headline inflation, as measured by the PCE index, came in below expectations at +2.4%, while core inflation (“core PCE”) recorded one of the smallest monthly increases in recent years. However, on an annual basis, core PCE remains stuck at 2.8%, a level it has deviated from very little throughout 2024. The Fed clearly shifted its tone at the end of the year, and we anticipate a maximum of two rate cuts this year.

Chart of the Week

Donald Trump’s Clear Vision on Tariff Barriers