While justified doubts persist in the United States, many investors are questioning whether, in the Eurozone, inflation’s ability to sustainably return to target levels in 2025—and thereby enable a significant reduction in interest rates—is still a realistic prospect. The ECB, for its part, appears very confident…

We believe that recent economic data and the European Central Bank’s assessments provide fairly strong reasons to expect a gradual return to inflation close to 2%. This evaluation is based on three key pillars: the evolution of inflation expectations, underlying dynamics, and the robust transmission of monetary policy.

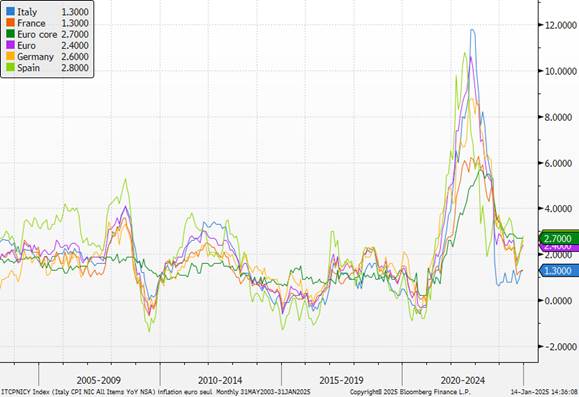

According to the ECB’s updated projections from December 2024, overall inflation is expected to reach 2.1% in 2025, following an average of 2.4% in 2024. This reduction reflects a significant decline in core inflation, which excludes energy and food prices.

EUROZONE inflation

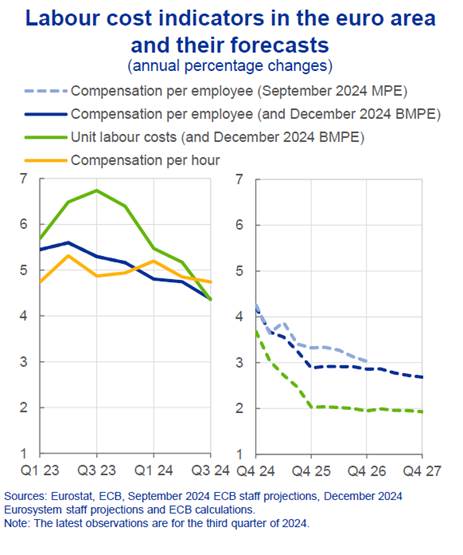

Several factors support this trend, notably the slowdown in wage pressures (with unit labor cost growth declining to 2.6% in 2025, compared to 4.7% in 2024). Demand for labor is clearly moderating. Additionally, energy prices, after having significantly contributed to inflation in 2022 and 2023, have partially stabilized. The risks of sudden new increases appear limited. At the same time, market indicators, particularly inflation-indexed swaps, confirm a widespread expectation of stabilization around 2% in the medium term…

Furthermore, underlying dynamics are moderating. In the short term, data points to a slowdown, but favorable conditions for a modest recovery in growth are present. While structural factors have weighed on the economy, particularly in the manufacturing sector, the weak productivity growth since 2022 also reflects cyclical elements, stemming from past restrictive monetary policy and weak external demand.

Core inflation is following a trajectory aligned with the ECB’s medium-term target. In particular, trend indicators, such as the Persistent and Common Component of Inflation (PCCI), remain close to 2%.

Persistent and Common Component of Inflation

Service inflation, driven by high wage pressures, is showing clear signs of moderation. The seasonally adjusted quarterly inflation rate fell from 3.4% in October to 2.6% in November 2024, indicating a downward trend. Profit margins, which had been elevated during the period of high inflation, are gradually normalizing. This is mitigating the second-round effects on prices.

Even though domestic demand remains supported by rising real incomes, thanks to lower inflation and a stable labor market, this combination of factors reduces the risks of an inflationary spiral.

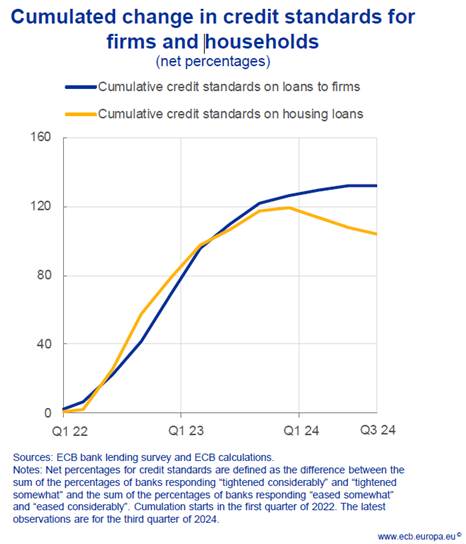

Finally, the transmission of monetary policy appears to have been effective. The ECB undertook significant monetary tightening starting in 2022, with the deposit rate peaking at 4% before being gradually reduced to 3% by the end of 2024. This cautious approach aims to secure the decline in inflation while avoiding excessive economic slowdown. The effects of this tightening are now becoming visible.

ECB rates and expectations as of June 2025

After a sharp slowdown, private sector credit is showing signs of stabilization, with annual loan growth to businesses reaching 1.2%.

This gradual transmission helps reduce inflationary pressures without compromising economic growth prospects.

Exogenous factors can still arise, notably a significant increase in energy prices or an excessive depreciation of the euro. Heightened uncertainty regarding trade policy tends to have significant and persistent negative effects on Eurozone activity, while the actual impact of tariff increases is harder to pinpoint. Generally, trade uncertainty reduces inflation, but higher tariffs could have a slight inflationary effect. The re-election of Trump could pose a significant risk to Eurozone growth. The negative effects on economic activity would be more pronounced than any inflationary pressures, justifying four additional ECB rate cuts in 2025.

The supply shock Europe suffered is not so distant, and its scars remain fresh in people’s minds. The central element of the disinflationary scenario undoubtedly relies on wage moderation in 2025, which will also translate into consumption moderation. The risk to this scenario would be an external shock resulting in imported inflation that cannot be managed through monetary policy.