The 3 must-know news stories of the week

1. China: Growth Target Achieved

2. US Inflation: Good News Awaiting Fed Confirmation

3. US Banks Operating at Full Capacity

Chart of the Week: Retail Investors’ Stock Holdings Rate!

China: Growth Target Achieved

The Chinese economy is showing signs of recovery, driven by industrial production and exports. China’s Q4 GDP was released this morning and exceeded expectations, rebounding compared to the previous quarter with sequential growth of +1.6% versus +1.3% in Q3-24 (an annual growth rate of +5.4%).This positive momentum is largely attributed to the beneficial effects of stimulus measures announced and implemented since the summer (interest rate cuts, consumer subsidies, support for local governments), which were necessary to help China achieve its 5% growth target set by the government for 2024, given the weakness of domestic activity since the start of the year.

In detail, growth in 2024 was driven by the industrial sector and foreign trade, particularly towards the end of the year, in anticipation of a return to global trade tensions following D. Trump’s inauguration, as evidenced by the sharp rebound in industrial production in December (+6.2% year-on-year vs. +5.4% in November). In this context, the challenge for authorities lies in reigniting domestic consumption momentum to offset the anticipated slowdown in foreign trade, as noted by the statistics bureau representative.In this regard, December retail sales send favorable signals, rebounding to +3.7% year-on-year, supported by the equipment and automobile exchange program, even though they remain weakened by structural vulnerabilities reflected in low inflation. The rise in the unemployment rate to 5.1% in December remains one of the most concerning factors for Chinese households. Attention will now focus on the economic momentum during Chinese New Year festivities (January 28 to February 4) and announcements following the annual parliamentary meetings in March, where economic targets will be formalized (particularly the 2025 growth target and potential new fiscal support measures).

Our Opinion: The measures taken by the government appear to be yielding results, even though the economy is still far from regaining strong momentum. It remains dependent on continued monetary policy easing and strengthened fiscal support. The country experienced a notable economic rebound at the end of last year, but the prospect of higher U.S. tariffs calls for caution in 2025. Exports, one of the few bright spots, may lose steam with Donald Trump’s return to the White House. The U.S. president-elect promised a significant increase in tariffs on Chinese goods during his election campaign. Chinese authorities have committed to further stimulating the economy this year, but the scope and scale of China’s measures could depend on how quickly and aggressively Donald Trump implements tariffs or other punitive actions.

US Inflation: Good News Awaiting Fed Confirmation

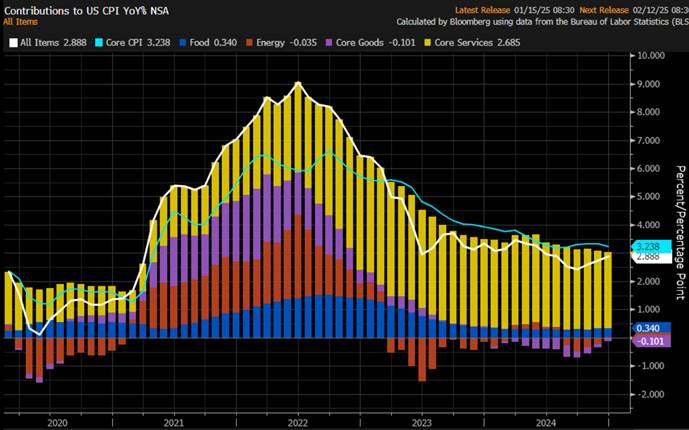

At last, there is some good news on the inflation front. U.S. price increases accelerated in December but were in line with expectations (+2.9% year-on-year versus 2.7% in November). This rise is largely due to less favorable energy-related base effects.The positive takeaway from this report is that core inflation (core CPI) finally declined to 3.2% year-on-year after three months of stagnation at 3.3%. Several components contributed to easing core inflation in the U.S. Goods prices rose only modestly, up +0.1% month-on-month, despite still-elevated used car prices, which increased by +1.2% month-on-month. While service price increases remain too high, they have shown a gradual overall moderation for the fourth consecutive month. Housing costs (“shelter”), which carry significant weight at 36.7% of the overall inflation index, saw a slight moderation for the third consecutive month. This represents a meaningful source of disinflation for the U.S. Federal Reserve.

With favorable base effects expected next month, a further decline in core CPI for January is anticipated. The resumption of the disinflation process after several months of stagnation has been welcomed by Fed officials, who expressed confidence in the continued slowdown of inflation.“The disinflation process is underway. But we are still not at our 2% target, and it will take time to achieve it sustainably,” said John Williams, President of the New York Fed.

Many indicators suggest that the labor market remains robust, reducing the urgency for Fed officials to continue cutting rates. A monthly report from the Bureau of Labor Statistics (BLS) showed that nonfarm payrolls increased by 256,000 in December, the highest in nine months, and the unemployment rate slightly decreased to 4.1%. Consumer surveys have recorded an increase in inflation expectations measures.The disinflation process is progressing, but the Fed has yet to achieve its 2% target, and it will take more time to reach it sustainably. The Fed remains patient and committed to completing its work.

Contributions to US Inflation

Our Opinion: As we have been writing for several weeks, the rebound in yields has become a genuine source of concern, both for consumers and for governments facing a heavy debt burden. At this stage, any slight downside surprise in inflation or even in economic data could be positive for risk assets. The yield on 10-year Treasury bonds has been extremely sensitive to relatively minor changes in outlook. The key for markets is to avoid a scenario where monetary policy is reversed due to uncertainties surrounding fiscal, trade, immigration, and regulatory policies. At this stage, the Fed is expected to lower its key interest rates twice this year (the first time in July 2025). However, for this trend to continue, confirmation will be needed during Donald Trump’s inauguration speech on Monday, January 20, and in the days that follow, that he will implement his program in a more moderate manner, thereby reducing inflationary risks. Fed members remain highly attentive to the decisions Donald Trump will make once he takes office on January 20.

US Banks Operating at Full Capacity

The major American banks have just released their Q4 2024 results, marking a year-end characterized by economic resilience and interest rate tensions. Early indications of the health of the banking sector come from the United States, and they are positive. JPMorgan, Citi, Goldman Sachs, and Bank of America—four of the largest international American banks—demonstrated in their annual results that the positive signals they had sent in Q3 2024 remain relevant through year-end.

JPMorgan reported its highest-ever annual earnings, exceeding $58 billion. This impressive figure sets a record, with net income surpassing $14 billion for Q4 alone. “Every line of business delivered strong results,” said CEO Jamie Dimon in a statement. Investment banking activities, bolstered by the volatility tied to the U.S. presidential election, generated a 49% increase in revenue compared to Q4 2023.

Citi showed a similar trend, with net income for 2024 rising 40% to $12.7 billion. “We entered 2025 with momentum across all our businesses,” commented Jane Fraser, the group’s CEO, in a statement.

Bank of America (BofA) announced Q4 profits that exceeded expectations, joining other U.S. banks in benefiting from a dynamic period in transactions and trading. BofA more than doubled its net earnings compared to the same period in 2023, reaching $6.7 billion. This increase was partly amplified by the absence of a payment BofA had made in 2023 to replenish the federal deposit insurance fund following the regional banking crisis. Sales and trading activities reached record revenues in 2024. BofA also reported a strong performance from its consumer base, which remained resilient despite high borrowing costs. Consumer spending on its debit and credit cards was 5% higher compared to the same quarter the previous year. Loan growth was particularly strong in credit cards and medium-sized corporate borrowing.

Goldman Sachs exceeded expectations, reporting “strong results” across all its business lines, significantly surpassing market forecasts. The bank benefited from an increase in managed assets and higher activity in its Global Banking and Markets division. Revenue for the last three months of the year reached $13.87 billion, a notable 23% year-on-year increase and well above expectations.CEO David Solomon expressed satisfaction, stating, “We are very pleased with our strong results for both the quarter and the year. I am particularly encouraged that we have exceeded nearly all the goals we set five years ago, resulting in a nearly 50% increase in our revenues over that period.” The Global Banking and Markets division, which represents over 60% of the bank’s revenue, posted a 33% increase in results for the quarter compared to the same period a year earlier, driven by a nearly 25% rise in commission fees. The Asset and Wealth Management branch also grew by 8% during the quarter, benefiting from an increase in managed assets and the associated management fees.

Normalized Performances of JPMorgan, Citi, BofA, and Goldman Sachs Compared to the S&P 500

Our Opinion: It is clear that the recovery of the U.S. commercial real estate sector remains uncertain, but the support for activity in 2025 remains strong for the American banking sector. While some players have emerged stronger from this period, others are struggling to find their footing in a complex financial environment. The outlook for U.S. banks appears particularly favorable in the coming months. First, mergers and acquisitions activity is expected to increase this year, which will boost advisory and financing revenues. Second, while lower interest rates may compress net interest margins—i.e., the difference between a bank’s funding costs and the interest income from its loans—this trend is expected to encourage a credit rebound in the second half of the year in the U.S. Provisions for potential credit losses could be largely offset by the increased revenues generated by higher activity levels. The election of Donald Trump has given the banking sector a boost. The president-elect and his advisors have expressed support for easing regulations. The implementation of Basel III accords could be significantly watered down, freeing up more capital for banking institutions..

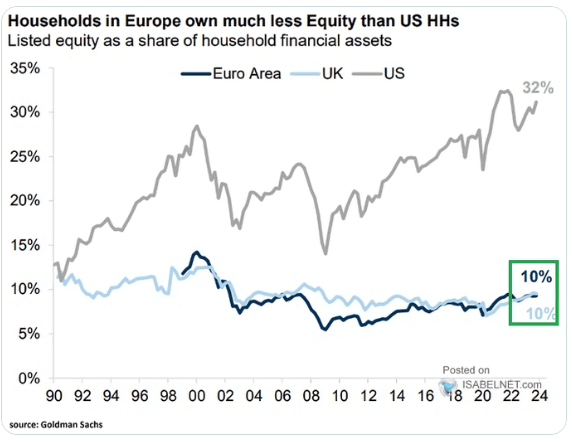

Chart of the week

Compared to American households, Europeans have lower stock ownership rates. This discrepancy can be attributed to cultural attitudes toward savings, structural differences in pension systems, and a stronger preference for liquid investments…