Today, Donald Trump will officially be inaugurated as the 47th President of the United States. A decisive turning point for American politics and the future of bilateral relations with the European Union.

Donald Trump’s inauguration for his second term, scheduled for January 20, 2025, promises to mark a shift in the economic and geopolitical policies of the United States. With a packed agenda and a limited window of opportunity—this being his final term allowed by the Constitution—Trump is set to implement bold but controversial measures. During a final major rally yesterday in Washington, he reiterated that the beginning of his term would be marked by the use of numerous executive orders to act swiftly. He aims to launch a massive wave of deportations, rapidly reduce regulations and bureaucracy, and bring an end to the war between Ukraine and Russia.

The first 100 days will be crucial. Approximately 100 executive orders are expected to be signed, covering topics such as immigration, trade, deregulation, and administrative reforms. However, the dramatic announcements and divisive rhetoric risk fueling increased volatility in financial markets. This period presents as many opportunities as risks. Trump’s proactive approach aimed at fostering economic growth and market performance is expected to support certain sectors.

Donald Trump’s communication on TruthSocial.com

Energy policy remains the cornerstone of Trump’s economy. Trump has a clear ambition: energy must become a lever for economic growth and a geopolitical tool. By withdrawing the United States from the Paris Agreements, reopening federal lands to fossil fuel production, and lifting restrictions on liquefied natural gas exports, his administration aims to achieve a triple objective: 3% GDP growth, a budget deficit capped at 3%, and an increase of 3 million barrels of oil per day.

This strategy is not without risks. Competition with OPEC producers and China could intensify trade tensions while triggering a market share war.

Oil production: US, Saudi Arabia, Russia

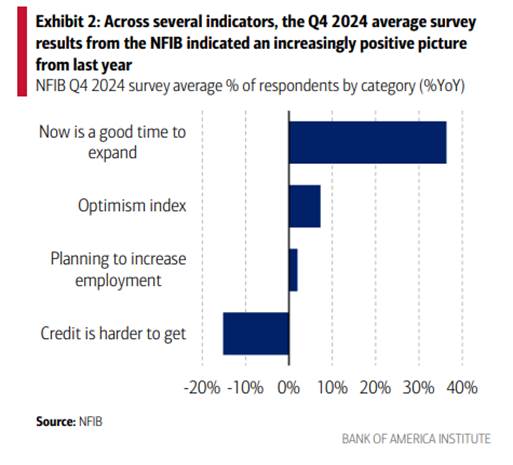

Another pillar of Trump’s agenda is the reduction of administrative regulations. Compliance costs, estimated at $1.4 trillion under the Biden administration, are expected to decrease through reforms targeting the finance, healthcare, and business permitting sectors. Efforts will also be made to eliminate up to 10 regulations for every new rule enacted, although this goal appears ambitious given legal timelines.

This approach could revitalize the small business sector, with a notable increase in entrepreneurial optimism. On the corporate side, optimism has rebounded sharply following the U.S. presidential election. December’s ISM manufacturing data shows a recovery, with the overall index rising to 49.3, while the “new orders” component reached 52.5, its highest level in a year. Signs of positive growth are on the horizon, with small business optimism exceeding the average, according to the NFIB.

The past two years have been disappointing for the U.S. manufacturing sector. Despite extensive fiscal programs designed to support the industry, domestic production has stagnated. We believe the new year will mark a turning point, and manufacturing output will rebound. We anticipate favorable conditions for the manufacturing sector. Business confidence has surged following Trump’s election, and manufacturers are optimistic about their production prospects.

Equipment spending is expected to benefit from the factory construction boom observed over the past three years, with private companies investing nearly one trillion dollars in these subsidized industries under the Biden administration. Furthermore, investments in artificial intelligence are experiencing strong growth and are expected to continue.

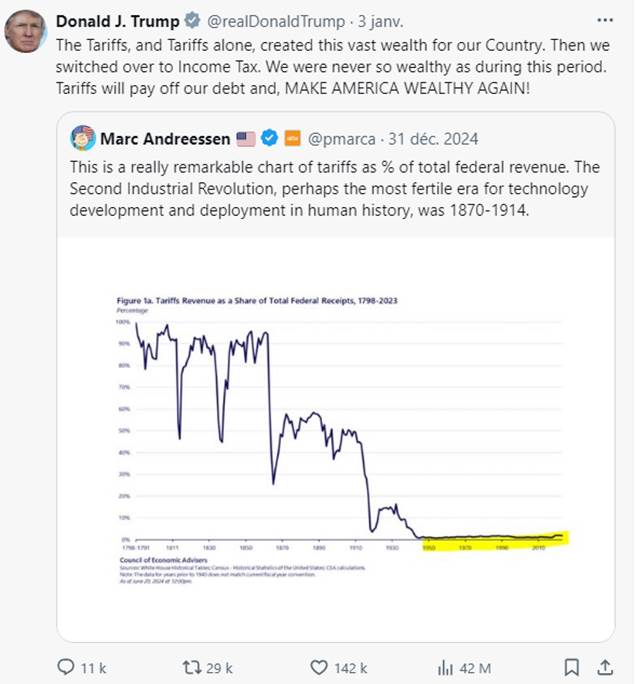

International trade will be one of the most sensitive areas. Trump plans to impose high tariffs, reaching up to 60% on Chinese imports and 25% on imports from Mexico and Canada. These measures aim to rebalance trade while strengthening the U.S. position on the international stage. However, such protectionist policies risk causing economic disruptions, particularly for sectors reliant on global supply chains. The inflationary pressures resulting from tariff increases are difficult to assess.

Contrary to expectations, the Trump administration could adopt a relatively cautious approach to fiscal policy. Although tax cuts and increased spending are anticipated, proposed budget cuts should help limit the impact on the public deficit. A high yield on 10-year Treasury bonds could present a strategic opportunity, especially if yields exceed the 5% threshold.

US Rates

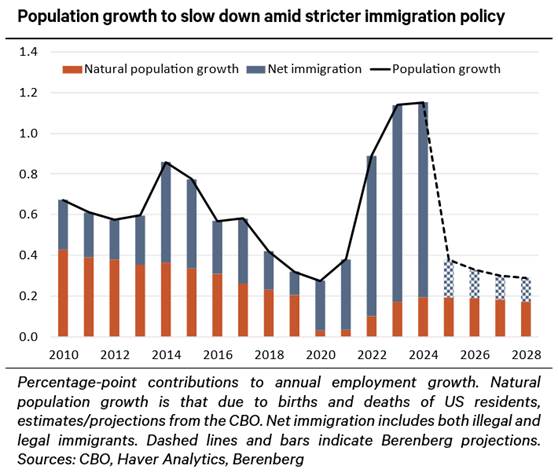

Immigration remains one of the most divisive issues. Although strict measures have been announced, including targeted deportations and visa restrictions, the economic impact could be limited. Industries reliant on cheap labor, such as agriculture and construction, could be negatively affected.

Beyond tariffs, it is Donald Trump’s immigration policy (given the estimated 11 million undocumented immigrants) that raises concerns for the Fed. Trump’s restrictive immigration stance risks causing labor shortages, which would accelerate wage growth, making the new administration’s policies inflationary even before accounting for tariffs.

Iran and China remain at the core of Trump’s confrontation strategies. Increased sanctions against Iran and stricter trade controls with China are expected to mark the beginning of this term. These tensions could lead to higher energy prices and boost demand for defensive assets. Defense sector companies, particularly those involved in air superiority, present attractive prospects.

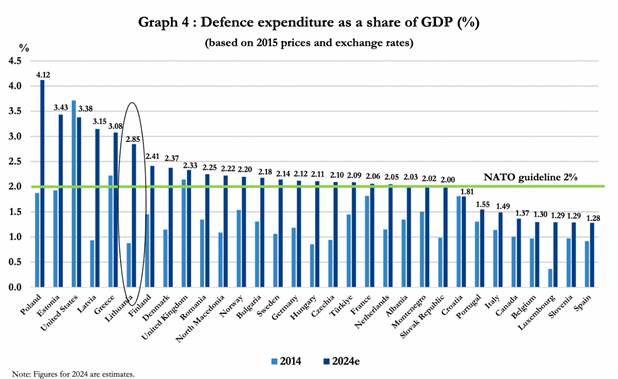

Trump’s statements regarding the acquisition of Greenland, the Panama Canal, or transforming Canada into an American state are unlikely to materialize but pose notable risks.Trump’s pressure on NATO allies to rearm, as well as on Europe to purchase American liquefied natural gas, is expected to have more positive implications.

Defense budget by country as a percentage of GDP

In light of this economic and geopolitical reshuffling, several investment themes are emerging—whether in the energy sector, small and medium-sized American businesses benefiting from deregulation and economic stimulus, investment opportunities, or the defense sector bolstered by increased military spending.

Rapid adaptation to this new environment will be essential to capitalize on these complex dynamics. Overall, we believe that Donald Trump’s economic program will have a positive short-term impact on activity, but negative effects are likely to prevail by 2026. However, the overall impact remains uncertain and will depend on the implementation timeline and the measures ultimately adopted.

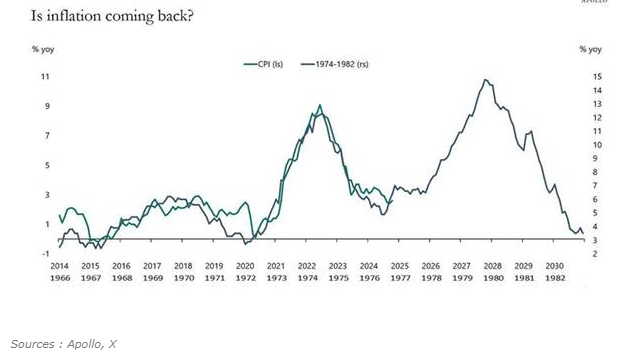

One of the most significant economic aspects of Trump’s re-election is its potential impact on inflation. The fear of a third wave of inflation, similar to what was experienced in the 1970s, is a major concern for many of our clients. Ultimately, the policy choices Trump makes will determine the trajectory of the Fed’s interest rates. However, we believe that the measures taken will take time to produce noticeable effects, and in the meantime, economic data will dictate the central bank’s decisions.

Comparison of inflation with the 1970s

On the markets, this phenomenon is known as the “Trump trade,” a bet that Donald Trump’s return to the White House would bring higher inflation and interest rates. Many of the key policies of the next president point in this direction: tariffs would increase import costs, and immigrant deportations could drive wages higher. In the face of rising inflation, the Federal Reserve would have little choice but to raise rates.We believe this risk is real but largely overestimated for now. Ultimately, Trump’s policy decisions will determine the trajectory of the Fed’s interest rates. However, we expect that the measures implemented will take time to have a significant impact, and in the meantime, economic data will guide the central bank’s decisions.

At a time when inflation appears to be partly under control due to the actions of the Federal Reserve, it is difficult to imagine Donald Trump willingly becoming unpopular with American households. Beyond the initial simplistic commentary on the Republican program and fears of another inflation wave, it seems unlikely that the new president would follow a course that led to the Democrats’ decline in public opinion.He not only has several tools to mitigate this risk, but apart from the so-called “Trump effects,” a significant portion of housing-related prices—accounting for 36.7% of the overall inflation index—should moderate and provide a substantial disinflationary buffer for the Federal Reserve.

We remain positive on U.S. equities. Beyond the economic implications for other countries and the societal challenges within the United States, inflation remains a top priority for the new administration, as it is crucial for the popularity of leaders among voters. Trump’s immigration program is arguably the most questionable aspect from an economic perspective. During his previous term, reduced migration flows had already triggered an initial inflationary wave by driving wages up. Experience has shown that if inflation were to rise again, it would be even harder to control. A similar scenario this time could have serious economic and financial consequences, reigniting the greatest fears of the 1970s.