All eyes are on the Fed as the FOMC meeting concludes this evening. The U.S. central bank will convene but is expected to hold off and keep its key interest rates unchanged at their current levels.

The institution’s members will not update their economic forecasts or the “dots,” but since the last meeting in December, published data has not shown any significant change in the trajectory of growth and inflation, which remain resilient.

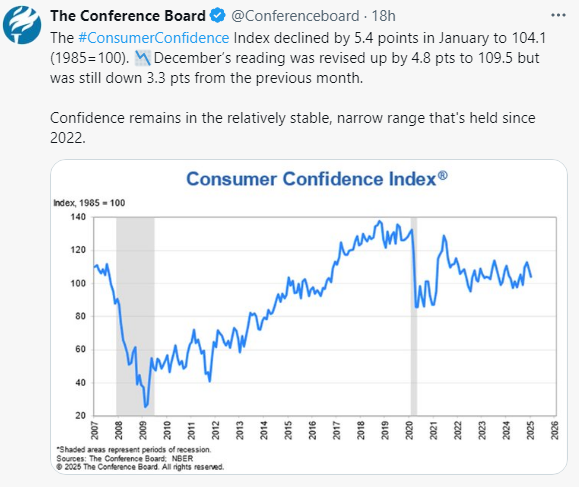

Caution remains essential in easing monetary policy, which must be very gradual to ensure a smooth landing for the economy and prices without reigniting inflationary pressures. The current level of monetary policy remains restrictive, which is beneficial in allowing disinflation to continue. Household consumption is expected to weaken (due to the reduction of excess savings and the deterioration of the labor market), as indicated by the Conference Board’s Consumer Confidence Index, which declined in January for the second consecutive month.

Close attention should be paid to Jerome Powell’s interpretation of Trump’s initial announcements and policies. The Fed is reassured by the recent decline in core inflation (core CPI and PCE at 0.2%) but remains cautious about the effects of Trump’s trade and immigration policies.

Why Trump’s Tariff Threats Could Worry the Fed More Than in 2018. In the past, price increases were uncommon. Today, after the high inflation of 2021-2023 (which the Fed mistakenly deemed transitory), businesses and workers have a stronger “muscle memory” for demanding higher prices and wages.

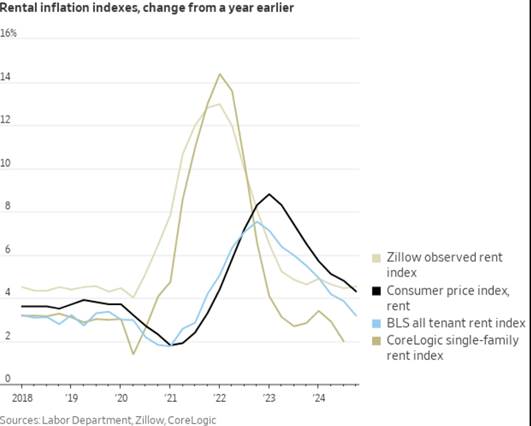

For now, several factors have helped curb underlying inflation in the U.S. Goods prices have risen only modestly, by +0.1% month-over-month, despite a still significant increase in used car prices, which climbed +1.2% over the month. Service price inflation remains too high but has been gradually moderating for the fourth consecutive month. Notably, there has been a slight easing in shelter costs for the third month in a row—an important development, given that housing accounts for 36.7% of the overall inflation index. This represents a significant disinflationary buffer for the Federal Reserve.

With base effects likely to be favorable next month, a further decline in January’s core CPI can be expected. Additionally, single-family home rental growth rose by just 1.5% for the year ending in November—the smallest increase in 14 years—suggesting that housing disinflation is likely to continue.

If the new administration’s economic policy is structurally more inflationary in the medium term, its effects will likely be felt in 2026. Efforts to curb public spending and reduce the size of the federal government could initially have negative consequences on economic activity and the labor market.

The Fed considers monetary policy to remain restrictive, which supports an adjustment if inflation continues to decline. The more hawkish members believe the Fed is approaching the neutral rate (estimated at 3.9%), while the more dovish members argue that it is lower, justifying multiple rate cuts. The most notable aspect is that the Fed does not want to commit to a specific timeline and prefers to wait for more data before making a decision. The focus remains on short-term inflation trends and the uncertain impact of new economic policies.

In this context, we still anticipate two Fed rate cuts of 25 basis points in the first half of 2025 (to 3.75%-4%), which will support the stability of U.S. sovereign yields (4.5%-4.75%) and help avoid reaching the 5% level on the 10-year Treasury—a potential warning sign of market stress.

U.S. Rates