EQUITIES: MORE SHORT-TERM GEOGRAPHICAL PREFERENCE

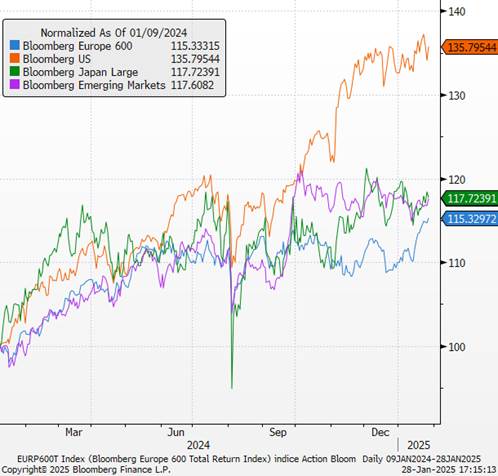

In the short term, we are narrowing the gap in our opinion between the European and US markets. We no longer have a geographic preference. The main reason is that we are reducing the likelihood of an escalation of the all-out trade war in the short term with Europe which, unlike other zones, has the weapon of regulation to favor negotiations with President Trump. The second reason is monetary. Indeed, the latest Fed and ECB meetings have shown that the latter will lower interest rates despite the status quo of its American counterpart, which should support credit distribution, maintain a strong dollar and favor European multinationals. What’s more, we believe that, just as happened in Gaza, talks between Vlodymyr Zelensky and Vladimir Putin will be set up, creating an air current in Europe’s favor.

Donald Trump’s carrot/stick/carrot method will create constant volatility throughout the year

US Equities: some short-term weaknesses, despite positive outlook

U.S. valuations and investor positioning are already at very high levels. Every disappointment will be severely punished. We remain optimistic for the year in the US market. Many sectors will benefit from Donald Trump’s measures (deregulation, potential corporate tax reforms). For the time being, we don’t question the USA’s strengths: remarkably sustained growth, huge engines of technological investment, rising productivity and, now, with Donald Trump back in the White House, a new wave of deregulation.

The volatility of December-January underlines a vision of a more volatile year ahead. We can expect periods of anxiety and market fluctuations, but on an overall positive trajectory. There are certainly many uncertainties concerning potential policies, inflation trends and Fed communication, not to mention the risks associated with the headlines on trade and tariffs. These factors have demonstrated their ability to generate volatility, noise and influence market sentiment.

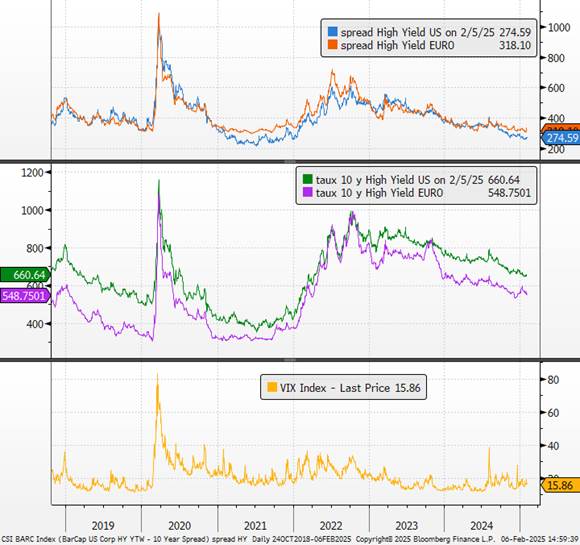

Vix (US market implied volatility)

However, the US economy is showing resilience and inflation should show signs of moderation, as we indicated in our January Flash. Market sentiment is more pessimistic and, in a way, avoids over-reaction.

In our view, this offers a favorable balance between risk and return. Fluctuations in sentiment are to be expected as the year progresses, but we need to remain pragmatic and agile.

At the end of the month, the new American president is showing a new face. He has already contradicted himself twice on his intentions regarding trade policy towards China, preferring negotiation and intimidation to the unilateral implementation of tariffs without warning. He seems to be opening the door to the search for a peaceful solution. ” We have a very big power over China, which is tariffs, and they don’t want them, and I’d rather not have to use it. But it’s enormous power over China. “

For her part, Chinese Foreign Ministry spokeswoman Mao Ning reaffirmed that trade disputes with the USA could be resolved through ” dialogue and consultation “. She stressed that ” economic and trade cooperation between China and the United States is mutually beneficial “.

Beyond Trump’s “shock” interventions, there is a way in which China escapes the worst-case scenario on tariffs. Tariffs remain a sword of Damocles for European and Chinese companies that have been seeking growth drivers in recent years from American consumers. Europe’s and China’s large trade surpluses make them vulnerable to Trump and his threats.

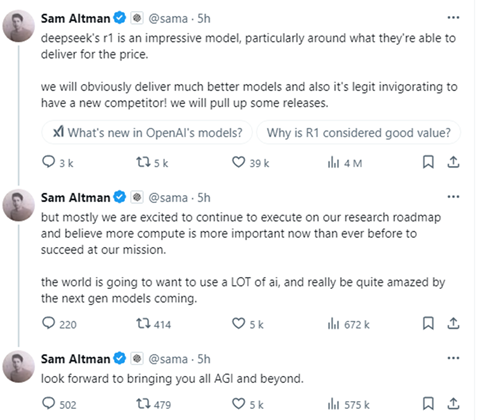

Even if it’s far too early, the DeepSeek episode (a Chinese startup, DeepSeek, unveiled an open-architecture AI model last week, assuring that it was capable of competing with OpenAI ) demonstrates that the Americans don’t have a monopoly on innovation and growth , and that they also have weaknesses and competition outside the price range. The company develops AI models in open source, which means that the entire developer community can inspect and improve the software. Its mobile application topped the iPhone download charts in the USA after its release in early January.

DeepSeek’s success could prompt US suppliers to lower their prices, and its open-source approach could accelerate the adoption of advanced AI reasoning models, which could lead to calls for regulation. It also calls into question the considerable spending by companies such as Meta and Microsoft, both of which have pledged to invest $65 billion or more this year, mainly in AI infrastructure. In summary, DeepSeek-R1 can offer a price of $2.19 per million responses generated, compared with ChatGPT’s current price of $60. . This case could show that efficient models can compete with much more modest expenses. . The threat to the US ecosystem is taken seriously, as confirmed by Sam Altam (CEO of OPEN AI).

Reply to X by Sam Altam

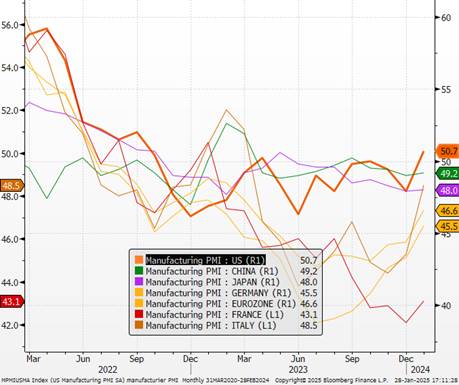

In terms of sectors, we continue to favor the banking sector. The US behemoths have just published very good results for the fourth quarter of 2024, marking a year-end dominated by economic resilience and interest rate tensions. Repentification and deregulation should deliver substantial earnings growth for 2025 . The last two years have been disappointing for the US manufacturing sector . Despite extensive tax programs designed to support industry, domestic production has stagnated. . We believe that the new year will mark a turning point and that manufacturing output will rebound. . We anticipate favorable winds for the manufacturing sector. Business confidence surged after Trump’s election, and manufacturers are optimistic about their production prospects. Spending on equipment should benefit from the boom in plant construction seen over the past three years: private companies have invested nearly a trillion dollars in these subsidized industries under the Biden administration. In addition, investment in artificial intelligence is growing strongly and should continue to do so. Despite more intense competition ahead, this confirms that AI remains at the heart of the USA’s strategic deployment, particularly in the face of China. Companies across the entire value chain remain attractive investments, even if volatility is set to increase.

Manufacturing PMI

Europe Equities: flows return on hope of Cessez le Feu

While the PMI indices may indicate that a low point for activity has been reached at the end of 2024, it will be a question of removing the uncertainties that persist at the start of the year (political fog in France and Germany, trade tensions with the USA) to enable a real rebound in household and business confidence. This rebound can be explained by the improvement in the manufacturing sector (restocking effect linked in part to fears of tariffs). If Trump succeeds in ending (or making people think he will end) the war in Ukraine, this could improve the mood on the other side of the Atlantic. The Gaza ceasefire episode shows that announcements can be made (even if the probability is more reduced). Waiving or lowering the levels of tariff increases on Europe would be another great relief for investment. In the end, we’ll be in a period of negotiation for a few months. Let’s not forget that one of the main beneficiaries of exports to the US is Italy (and Germany, of course). Among the major European leaders, Giorgia Meloni is the only one close to Donald Trump. In early January, the head of the Italian government made a surprise return trip to Florida to meet the American president-elect, who was delighted to have at his side ” a fantastic woman who has conquered Europe “.

Finally, the German election could also bring renewed optimism, if its outcome signals a revision of the country’s public spending limit. Voters will go to the polls in February, but probably won’t have a new government until spring.

ECB rates and expectations in June 2025

The European Central Bank should continue to move monetary policy back into accommodative territory over the coming months, with further cuts of 25 bp at each meeting (up to 2%). Further easing of financial conditions will not only support consumption, but also the recovery of credit dynamics. The European Central Bank’s Q4 2024 bank lending survey revealed that lending conditions are stabilizing after improving considerably over the past two years. These factors will support European growth at the end of the year. European equities could regain their appeal in the short term, as evidenced by the return of flows at the start of the year.

German election poll

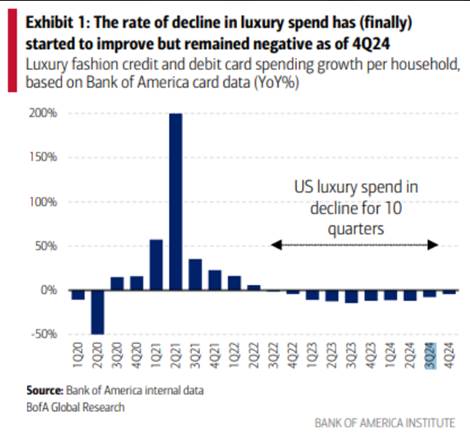

In terms of sectors, we prefer yield stocks (utilities), which will be supported by their dividends. The banking sector, whose profitability has further improved, will benefit from the return of credit distribution. Increases in defense budgets will not be jeopardized by a ceasefire in Ukraine. Major players exposed to US growth will continue to benefit from the US economy, boosted by Trump’s programs. We are still negative on sectors that are too cyclical and too vulnerable to tariffs (automotive, luxury goods, spirits). In the luxury goods sector, consumer spending seems to be stabilizing in the US, which will enable us to select a few stocks.

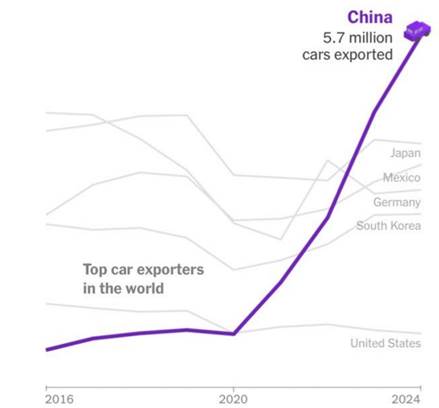

In Europe, the automotive sector employs 13 million people. Not only have European carmakers lost market share in China, but Chinese car exports to other markets have exploded. The Europeans simply cannot afford to lose the US market to tariffs, and will be prepared to make significant concessions.

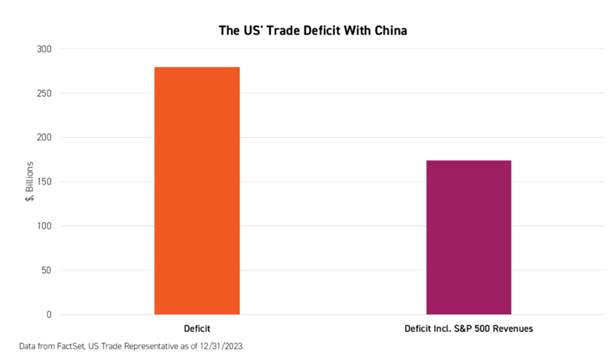

China equities awaiting negotiations

For now, we’re reducing the likelihood of an all-out trade war with China, especially after a “friendly” conversation with President Xi Jinping, after which he said he “would prefer not to have to use tariffs on China.” The year 2025 remains high-risk in China. The need to boost domestic demand is more essential than ever. As it turns out, this is also an objective for Donald Trump for the outlets of American companies. Negotiations are therefore possible……. We believe that President Trump could introduce limited general tariffs as a starting point for negotiating with key trading partners, including China. In our view, the likelihood of these tariffs reaching the 60% level previously proposed is low. Many of America’s largest companies generate significant revenues in China. S&P 500 companies generated over $100 billion in revenues there in 2024. It is conceivable that the start of negotiations will involve an increase in tariffs on imports from China, beyond the current level of 19%. However, these tariffs could also be phased in gradually, or even monthly, according to some members of the transition team, leaving sufficient time for negotiations. Future Treasury Secretary Scott Bessent, a globally respected macroeconomic investor, understands the consequences of tariffs and how the US and Chinese economies are interdependent. One of his advisors, Elon Musk, also understands the importance of China, which accounts for 25% of Tesla’s revenues. President Trump invited President Xi to his inauguration. Since state visits require months of preparation, Xi was unable to attend in person, but he did send China’s vice-president, Han Zheng.

We remain neutral on Asian equities for the time being. Valuations are supportive, and the month of January seems to show that a way is possible to avoid a trade escalation that would be detrimental not only to China, but to the market as a whole. In any case, we’ll have to wait until the end of the third annual session of the 14th National People’s Congress in March to find out the details of the new fiscal stimulus measures.

Equity indices over 1 year

BONDS

We adopt different tactics in different geographical areas.

In the United States, we prefer short durations and are looking for yields that are still appreciable in USD. In Europe, we think you need longer maturities and quality to take advantage of future rate cuts.

Sovereigns United States: fragile disinflation still in progress for the time being.

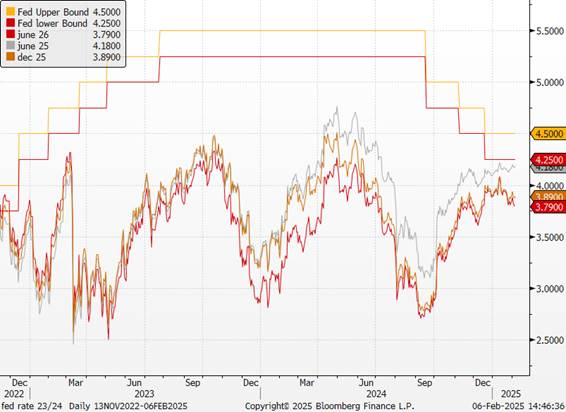

The US bond market continues to be driven by contradictory forces: a more accommodative monetary policy from the Fed, growing budget deficits and fears about the impact of Donald Trump’s policies. For the time being, we are not calling into question our scenario of 2 rate cuts by 2025 at the most (the risk now being a smaller cut).

Fed rates and futures expectations

Price inflation in the USA accelerated in December, but was in line with expectations. The good news in the report is that core CPI inflation is finally falling, to 3.2% year-on-year after 3 months of stagnation at 3.3%. Numerous components have contributed to easing core inflation in the US. Service price inflation remains too high, but is gradually moderating for the fourth month in a row. There was even a third consecutive month of slight moderation in the shelter component, which is so important with a 36.7% weighting in the overall inflation index. This represents a significant disinflation reserve for the US central bank. With base effects a priori favorable next month, we can expect a further decline in January’s core CPI. ” The disinflation process is underway. But we’re still not at our 2% target, and it will take some time to reach it on a sustainable basis. “says New York Fed President John Williams. Numerous indicators suggest that the labor market remains robust, reducing the urgency for Fed officials to continue cutting rates. The Fed wants to finish the job and remains patient. As we have been writing for several weeks, the rebound in yields had become a real source of concern, whether for consumers or for governments faced with a heavy debt burden. Yields on 10-year Treasuries have been extremely sensitive to relatively minor changes in the outlook. The challenge for the markets is to avoid a monetary policy reversal scenario linked to uncertainties over fiscal, trade, migration and regulatory policies. Fed members remain very attentive to the decisions that D. Trump in his first months in office. Our range on the US 10-year remains between 4.5% and 5%. We are going negative below current levels and prefer to hold USD cash at 4.25% to avoid short-term capital losses.

US Credit: yield with low duration

As far as credit is concerned, the most fragile borrowers will suffer from the trade war if supply chains are disrupted and input costs rise. Companies are already suspending capital spending and hiring until they understand the situation. Rising debt servicing costs and falling profits could turn more US companies into zombies (those that don’t generate enough revenue to cover their interest expenses). This would ultimately mean a higher default rate, which is far from being built into a credit market. According to Bloomberg, as of January 31, 589 members of the Russell 3000 had not generated enough operating income in the previous 12 months to cover their listed interest expenses. This is up from 570 a year earlier, and includes some of the largest debt pools in the U.S. credit indices, such as Boeing, Warner Bros. Discovery and Intel.

We prefer short durations in the US, given the yield curve and the risks to US trade policy. Yields remain appreciable, given spreads but above all thanks to the level of government rates. We prefer HYs , whose yields will enable us to take advantage of risk premiums despite volatility. In terms of investment grade, we remain cautious on longer maturities, given the very tight spreads.

HY spreads

Sovereigns Europe: the ECB to the rescue

The continued deceleration of inflation and the lack of growth drivers in the eurozone are leading the ECB to continue cutting rates aggressively into 2025. Unsurprisingly, it cut rates by a further 25bp to 2.75%. The governors seem more concerned about growth than inflation. The ECB remains confident that inflation will return to target:

“The disinflation process is well underway. Wage growth eases as expected ” . Since the last committee meeting in December, the data have generally evolved in line with forecasts. Asked about the lack of progress in services inflation, Christine Lagarde pointed out that all indicators point to a slowdown in wages: compensation per employee, Indeed indicator, negotiated wages, job vacancies . “We are paying close attention to services, which are largely sensitive to wages, and our attention is also focused on the ‘late comers’, such as insurance companies, which are raising their rates late.” ECB surveys indicated that companies were less willing to pass on price increases at the start of the year compared with 2024. Nevertheless, the risks to growth remain tilted to the downside, particularly if consumption and investment do not recover as expected. Asked about the effects of the Trump administration’s US policy for Europe, she felt that little tangible had been announced so far, and that the ECB would take this into account in due course.

Financing conditions remain restrictive. In the final quarter of 2024, eurozone growth stalled at close to 0. As indicated in Davos, the normative monetary rate is seen to be around 1.75%-2.25%. Given C. Lagarde’s confidence in the disinflation process, we believe that a further cut on March 6 is highly likely. A pause in April is still expected, but we believe that the ECB will choose to cut its key rates again to at least reach the upper limit of the normative rate just communicated. We are aiming for 2% or even 1.75% in July.

We had decided to overweight Eurozone sovereign bonds, given the rise in yields at the start of the year, which was only justified by fears of US contagion. We are now neutral on the curve as a whole, with a preference for peripheral countries.

10-year rate

Europe credit: duration with better quality

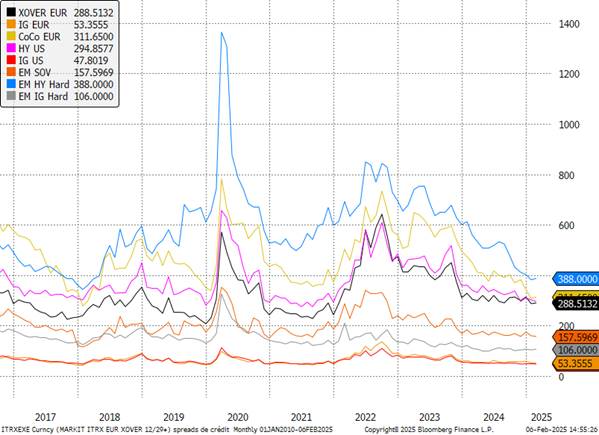

Growth momentum is under threat, and we believe that the credit spreads of the weakest ratings could suffer. The credit market benefited from a buoyant primary market in January, with strong demand at the start of the year. Most of the fall in yields is expected to come from lower risk-free rates, driven by central bank action. The undeniable weakness of credit spreads reflects the resilience of the corporate debt universe, but the potential for further tightening is now fairly limited. Although flows into the asset class have begun to decline, due to the high cost of this market, it continues to benefit from the attractiveness of its yield over investment grade and good corporate fundamentals. On the GI side, fundamentals are holding up well, with leverage stabilizing at its long-term average of around 2.5 times EBITDA. Bank fundamentals in Europe are also solid, and should remain so in 2025.

In contrast to the US zone, we prefer to opt for better issuer quality, but extend duration to take advantage of still-attractive rates on the long end. If the carry justifies maintaining credit positions, we should favor IG, including financial subordinates and corporate hybrids, and be selective on HY. In the event of a marked slowdown, which is not our central scenario, there is more risk on the latter segment, especially as spreads are historically tight.

On the lower end of HY, single B, we need to stay with short maturities. It is possible that credit premiums will diverge slightly during volatile episodes, but not significantly, except in the event of a recession, which we do not anticipate. We will take advantage of any 50-60 bp spread to strengthen our positions and return to a more positive credit stance.

Credit spreads

USD: according to rates

Last quarter’s movement correctly reflected Donald Trump’s victory and the perception of the implementation of his potential program in a first stage. Several of the measures announced are aimed at boosting the competitiveness of the US economy and limiting the decline in inflation.

However, a potentially higher and more sustainable interest rate differential in favor of the dollar zone has yet to be fully priced in. The European Central Bank is likely to accompany the eurozone slowdown with a deeper rate cut than the market is currently anticipating. Our baseline scenario for early 2025 remains unchanged: sluggish recovery, low inflation, ECB terminal rate at 2% or even July. The list of risks to the European economy is very long: trade tensions, energy prices, domestic politics, heterogeneous domestic growth dynamics. Risks occupy an important place, and unfortunately, bearish risks continue to dominate the continent, even though it is still difficult to integrate too much trade uncertainty for the time being.

For its part, the Fed will be watching the effects of Trump’s new policy and may be forced to slow its monetary easing considerably. Beyond tariffs, it’s Donald Trump’s migration policy that raises questions for the Fed. Trump’s restrictive migration policy is likely to lead to labor shortages. This will accelerate wage growth, making the new administration’s policy inflationary, even before tariffs are taken into account. This mismatch between the monetary and growth policies of the two zones could increase pressure on the euro, bringing the euro-dollar rate back to parity by the end of 2025. Our intervention range since December has risen from 1 to 1.05. However, Donald Trump will be blowing hot and cold in the coming weeks. Currency volatility will be higher, partly due to rhetoric on tariffs. The dollar remains the asset of choice for diversification against other assets. Indeed, inflationary or trade tensions damaging to the latter would mechanically strengthen the US currency.

EURO-USD

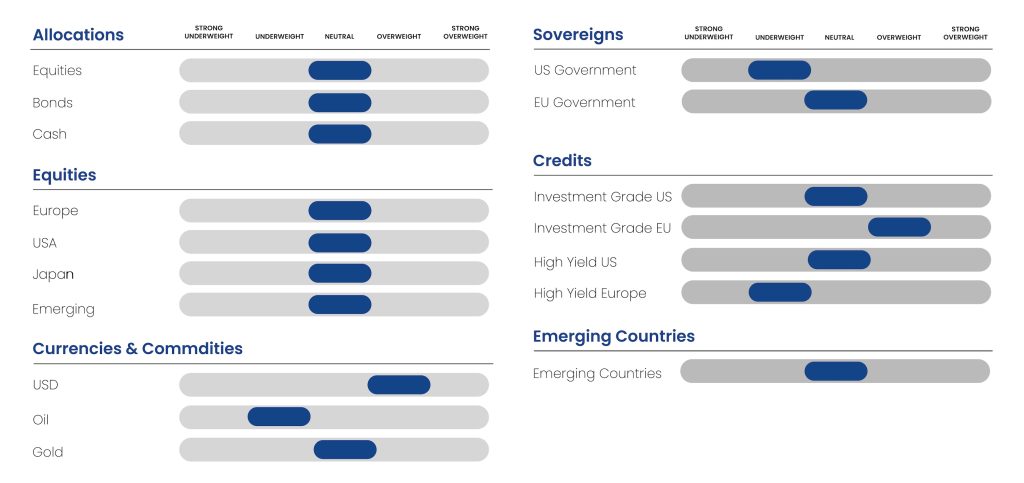

ALLOCATION TABLE