The 3 must-know news stories of the week

- “If they impose a tariff or a tax on us, we impose exactly the same level of tariff or tax on them.It’s as simple as that.” – Donald Trump

- A ceasefire “in the not-so-distant future” – Donald Trump

- U.S. inflation figures delay rate cuts

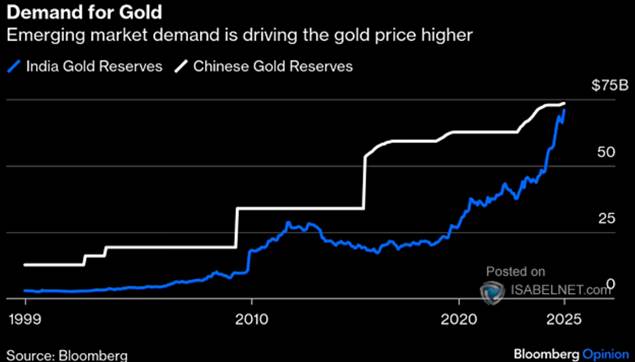

- Chart of the Week: Gold reserves in India and China have reached record levels, with emerging markets fueling the surge in gold prices.

“If they impose a tariff or a tax on us, we impose exactly the same level of tariff or tax on them. It’s as simple as that.” – Donald Trump

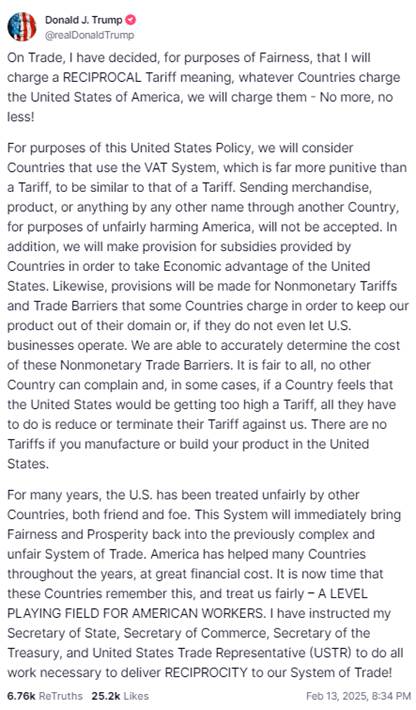

The American president signed the long-awaited executive order on reciprocal tariffs on Thursday, marking a new escalation in the trade war against the United States’ economic partners.”Three extraordinary weeks, perhaps the best ever, but today is the big day: reciprocal tariffs!!!” the president wrote on his Truth Social network, accompanied by his famous slogan, “Make America Great Again.” The future Secretary of Commerce, Howard Lutnick, stated that Donald Trump would be able to implement his plan by early April.With these reciprocal tariffs, the Republican aims to impose the same level of taxes on products entering the United States as the country of origin imposes on American products.

Donald Trump believes that products entering the United States should be subject to the same level of taxes as those imposed by the country of origin on American products. He suggests that countries finding the new tariff barrier too high should lower their own.The idea is to align tariff levels, which could deal a severe blow to certain emerging economies—such as Brazil or Thailand—that set higher trade barriers to protect their respective economies.India, for example, whose Prime Minister Narendra Modi is expected at the White House on Thursday, imposes a 25% tariff on American cars, which would mean that the United States could do the same for Indian vehicles.After the additional 10% tariffs on Chinese products and the 25% duties on aluminum and steel, Donald Trump continues his aggressive economic policy, driven by his agenda and a clear direction: “America First.”

Donald Trump’s idea is to raise tariffs to partially fund tax cuts and reduce the growing trade deficit, but also to use them as leverage against other countries. He summed up his “very simple” view of reciprocal tariffs: “If they make us pay, we make them pay.” “What President Trump believes is that we can all at least agree that if we are taxed at 20%, we should be able to do the same. So, if they lower their tariffs, we lower ours—that’s the idea of reciprocity,” his economic adviser Kevin Hassett explained on CNBC on Monday.

Our Opinion:

The United States imports $3.3 trillion worth of goods, meaning that each additional percentage point in tariffs would, all else being equal, generate $33 billion in additional revenue. However, this revenue would correspond to an equivalent extra cost borne by American households. This presents a significant inflation risk for the U.S., as well as for countries that choose to engage in a trade standoff with the United States. In a way, it forces all countries to renegotiate their tariff schedules with the U.S. To hope for a de-escalation, the current phase of escalation must give way to negotiations and a compromise must be reached. This remains Trump’s objective, as he seeks concessions from trade partners, particularly from Europe—which has a tool that others may lack: regulation. Concerns over renewed inflationary pressures linked to these tariffs persist, and as a result, the Federal Reserve is expected to remain cautious in the coming months.

A ceasefire “in the not-so-distant future”

During a bilateral meeting, the two presidents called for the “immediate” launch of peace negotiations to end the war in Ukraine. D. Trump stated that he had called Ukrainian President V. Zelensky to inform him of this discussion. Secretary of Defense P. Hegseth, meanwhile, outlined three conditions set by the Trump administration at the start of negotiations:

- The goal of returning to Ukraine’s pre-2014 borders is “unrealistic.”

- The possibility of Ukraine joining NATO is ruled out.

- The deployment of a military contingent in Ukraine will not take place as part of a NATO mission and will not include American soldiers.

According to some sources, Trump’s peace plan could include a $500 million agreement with Ukraine for access to its rare earth resources in exchange for increased military support. These strategic minerals are essential for many modern technologies. However, a significant portion of these resources is located in areas currently occupied or threatened by Russia, making their extraction difficult without a resolution to the conflict. Meanwhile, European leaders are seeking to adapt to the new U.S. approach to foreign policy. They are striving to play a more active role in peace negotiations while demonstrating their determination through concrete actions. The Munich Security Conference will provide them with an opportunity to discuss these strategies and coordinate efforts to end the conflict in Ukraine. Ukrainian President Volodymyr Zelensky has recently expressed his willingness to negotiate directly with Vladimir Putin and other leaders to end the war. He also indicated that the United States would have priority access to Ukraine’s strategic mineral resources, emphasizing the importance of international cooperation in the country’s post-war reconstruction. “Those who help us save Ukraine will have the opportunity to rebuild it, with their companies and Ukrainian companies. We are ready to discuss all these matters in detail,” he told The Guardian. Ukraine holds some of the largest mineral reserves in Europe, and it is “not in the interest of the United States” for these resources to fall into Russian hands, the Ukrainian president reminded.

Discussions are also intensifying among European officials. French Foreign Minister Jean-Noël Barrot has invited his German, Polish, Italian, and Spanish counterparts, as well as the British Foreign Secretary and EU foreign policy chief Kaja Kallas, to a meeting in Paris on Wednesday, February 12. The goal is to adopt a common position on American and Russian initiatives and to ensure that Ukraine’s sovereignty and European security are not compromised in the peace process. As the Ukraine conflict enters its fourth year, diplomatic efforts are ramping up to find a peaceful solution. U.S. initiatives, combined with European leaders’ actions and the willingness of all parties to engage in dialogue, offer a glimmer of hope for an end to hostilities and the reconstruction of Ukraine.

Our Opinion: A truce in Ukraine could mark the beginning of a true economic reconstruction, benefiting both Ukraine and Europe. While European states are not directly involved in the negotiations led by D. Trump, they could still gain from an end to the war, especially in the current weakened economic climate. The European industry continues to suffer from rising energy costs linked to the conflict, as evidenced by the decline in industrial production. Ukraine’s economic recovery will require a massive mobilization of capital. The European Union has already pledged €50 billion in aid between 2024 and 2027. Additionally, private investments will play a crucial role, particularly in the energy, construction, and transport infrastructure sectors. Post-conflict economies often experience rapid recovery. Wind and solar energy will become a priority, and rebuilding critical infrastructure represents both a major challenge and an opportunity for the construction industry. The demand for materials such as cement and steel is expected to triple by 2028. European and American construction companies will play a key role in this urban renewal.

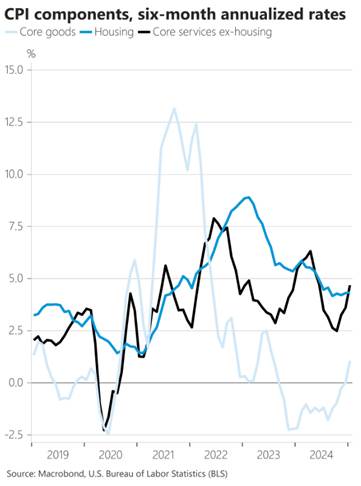

U.S. Inflation Figures Delay Rate Cuts

The U.S. Consumer Price Index (CPI) exceeded expectations, with an acceleration in its core component. The return to the 2% target now seems more distant in the short term, while upside risks remain due to the ongoing trade war. This marks the 9th time in the past 10 years that January inflation has come in higher than expected. This time, the rise in core inflation is almost entirely driven by the transportation component—another reason for the Federal Reserve to take its time before cutting rates. Headline inflation rose to 3% year-over-year in January, its highest level since May. The increase is largely due to less favorable energy base effects, which are expected to improve slightly in the coming months. Core inflation increased by 0.4% in January, compared to the 0.3% expected. The contribution of “shelter excluding energy” to core CPI continues to decline slowly but steadily.

Many components saw price increases, including food, while energy prices rose significantly again in January, following December’s sharp increase. Several sectors had their December indices revised downward, which may explain part of the upside surprise in January. The trend remains generally manageable for goods, with a notable post-holiday decline in clothing prices, despite a sharp increase in used car prices and prescription drugs.

The main issue remains service prices, which rose 0.5%, accelerating after five consecutive months of slowdown. This increase is driven by transportation costs, with a sharp rise in auto insurance and another increase in airfare—though less pronounced than in December. Notably, housing inflation (shelter) continues to moderate. Housing prices ticked up slightly on a monthly basis, enough to impact both the CPI and core CPI indices, where this category still accounts for 35.5% and 44.3%, respectively. Meanwhile, higher mortgage rates are pushing more Americans into the rental market, where vacancy rates remain near historic lows.

Our Opinion: Fed Chairman Jerome Powell, speaking before the Senate Banking Committee, and B. Hammack (Cleveland Fed), a non-voting member of the FOMC, defended the need for the central bank to avoid easing monetary policy too quickly given the resilience of economic activity, inflation risks, and the potential impact of D. Trump’s economic policies. At this stage, Powell believes that monetary policy remains appropriate, while Hammack suggests that Fed rates may already be near the neutral rate—the level that neither stimulates nor slows economic activity and inflation. Given the recent inflation rebound and political developments, we expect the Fed to remain on an extended pause. Real estate prices could offset concerns about Trump’s tariffs. The Cleveland Fed has extensively studied U.S. rent dynamics and produces a quarterly series tracking housing costs in new rental contracts—which showed positive trends in Q4, potentially signaling a decline in housing inflation by late summer. Political considerations also favor a pause: if the Fed wants to avoid the risk of future rate hikes, it would be prudent not to cut rates too soon.The overall inflationary impact should remain limited, but as long as risks persist, the Fed’s actions will be constrained, delaying potential rate cuts until the second half of the year. In the short term, this will support U.S. interest rates and the dollar.

Chart of the week

Gold reserves in India and China have reached record levels, with emerging markets fueling the surge in gold prices.