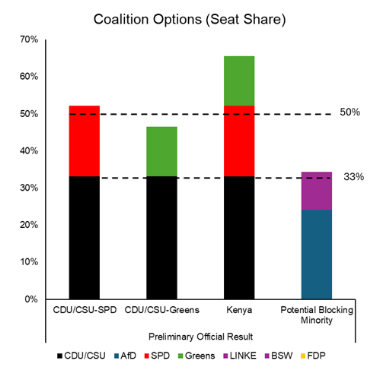

Germany has elected a new parliament. According to preliminary official results, the conservative CDU/CSU alliance, led by Friedrich Merz, won the election with 28.5% of the vote, ahead of the far-right AfD, which secured 20.8%. Notably, the AfD has made historic gains (20.8%), while the Social Democrats (SPD) have lost ground (16.4%). Outgoing Chancellor Olaf Scholz failed to convince many undecided voters to support his Social Democratic Party, which recorded its worst result since World War II. The Greens and the left-wing party Die Linke also secured seats in parliament. However, the anti-migrant left-wing party BSW and the liberal FDP did not reach the required 5% threshold to enter parliament. At this stage, an alliance with the Social Democrats (SPD) is the favored option, potentially securing 328 seats, according to initial estimates, for a simple majority of 315 seats in the Bundestag. Friedrich Merz, the leader of the CDU/CSU, is the likely next chancellor.

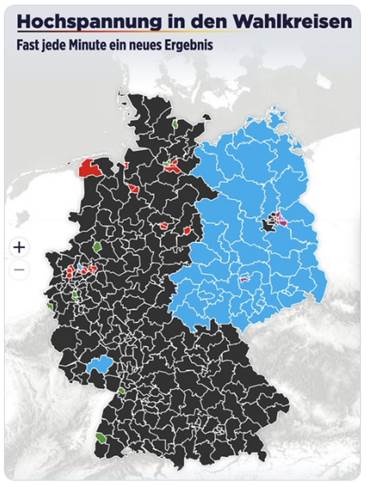

The country’s political map has changed. In the west, the CDU/CSU (in black) dominated almost all constituencies, while in the east, the AfD (in blue) won the majority of votes.

Budgetary prospects could be complex due to the fact that the AfD and Die Linke together hold 216 seats (34.3%) in parliament, potentially forming a constitutional blocking minority against a reform of the debt brake or the creation of an off-budget defense fund, which requires a two-thirds constitutional majority. However, the actual blocking minority opposing the debt brake consisted of the AfD and the FDP.

o The Alternative for Germany (AfD) has strongly criticized any attempt to ease this rule. Its leader, Alice Weidel, specifically accused the likely new chancellor, Friedrich Merz of the CDU, of wanting to increase national debt under pressure from left-wing parties, which, according to her, would go against the country’s needs.

o The Free Democratic Party (FDP) had also expressed its opposition to modifying the debt brake. Traditionally committed to strict fiscal discipline, the FDP advocates maintaining this rule to limit the federal government’s structural deficit to 0.35% of GDP. The FDP did not win any seats.

o The left-wing party Die Linke has argued for easing the “debt brake” to allow for increased public investment, particularly in social housing. Its program planned to invest 20 billion euros per year in non-profit housing, which would require exceeding the current debt limits imposed by the German constitution. This stance contrasts with that of the AfD and the Free Democratic Party (FDP), which oppose lifting the debt brake. However, negotiations with this party will be subject to discussions and concerns about a potential fiscal drift.Les résultats des petits partis et leur capacité ou non à franchir le seuil minimum de 5 % des suffrages pour entrer au Bundestag, à cet égard, jouent un rôle important.

There is a higher probability that the debt brake (limiting the deficit to 0.35% of GDP) will be modified. Indeed, if a two-thirds majority is required, the combined support of the main forces potentially in favor (CDU/CSU under conditions, SPD, the Greens, and Die Linke) accounts for more than 76% of the votes.

It is clear that discussions will be challenging regarding the allocation of additional spending, but if a favorable outcome is reached, it would be good news for the German economy.

Furthermore, the prospect of a less fragmented political situation in Germany than before is largely reassuring.

A traditional two-party coalition between the CDU/CSU and the SPD is highly possible. Germany’s European partners hope for the swift formation of a government. Friedrich Merz, who had stated his goal of forming a government by Easter, is expected to turn to the SPD. This alliance, known as the “grand coalition,” between the two parties that have dominated the post-war political landscape, is also the preferred coalition among Germans, who seek stability after the constant disputes within Olaf Scholz’s three-party government with the Greens and the liberal FDP.

The leader of the CDU/CSU, Friedrich Merz, is the likely next chancellor. He has announced his intention to begin coalition negotiations after the regional election in Hamburg next Sunday and aims to form a new coalition by the end of April.

Friedrich Merz enjoys the support of many European leaders, but his positions on European foreign and defense policy have sparked debates and concerns among other partners. Merz has criticized European foreign and security policy, calling it a “state of desolation.” He has also called for greater European independence in defense, suggesting an alternative to NATO in its current form.

German businesses have high hopes for the new government after the elections, as shown by the Ifo Business Climate Index. While business expectations have improved, the assessment of the current situation has dropped significantly.

Ifo Index (Business Climate in Germany)

We believe this is a positive outcome for confidence in German assets. Greater stability and the absence of political blackmail by certain parties to maintain government cohesion are reassuring regarding the sound management of a rising budget deficit.

Merz’s positions should benefit German equities in general, particularly industrial and defense stocks, as well as German midcaps. The German midcap index (MDAX) also represents an interesting segment, aiming to capitalize on upcoming interest rate cuts by the European Central Bank and a potential ceasefire in Ukraine.

Given that the MDAX index is closely tied to the German economy, it stands to benefit the most from these expectations. Defense spending can be organized through European mechanisms, circumventing Germany’s debt brake, and the Left Party is likely to support changes in infrastructure investment in Germany.

DAX versus MDAX

Conversely, long rates are likely to remain high (increase in financing requirements) despite the ECB’s cuts, encouraging a steepening of the yield curve. Die Linke could have negotiating power as a possible player in the blocking minority.

German rates