The 3 must-know news stories of the week

- A German-style “whatever it takes”: the new coalition ready to ease the debt brake

- ECB: and that makes 5!

- Washington backtracks on Canada-Mexico tariffs, another abrupt shift in trade policy

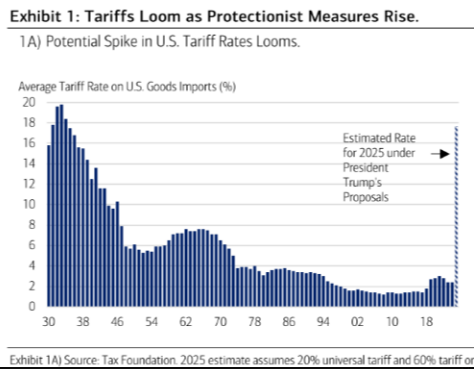

- Chart of the Week: The effective tariff rate in the United States could reach its highest level in 90 years.

A German-style “whatever it takes”: the new coalition ready to ease the debt brake

The climate of geopolitical uncertainty has significantly accelerated negotiations for forming a new coalition in Germany. In a surprising move, the conservative CDU/CSU and the social-democratic SPD announced an ambitious budget plan last night, featuring:

- A modification of the debt brake rule (in place since 2009, limiting the structural budget deficit to 0.35% of GDP per year) to exclude all defense expenditures exceeding 1% of GDP.

- The creation of a €500 billion fund dedicated to infrastructure modernization and strengthening “competitiveness,” with a ten-year lifespan and €100 billion allocated to the Länder.

If this plan is approved by lawmakers—which seems likely—it would mark a real turning point for Germany. Two factors support this paradigm shift:

- A lasting fiscal boost for defense: Instead of resorting to a specific fund, modifying the debt brake suggests that these expenditures, and the resulting debt, will be more sustainable and theoretically unlimited.

- An accelerated legislative timeline: The CDU/CSU and SPD reportedly agreed to pass these reforms through the current parliament (before March 25) to secure a two-thirds majority, notably with the Greens’ support. Indeed, the next legislature, following the elections, is expected to narrow the margin for reaching a qualified majority.

Of course, this maneuver could spark tensions. Some SPD and Green lawmakers are already denouncing what they see as an “undemocratic” power move, pointing out that the outgoing coalition wavered at the end of 2023 due to budgetary constraints linked to strict adherence to the debt brake and the use of special funds. Moreover, they have not forgotten that it was the conservative CDU/CSU that triggered this crisis.Nevertheless, the four parties (CDU/CSU, SPD, Greens, and potential partners) hold a majority well above the required two-thirds threshold, minimizing the risk of failure.

Moreover, the increase in military spending has become a central issue in Europe. The European Commission and Ursula von der Leyen have unveiled an investment plan of approximately €800 billion aimed at strengthening European defense and supporting Ukraine, while encouraging member states to invest in defense without being constrained by budgetary rules (including the public deficit limit of 3% of GDP).While these stimulus initiatives could support economic growth—and potentially reduce pressure on the ECB to further cut its key interest rates—they come at a time when the prospect of additional debt issuance could destabilize a bond market already weakened by the ECB’s gradual withdrawal. Indeed, the ECB is no longer reinvesting maturing bonds under the PEPP and APP programs, signaling a less favorable balance in the debt market.

Tweet from Friedrich Merz

Our Opinion: From a macroeconomic perspective, the extent of the upward revision we foresee for our German sovereign rate targets, as well as for the euro, will depend on the approval of these amounts and reforms. Following our post-German election flash report (https://news.banquerichelieu.com/en/2025/02/24/__trashed/), we viewed the election outcome as positive for confidence in German risk assets and for the eurozone. Greater stability and the absence of political blackmail by certain parties to maintain government cohesion are reassuring regarding the sound management of a budget deficit set to increase.

Merz’s positions were expected to benefit German stocks in general, particularly industrial and defense sectors, as well as German midcaps. We had expressed doubts about long-term bond yields, despite ECB rate cuts favoring a steepening of the yield curve. We believe that European equities should continue to outperform the rest of the world given the European context. Regarding sovereign interest rates, the movement observed in the days following the announcement has led us to reconsider our position. We are now positive on long-term eurozone bonds in light of current levels. As for the euro-dollar exchange rate, we have revised our pivot point to 1.10. At this stage, only risks related to tariffs continue to support the U.S. dollar..

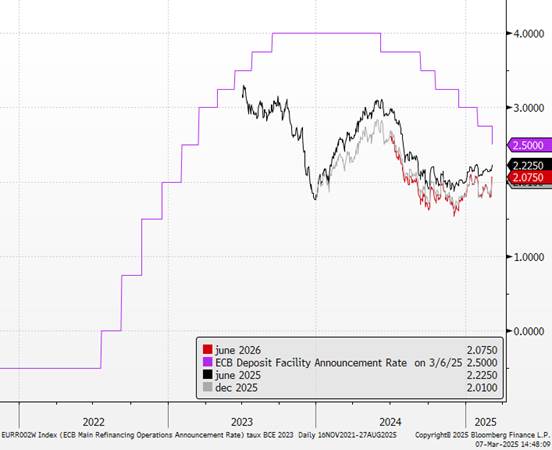

ECB: And That Makes 5!

The Governing Council of the European Central Bank (ECB) approved another rate cut on Thursday—the sixth since the beginning of the cycle and the fifth in a row—lowering the deposit rate from 2.75% to 2.50%. Shortly after, the Frankfurt-based institution released new three-year economic projections, downgrading its growth forecast for 2025. In both cases, these announcements do not take into account the latest budgetary plans discussed in Germany and at the European level. The general tone reflects a more cautious ECB, concerned about “high uncertainty.” In its statement, the bank replaced the notion of a “still restrictive” monetary policy with “significantly less restrictive,” as rate cuts make new borrowing cheaper for businesses and households.

Despite this shift in language, the ECB is not changing its decision-making approach, which it deems “even more relevant”: deciding meeting by meeting, without a predefined path, based on inflation data, core inflation, and monetary transmission. ECB President Christine Lagarde highlighted the rebound in loan growth while reminding that past tightening measures continue to weigh on the economy. While the ECB remains confident in the ongoing disinflation process toward its 2% target—supported in part by moderate wage pressures—Lagarde remains highly cautious about growth prospects, which she still sees as “tilted to the downside.” She warns, “The situation is shifting dramatically from one day to the next, and the impact of defense investment projects will depend on the details.” The ECB’s internal projections, finalized in mid-February, already seem outdated. The average growth forecast for 2025 has been lowered from 1.1% to 0.9%, mainly due to a decline in exports linked to the introduction of tariffs. Meanwhile, the expected average inflation rate for 2025 has been revised upward from 2.1% to 2.3%, based on rising energy prices observed in early February. However, since then, energy prices have dropped significantly: European TTF gas has fallen from €50 to €38/MWh, Brent crude from $75 to $69 per barrel, and the euro has appreciated against the dollar (from 1.04 to 1.08).

ECB Deposit Facility Rate vs. Market Expectations

Our Opinion: Following Germany’s historic fiscal shift, Europe is reclaiming control over the future trajectory of its industrial and defense sectors, as well as its broader economy. However, fiscal policy aimed at investment must be supported by a monetary policy that allows it to materialize. If the proposed budget plans are adopted, their multiplier effect will be very gradual. The German economy accounts for a quarter of the eurozone economy, and since few other major countries in the region will be able to follow suit, this could mechanically reduce the ECB’s rate cuts by 25 basis points before reaching the terminal rate. Nevertheless, wage growth in the eurozone slowed at the end of 2024, supporting the European Central Bank’s plans to continue lowering interest rates as inflation declines. As we anticipated, these data reinforce the ECB’s assumption that wage growth should now decelerate after adjusting to inflation increases in recent years. This should, in turn, lead to a decline in services inflation. We expect two more rate cuts (in April and July), followed by a pause, aiming for a 2% deposit facility rate. To offset the rise in long-term rates driven by fiscal spending, the ECB should continue cutting short-term rates to restore the yield curve’s steepness, allowing banks to keep lending to the economy—which also remains highly positive for the banking sector.

Washington Backtracks on Canada-Mexico Tariffs, Another Abrupt Shift in Trade Policy

The executive order signed on Thursday by President Donald Trump caps a tumultuous week, marked by sharp market turbulence and deteriorating diplomatic relations between the United States and its key trade partners. The Trump administration has backed down from imposing broad 25% tariffs on imports from Mexico and Canada, a significant retreat from its aggressive trade agenda. The U.S. president issued a decree granting a one-month reprieve for all goods complying with the rules of a free trade agreement reached in 2020 with North American neighbors.

Until Wednesday, only a temporary one-month exemption had been planned for automakers compliant with the USMCA. The new order extends this exemption to all products meeting the agreement’s requirements, until April 2. However, the White House hinted that Canada and Mexico could receive an extension if they effectively tackle the trafficking of fentanyl, a deadly opioid. This reversal came after Donald Trump reiterated before Congress his intention to use tariffs, stating, “There will be some disruptions, but we accept that.” The introduction of these tariffs on Tuesday had already triggered significant market volatility after Canada and Mexico announced their intention to retaliate. The gains recorded by the S&P 500 since the presidential election were completely wiped out following another sharp decline on Thursday.

Howard Lutnick, the U.S. Secretary of Commerce, stated on Thursday that stock market fluctuations would not dictate the country’s trade policy: “Whether the market goes up or down by half a point in a day is not what drives our decisions.” This shift by the Trump administration is the latest episode in the chaotic implementation of its trade policy, unsettling U.S. partners. According to the U.S. Trade Representative, trade in goods and services between the three countries under the USMCA amounted to approximately $1.8 trillion.

Washington’s U-turn came just hours after data showed a widening U.S. trade deficit in January, reaching $131.4 billion, up from $98.1 billion in December. Economists suggest that this increase was partly due to businesses rushing to stockpile goods ahead of the tariff implementation. U.S. automakers, whose supply chains are highly integrated across the three countries, have fiercely opposed the imposition of high tariffs. Thursday’s executive order emphasized that the auto industry is “essential to the economic and national security of the United States,” stating that the suspension of tariffs aims to “minimize disruptions” to the sector.

To be exempt from tariffs, cars manufactured in Canada and Mexico must contain between 65% and 75% regional content. However, automakers still face the impact of a planned 25% tariff increase on steel and aluminum, set to take effect next Wednesday. Donald Trump also announced that starting April 2, he intends to apply “reciprocal tariffs” against trade partners accused by Washington of imposing unfair taxes, regulations, and subsidies. Additionally, the executive order reduced the tariff on Canadian potash imports that do not meet USMCA criteria to 10%, a move that reassures American farmers, who rely on Canada for 80% of their fertilizer potash supply.

Our Opinion: Donald Trump’s strategy is to raise tariffs to partially fund tax cuts, reduce the growing trade deficit, and use them as a bargaining tool against other countries. The new president needs to find additional sources of revenue to get his budget approved by Congress. This is an urgent matter, particularly with the looming extension of the 2017 tax reform. He aimed to accelerate his tariff plans in the coming weeks to maintain credibility ahead of the budget review. However, he now finds himself caught between a rock and a hard place. The Trump administration’s reversal on tariffs highlights the negative consequences for U.S. economic actors. The president’s bold statements continue to multiply, but they are generating increasing anxiety. Household spending in the U.S. fell by 0.2% in January, according to data from the Commerce Department. Inflation is weighing on consumer confidence, as fears grow over further price increases due to the trade war. This is not a matter of declining incomes—Americans simply can no longer tolerate persistently high inflation. They also fear it could worsen with the 20% to 25% tariffs Trump has promised against Canada, Mexico, China, and the European Union, along with broader geoeconomic threats. According to a recent CNN poll, 62% of American households believe the president is not doing enough to curb inflation. In the short term, uncertainty dominates, as reflected in economic surprise indicators. While trade policy may seem to boost domestic industry, uncertainty and investment do not go hand in hand. This month, we downgraded our outlook on U.S. stock indices (underperformance) and the USD to account for this shift in dynamics.

Chart of the Week: The effective tariff rate in the United States could reach its highest level in 90 years.