The 3 must-know news stories of the week and What We Think

- US: tensions at every level

- The IEA again lowers its forecast for oil demand in 2025

- Historic debate in the Bundestag on the reform of the “debt brake”

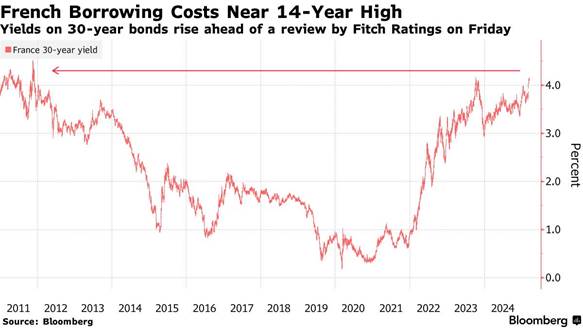

- Chart of the Week: French 30-year rates at a 14-year high

US: tensions at every level

Donald Trump’s inconsistency continues to sow doubt in the U.S. markets. In the United States, Donald Trump’s trade policy is once again stirring controversy. After threatening to double tariffs on Canadian steel and aluminum to 50% in retaliation for the surcharge imposed by the Canadian province of Ontario on electricity exports, the U.S. president ultimately reversed course when Canadian authorities withdrew the surcharge. The tariffs, which are set to take effect soon, will therefore remain at 25% for Canada, as for the rest of the world.This uncertainty surrounding trade policy, seen by many investors as a factor in economic slowdown (despite Trump’s denials), is compounded by fears of a potential federal shutdown. While Republicans hold a 53-seat majority in the Senate, they must still secure at least seven Democratic votes to overcome parliamentary obstruction and pass the interim budget. However, this proposal is not bipartisan: Democrats notably oppose the increase in funding for immigration and customs services responsible for deportations and criticize the lack of limits on the power to dismiss federal employees and cancel federal contracts, particularly those involving Elon Musk and certain agency directors. Nonetheless, aware of the potentially more negative impact of a shutdown, some Democratic lawmakers may ultimately support the Republican plan.

Meanwhile, the NFIB survey on small business optimism for February suggests a risk of renewed inflationary pressure. From the Federal Reserve’s (Fed) perspective, the main concern is the potential impact of rising tariffs on companies’ sales prices, which could fuel a dreaded stagflation scenario. Moreover, Donald Trump has intensified the tariff war by threatening to impose 200% tariffs on European wine and champagne, further increasing market volatility. Additionally, forecasts from major U.S. companies have darkened: two of the country’s largest airlines have revised their estimates downward, and Walmart Inc., often seen as a key indicator of U.S. consumer trends, has also expressed concerns about an impending slowdown.

Our Opinion: This escalation confirms that the current phase of the trade war is here to stay and that further significant announcements from Washington should be expected by April 1, the date by which the administration must deliver its reports on trade relations with various countries, likely resulting in reciprocal tariffs. U.S. importing companies are sounding the alarm about the risk that Americans themselves will end up footing the bill for these decisions. We believe that a period of easing in the trade war will follow the “acute” phase we are currently experiencing. For now, we remain pessimistic in the short term regarding the U.S. market. The recent trend in U.S. financial assets highlights growing concerns about a potential recession in the United States, as well as in the bond market. At present, there is certainly no “Trump put.” After the U.S. elections, many analysts believed that potential negative market reactions would limit the Trump administration’s measures. However, despite the massive sell-off in recent weeks, the administration has proceeded with tariff hikes and the potential for further escalation.

“Trump 1.0” previously used stock market indices as a real-time indicator of confidence in his tax agenda. “Trump 2.0” has shifted his focus, now prioritizing the 10-year Treasury yield as his administration’s key barometer. A recession does not even seem to faze him. Donald Trump appears willing to backtrack once compromises are reached, as long as he can claim sufficient economic or political gain.

For now, the U.S. economy is far from recession, with a labor market that remains solid for the time being. We believe that the anticipated economic slowdown will act as a brake on hiring, and that public sector job cuts will maintain an atmosphere of uncertainty for American employment. The labor market is likely to show signs of weakening in the coming months. It will therefore take some time before we see a potential “Powell put.” The Fed will remain cautious and wait for uncertainty surrounding economic policy to clear and for labor market indicators to deteriorate before resuming its interest rate cuts, with two cuts expected in the second half of the year compared to three anticipated by the market.

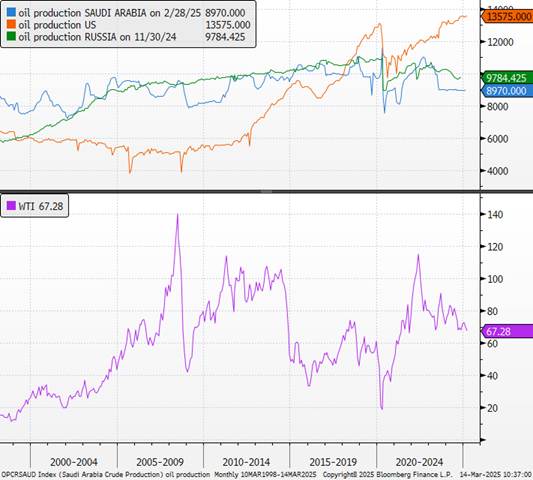

The IEA Again Lowers Its Forecast for Oil Demand in 2025

While oil demand is expected to grow, global oil supply could exceed demand by about 600,000 barrels per day in 2025, the International Energy Agency stated in its monthly oil market report, following a downward revision of its demand growth forecasts for 2025. Production could increase by an additional 400,000 barrels per day if the Organization of the Petroleum Exporting Countries extends its production boost beyond April. An initial tranche of 2.2 million barrels per day, previously withdrawn from the market, will be gradually reintroduced. In February, production by OPEC member countries and their allies, grouped under OPEC+, reached 41 million barrels per day. This development is part of a gradual revision of the group’s production policy, which plans for a phased easing of voluntary cuts starting in April.

Additionally, non-compliance with OPEC+ quotas by some member countries, notably Kazakhstan (highlighted in OPEC’s report), continues to cloud the energy market outlook. At the same time, the IEA, like OPEC in its report, emphasized uncertainties related to tariffs and retaliatory measures that could slow economic growth. The rapid escalation of the trade war represents the main downside risk to oil prices. The imbalance in the oil market could worsen this year. “New U.S. tariffs, combined with escalating retaliatory measures, have shifted macroeconomic risks downward. Recent data on oil demand has fallen short of expectations, and growth estimates for the fourth quarter and the first quarter have been slightly revised downward,” the agency noted.

Production is expected to be driven by the United States, following Donald Trump’s “drill baby drill” push and the goal of an additional three million barrels per day promised by U.S. Treasury Secretary Scott Bessent. The United States is currently producing at record levels and is expected to be the largest source of supply growth in 2025, followed by Canada and Brazil. Meanwhile, the forecast for global demand has been revised down by 70,000 bpd and remains heavily dependent on China’s needs. “In an unusually uncertain macroeconomic climate, recent delivery data has been below expectations, which has led to slightly lower estimates for growth in Q4 2024 and Q1 2025, at 1.2 million bpd year-on-year,” the IEA stated.

Oil Production and WTI

Our Opinion: We believe that oil is the cornerstone of Donald Trump’s strategy to increase American household purchasing power. Recent polls suggest that the president has not done enough to curb inflation. The University of Michigan’s consumer sentiment index has been significantly revised downward, with five-year inflation expectations rising to 3.5%, a level unseen since 1995. The rebound in inflation complicates the economic equation for the White House and Federal Reserve members. Prices are expected to remain under pressure. We remain negative on oil prices, even though OPEC+ is currently caught between the need to maintain its market share and the necessity of preventing prices from falling below the $60 per barrel threshold.

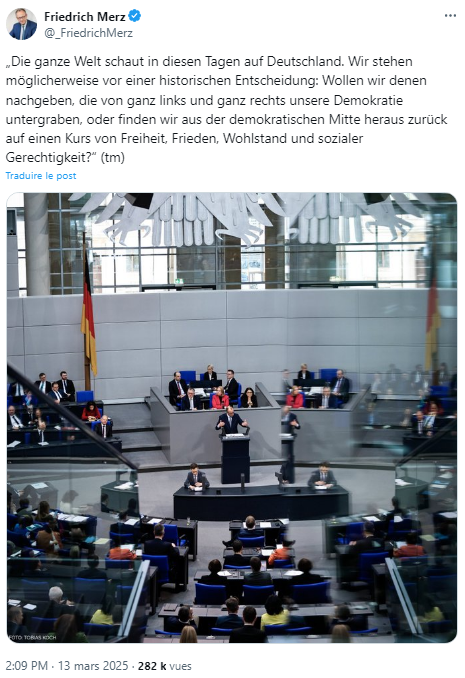

Historic Debate in the Bundestag on the Reform of the “Debt Brake”

The future conservative chancellor, Friedrich Merz, presented his plan to rearm the country before the deputies, a program that involves revising the constitutional article limiting the use of borrowing. The first day of debates in the Bundestag on the reform of the debt brake and the creation of an infrastructure investment fund did not reach a conclusion. As they had announced earlier in the week, the Greens adopted a negotiation strategy by temporarily blocking the bill to obtain guarantees from the future coalition on the energy transition (their vote is crucial to securing the two-thirds majority required in the current parliamentary configuration).

Alongside his future Social Democratic partners, the CDU president amended his proposal to win over the Greens. Additional funding for the Bundeswehr must also include intelligence services and cybersecurity. Furthermore, the special €500 billion fund intended to modernize infrastructure must allocate €50 billion specifically for climate initiatives. “This is a very concrete offer I am making to you, because you rightly emphasized during our recent discussions that this money should also benefit the environment,” said Friedrich Merz. He proposed expanding the scope of defense spending to include civil defense and intelligence services (a demand made by the Greens earlier in the week).

The CDU and SPD aim to secure a vote quickly before the end of next week (another session is scheduled for March 18), as the new legislature (taking office on March 25) will require the future coalition to negotiate with other parties (AfD and Die Linke) that have opposed any reform. From the Greens’ perspective, the proposed fund transfer remains insufficient: they are demanding guarantees that these funds will be “additional” and specifically dedicated to the energy transition.

Friedrich Merz Tweet

“The whole world is watching Germany these days. We may be facing a historic decision: do we want to give in to those on the far left and far right who undermine our democracy, or should we return from the democratic center toward a path of freedom, peace, prosperity, and social justice?”

Our Opinion: The negotiations will create some nervousness, but given the stakes for the German economy, we believe that the various parties will ultimately reach an agreement. However, we think the positive effects will take time to be mobilized and reflected in growth, posing a risk of disappointment that could lead to a decline in European sovereign rates from their recent highs. We are now positive on German sovereign rates in particular.

Chart of the Week: French 30-year rates at a 14-year high