In our various analyses and statements, the “Draghi Report” has often been mentioned as a roadmap for the upcoming European plans developed by Ursula Von der Leyen.

The report submitted on September 11 was overshadowed by the American election and had very little short-term impact on European markets. Ultimately, it is Donald Trump’s election and his actions that give substance to this report.

We believe that the emerging geopolitical and economic landscape is steering Europe towards a new paradigm. Germany is undergoing a revolution by breaking away from the dogma of budgetary orthodoxy. Europe aims to be more proactive. The Commission presented its roadmap today to revive the Union of Savings, Investment, and Financial Integration in Europe. It also launched a plan to rearm the continent by 2030, in response to the Russian threat and the risk of American disengagement.

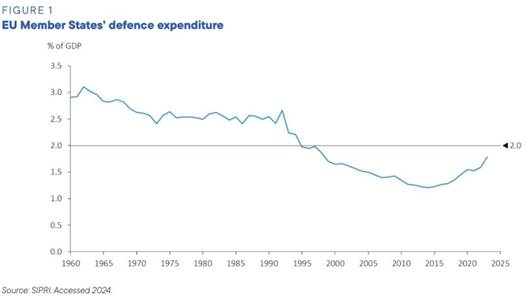

The main outlines of the plan unveiled two weeks ago by Ursula von der Leyen have a stated goal of 800 billion euros to get Europe’s defense in order. The European Commission thus aims to allow member states to allocate up to 1.5% of their Gross Domestic Product to military spending for four years, without fear of breaching budgetary rules that regulate public deficits.

Building a defense industrial base was already one of the major pillars of the report.

It is clear that Europe will not be able to achieve its Copernican revolution in a single day. But the institution has always demonstrated its ability to react when pushed to the wall. The Draghi Report appears to us as the roadmap that will be followed in the coming years. We believe it is interesting to present its main points to help understand the decisions that will be made.

The report starts from the observation that growth in Europe has been slowing since the early 2000s, with productivity advancing more slowly than in the United States. European households are bearing the consequences of this lag in the form of lower incomes, while the Old Continent faces a new, less favorable global environment and three major transformations:

- Accelerate innovation to bridge the productivity gap and create new growth drivers.

- Simultaneously pursue decarbonization and competitiveness to preserve industry and create opportunities in clean technologies.

- Strengthen security and reduce dependencies (energy, industrial, raw materials, etc.) to no longer be vulnerable to geopolitical shocks.

The report’s ambition is therefore to propose a new industrial strategy for Europe, Anchored in an integrated approach that combines industrial policies, competition, trade, financing, and governance, while maintaining social inclusion. It also emphasizes the importance of better European coordination and institutional reforms to act faster and more effectively.

I. The State of Play: A Renewed Landscape for Europe

- Productivity Slowdown and New Constraints

- Europe has long benefited from globalization to offset its internal slowdown, but the current climate is less favorable: intensified Chinese competition, the crisis of trade multilateralism, the loss of a major energy supplier (Russia), and rising geopolitical tensions.

- The report highlights a growing GDP and productivity gap with the United States: European productivity has fallen to approximately 80% of the U.S. level.

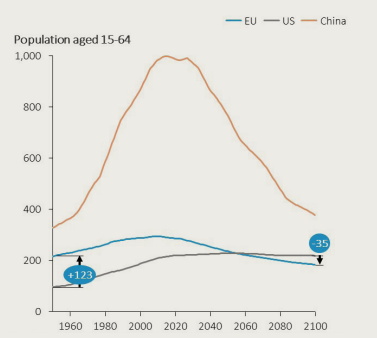

- Added to this is demographic aging: the workforce is expected to shrink by nearly 2 million people per year by 2040, making it essential to rely on productivity to sustain growth..

- Three Major Transformations

- Innovation and New Growth Drivers: Europe must catch up in high technology (AI, advanced digital technologies, etc.) and foster a favorable environment for innovative scale-ups.

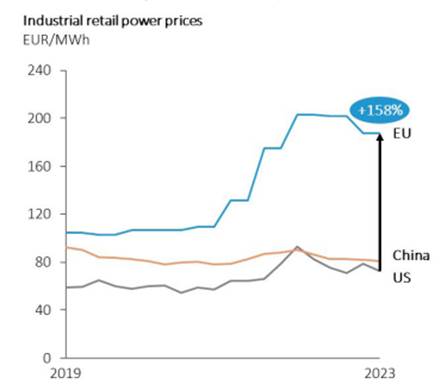

- Decarbonization and Competitiveness: The EU faces higher energy costs than its main competitors (electricity 2-3 times more expensive than in the United States, gas 4-5 times more expensive). It is crucial to reconcile the green transition with a competitive industry.

- Security and Dependencies: Dependencies on China (critical raw materials, digital technologies) and the need to strengthen the European defense industry.

- A Need for a Coordinated European Response

- Excessive fragmentation of industrial policies, public support, and the single market.

- Lack of clarity and focus in common priorities.

- The need to fully leverage the size of the single market (440 million consumers) to achieve scale and promote major pan-European projects (IPCEI, collaborative projects, etc.).

II. Bridging the Innovation Gap

The report highlights that the core weakness of European competitiveness lies in innovation and the ability to industrialize breakthrough innovations.

- Despite a strong level of fundamental research (presence of talent, quality education, number of patents, etc.), Europe often struggles to turn innovations into thriving start-ups or global scale-ups.

- Funding is considered insufficient and too scattered: total European R&D spending is lower than that of the United States, and spending remains concentrated in mature sectors (automotive, pharmaceuticals) rather than in digital and AI.

Proposals:

- Reforming European R&I Framework Programs:

- Refocus the future Framework Program (replacing Horizon Europe) on a limited number of common priorities.

- Increase the budget share dedicated to breakthrough innovation through an “ARPA-type agency” (enhanced EIC).

- Simplify and professionalize governance, relying on project managers and globally recognized experts.

- Double the total budget allocated to breakthrough research (up to 200 billion euros over seven years).

- Cooperation and Networking:

- Develop a “Research and Innovation Union” to coordinate national policies, budgets, and private sector players.

- Strengthen the role of the European Research Council (ERC) and increase its funding to support far more excellence projects.

- Create a framework to attract and retain world-renowned researchers (with “EU Chair” positions).

- Facilitating the Growth of Start-ups and Scale-ups:

- Refocus the future Framework Program (replacing Horizon Europe) on a limited number of common priorities.

- Increase the budget share dedicated to breakthrough innovation through an “ARPA-type agency” (enhanced EIC).

- Simplify and professionalize governance, relying on project managers and globally recognized experts.

- Double the total budget allocated to breakthrough research (up to 200 billion euros over seven years).

Invest in venture capital at various stages of development.

III. Achieving Competitive Decarbonization

The report emphasizes the need to reduce energy costs for industry and turn the climate transition into a growth opportunity.

- Ensuring Coherent and Effective Decarbonization:

- Electricity prices that are 2 to 3 times higher and gas prices that are 4 to 5 times higher in Europe compared to other regions can be explained by the end of Russian supply and the lack of abundant natural resources.

- In the medium term, electrification through low-carbon energy sources (solar, wind, nuclear, decarbonized hydrogen, etc.) could stabilize prices, provided it is well-coordinated and the EU ensures that cost reductions are passed on to end users.

- Supporting the Green Industry:

- The Union leads in certain technologies (wind turbines, electrolyzers, etc.) but faces fierce competition from China, heavily supported by substantial public subsidies.

- The report recommends a joint industrial plan, including:

- Coordinated support for low-carbon technologies (via IPCEIs, regulatory relief, public procurement).

- Trade policies to restore fair competition conditions (anti-dumping tariffs, local content rules in certain strategic cases).

- Example of the Automotive Sector:

- In response to Chinese competition in electric vehicles (EVs), the EU recently launched an anti-subsidy investigation and is considering countervailing duties.

- There is a need for coordinated strategies on access to critical metals, batteries, repurposing and recycling (circular economy), charging infrastructure, and standardization.

- Maintaining technological neutrality (hydrogen, synthetic fuels, electric) is essential to decarbonizing transport..

IV. Enhancing Security and Reducing Dependencies

Europe is highly open to trade and depends on third countries for strategic resources (critical raw materials, digital technologies, etc.). The report proposes:

- Developing a Unified Foreign Economic Policy (“Statecraft”):

- Coordinate trade tools, investments, diplomacy, and security.

- Establish industrial and trade partnerships to secure supply chains.

- Develop strategic reserves of critical raw materials and implement targeted actions for each sensitive sector.

- Building a Defense Industrial Base:

- Currently, the defense sector is highly fragmented (with around a dozen different tank models in Europe, compared to just one in the United States).

- Europe has the world’s second-largest military budget, yet procurement is scattered, and there is a strong reliance on external suppliers (approximately 78% of equipment orders go to non-European suppliers).

- The report recommends collaborative purchasing and funding joint projects to promote consolidation and innovation in the defense sector..

V. Financing Investment

The report estimates that annual investment levels must increase by 5 percentage points of GDP (unprecedented proportions since the 1960s-1970s) to simultaneously fund the energy transition, digitalization, and defense efforts.

- Mobilizing Private Investment by Integrating European Capital Markets: Complete the Capital Markets Union to attract and channel private investment.

- Public Sector Cooperation: Relying solely on the private sector is insufficient. Joint public funding will be required for certain European public goods (key innovation projects, defense, cross-border networks).

- Improving Productivity to Expand Fiscal Capacity: According to simulations, a 2% productivity gain over ten years would already cover one-third of the necessary fiscal effort.

- Creating New Common Financial Instruments (European Safe Assets): Introduce these instruments if political conditions permit.

VI. Governance: A More Agile Europe

The report highlights the EU’s slow decision-making process, with an average of 19 months to adopt a legislative act.

It recommends creating a “Competitiveness Coordination Framework”, which would define a few strategic priorities adopted by the European Council and translated into “competitiveness action plans.”

- Reduce current complexity by merging certain coordination processes (e.g., aligning the European Semester with national plans related to innovation, the green transition, etc.).

- Better apply the principle of subsidiarity by distinguishing:

· What should be delegated to the European level (common interest projects, IPCEIs, cross-border standards, etc.).

· What should remain at the national or local level.

- Simplify regulations and reduce the burden on businesses, especially SMEs.

The “Draghi Report” thus outlines a roadmap to revive European competitiveness. To achieve this, it emphasizes the need for massive investments, coherence across multiple policies (fiscal, trade, industrial, educational), and EU governance reforms to enable faster and more integrated action.Finally, the report stresses the importance of preserving social inclusion (avoiding a U.S.-style model with greater inequalities) and promoting regional convergence, even though innovation and service dynamics often favor large metropolitan areas.The ultimate goal is to “enhance Europe’s growth and prosperity potential” to safeguard the European model (prosperity, equity, democracy, sustainability) and ensure the continent’s strategic independence in an increasingly uncertain world.