A historic day in the Bundestag. German lawmakers have approved, by a two-thirds majority (513 votes in favor, 207 against), the constitutional reform proposed by conservative Friedrich Merz and supported by the Social Democrats (SPD) as well as the Greens. This vote, marking a major turning point, authorizes the partial lifting of the “debt brake” and unlocks massive public investments. For the future conservative chancellor, this is a significant step forward: “The decision we are making today for the defense of our country is nothing less than the first major step towards a new European defense community.”

CDU Communication

Final decision: The German #Bundestag has just approved our financial package for reforms in defense and infrastructure. This paves the way for investments in the freedom and future of our country. We are ensuring that Germany #movesforward again. Bundeswehr, transport, schools, climate protection – the money must now quickly reach where it is urgently needed.

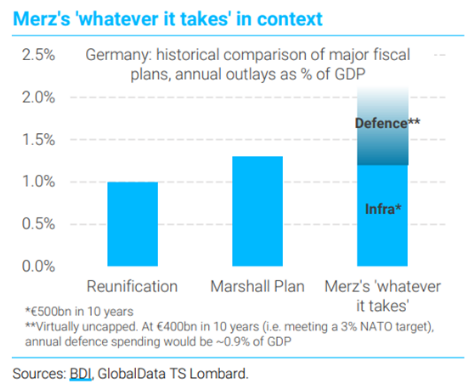

This reform, dubbed the “budgetary bazooka” by Friedrich Merz, marks the end of several decades of fiscal orthodoxy. Germany, often seen as the champion of budgetary rigor, will now have significant leeway to finance an ambitious investment and modernization program.

At the heart of this measure is the creation of a special €500 billion fund over twelve years, dedicated to German infrastructure. Roads, bridges, railways, energy networks, hospitals, daycare centers… the scope is particularly broad. The 16 Länder are not left out: they will now be allowed to incur debt up to 0.35% of GDP (compared to the previous requirement of nearly balanced budgets) and will also receive €100 billion out of the total €500 billion for their own projects.

To win over the Greens to their project, the conservatives and the SPD agreed to allocate €100 billion for climate initiatives. The goal is to accelerate the energy transition, complementing investments dedicated to transport and defense.

The reform primarily affects the well-known “debt brake” rule, enshrined in the German Constitution since 2009. As it stands, this mechanism limits borrowing possibilities to 0.35% of GDP per year. The text adopted in the Bundestag introduces four major changes:

- Partial exemption of defense spending: All defense expenditures exceeding 1% of GDP are now excluded from debt constraints.

- €500 billion special fund: These new loans will be spread over twelve years, financing a broad range of infrastructure projects.

- More flexibility for the Länder: They will now be allowed to present cumulative deficits of up to 0.35% of GDP.

- Broader definition of defense: A significant portion of expenditures (around €17 billion per year) can now be reclassified under the “defense” category. This effectively frees up additional budgetary room in the regular federal budget.

For Berlin, the stakes are strategic. Germany is accelerating its rearmament, with an announced ambition to gradually increase defense spending to nearly 3 or 3.5% of its GDP in the coming years. Ultimately, this would represent some €1.5 trillion invested in the military and related infrastructure.”This is a paradigm shift in defense policy that lies ahead,” emphasized Friedrich Merz, stressing the priority given to equipment orders that are “as European as possible.”

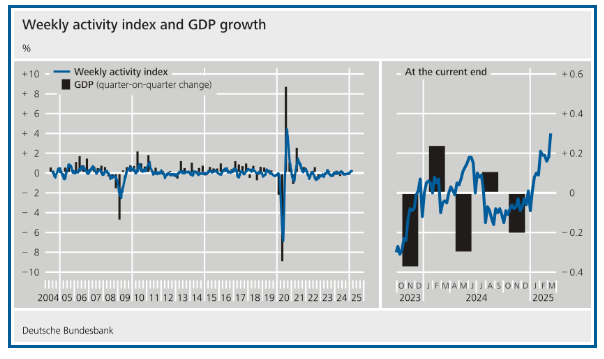

According to initial estimates, these new spending flows could boost German growth by approximately 0.3 percentage points of GDP per year over the next five years, thanks notably to massive public investments but also to a positive confidence effect on the private sector. Inflation, however, could rise slightly compared to forecasts (2.3% this year). From a European perspective, the impact would not be insignificant. With Germany accounting for nearly 28.5% of the eurozone’s GDP, its fiscal stimulus could contribute roughly 0.15% additional growth to the bloc.Economic activity is already beginning to pick up, as shown by the latest Bundesbank report.

The reform must still pass the test of the Bundesrat, the upper house representing the 16 Länder, where a two-thirds majority is again required. Bavaria, a regional heavyweight, rallied behind the project earlier this week, which should facilitate the text’s adoption on Friday. Markus Söder, Bavarian Minister-President and leader of the CSU, confirmed that Bavaria would lend its support after reaching a compromise with its local ally, the “Free Voters” party.The race against time is also linked to the political calendar: Friedrich Merz was determined to have the constitutional reform voted on before the new Parliament is installed, scheduled for March 25. The conservative leader is now working to form a formal coalition with the Social Democrats. “This may be the largest investment package in our country’s history,” said Lars Klingbeil, SPD co-chair. If negotiations succeed, Friedrich Merz could form his government by the end of April and further outline the planned structural reforms.This budgetary “big bazooka” marks a turning point for the eurozone’s largest economy. By investing heavily in its infrastructure and defense, Germany signals its intention to strengthen its sovereignty while supporting economic growth. It remains to be seen to what extent Berlin will be willing to take a further step toward financial solidarity at the European level, especially after breaking a long-standing domestic taboo.

In the bond markets, the announcement of this German shift has already pushed 10-year Bund yields up by 40 to 50 basis points. We believe that the sharp rise in yields following Germany’s announcement of its intention to ease the debt brake has been exaggerated. The 10-year rate is expected to stabilize around 2.6% initially. The positive economic effects will take time to materialize, and the risk of disappointment may lead to a decline in rates from recent highs. We are now positive on German sovereign bonds.

German rates

Moreover, in a portfolio allocation, high-quality European sovereign assets provide genuine diversification and insurance against a potential U.S. recession. Even though inflation will be revised slightly upward, this will not hinder the ECB’s move to cut interest rates. We believe this is a positive outcome for confidence in German assets.Greater stability and the absence of political blackmail from certain parties to maintain government cohesion are reassuring regarding the sound management of a budget deficit. Merz’s positions will continue to benefit German equities in general, particularly industrial and defense stocks, as well as German midcaps specifically.

DAX versus S&P 500